2023's Market Cycle & Price Action

Declining Inflation, Rate Cycle Behind Us and an Upcoming Recession

I Believe We Are Positioned for a Multi-Year Bull Market

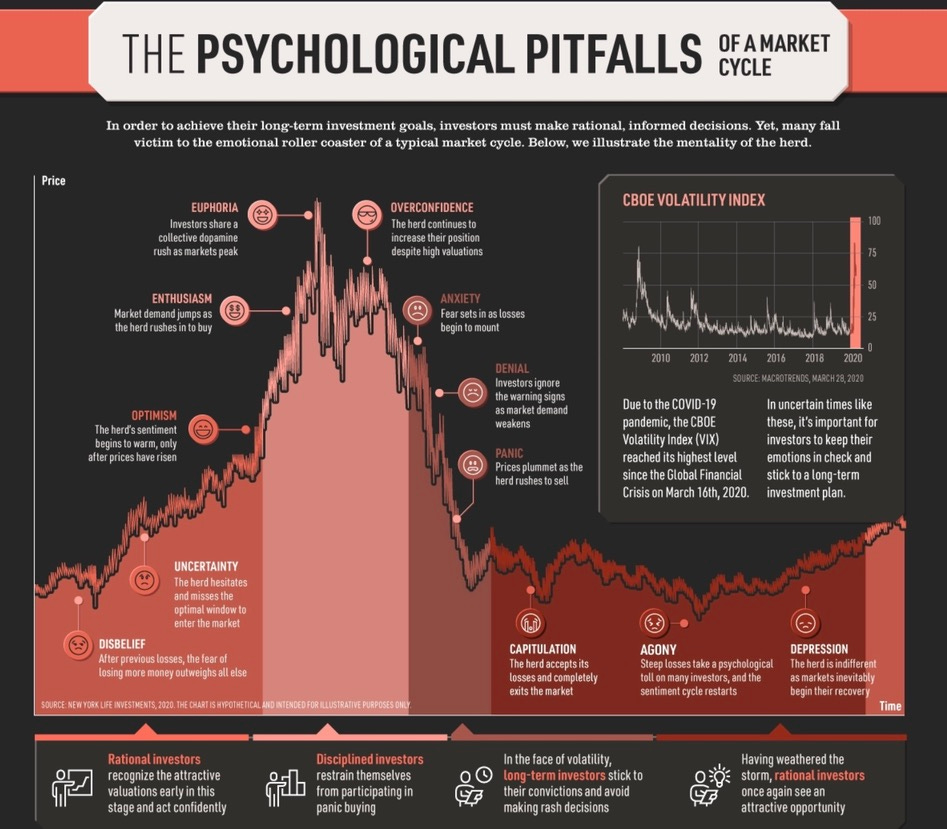

Reflecting back over the past few years, since, let’s say, the beginning of 2021. We have had the ability to witness a true boom/bust cycle. During this period, we had extreme market euphoria evolve into extreme market pessimism. Or, as some folks would consider, a complete ignorance toward risk to an extreme aversion toward it. The psychological/emotional roller coaster, alone, created major emotional swings in this market sentiment and the investing community at large. Particularly in newer investors/traders.

We should address this, the emotional part of investing and benchmark reality against our data driven analysis. See, emotions can cloud our judgement AND our analysis. Both “hopium” or feelings of extreme hopelessness can cause us to capitulate or FOMO into or out of investments and positions. We usually see this emotion manifest itself on Twitter, or on Substack, on a daily/weekly basis where people will project their feelings onto others. “Cash is a position” often manifests itself into the conversation at/near market bottoms and “buy the dip” often becomes consensus toward market tops. In reality, the opposite couldn’t be more true. Cash should be a position at highs and buy the dip should be the philosophy at the lows. Market cycles are real.

We are at Agony, particularly in the growth/innovation/SaaS market

ARKK trades as an innovation/growth ETF that is the best representative of the deflated bubble

Recognizing this part of investing, I am going to speak on the data today from a macro point of view and more importantly, the evolution of the market cycle to gauge an idea of where we are going. The last post I made in relation to the market cycle and the evolution of it was made back in November. Article below:

Primary point being that peak inflation = market bottom because of how the economic cycle works

Since then, we have traded sideways with an upward bias as the data has worked itself through. The market appeared to be equally conflicted during this period. On one side of the coin, inflation is falling. On the other side, the Fed is clearly trying to keep financial conditions as tight as possible as long as possible leading us to recession.

