Growth Stocks Could be Forming a Bottom, Set to Outperform. Inflation to Abate.

The signs and signals we are watching. Data to support hypothesis.

Disclosure: I am not saying the selling is done today and anything can happen in the short term. This is a paper about the longer term, 1+ year, trends taking place.

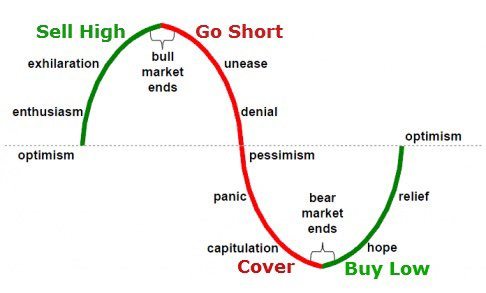

There are times in the market where sentiment leans into one extreme. This happens on both the upside and the downside. However, when these extremes happen opportunity is born.

Brief, recent, stock market history and what happened during periods of time.

February 2020, COVID-19 rocks the world and markets crash

March 2020, was the bottom of the fastest crash in stock market history. This was met with unprecedented fiscal stimulus in the economy to prevent an economic depression

September 2020, markets have rallied extremely hard and since August markets began becoming euphoric. Dave Portnoy coined a term called #DDTG and began the “stonks” terminology as a way to say stocks only go up

November 2020, post election markets rebound heavily with the Russel 2000 going vertical. Ark Innovation ETF’s double this year. Rampant speculation and euphoria enters the markets.

December/January 2020, SPAC’s and EV’s become the new “thing”. Any EV SPAC that hits the market rallies hundreds of % just because it’s green energy or the next Tesla. Markets are in full melt up. Other popular theme’s were anything biotech, genomics, sports betting and data infrastructure. It becomes nearly impossible to buy anything under 30x P/S.

February 2021, the epic Game stop short squeeze and a movement among retail traders. They think that they’re actually squeezing and getting back at the hedgies and the shorts. This is when the bubble popped.

Since February 2021, the bubble popped and months of unwind began to ensue. Favorite stocks like Peloton, Zoom, Roku, and many others fell out of favor. Some stocks like Skillz never even looked back. Skillz is now $6 from it being over $40. Needless to say, 2021 was a difficult year due to the wild swings back and fourth for growth stocks. It was a year of extreme multiple contraction and expansion.

I think this is all coming to an end and growth stocks are forming a bottom after a 1 year bear market.

In addition, after looking at some of the inflation data it really is pointing toward it being transitory. My tune has hardly changed on this topic and my views tend to align with what the Fed is telling investors. I’ll explain more.

In this article, I’ll talk about why inflation looks transitory, how this plays into growth stocks and discuss why we could be bottoming from a fundamental and valuation perspective.

Inflation is Transitory

There are secular forces that create deflation and create a low interest rate environment. Essentially, since the 1980’s we’ve seen bond rates slowly go down over time. The forces at work are government debt, globalization & trade deficit, technology, low birth rates & population growth and low money velocity. What’s unfortunate is that we can control very little of the secular deflationary forces at stake. But, this does lead us to ask the question why is inflation so high?

Think of it like this. We have a balloon and there’s a giant hole in the back of this balloon. The Fed is dead set on keeping this balloon inflated so they do various things to pump it up (monetary policy). If the Fed begins to slow down its inflationary policies the balloon begins to deflate and the secular forces of deflation begin to create pressure over head.

What happened in 2020 is that these forces became extreme and the hole in the back of the balloon grew larger. As a solution, the Fed bandaged up the balloon and increased the amount of air going into tit. To make sure they got it stabilized and right, they pumped excess air to inflate it more. But now, they’ve realized the balloon is unstable and they’re looking to slow down the amount of air they’re pumping.

The balloon is our economy and the hole in the back of it still exists. None of that is going away and the balance will continue. If we peel back what was most impacted by inflation in 2021 and couple that with the secular forces of deflation, a thesis begins to emerge. What was most impacted by inflation?

