The Equity Markets Will Trade Sideways for 2 Years

In today’s Podcast Newsletter, there’s a lot to talk about because we’re in the middle of a market crash, geopolitical crisis and earnings season. The goal here is to give you, the subscriber, a one stop shop on the state of our markets before market open on Tuesday. There’s a few key points I’ll talk on:

The ongoing bear market, the narrative, what history has showed us and what is to happen next

Previous weeks earnings with Palantir, Roku and Global-E

Earnings to keep an eye on for this upcoming week

There’s quite a few take aways from last week and heading into this week. It has become difficult to decipher what good looks like when it comes to company earnings because of how bearish the overall sentiment is toward growth stocks. But, it’s important to know that the best long term risk reward comes during times negative sentiment, not during euphoric sentiment.

It’s very difficult and almost un-instinctual for us to focus on delayed gratification vs instant gratification. Typically, being bullish in this environment isn’t welcomed because of the “pain” associated with the portfolio equity going down today or over the next week or two. But honestly, in one year, a lot of the fundamentally sound companies we are talking about here today will be higher. When saying, “a lot” I would estimate 60%+ of them will make it and will continue their growth (price appreciation) trajectories, handsomely rewarding investors.

Let’s start by talking about our ongoing Bear Market, the Economic Cycle, and what will happen next.

The State of the Markets

As a bull with the ongoing secular bull bear, one must realize I am not unrealistic when it comes to the obvious down side we are facing. When analyzing the markets and given the contracting liquidity position in the broader macro-economic environment, it’s safe to assume that near term downside and volatility is more and more likely.

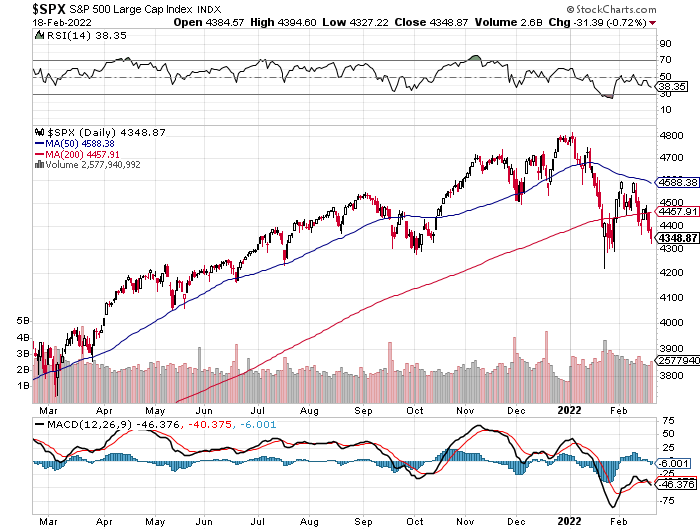

S&P 500

This is where I find the most concern, is in the broader index. The reason why, it looks like it’s forming a head and shoulders pattern and large caps as a whole are still richly valued.

This is where things get most interesting, when you look at the bifurcation in the markets as a whole, something I’ve often talked about.

The disparity of difference between Large Caps and Small caps is most closely related to the 99’ tech bust

Although still in high demand, Large Caps would historically considered “over valued” with valuations reaching 99’ levels

It is note worthy that some large caps like Microsoft, Apple, Google and Amazon are some of the best companies the world has ever seen. In addition, their ability to generate FCF is second to none.

Despite the high quality business perception, an investor could imagine that short term pressure would be likely on a lot of these large cap names, specifically in the S&P 500. Essentially, when you combine Macro factors like tightening liquidity, technical break down, and extended valuations there absolutely is a reason to give an investor pause.

During the heat of the tech and telecom bust, it is note worthy that small cap stocks bottomed in 1998. From there, they out performed the indices (even finishing up positive) for the next few years despite the ongoing bear market.

When we look longer term, we can see that the 200 week moving average in the S&P 500 has, on multiple occasions, played a significant structural support line. By looking at history, during the last tightening cycle, we can see how this played out in between 2014 - 2016.

In October of 2014, QE ended where we can see a similar, aggressive, rally in the S&P 500 over the past few years during fiscal stimulus. From October 2014, the markets traded sideways for the next 2 years. If we use history as any guide, we can fall under this assumption:

The stock market as whole (as depicted by the S&P 500) will likely try to rally back to its highs at the end of March/April, once QE is finally complete, but then trade sideways for a few years. Multiple expansion will be incredibly difficult in an environment without expanding fiscal stimulus. Investor expectations should be tempered and should forget about the past 2 years price action. A more normalized environment is likely.

