FOMC, Hedging Zones and Confluent Earnings

FOMC Take-a-Ways, Trading Strategy and Confluent's Earnings

The number one lesson I have learned during this bear market is to be willing to be wrong, on a dime, and plan to be wrong about a thesis I have at any given point in time. As many of you are aware, I am 31 (almost 32) and I did not navigate the bear market of 2008. Since the 2009 market bottom, a simple buy and hold strategy has allowed investors and individual stock pickers to out perform for years. This was what I thought to be “the right way to invest”. The funny thing is that bear markets have a strong tendency to make both bulls and bears look dumb due to the very nature of volatility.

In many ways, taking a Peter Lynch or Warren Buffet style approach was the right way to do things during a secular bull market. But, in the event of a secular bear market, opportunity for outsized returns are exponentially increased with the proper risk management strategy, discipline and proper time frame. A willingness to learn and adapt is priority when navigating such a complex environment. That’s what I like to consider myself as doing.

In today’s publication, I am going to discuss my strategy and thinking post FOMC meeting. More importantly, I am going to discuss what I plan to do in the event the market goes down or in the event that the market goes up by discussing key levels I am watching. At the end, I also believe it’s suitable to discuss Confluent’s earnings and how this is playing a key role into my strategy moving forward.

FOMC Meeting

There were a few key take away’s from the recent FOMC meeting. I was under the impression that the Federal Reserve would do what they have always done and pause rate hikes due to the 3 month & 10 year yield inverting. Historically, this was the right (data backed) assumption to make about the future of rate hikes. This assumption was completely invalidated when JPow slipped and said, “we have tools that can correct over tightening.” This was alarming to me.

If we translated this Fed Speak and simplify what he meant; he meant ZIRP (zero interest rate policy) and QE to offset any deflationary forces. This, I was under the impression of, wouldn’t seem like an ideal scenario after combating inflation. Thinking of living in an environment (with a Fed Chairman) controlling the economy and markets by using deflation to counter inflation and inflation to counter deflation, doesn’t seem like a healthy way of conducting monetary policy. The Federal Reserve is supposed to be a force that balances economic extremes, not cause them. Still, Jerome Powell never stops surprising anyone.

This Told Me that They Will Hike and Hold Until a They See the Whites of Recession’s Eyes

There is a reason why this is important and it’s best explained here:

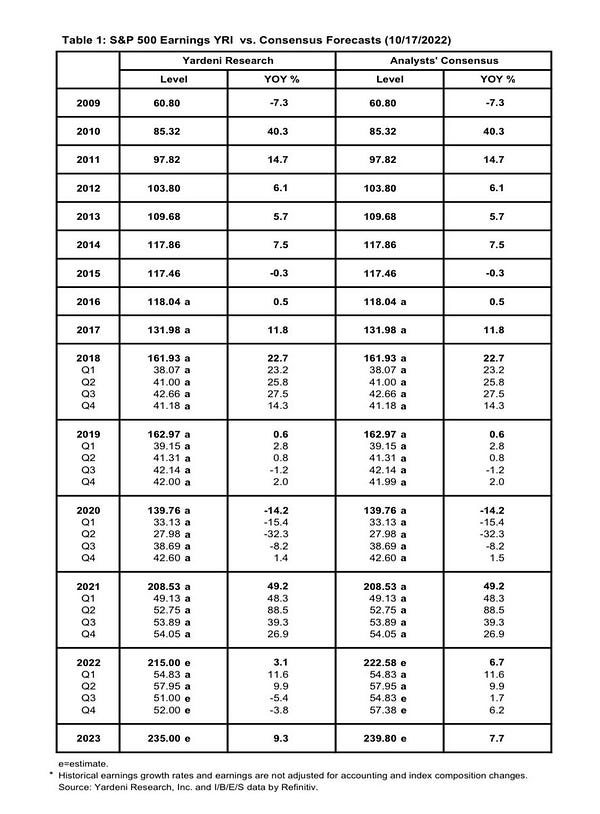

The S&P Hasn't Priced in a Recession

Simply put, when looking at the forward P/E multiple and projected earnings for 2023 a recession (earnings contraction) is NOT baked into the price of the S&P. I briefly explained in this tweet here.

This (below) is the zone we would be looking at when the recession begins to get priced in, based on the S&P’s fundamental valuation.

The number 1 thing that can prevent the market from reaching this level (once recessionary pricing begins) IS A FED PIVOT. Not a pause, not a slow down, but a pivot toward accommodative monetary policy and completely away from restrictive.