But markets are forward looking. If they are sniffing out a change in policy, the market will begin moving before the policy response especially since the Fed has us all trained already. Easy monetary conditions = rally. Tight monetary conditions = crash. We should expect markets to front run the Fed months/weeks before policy pivots in the future.

The Evolution of 2023’s Market Cycle

I am under the impression that the markets are prepared to rally for the next few years in the future until the business cycle resets itself. This observation is important because it is often what I speak on and something I have found to be the most accurate way to assess and gauge market direction. It is rooted less in what is happening today (narrative) and more in line with “what history has taught us” when Fed policy, employment, inflation and the business cycle is in a similar position.

There are Three Important Data Points to Pay Attention to Today

The Fed is important but few people understand exactly why the Fed is important. It is less about the common ‘general’ statements we see on Twitter, or other areas of financial media, such as “liquidity drives markets”, or “QT/QE drives markets”.

Although Banking liquidity is important to prevent tail risks (think 2008) in the banking system, it is how the Federal Reserve influences the credit cycle and how the credit cycle influences the business/economic cycle. Think of it like this:

I could go further into how Fed policy influences the credit cycle and how credit influences economic growth but we should focus on what matters today; what’s moving markets. When it comes to what’s moving markets, there are three data points we need to pay attention to, to get an idea of where where stock prices will go:

Inflation Declining

Jobs Data

Bond Yields and Rate Hiking Path

Each of these data points are extremely important because they will influence how severe the coming recession will be and if we get a “soft landing”, thus influencing stock prices. In today’s case, I do believe a soft landing has a strong potential of becoming reality. First, let’s talk about the data points and how they are trending into the coming recession. Then, we’ll close on how the market cycle will evolve (as history suggests) and the expected market price action as the cycle progresses.

Inflation is Everything

Recently, inflation data declined -.1% month over month, which means we are in the process of seeing deflation in CPI. I hear many commentators nit-picking the fine details but I saw the same thing when CPI was going up. At first it was just fuel, or goods inflation, then it spread to core CPI and services CPI which was the stickier components. I imagine we will begin seeing deflation accelerate in the months to come. But why should we assume that deflation will accelerate?

This has a lot to do with the monetary policy lag that transpires after the Federal Reserve makes a different policy decision. Historically, the Fed will cut rates before the peak of inflation (with the exception of the 1980’s “keep at it” Paul Volker era). Below, I marked where the Fed began cutting with black lines. You can see that, historically, the Fed will begin cutting rates before inflation peaks.

But today, that’s not the case. The Fed has kept raising rates despite declining inflation. Note that this data is not 100% up-to-date yet after last Thursday’s CPI release. Inflation has fallen even further, faster.

We can assume that deflation will accelerate because inflation peaked simply when the Fed backed off QE and raised rates to 1.25%. If we notice from the table above, where I showed the month over month trends (titled one-month percent change), CPI essentially came to an immediate stop in July and the MoM numbers fell off dramatically. But yet, the Fed has raised the Federal Funds rate to 4.25% and they are planning on hiking once more in late January, early February. Think about it, they raised rates by another 300 basis points AFTER inflation peaked.

Not only has the Fed tripled their efforts to fight inflation, M2 money supply is actually declining on a year over year basis. It’s extremely hard to have any sort of inflation on declining money supply. The last time money supply actually declined, like this, was 1929 - 1932 which fuel’d a deflationary bust. I assume the Fed knows this and they should be cautious. For now, just my opinion, we still have some excess in the system from printing 40% of all money in circulation over a 2 year period.

Between the Fed tripling down on their inflation fight and a declining money supply, CPI will LIKELY reach the Fed’s 2% target by summer.