NASDAQ & Growth

The NASDAQ, with more growth stocks than the S&P 500, is telling a different story. It’s very difficult to not see the bearish pattern forming and investors should know/understand that we are likely in the middle of a Bear Market.

The image above really puts into perspective how spectacular the past 2 years have been for the NASDAQ. But, looking at historical trends, the longer term support line is at the 200 week ema. If we look at 2014 - 2016, we can see that the NASDAQ, much like the S&P 500, traded sideways for 2 years as well. It wasn’t until stocks bottomed at the 200 week ema that an epic rally occurred. The same can be said for the bottom of the 2018 market crash AND the COVID pandemic. But, as individual investors, we know that the index does not tell us the full truth of what has happened the past year.

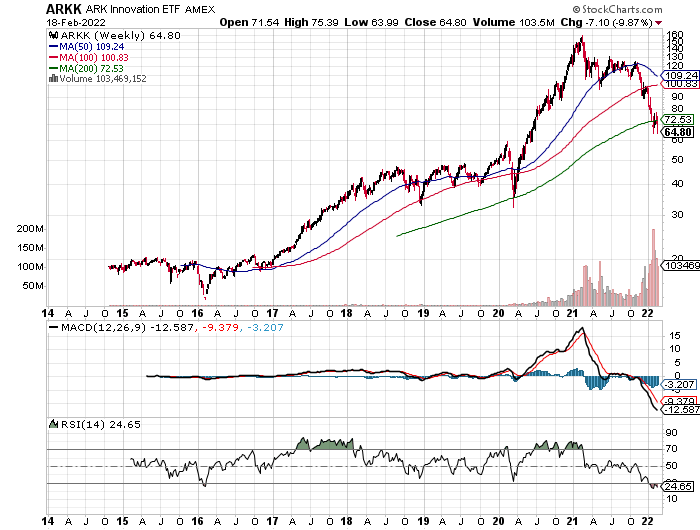

Beneath the surface, it has been a bear market for the past year. This is also depicted by ARKK’s ETF that falls under the “Mid Cap Growth” sector of the market.

What’s most concerning is that ARKK does resemble what happened in the 1999 NASDAQ. Time and time again, I can see similar patterns emerging, which is concerning. This would suggest that growth stocks will be out of favor for the next few years. 99’ tech bubble for reference:

If history is any guide, as it usually is a gauge of human behavior, ARKK innovation fund can see $40 at the max low. This could happen this year BUT, I am hopeful this does not happen. This would leave my growth stock picking strategy on the sidelines for the next 1-2 years. Pay attention for a meaningful break below the 200 week moving average, this will likely be the signal for an ongoing bear market in growth. Full disclosure, I’m optimistic that my stocks will decouple from ARKK’s more speculative stock picking strategy.

Why the Markets Will Trade Sideways for 2 years, from November 2021.

This is more about the economic cycle, current stock valuations, and expected growth over the next few years.

