Growth stock investing is a style and it’s volatile. However, BluSuit’s investing style is based on fundamentally strong companies with a competitive moat and strong growth. More importantly, every growth stock I see is selling at a steep discount due to Fed policy anticipation.

It is important to first bring up that growth stock investing is not completely dead (despite recent price action), it can’t be. There are major secular forces at work and the short term market forces temporarily are unfavorable. However, like I said, short term, it’s temporary. Long term, these market forces aren’t going away till our next secular bear market when the financial markets, the Fed and the U.S. government reset. In other words, I’m saying until the next Great Depression, major World War, or monetary bust, this is likely to stay. I’ll have to do a different publication on this long term thesis.

The purpose of this publication is to provide my TOP 5, must have, growth stocks for 2022. Short disclaimer, this is based on information I have today. International business changes rapidly and these outlooks can quickly change. It typically changes based on competition, poor management decisions, or simply business maturity in a given market. But for today, these are the BEST ideas I have and I am sincerely exuberantly excited about holding these growth stocks. They all have 5 things in common:

Massive market opportunity

Profitable

Recurring business revenue

Founder led

Deep competitive moat

With each business, I will provide a description of their business model and what they do. In addition, I will provide a chart and probable price prediction based on maintaining today’s valuation through expected growth. The idea is what would be the years total return by December of next year. Hope you guys enjoy this one!

I’ll start at number 5 and will work my way down to number 1. The first 2 will be complimentary but the last 3, my top 3 conviction, will be for BluSuit members.

5.) MercadoLibre $MELI

Basically the Amazon of Latin America (I know this is over used, but really). They offer Latin America’s largest e-commerce store and digital payment solutions in 18 different countries in LatAm. What’s most interesting is that Latin America’s total e-commerce market is expected to double in 5 years, according to statista.

This means that MercadoLibre is expected to grow exponentially in the years to come as they stand to heavily benefit from not just one but two secular trends in e-commerce and digital payments. Some of their most recent top-line financial metrics:

72.9% YoY (FX neutral basis) revenue growth in Q3 2021, up to $1.9B

GMV growth of 29.7% YoY (FX neutral basis)

Total payment transactions increased 59% YoY (FX neutral basis)

