2024's Market Crash

An Important Lesson, a Crucial Warning & My Plan of Action

An Important Lesson - Being Different

From a young age, we are taught to “follow the crowd” and not to do anything too extraordinary to stand out from the crowd. Think of it, we have teachers (authority) and peers (the crowd). We want to fit in and in some cases we could be punished (from our peers) for being too:

Smart

Nerdy

Tall

Skinny

Short

Dumb, etc.

Even today, I’m hearing that kids are not allowed to take honors classes (in some States) in order to make us more “equal”. The list can go on about what makes us individually unique, especially in a kid’s eyes. As adults we don’t become much better, the group think just become different. Physically, we settle into who we are but the “need to fit in”, or “group think”, changes.

For instance, speaking directly about the financial markets, heard mentality is strong. So strong, in fact, that it gets to a point I wonder what reality even is to a point I need to turn away from my phone and disconnect back toward reality. Have you ever realized that at the very top of markets a narrative, like “AI and Large Language Models will change EVERYTHING”, will become so pronounced that investors will take incredibly speculative positions that they know nothing about and claim it’s the best company ever. Vise versa, on the bearish front, investors will speculate to an extreme narrative in the macro economy that they will justify selling stocks at extreme prices because of “rates”, “depression”, or “unemployment”.

There is no doubt that there is a direct correlation to macro economic conditions and corporate earnings but the oscillation of these events is minimal in the bigger picture. For example, let’s look at Tesla, who recently reported earnings.

Here is a stock that, quite literally, went from $400+ per share to $100 per share within 1 year, then back to $300 within 6 months. That’s INSANE! On the bullish side of the equation, Tesla was the greatest company ever. Twitter spaces every day, YouTube channels literally dedicated to Tesla. Then, everything got bearish. Remember; “inflation”, “interest rates”, “car economy is going bust”, “100% chance of recession in 2023”. Basically everything but criticisms about the business. Meanwhile, when we look at earnings over the past few years this paints an incredibly different story.

Now, today, I am sure they’ll sell off because their gross margins are apparently going to go to zero, Cyber Truck won’t sell, interest rates or something stupid will push the stock price lower. It’s not just Tesla, I can provide examples of every stock that I have in my portfolio today. For many of my cloud stocks, one day, it was “revolutionary” and going to “change the world”, or “the best company ever” to, over the course of a couple months, “cloud computing is dead” or my favorite “stock based compensation, etc”. Or how about ZScaler? This one has had some wild sentiment shifts the past few years.

Meanwhile, if you paid attention to the earnings, they’ve been steadily growing top and bottom line. It’s almost laughable when you see the steadiness of the revenue and earnings growth but couple this steady performance with the wild swings in the stock price. To me, these manic depressive swings are more of an opportunity than a risk.

So… how can we think of the swings from an opportunistic perspective? First, we have to know what’s coming.

A Crucial Warning - A Recession is Months Away

In the Financial Markets, I always say “I can never be 100% certain”. What I have started saying is that “I am 70% certain”, which is as certain as I can be in this business while still being cautious of the other side to my argument. Today, I am 70% certain we are within 6 months of an official economic recession, where unemployment rises, and of course the narrative of today is:

“Structurally high interest rates”

“Higher for 'longererer”

“Consumer is strong”

“COVID savings have been revised up”

