On Friday, I listened to David Lin on Twitter Spaces with Michael Gayed. It was perhaps the single most important data set I have heard recently. For those of you who are not familiar with David, he is a host of KitCo news (a popular YouTube financial News Network). He spent time discussing financial media content and what “sells” to investors. He brought up how investors were significantly more likely to watch or consume content that is bearish. That means that a lot of the news you (me too) hear is a result of “click bait” and attention. A bullish opinion does not garner as much attention or is as profitable.

As many of you know, BluSuit Newsletter is not an echo chamber. No, I wouldn’t consider myself a “Perma-Bull” but I do call it how I see it. As Howard Marks once said, “the further out you get from the Micro (individual businesses) and the further you get into the macro, the less confident you should be”. Think of it, there’s millions of data points and the future is unknowable. But as Michael Gayed has once said, “I don’t know what the future holds but I can tell what conditions favor certain outcomes”. The conditions of today favor a continued melt-up and that the bottom made in June and October will hold.

This leads me to the point of today’s newsletter. It will have two parts:

The market’s direction in the coming months based on how I see events shaking out.

A bold call

Inflation Coming Down Means All Time Highs are Coming Despite a Recession

*Hear me out first before you dismiss my hypothesis*

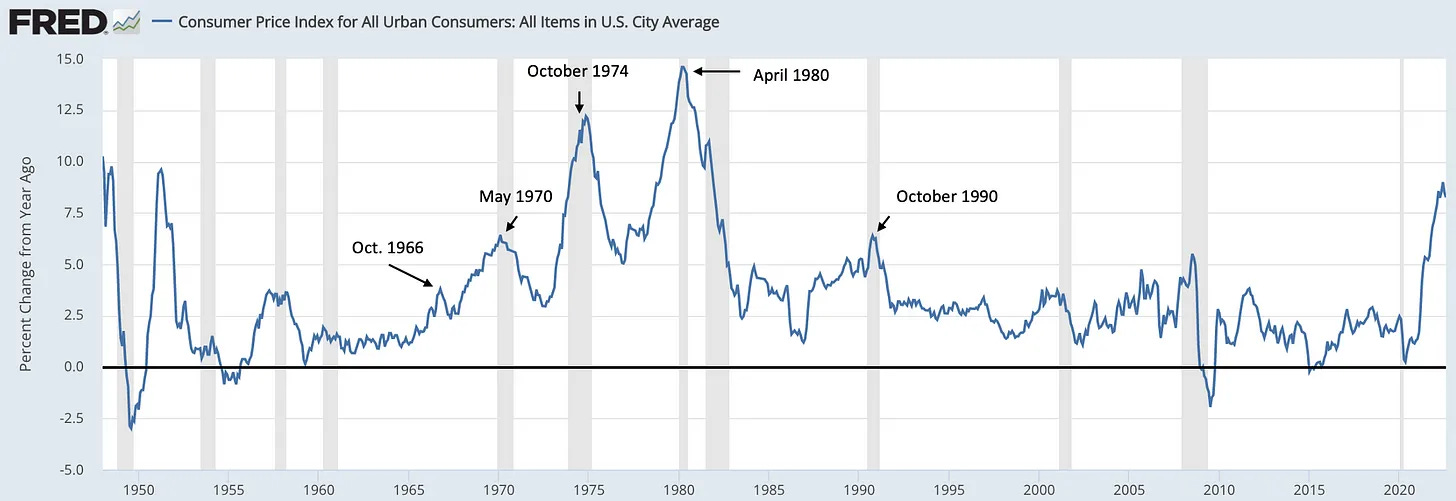

Knowing a recession is coming is perhaps the most difficult park on my perceived outlook. But, there are three reasons why I think the market has seen its major low (despite an incoming recession) and there’s two time periods I can recollect where the market bottomed not on recession, but when CPI peaked. Aside from these time periods, we can pull up what happened the entire decade of the 1970’s as well. The three reasons why I believe the market has already bottomed:

Inflation data, inflation trends and bond market signals

Sentiment shows we priced in A LOT, it got extremely bearish. We even started pricing in 2023’s recession toward the end of October.

What the Fed has done, what they will do and how this impacts the future of corporate equity earning expectations

I will dig more into these individually but before I do, let me show you the two time periods this reminds me of.

History Proves this Thesis

Paul Volker’s “Keep at it” Policy Toward Inflation 1979 - 1982

Price Action of the 1980’s:

Alan Greenspan 1990 “Soft Landing” to Control Heating Inflation

Price Action of the 1990’s:

How Policy and CPI Developed:

WE CAN QUICKLY TAKE AWAY THAT IT WAS THE PEAK IN CPI THAT MARKED THE BOTTOM OF THE MARKETS, NOT THE RECESSION

It was not just these two periods. In past updates, I also posted the 1970’s price action.