Gross margin expansion to 43.4% compared to 43% last year

Operating expenses fell to 34.8% of revenue compared to 35.6%

Net income before tax expense grew 139.5% YoY

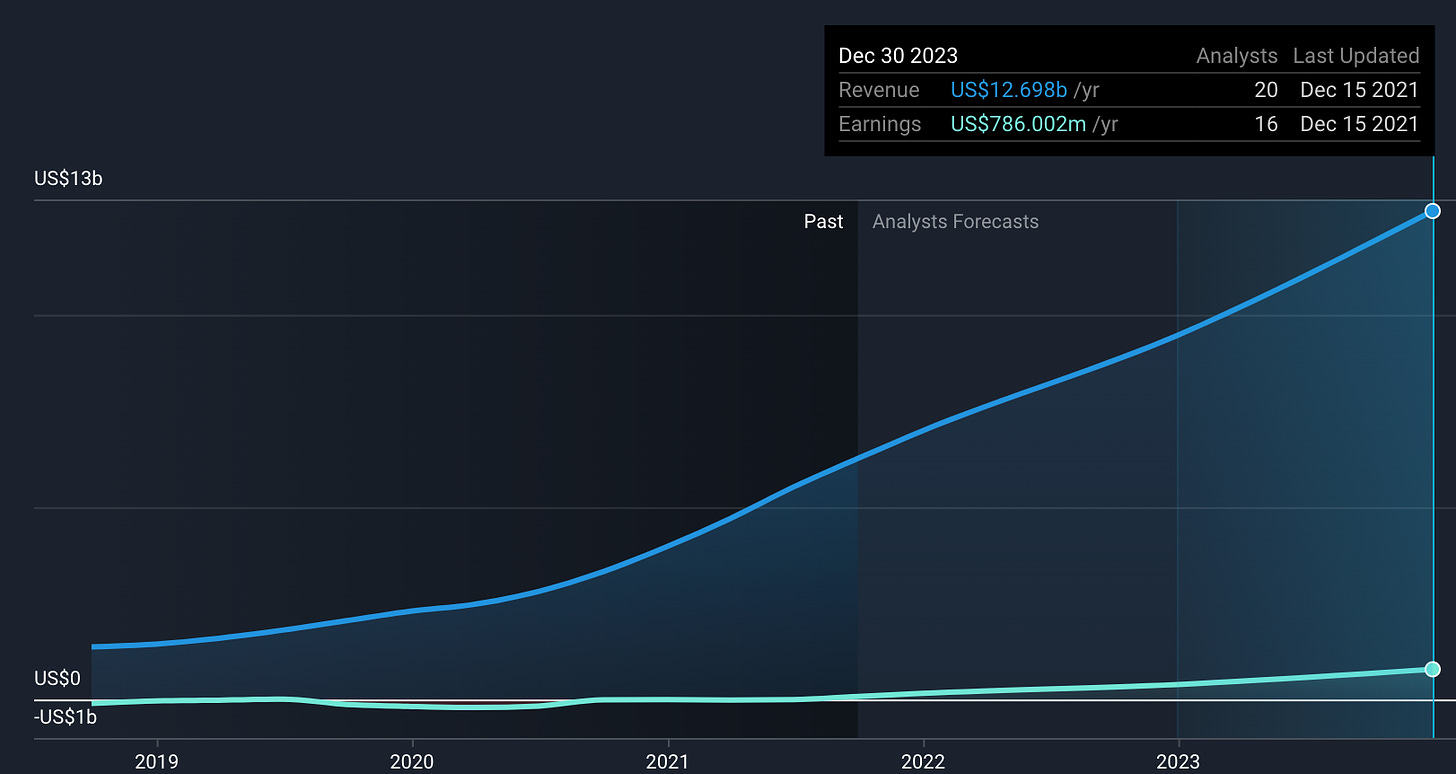

FX neutral basis was used here because it accurately represents growth rather than an adjusted basis, based on the U.S. Dollar exchange rate of foreign currency. There are a few key take away’s I’d like to bring to these financial highlights, which are very important. The first; revenue is still growing extremely fast despite posting over $1.8B (on an adjusted basis). This is very important. The second, their operating margins are improving with scale rapidly. Analyst future projections also have MercadoLibre expanding their earnings by 128% in 2022 and 112% in 2023 with revenue growth expected to be 35% and 34% sequentially. This leaves room for substantial outperformance given the expected market growth.

Given their recent 40% haircut, but now to 26%, from all time highs I am led to believe that there are few more compelling discounts on the market. MercadoLibre is expected to grow for years, possibly over 30%+, with expanding operating margins and earnings growth. In other words, this should be strongly considered for all growth investor portfolios. They are also strongly positioned for stock out performance in 2022 given that they are expected accelerated earnings growth and only expected revenue growth of 35%, leaving room for outperformance of expectations.

1 year price target of $2000 - $2,500 per share, which will be a near doubling in share price. This isn’t difficult to see due to expected earnings growth of 120%+ and no significant change in multiple expansion/contraction.

4.) Digital Turbine $APPS

2021 should have been expected to be a volatile year but recently, they’re downright cheap. In 2021, they acquired 3 businesses: Appreciate, Fyber and AdColony. All of these companies are mobile ad-tech firms. These works extremely well with Digital Turbine’s organic business of integrating within mobile android devices. Basically, Digital Turbine’s software integrate directly within android phones to implement their advertising capabilities for mobile apps. Their organic software helps mobile apps get installed onto a device and their newly acquired businesses will keep the relationship ongoing by enabling advertising services on all these android devices. This is all brand new and 2021 was their year of integration, 2022 will be a much different story for this profitable growth company. Highlights from their latest earnings call:

338% YoY growth as reported but a 63% YoY growth on a pro-forma basis. It’s better to use the pro-forma basis to get an accurate reflection of the growth year over year as a combined entity.

GAAP net loss of -$.06 per share, which was mostly contributed to merger expenses. Non GAAP profit of $.44/share compared to $.15/share last year. Main take away here, on a Non-GAAP basis they’re profitable but on a GAAP basis, this should see improvement in 2022.

Cashflow from operations of $36.7m and free cash flow positive of $30m. This is important because they are carrying a larger debt load but appears they’re making payments on their debt as a combined entity. Nearly all debt is long term debt ($244m) compared to short term debt ($13.4m) which typically yields a lower interest rate, making it easier to pay off assuming a company is cash flow positive.