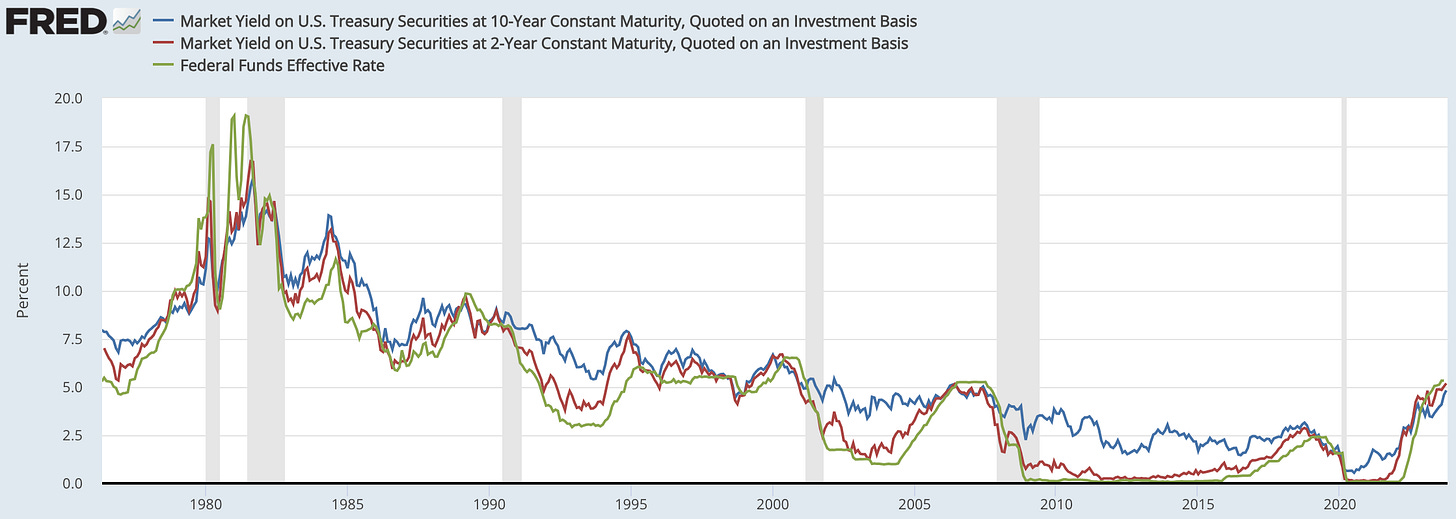

Looking at the chart above, the yield curve is finally beginning to un-invert after being inverted for nearly 2 years. Let me explain briefly what this means, how the long end (10 year T-Bill and up) works and how the short end (2 year and below) works.

The bond market is a massive, deep, market composed of governments, pension funds, big/small banks, institutional investors and corporations. Essentially, these are people with a pool of data that we only wish we had access to and are well educated/versed in making investment decisions. The long end and short end of the yield curve effectively mean 2 things:

The long end is the bond markets perceived rate of “neutral” credit conditions. Effectively, it’s the rate which the bond market believes the economy will neither grow nor contract, it’s neutral.

The short end is controlled by the Federal Reserve and Fed policy. This is effectively what the market anticipates the Federal Funds rate is going to be within 3, 6, 12, and 24 months.

Above you can see that, historically, the 2 year yield (red line) leads the Federal Funds rate (green line). However, the 10 year yield has been significantly less volatile and there have been periods of time where both the 2 year yield and federal funds rate have been higher than the 10 year yield. It’s simple, this means that credit conditions are too tight, the Fed hiked too much and they are likely to put the economy into a recession.

When the Yield Curve Un-Inverts, the 2 Year Yield Will Likely Head Lower (than the 10 year) Because Unemployment is going to Begin to Rise, Putting Us into an Official Recession

Today, as the yield curve un-inverts, we are what seems to be within a few months of an economic recession where unemployment will begin rising and the Fed lowers rates. We have to watch the 2 year yield to signal to us exactly when that is going to happen. Once the 2 year yield is lower than the 10 year yield, we know we are very close and likely within months of a major market top where earnings on our favorite companies begin deteriorating. In recessions, everything is hit. The question I don’t know is how much.

An Actionable Plan for 2024

I believe the S&P 500 will revisit the 200 week moving average (dotted green line), which historically acts as a structural moving average that cyclical bear markets bottom at during secular bull markets. If it falls lower, I think we could revisit the 3,800 mark or the 3,600 zone. However, I am not very convinced it will break lower for a sustainable period of time because the Fed “has a lot of ammo” with rates at 5% and a balance sheet that’s been reduced in size. I believe the Fed will, and has the ability to, put the bottom in the markets, as we transition to a more sustainable expansionary market cycle with inflation around 2%.

My Plan

Quick plug, I share everything I do in the financial markets. This includes my positions, how I am interpreting earnings, stocks I am watching, the analysis I am doing and how I am interpreting the economic data that is coming in. You can find that link here:

It’s free to see what I hold and my performance. To get more data, analysis and real time buy/sell alerts, it’s $25. It’s a great way to interact instantly with you and many others. Savvy Trader has been a game changer.

For my plan moving forward, because I don’t know the severity of the coming recession, I plan on holding my stocks but increasing my cash position. Today, I have 0% cash but that’s why having some sort of “roadmap” of the future is crucial. Having a general idea of the economic and market cycle can help us manage risk.

Building on top of and knowing the data I shared above, I’ll be saving money and selling positions (only if they run too much) from here. I think I can get to a 20% cash position before markets sell off on recession but I’d like to have 30% ready to deploy into my favorite stocks.

Volatility is best prepared for, not avoided, so that when the time comes to buy, we can to produce long term market beating returns. This way, when the market reverses (to the upside), we don’t miss any of the gains and can still take advantage of the discounts that produce life changing returns.

Let’s do this thing.

Stay Tuned, Stay Classy

Dillon