Jobs Data

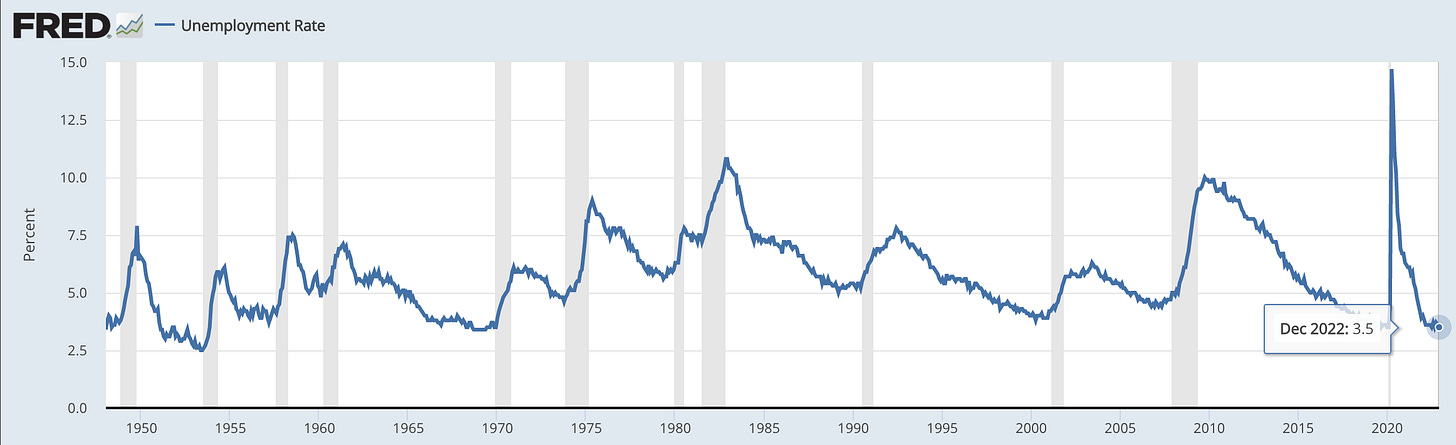

The data point that we recently received, where unemployment is 3.5%, is a “good news is good news” situation rather than a “bad news is good news” scenario. Let me explain further.

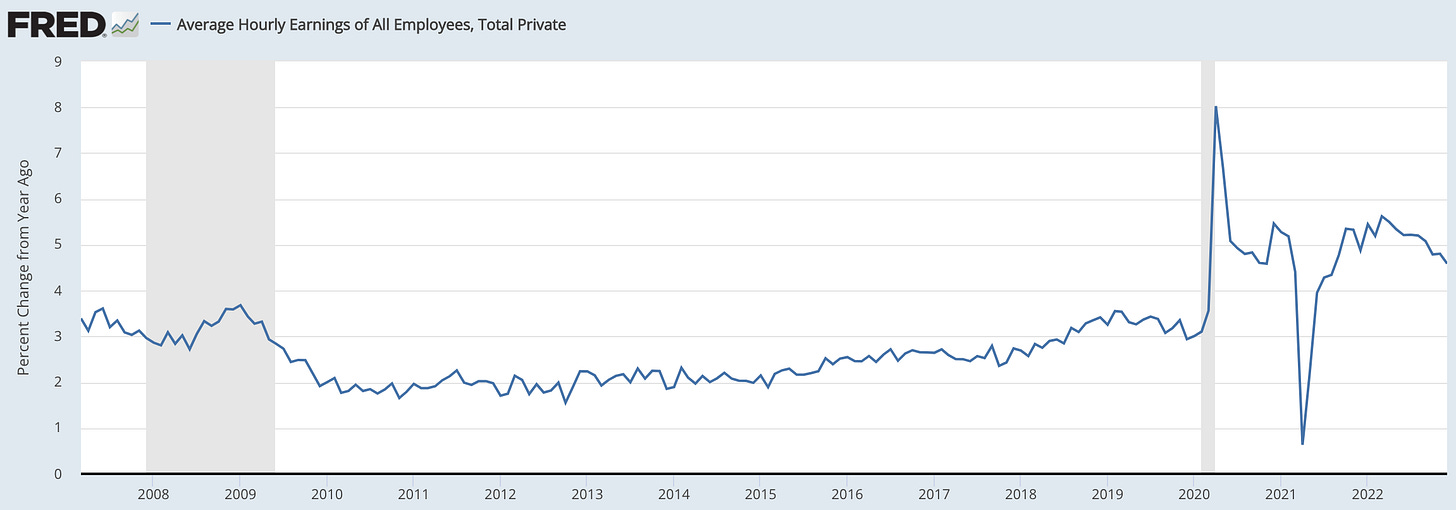

Back in the 1970’s, the rationale behind the sticky inflation is a theory called “wage-push inflation”. This is often why you hear Jerome Powell talking about “inflation expectations” being anchored. It’s a combination between inflation expectations and the wage push inflation that creates a spiral that needs to be destroyed by high rates and devastating economic recessions.