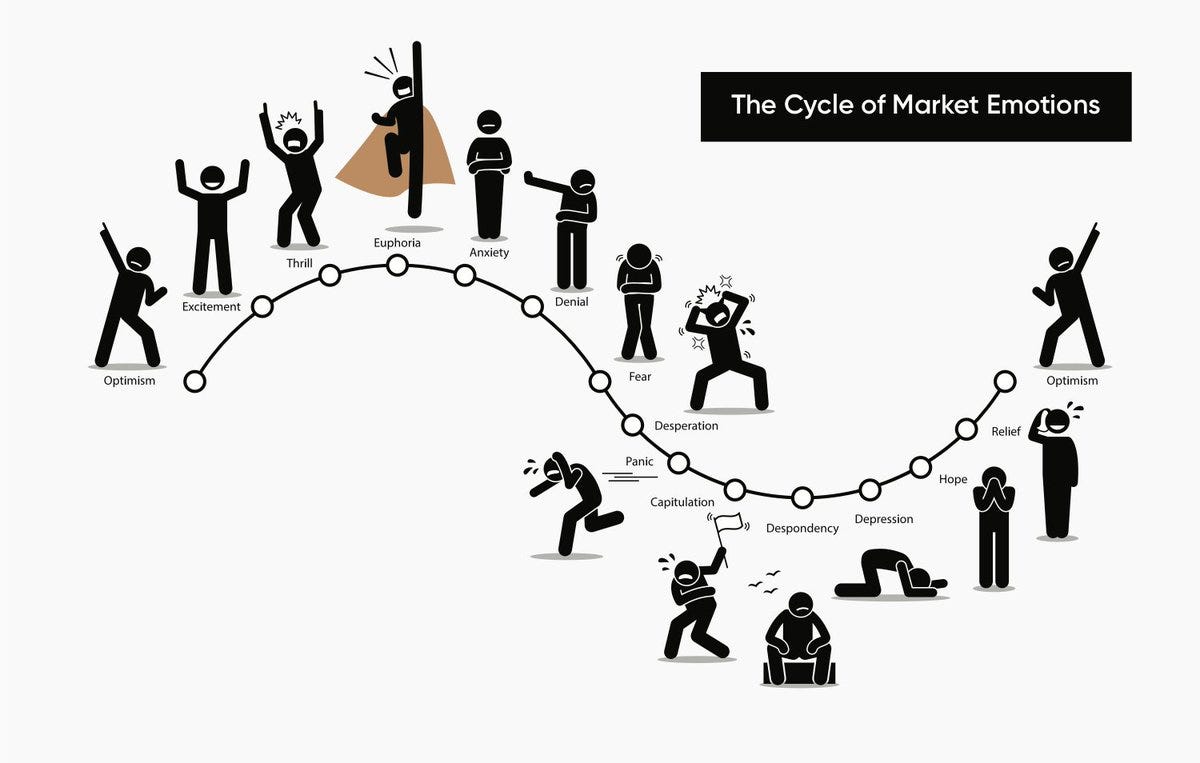

Like everything, there is life and death, rotation, rise and fall. There is always ying and yang, meaning there must be balance. This is a truth that has existed for as long as time itself. What we are witnessing is a classic cycle. In relation to the chart above, it would appear that we are likely in a Bear Market to Late Bear Market. The reason why:

Leading economic indicators such as the 30 year and 5 year spread as well as inflation and consumer sentiment would tell us we are in “full recovery” & “early recession”.

Monetary policy must tighten, the reason why that’s important is best depicted by this tweet

Earnings are likely to under perform for the broader indices due to its balanced approach and exposure to the economic cycle

The fundamental (valuation & earnings), macro (economic and business cycle), and technical (distance from major moving averages) are all leading to validate the same thesis. If history does repeat itself, or at least rhymes, we should see similar price action to 2014 - 2016 after a prolonged period of consolidation. This will prove to be a difficult time period for traders, an accumulation period for the patient investor, and a correction/crash in the secular bull market we are experiencing. Delayed gratification mindset will be of value for the next few years/months.

Don’t invest money you can’t lose, which includes margin and is somebody else’s money.

Earnings Last Week

I’d like to cover four stocks but rather than reviewing exactly what the individual results were, I’d like to paint a picture to a few of the secular trends we are watching. I will dive a little more deep into GLBE and PLTR because I believe these may be two of the best opportunities on the market.

First, let’s talk about Roku and Amplitude. I am very concerned about both of these businesses over the long term. Amplitude guided down on their earnings and Roku missed and guided down. This is concerning because it’s showing that both of these businesses are “nice to haves” and not “need to haves”.

When reviewing Roku, I noticed that competition and international expansion efforts are not going as planned/expected. In addition, they continue to lose money on their player business. Long term, I believe that their best opportunity is their advertising business which is where they should actually be valued. The player revenue, at this point, is actually acting as a drag on the stock. Leadership may have a longer term vision but the didn’t make the best choice in the short run.

Amplitude confirmed concerns I originally did have about the business. Because they are in the business of “Digital Optimization”, which is a fancy world for product analytics, they are prone to being cut out of a businesses crucial operations. It was an easy choice to cut them and move on. Moving forward, I will continue to watch them but I see no reason for either to have a place in my portfolio.

Global-E stole the day along with Upstart. After reviewing both of these calls, I am extraordinarily excited for both of these businesses and believe both present incredible long term opportunity. On one hand, Upstart is proving that it’s customer growth and leadership execution is over coming the cyclical cycles in the economy which is note worthy. Global-E is experiencing an identical situation. The demand for AI automated loans and international e-commerce is appearing to likely overcome any short term challenges in 2022 - 2023. Both of these stocks should be considered for your portfolio.

Palantir showed business results better than I expected, the reason why: commercial revenue growth. I did notice that there was a moderate slow down in their government portion of their revenue growth BUT, this was expected especially as you see its historical revenue growth. It’s definitely lumpy. But, where I found the most encouragement was the 100%+ YoY commercial revenue growth in the United States. The reason why this was so bullish is that they only recently began investing into their sales force. They have effectively grown 100% YoY commercially without a true sales team. I expect this to be a growth driver long term. I also expect stock based compensation to come down and Palantir reaching GAAP profitability within two years. We could see Tesla like price action when they do.