Every. Single. Time. Inflation. Peaked. The. Market. Bottomed.

Full Stop.

Twitter, Substack or YouTube is not believing that the market bottomed, at all, and believes that the recession to come must lead the markets lower. However, the past 50 years of market history is suggesting that the markets bottom when inflation peaks. I am not sure why this happens, I assume that it has to do with the business cycle:

I assume this is why financials, transportation and consumer discretionary have shown relative strength over the markets recently.

Sentiment Got Really bad, but it’s not “Just” the Sentiment that’s Important

The market got (is) more bearish than 2008, only to rival post 1987 crash where it continued to march higher into what ended up being a historic bull market.

The market is forward looking, as most people know, which means that it’s not the data today that is important but it’s the future outlook. Think of it like this, the market is a competitive place where investors are constantly looking to outsmart one another for clicks, views, assets, trust, alpha, yield, etc. It’s all about being the best of the best, out smarting the other guy and thinking/knowing where the funds are going to flow to in an effort to gain as much profits in the shortest amount of time possible.

Because of the competitive nature of markets, this leads investors to find/use the best data available to them to “guess” which sector or stock will perform the best in the next 1-2 earnings seasons. This leads institutional investors and retail investors alike to copy each other, know what the other guy is doing and try to ride a certain trend better than the others. It constantly leads to a lot of discussion about the “future”. It leads to investors pricing in the future.

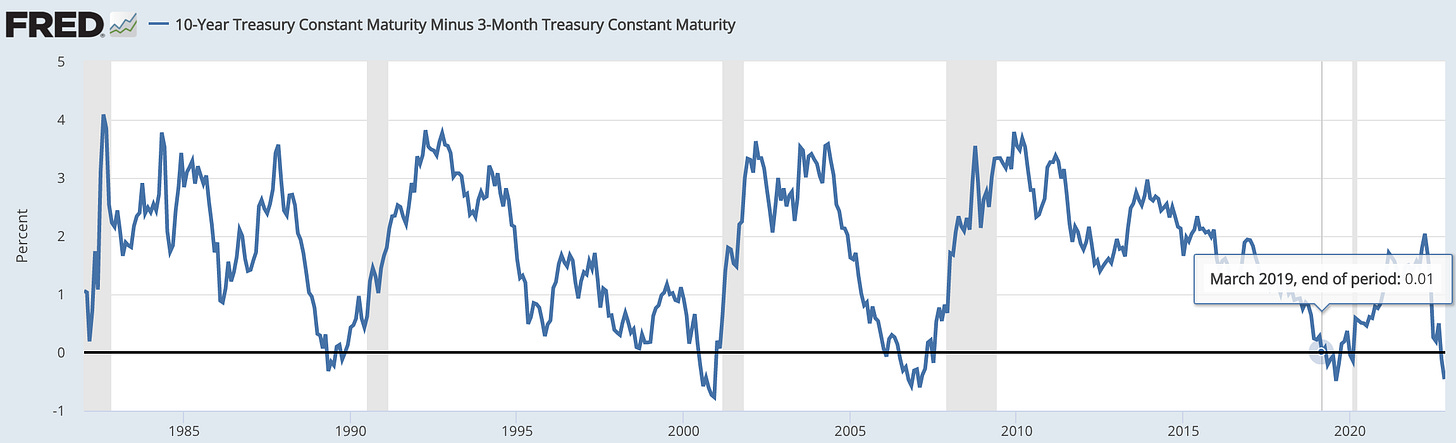

The problem with this, when it gets to retail investors, is that this information was already known by Wall Street months ago. There is no better place to validate this than looking at the 10 year - 3 month spread in the bond market in 2019. Historically, the 10 year - 3 month bond yield spread is the single best indicator of recessions or economic turmoil in the coming months.

In March of 2019, the stock market was rallying off the 2018 December lows and there were issues in the repo market (repo market is basically a market were banks buy and sell US treasuries with each other). Sure, with what we could have known at the time, after the Fed hiked too far in 2018, it made sense that we could have assumed a recession in the months to come. But, for those who remember, the Fed actually implemented a form of QE that provided liquidity to the bond market.

For all rationale purposes, since Powell actually cut rates (in 2019) and started expanding the balance sheet, we should have gone through a period of economic expansion. But, we didn’t. We still got our recession in 2020 but not because of Federal Reserve purposes. It was a once in 100 year event called Corona Virus. Did the bond market know this was coming?

The Point I am Making with Sentiment is that the Future Matters More than Today and the Market Knows a Recession is Coming

We need to stop thinking that we (individual investors) can out smart Wall Street, time the markets better than them or know something they don’t. They know the Fed is doing QT, the know the Fed is raising rates today and will in the next meeting, they know where unemployment is going and they know what will happen with the economy in the next 6-9 months. We can’t “guess” better than they can but we can observe what they are doing.