The theory and philosophy here is that inflation becomes far stickier within an economy when it becomes embedded within the psychology of the general population. What happens is that companies raise prices in anticipation for higher inflation in the future. This, in turn, creates a higher cost of living. Companies, in turn, compensate their workers from the higher profit margins and higher cost of living by raising their workers salaries. When companies raise salaries, the consumer can now afford a higher cost of living and, well, consume more. This consumption fuels the ability to buy products at higher prices which feeds the companies ability to raise prices. This becomes a cycle, a wage-push-inflationary cycle.

The significance of the employment data was the miss to the downside (also downward revision from the last report) and a new downtrend being established with a declining wage growth. This will likely continue as the economy softens and the Fed keeps tight monetary conditions. This is bullish as it means that the supply/demand imbalance in workers is being restored. If it goes too far, it’s not a good thing.

So this is where it gets interesting when thinking about both jobs data and inflation.

Historically, inflation peaks after unemployment has risen but this time, it’s not. Also, historically, inflation peaks after a recession has began but this time, it hasn’t. This peak in inflation before unemployment has risen or before an official recession has began has made this situation unique. Particularly in the sense that a SOFT LANDING has become a “likely-ish situation”.

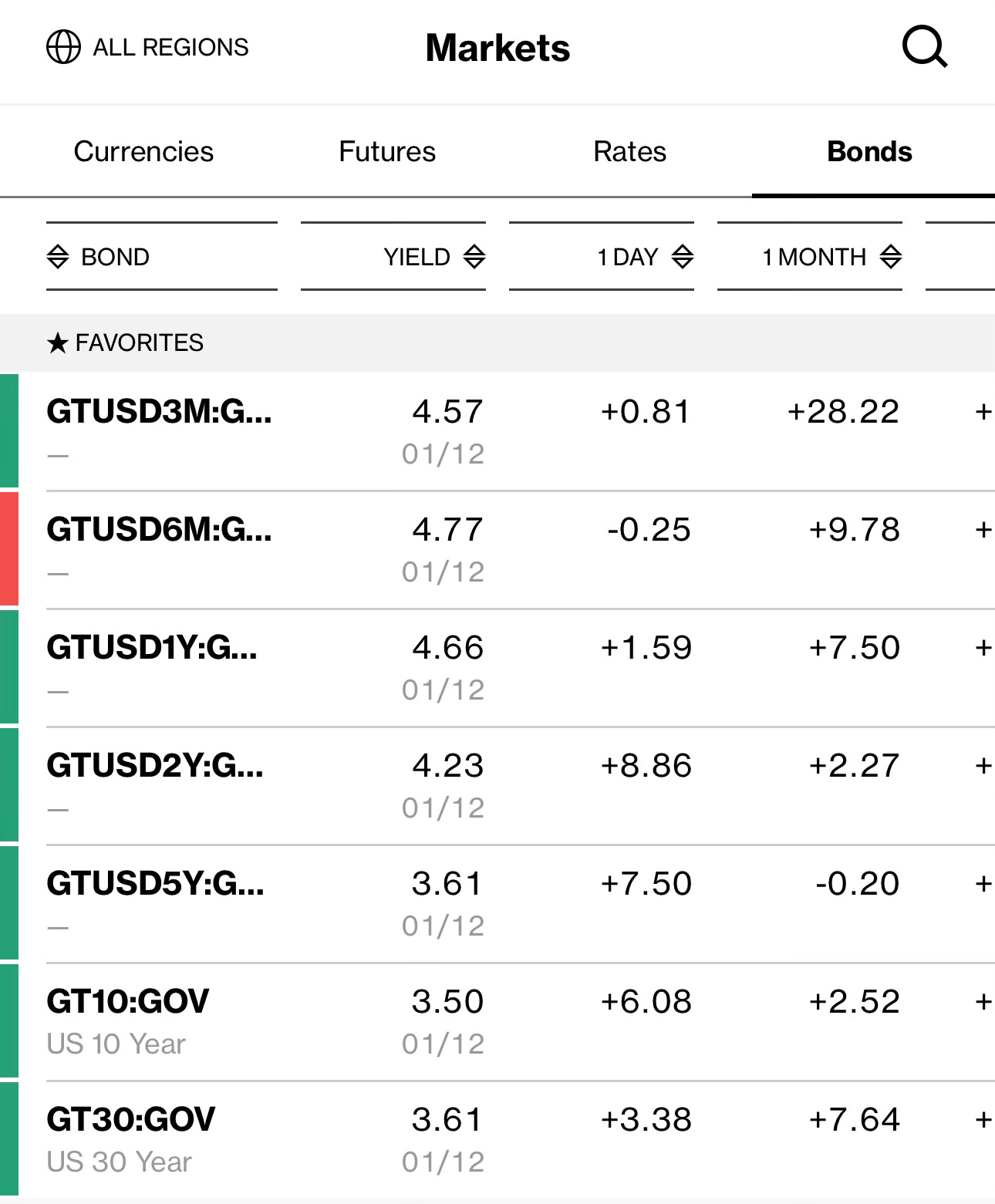

The Progression of Fed Policy & the Bond Market

The Federal reserve narrative, that’s what this is all about. Have you noticed recently how Bullard (FOMC member) can come out and speak hawkish (another word for tight monetary policy) but the markets appear relatively unfazed? The upward trajectory to the market continues. This is for a reason. We need to see what the yield curve is doing.