I’ve Been Beaten Up Enough this Year

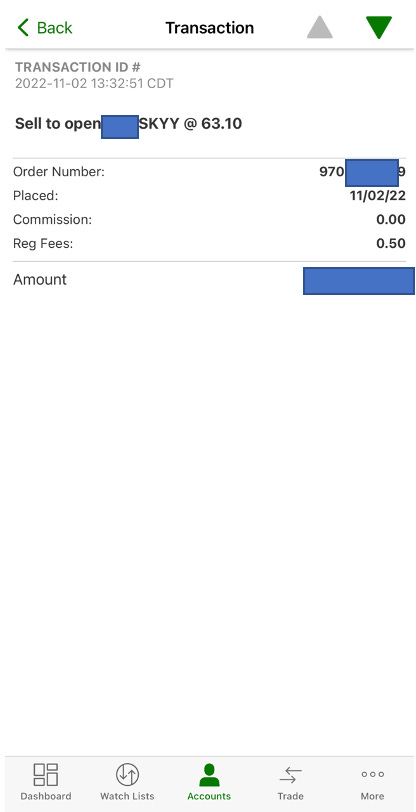

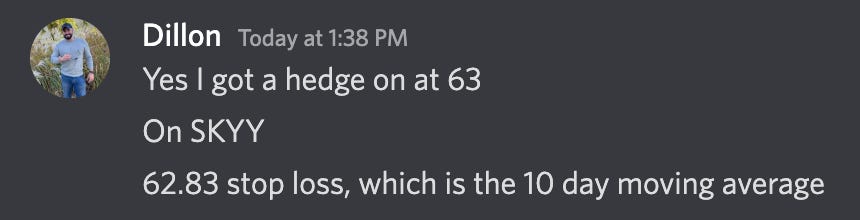

As soon as I heard JPow mention he wont pause, I hedged 80% of my portfolio into today’s mini rally on initial release of the JPow’s prepared remarks. My short position was started at $63.10 on SKYY.

I announced this to members in our Discord chat

My stop loss was moved to $63.10 shortly after this, for now but I plan on moving it depending on market price action.

It’s Note Worthy That I Did Not Sell Any of My Positions

Key Levels I am Watching

NASDAQ Key Levels

For tomorrow I will look for any sort of reclaim of the 10 and 30 day moving average. A reclaim of these key moving averages will be a bullish signal that will lead me to cover my SKYY position (because the NASDAQ leads SKYY). From there, I will be looking to re-hedge at the 11,201 but I will look at a retest + rejection in price movement in order to put a short position on.

I will plan to cover the hedge at 10,010 (depending on price action and breadth of the move) or 9,700 which will be the next major area of support. This was the previous high made in late 2019 and early 2020. This would be a likely zone for a large bear market rally upward. Obviously this is dependent on how the data and price action emerges. I can cover at any point in time if key levels or moving averages are broken.

SKYY Key Levels

Tomorrow is very important. Further undercut of the lows made today will certainly send SKYY lower to $55 as there is a gap there to be filled. It may turn green after today’s reaction but if $61.44 is not reclaimed, the market will be heading lower on a waterfall like sale.

The Goal Here is Plan to Fail So We Can Succeed

If I am wrong about the down trend the market is about to make, I have multiple zones in both the NASDAQ and SKYY ETF I will look to cover which will prevent permanent loss and will lock in a gain of 1-2% on the trade. Considering this is a size-able position, the gain will be nice to reallocate to my long positions.