Results:

Roku: Bearish

GAAP EPS $.17 beating by $.13

Revenue of $865m missing consensus by $29m

Q1 revenue guidance revised downward to $720 from $756m

Amplitude: Mixed, Poor Guidance

Non-GAAP EPS of -$.05 beat by $.03

Revenue of $49.4m beat expectations by $2.45m

1Q revenue guidance of $50m - $51m revised downward from $51.3m

Full year revenue guidance of $226m - $234m revised downward from $236m

Global-E: Bullish, Accelerated Growth Guidance in 2022

GAAP EPS of -$.15 beat expectations by $.01

Revenue of $82.75m beat expectations by $5m

1Q revenue guidance of $74.5m - $76.5m vs $64m consensus

Full year revenue guidance of 70% YoY growth, $411m - $421m

Palantir: Mixed/Bullish

Non-GAAP EPS of $.02 missing expectations by $.02

Revenue of $433 (34.4% YoY growth) beat expectations by $15m

Q1 revenue guidance of $443m vs $439.6m consensus

Long term growth guidance of 30%+ through 2025

Upcoming Earnings This Week

This week will be a busy week for growth stocks. I will be listening and providing and update on many of these stocks as the week goes by. Company earnings by day and expectations for each company:

Tuesday:

TDOC (Teladoc): A Cathie Wood favorite and COVID beneficiary. The specialize in Tela-Health and are an industry leader.

Revenue expected to be $546.4m

Non-GAAP EPS of -$.54

MELI (MercadoLibre): A leading e-commerce and payments business in Latin America. MercadoLibre has been a major long term winner and COVID beneficiary. Look here to get international e-commerce and payment trends.

Revenue expected to be $2.02B

Non-GAAP EPS of $1.21

Wednesday:

FUBO (FuboTV): A sports first streaming and online wagering company. Fubo has been left for dead due to profitability concerns. Secretly, behind the scenes, they’ve been executing incredibly well with recent acquisitions and advertising revenue. Will they out perform bottom line expectations?

Revenue expected to be $220m, up from $213m expectations

Non-GAAP EPS of -$.56

MNDY (Monday): A SaaS business in the work place collaboration front and direct competitor to Asana. Monday has been growing 90%+ for a few years and offer a unique customizable SaaS product to both small and large businesses. No concerns here and likely a beat on top/bottom line.

Revenue expected to be $87.8m

Non-GAAP EPS of -$.52

Thursday:

STEM (Stem): A pure play on renewable energy and software AI for energy businesses. Stem has been growing very fast and has been caught up in the SPAC revolution. I would like to see increased gross margin and continued accelerated growth.

Revenue expected to be $73.7m

Non-GAAP EPS of -$.12

EXPI (ExP World Holdings): ExP is a cloud first real estate brokerage. They specialize in enabling real estate agents to run their own businesses and offer a “pyramid” type model of compensation. They also have a software product called Virbella which is a metaverse product. Growth has not been notable for Virbella so far.

Revenue expected to be $1.03B

Non-GAAP EPS of $.07

MGNI (Magnite): This is important for me as a PubMatic owner, who reports earnings a few days after Magnite. What I’m looking for here is industry trends in SSP and what their revenue expectation is compared to PubMatic. Magnite and PubMatic are direct competitors. A large portion of their recent growth has been inorganic, from acquisitions.

Revenue expected to be $139.85m

Non-GAAP EPS of $.25

DOCN (Digital Ocean): An SMB cloud infrastructure business. Digital Ocean has recently seen accelerated growth on top and bottom line. They are currently projected to grow 30%+ for years, profitably. This is likely to be a beat if they follow a similar trend to all other cloud providers. If this isn’t a beat, it would be cause for concern but unlikely. They have beat earnings every time since IPO.

Revenue expected to be $119m

Non-GAAP EPS of $.09

Other notable earnings that many other investors will be watching:

COIN (Coinbase) - Crypto exchange/brokerage

ZS (Zscaler) - Cyber security leader

SQ (Block, previously square) - Digital payments provider and blockchain enabler

I am hyper focusing in on Fubo, Monday, Digital Ocean, and Magnite. All of these businesses have a large impact on my current portfolio and will tell me the direction to make important portfolio adjustments. In the event any of these businesses out perform, it will be likely that they will rally after hours but could see the rally faded a few hours later after open due to broader bearish sentiment.

Summary - The Year of Accumulation

Believe me when I say, this type of price action tests all investors. The delayed gratification mindset isn’t normal for us especially when it comes to money. Typically, most people who have $10,000 to invest would rather buy something new and exciting to get gratification today.

2022 is the year of corporate equity accumulation. This means that the dollars you have are subject to swings both up and down, traders could get torn up. But there’s opportunity in every storm and it’s usually those who whether it the best that will come out on top once the clouds pass.

Stay Tuned, Stay Classy