Let’s explain, briefly, what the yield curve implies and the economic/market consequences of it. Pay attention to, specifically, the “yield” and the time to duration (3 month, 6 month, 1 year, 2 year, etc.). Notice how the short dated yields are higher than the longer dated yields. For example, the 10 year yield is 3.50% and the 3 month yield is 4.57%. Why would this happen? Historically, this is not the case.

The 3 month yield is ‘supposed’ to be a lower rate than the 10 year because of the “risk” that’s associated with longer dated bonds. If you think about it, we know that the US Government, with near 100% certainty, will still be here in 3 months which leads us to assume they can meet their debt obligations. But when we think 10 years ahead, it becomes a little less clear. What will happen between now and then? Will there be another black swan? What will inflation be?

The idea is that there should be a level of risk premium priced into the 10 year yield compared to the 3 month yield that should lead to the 10 year bond returning a higher yield than the 3 month bond. Today, that’s not the case because of how the long end and short end of the yield curve behave.

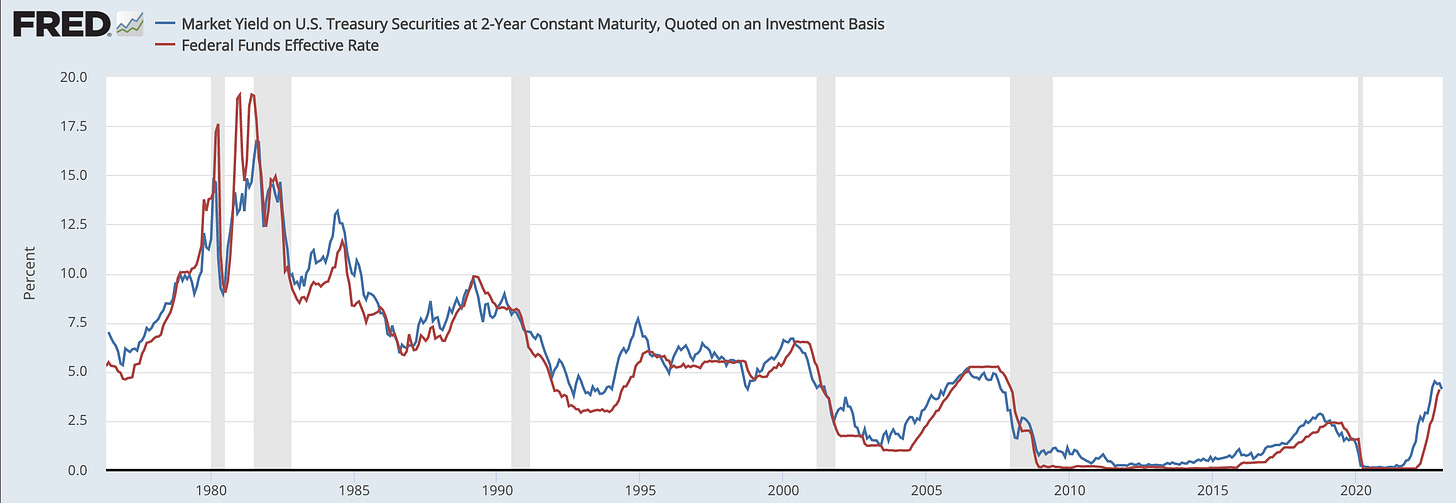

The short end of the yield curve, 3 month to 2 year yield, is highly sensitive to Fed policy and rate hiking cycles

The long end, 5 year bond to the 30 year, is significantly less likely to take in cyclical forces like Federal Reserve policy and more likely to price in structural/secular changes in an economy.

So what does this all mean?

The Yield Curve Inversion Means Three Things:

The bond market is perceiving economic risk to be higher in the short run compared to the long run. Inflation is less structural and deflationary risks are still very real.