Speaking of Long Positions, We Have to Discuss a Rockstar Business

Confluent is Buy the Dip Worthy

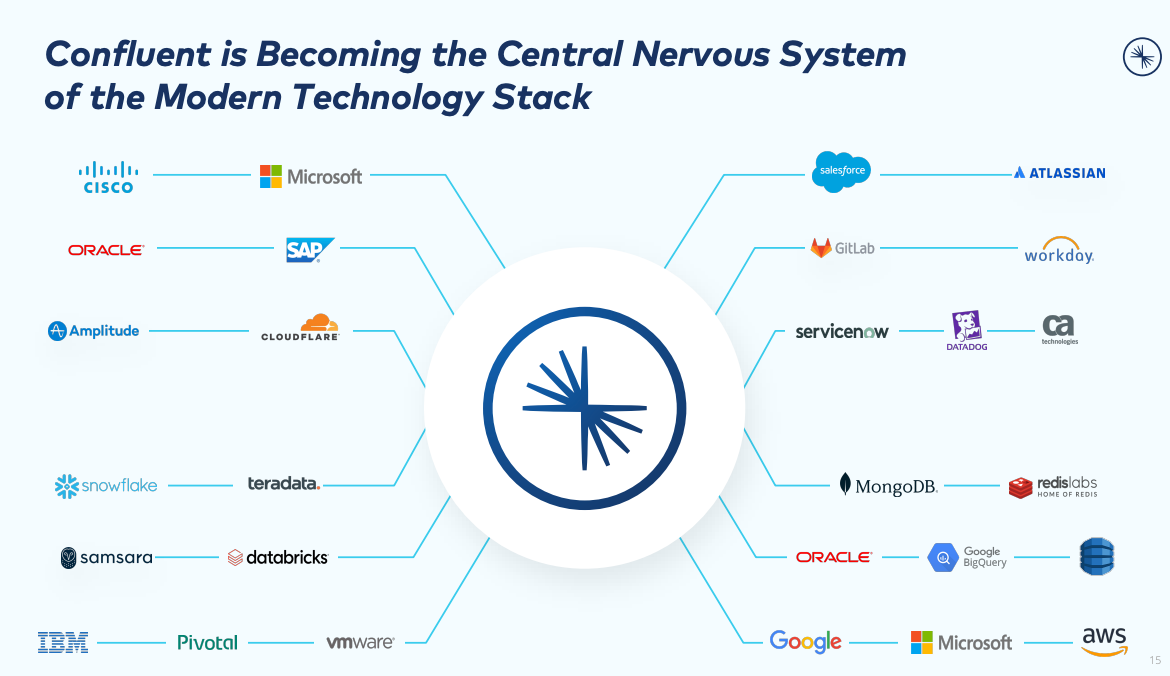

Confluent is a data infrastructure business that manages Kafka code. I have found that I am one of the few FinTwitter’s out there that own Confluent and I have been accumulating since IPO. I wrote about Confluent here in a SubStack published in July:

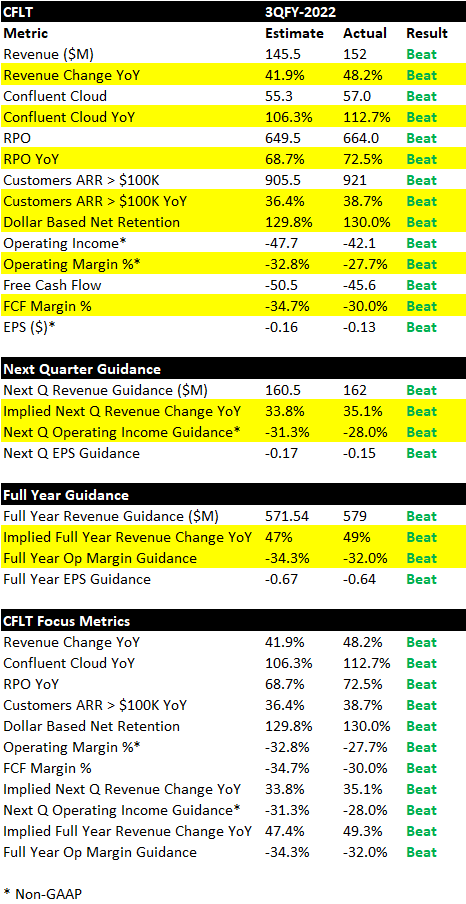

Their financial results that were released today were incredible. Ophir did a great job showing just how impressive this quarter was.

During a time where tech spend is being consolidated and even pulled back on, Confluent continues to see strength in demand on a go-forward basis.

There Were a Few Key Details I Took Away From the Call

They mentioned that tech spend is consolidating away from nice to have applications to mission critical components to a business. This signaled to me that not all software will suffer the same fate as ZoomInfo may have. This makes me bullish on businesses like ZScaler, Snowflake, or DataDog (hopefully I don’t eat my words here tomorrow as they release results in the morning).

They saw longer than expected sales cycles due to the macro but they are still closing expected deals and bringing on new clients

They have both an On-Prem and cloud native portion to their business model. They mentioned the secular tail winds toward the transition to the cloud for medium to large businesses is still very much alive. They are investing predominately in their managed cloud offering.

Confluent released two new products that continued to expand their TAM and upsell opportunities to their clients

Expected to become Non-GAPP profitable by 2024

Used a case study of which one of their new clients is now using Confluent to build their business on top of. This is extremely bullish and is similar to Snowflake where businesses can be built on top of their platforms.

Guided for $760m - $770m (conservatively) for 2023 assuming Macro head winds continue. This is at least 35% growth next year.

To simplify Confluent’s call, I found everything I look for when reviewing an earnings report. They validated their long term thesis, the story improved, and they continued to prove that they are a sticky mission critical application to their clients. I am happy to continue to build my Confluent position and accumulate more shares than I do today.

This is All I Have for You Guys for Now

If you’re not already, consider becoming a member and join our Discord community. We are getting better every day and have continued to grow despite the bear market.

I don’t believe I am perfect and believe subscribers of this SubStack stand to benefit from other like minded investors/traders and macro minds.

Stay Tuned, Stay Classy

Dillon