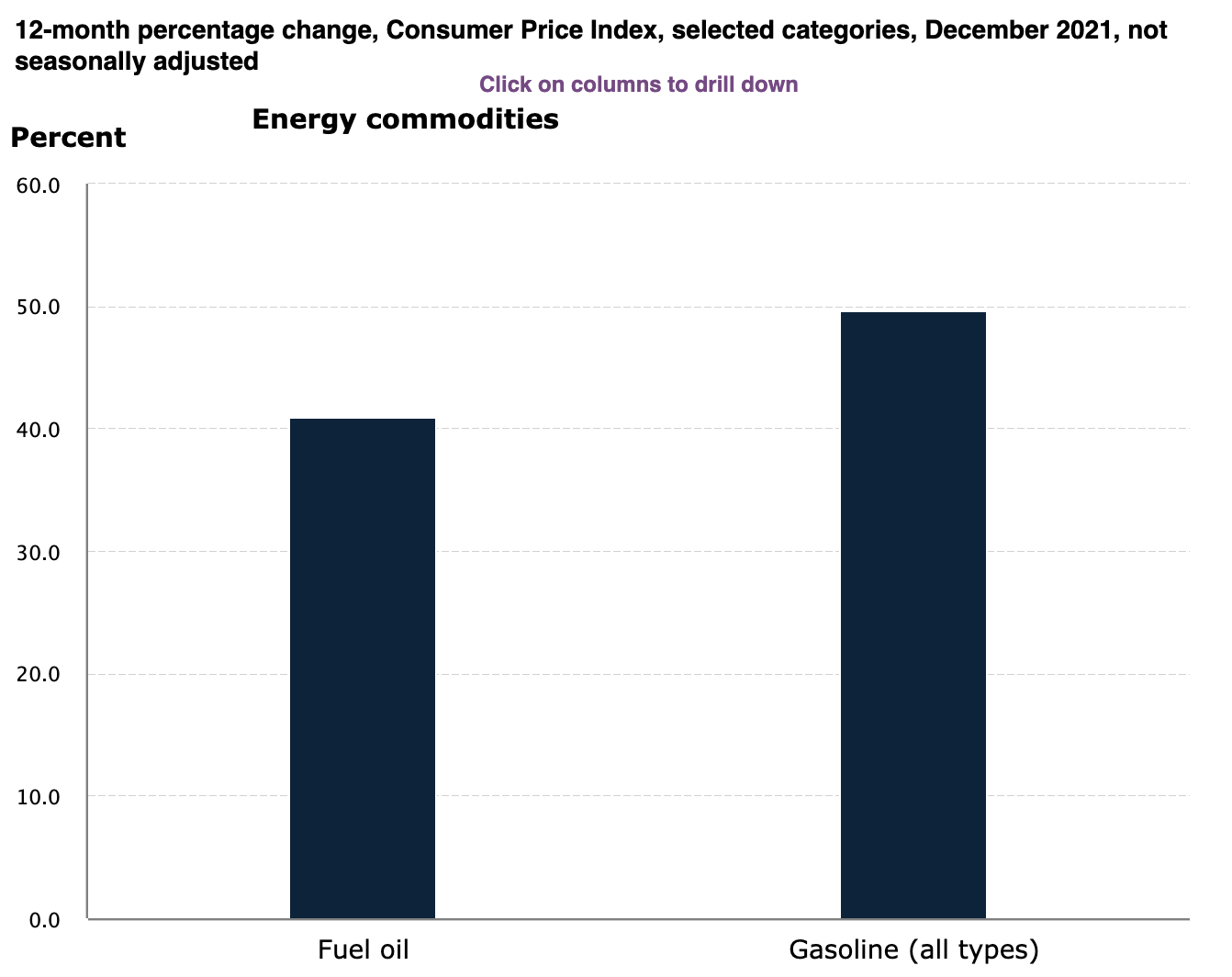

When you break things down it’s heavily skewed when it comes to both energy and transportation. Energy, specifically, was the price of oil and transportation, specifically, was used cars who find them selves in bubble territory. Knowing this, there’s 3 things I want to point out specifically about inflation:

Energy prices

Vehicle prices

M2 money supply and velocity

Energy Prices

First, I have to explain something very important. This will discuss POLICY actions. In no way is it meant to be divisive, political or single any one party out.

Joe Biden, as soon as he took office, enacted a multitude of energy policies that decreased America’s energy independence. Democrats typically do this because they’re trying to push more toward renewable energy and make the unit economics of EV’s seem more appealing to the broader public. A series of this policies decreased supply in the international community despite demand staying the same.

You can see on January 20th this article above was posted. The chart below shows approximately the date new policy took into effect in relation to crude oil.

On a multi-year chart it shows that crude oil was last seen this high in 2014.

According to bls.gov, a majority of energy inflation took place in energy commodities.

Oil and gas prices are historically transitory and have little to nothing to do with the Fed’s printing money. When it comes to energy inflation, this can be directly tied to political policy and drastically fluctuates both up and down, often. This is 100% transitory. Energy prices can change with a change of policy in the White House almost immediately.