The Federal Reserve has tightened monetary conditions into highly restrictive territory.

Most important, it implies that the Fed rate hiking cycle IS COMING TO AN END because the Federal Reserve risks pushing us into a devastating recession. It also means that the bond market is signaling that the Fed will actually CUT rates this year.

Historically, the 2 year yield leads the Federal Funds Rate. Today, the 2 year yield is at 4.13% and the Federal Funds Rate is at 4.33%. This signals that the Bond Market is in line with my thinking. The Fed is going to cut and the rate hiking cycle is done with, maybe, one more rate hike.

Circling back to the beginning where I mentioned how Bullard (FOMC member) is coming off hawkish, claiming that they will raise rates to 5%+ and “hold them there”. First thing I usually think is, “ok Bullard, sure, nobody believes you” because they are jawboning markets and intentionally lying to not premature ease financial conditions. The truth is that the economy is rapidly deteriorating and there are many indicators that suggest we are in, or slipping into, a recession today.

How the Market Cycle Will Evolve From Here

From the three data points above; inflation, jobs and bond market. We can look back at history and assume that, when history looks like this, the next step in the cycle will be:

Cutting rates because the rate hiking cycle is over

Rising unemployment because financial conditions are too tight

Easing financial conditions to prevent an economic depression (recession is in the books)

Falling inflation (even deflation)

The Most Important Data Point Here is Falling Inflation. Remember, the Whole Reason Why the Fed Began Raising Rates in the First Place Was Inflation Rising too Fast. IF INFLATION FALLS, THERE IS NO REASON TO KEEP RAISING RATES OR KEEP RATES TOO HIGH. Especially if Inflation Falls Rapidly to the 2% Target.

If, as we can assume, inflation falls as rapid as we may think. The faster the Fed will cut rates while the jobs market stays relatively resilient. If the jobs market stays strong while inflation falls, the likely scenario here is actually… “Goldilocks”, a soft landing.

The Soft Landing

Believe me when I say that I have a hard time saying it as well. I do think this is the optimistic scenario but as time goes by, it becomes increasingly likely as unemployment stays relatively strong. The time frame that I think about most, for how the markets could play out in the coming months/years, is the late 1980’s and early 1990’s.

When I say soft landing, I think it’s important to say that I am not mentioning we will avoid a recession, because we wont. I am saying that the recession shouldn’t be as bad as 2008 (pending a black swan) and a 20%+ decline isn’t the likely scenario from today’s level because inflation is declining.

On October 4, I did call the year end rally pretty well and put this price action together:

Unedited publication:

This is where we are at today, not bad:

This is how I see this year playing out:

In Conclusion - Pending any Black Swan

2023 will be a year of recovery in the sense that inflation will fall but a recession looms on the horizon. Despite a recession looming, a substantial amount of damage has been done in the markets. We can’t underestimate what was priced in during the October lows, as sentiment reached abysmal levels comparable to 2008. More importantly, there are sectors in the market (especially tech) that has been priced for a recession. Remember, the NASDAQ fell nearly 40% from top to bottom with many large cap tech stocks trimming trillions in market-cap.

As inflation falls and the economy enters recession, we will see the Federal Reserve ease by cutting rates. If the economic situation becomes meaningfully dire, there is a scenario where the Fed immediately stops QT and initiates a “bond buying program”, or QE. This will be what creates the “soft landing” (from here anyway) in the financial markets. Once the Federal Reserve eases enough, this will be enough to reverse any down trend in the markets as we move toward 2024’s economic expansion.

The Outlook in the Future, Past these Next Few Months, Will be Determined by the Emerging Economic Data, Sentiment and Fed Policy

I will keep all of you updated on both SubStack (where analysis will always be more detailed) and Twitter, where it will be more surface level.

For those of you who have been wondering what the future of BluSuit is, I have so much to share in the coming weeks but details are being made and tests have been scheduled (hint hint). We are going to grow further than many expect. I will keep many of you updated.

Stay Tuned, Stay Classy

Dillon

Great input, glad to read your well thought through and documented contrarian view. Keep it up!

Thanks a lot, Dillon!

I think about how the situation with zombie companies will develop. We haven't seen bankruptcies yet. If the rate is high for a while (even without a further increase) the zombies may fall. At the same time, some sectors (technology, biotechnology ...) may collapse (panic) against the backdrop of a slight decline in the broad market (possible option).

How do you think this will affect the market? How probable is this?).