We can observe the bread crumbs “smart money” is leaving behind in regards to their projections about the future.

This leads me to the next point on Fed Policy, how it will evolve and why this is important during the recessionary downturn to come. It is important to think about the steps of how this will develop, what comes next and how the market responds to Fed Policy.

The Evolution of Federal Reserve Policy

The Cycle Chart that I made (above) is extremely important to know because it’s the visual representation of why markets bottom on inflation, why all time highs seem to be the next step in the evolution of today’s market cycle and what to expect in the months/years to come. More importantly, what the Federal Reserve will do next in their fight in inflation. Let’s look at today:

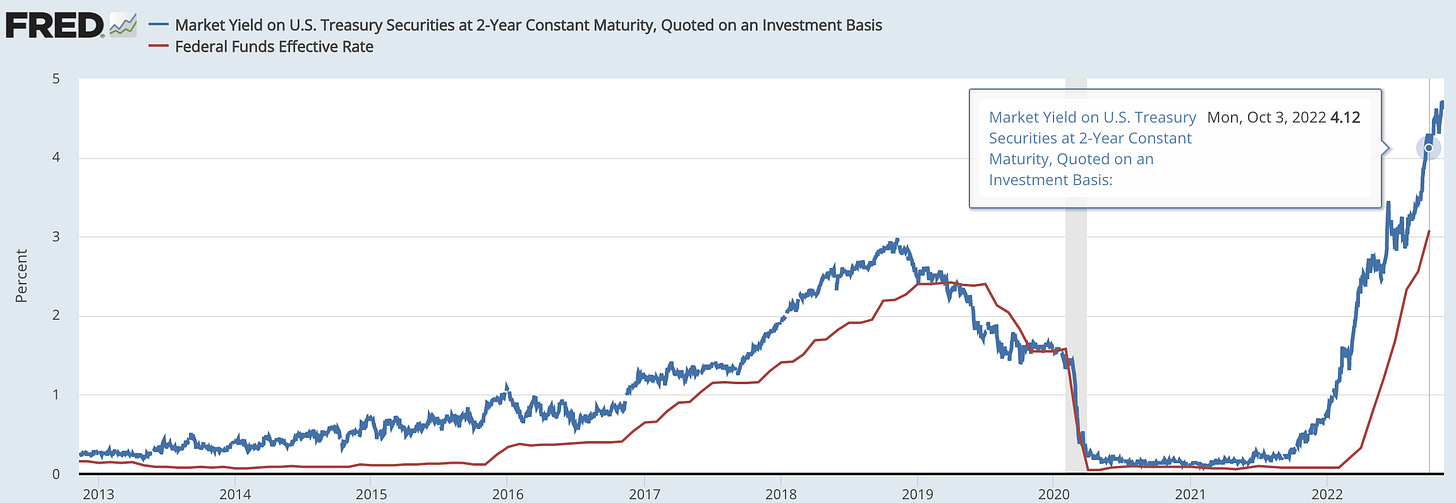

The Fred website hasn’t updated the Federal Funds rate but currently it is at 3.75% - 4% with the two year yield at 4.4%. This essentially means that on a forward basis the bond market thinks the Federal Fund rate will only experience one more rate hike of .50bps and then they are done. Historically, the bond market leads the Fed (telling them what to do) and not the other way around.

So then we ask, what happens after the December meeting? The bond market thinks:

Inflation is cooling down

The rate hiking cycle will end in December

If we assume that the bond market is right (which I think they are), what comes next in our market cycle diagram?

If We Saw Peak Inflation and the 10/3 Yield Curve is Correct About A Coming Recession, We Can Make These Assumptions

Inflation Will Come Down Because We are Going Toward Recession, Which is Expected by Now

QT Will End Because Inflation Will Come Down

Rate Hikes Will Certainly Pause and May Even See Cuts Beginning in 2023 Because of Recession

Only Accommodative, Easier, Monetary Policy Will Pull Us Out of Recession

Perhaps the biggest assumption we can make of all….

The Stock Market Will Reach All Time Highs

It will reach highs because Jerome Powell will get inflation under control as it was likely a cyclical event proceeded from historical monetary and fiscal stimulus. If inflation was, in fact, a cyclical phenomenon driven by a liquidity hurricane, the Fed will move toward more easy monetary policy which will fuel the all time highs and rally to come in the stock market.

Is inflation structural? I don’t know. Nobody really knows. But, I do know that every single time that inflation has peaked in the past 50+ years, the stock market saw a major low and a V shaped recovery. I do know that Investors and Traders that are waiting for the economic picture to improve will miss the vast bulk of returns and will become the next generation of “perma-bears”. I do know that inflation has peaked and we are transitioning toward the next phase of the market cycle.