In addition and arguably more important is the INNOVATION around electric vehicles. The trend is undeniable. This is a secular force to energy price deflation. Estimates have EV’s consisting of over 30% U.S. market share by 2030.

Every EV that’s sold incrementally decreases the global demand for energy. Eventually oil will be obsolete and not as needed. It’s hard to imagine a world where Russia and OPEC economies, who are dependent on oil production, slow down their contribution to global trade. In other words, supply will exceed demand in the very near future as the world becomes more green. It is important to note that China is even further ahead of us when it comes to EV adoption.

EV’s will further contribute to secular deflation when it comes to global and national energy prices

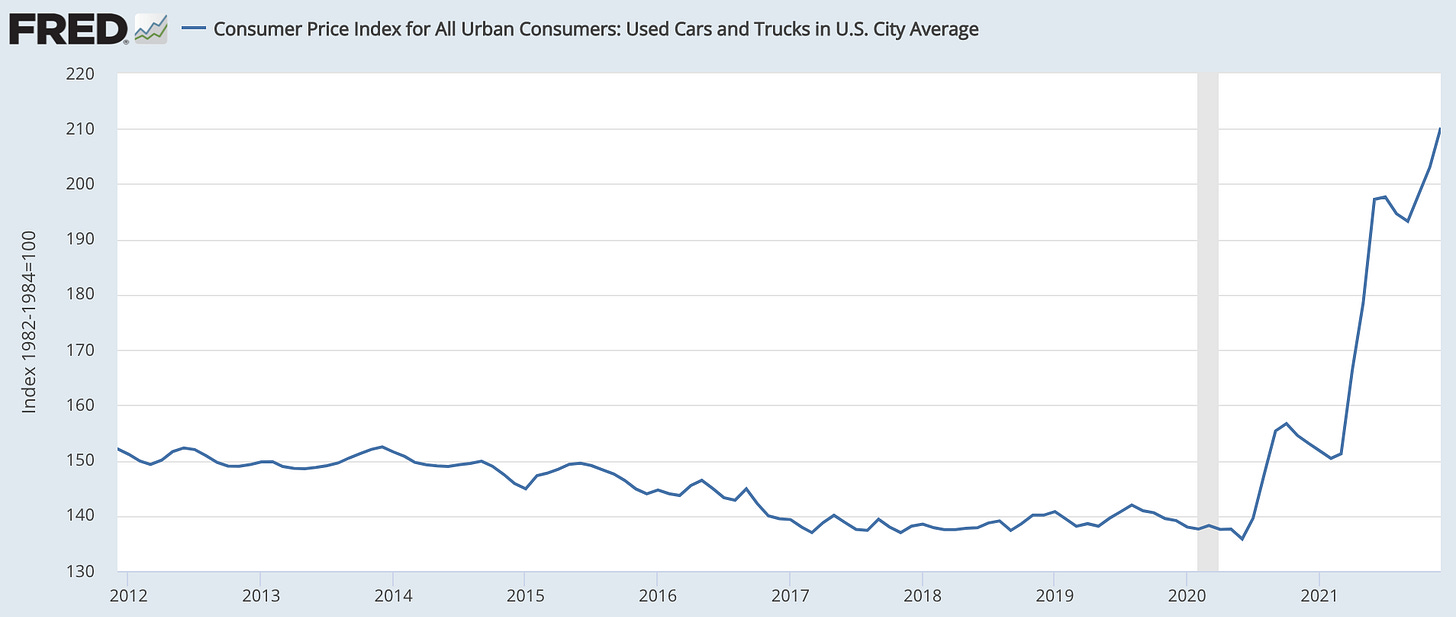

Soaring Vehicle Prices

Used car prices and new car prices have soared in 2021. This is likely due to 4 major factors/trends:

Supply chain and production disruptions from the pandemic

Major influx of capital to the American consumer

Work from home 2020 & 2021 and Millennial home buying (commute demand)

Chip shortage

3 & 4 I can’t help but believe it wouldn’t necessarily be much of an issue if the world wasn’t shut down for a period of time to contain the pandemic. Manufacturer's were disrupted and many businesses postured up defensively, anticipating a longer recession or possibly depression. Think of this as a shock to the system that’s been attempting to play catch up for awhile. Demand exceeded supply, people needed cars, so prices shot up. The problem with this is that it created a bubble within the used car market.

We have to remember something important though. Inflation is cause when demand exceeds supply or when supply constrains and cant meet demand. If you look at total vehicle sales we begin to see interesting trends.

Vehicle total sales are slowing down dramatically while price continues to rise. This signals that either the America consumer has slowed buying in vehicles or that there’s no vehicles to sell. Used vehicles aside, vehicle production is expected to be closer to meet demand in 2022 as chip shortages ease. If this is a top to prices and manufacturer’s are able to meet demand, prices will slowly begin to come down which will be deflationary on a month over month basis.

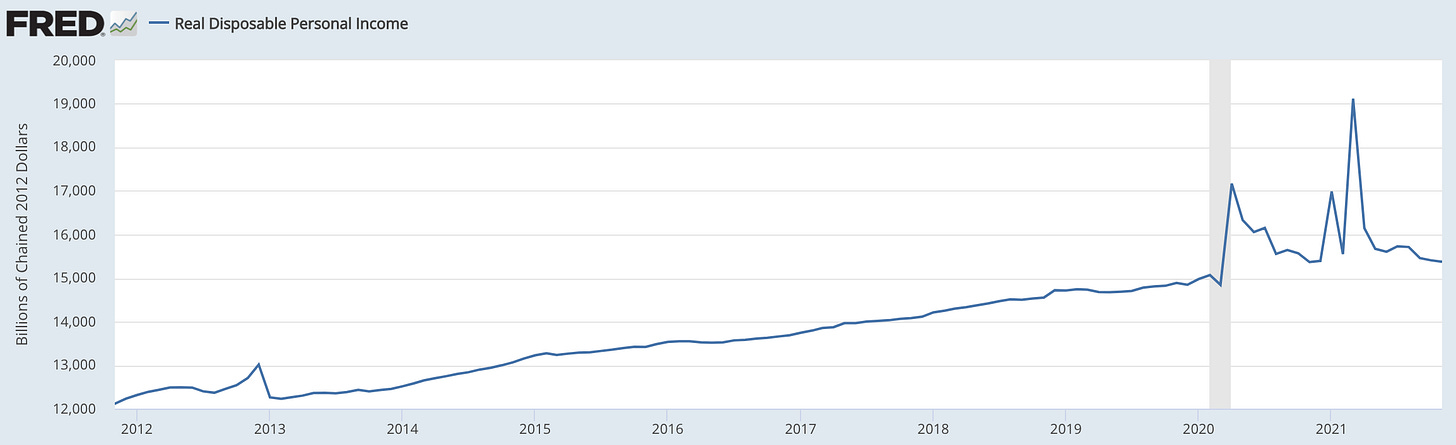

There’s one more piece to this puzzle piece with inflation. That’s the consumer, where it’s been shown that real disposable income has declined substantially due to a run off of government stimulus benefits and checks. If you couple declining vehicle sales, a declining level of disposable income of the consumer and an easing of chip shortage. Demand could ease and supply could increase in 2022, which may contribute to an easing of top-line inflation. If people have less money to spend, they won’t buy it especially if the money isn’t given to them.

Meet Kevin Reports on Vehicle Trends

M2 Money Supply and Velocity

Economics theory states that inflation is correlated between money supply and money velocity. Money supply can be increased by the fed but money velocity isn’t as controllable because it’s how many times a dollar exchanges hands. I’m not going to go too much into the equation but it can be summed up:

(Quantity of Money) x (Velocity of Money) = (Real GDP) x (Prices)

This is based on Nominal GDP = (Real GDP) x (Prices) as well as Nominal GDP = (Quantity of Money) x (Velocity of Money). Nominal GDP is the prices of all goods and service.

Simply put, money supply and the rate at which it changes hands impacts inflation in an economy. JPow effects money supply and velocity of money is reflective of economic activity. To get an idea about what we know, based on this equation, we know JPow is seeking to impact the money supply by increasing rates, stopping QE and potentially a balance sheet run off (to combat inflation). All of these ‘tools’ decrease the money supply in an economy. M2 money supply is a way to measure that with the Fed.

M2 over the past 10 years

Since the bottom of the pandemic, the Fed has expanded the money supply by +40% of its pre-pandemic level (or nearly 30% of all current money supply). This is A LOT. But, according to the equation we know that velocity is also influential.

Velocity of M2 Money

Over the past 10 years we’ve seen the VELOCITY decline, exponentially during the pandemic. This tells us that as the Fed expands money, it’s slowing the exchange of hands. One could theorize that this is heavily contributing to the growing wealth gap in America and never truly getting to and exchanging hands in the general public.

According to this theory, if the Fed slows M2 growth and the velocity of money continues to lower this will create a disinflationary force in the economy. Offsetting the exponential M2 growth we’ve seen the past 2 years.

Inflation Debate

Puru always has insightful perspective on the macro environment despite not always agreeing. But this tweet really stuck out.

There are massive secular deflationary forces that are forcing themselves against inflation. If you print 30% of all money in circulation in 2 years and all we get is 7% inflation, we have to start thinking about what we’re dealing with on a secular basis. I know 7% is a big number on a YoY basis but if we took inflation from 2019, we’ve had 8% inflation over 2 years (+4% inflation per year). 2022 comps will be significantly less. I think Bloomberg reported on 3% and Fed is estimating 2.5%.

The Fed will begin to normalize policy to be less accommodative, supply chain issues will ease, microchip production will increase inflation will abate. Secular forces strongly favor deflationary forces over time.

Growth Stocks - Likely ‘Forming’ a Bottom

If we look at the relation of the treasury yields to growth stock performance, it’s surprising. This really is correlated more than most people think. The reason why; it has to do with money flow and where allocation of assets are best directed to.

When institutional investors and trading algorithms judge the price of a stock and its projected return over a period of time, it constantly weighs risk and premium to bond prices and yield. In plain english, it means that investors are constantly deciding between bond prices, value stocks and growth stocks. The end goal at the end of the day is always the same time, yield. Investors seek return and yield over a given period of time. However, they must decide how much risk they’re willing to take to achieve that yield if deviating away from bonds.

Growth stocks are inherently more risky and the future return is often pulled from the future to todays price and valuation. Basically, growth stocks are priced 3-5 years in the future. If yields go up, the cost of capital goes up and decreases the potential future cash flows and earnings. In other words: rates go up, future earnings go down & rates go down, future earnings go up. Bond prices being low is inherently good for the stock market.

The Dog wags the tail with the Bond Market being the Dog and the tail being the Stock Market.

The headline article above from Bloomberg goes into how the market has priced in about 3 rate hikes currently for 2022 and is in the process of the fourth.

From a valuation perspective, the contraction should ease as the bond market has likely tempered off. This means that from a fundamental perspective, the odds are strongly in growth stocks favor to be at or near the bottom.

In this Twitter post, it was very important to put the perspective on where things are from a fundamental perspective in the flag ship innovation ETF. I constantly use this and reference her ETF because it is a high beta, long duration, ETF that moves with the broader growth stock market sentiment. Cathie Woods has been very in the way of this liquidity speculation bubble as well as the bust, just like many other growth stock investors. What you see in the post is that nearly all valuations have come back down to earth from a P/S perspective and in some cases, are lower than pre-pandemic era when interest rates were higher. What this signals to us is that it’s very likely, once again, from a fundamental perspective that we are at or near the bottom of the growth stock crash.

The secular forces between stock fundamentals and bond fundamentals favor growth stocks to bottom and out perform this year.

The out performance is rooted in current sentiment and market expectations. Essentially the stock market has completely ignored growth stocks and left them for dead. What has been fortunate for us is that our near term pain of buying growth stocks is that valuations are FINALLY reasonable and rationale.

I would assume that we are at likely at capitulation in the growth stock market cycle. This means this is the point of maximum returns for rotation and the next cycle up. Please know, that during the capitulation phase it is volatile and stocks can head lower. The bottoming process is just that, a process. Just like when markets top, it’s a process. But in my opinion, there’s opportunity every where in the markets. Particularly fundamentally strong growth companies.

Conclusion to this Thesis

Inflation is becoming increasingly likely to trend down ward because major drivers of inflation are beginning to trend downward. In addition the secular forces of deflation still persist and will continue to persist for some time, possibly years.

Because inflation is likely to abate this may back track some of the Fed’s comments on various topics like 4 rate hikes in 2022 or balance sheet runoff at the end of the year. The reason why one could think this is that the whole reason why they are tightening monetary policy is to combat inflation. There wont be a reason to tighten if deflation begins to take hold.

There is one key question to ask here, if less rate hikes take place and QT does not happen, how will the markets respond? Will slower economic growth be the result of tightening policy?

If this is the case, growth stocks are likely to out perform in 2022 because all negative news is baked in. Consensus has them in the dog house but this is typically the point the market begins to reverse.

If you liked today’s content please consider subscribing!

Until next time, stay tuned and stay classy,

Dillon

Thank you Dillon.

Thank you Dillon , Again a great read of which as you usually do ; You look at Markets from every point on the compass , giving us that energy to look from every direction ... Did I see this in " Seeking Alpha " ... or you didn't send it over yet ...

Stay Classy and keep up your great work ..