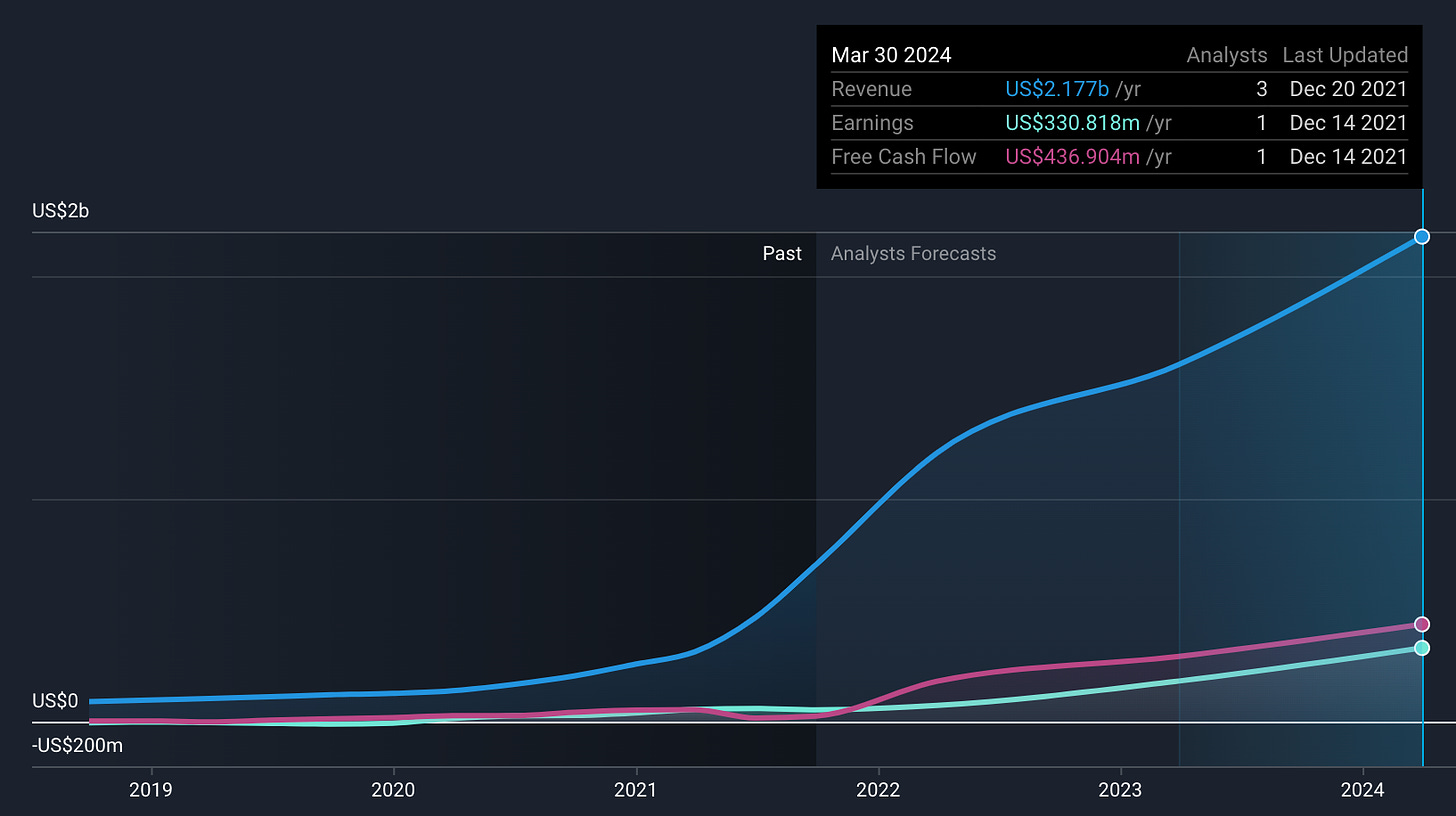

There are two very important things to bring up when it comes to the future of the business. On a forward P/E basis, it’s extremely low and is valued lower than some cyclical (low growth) value stocks which baffles me. In regards to future growth, analysts appears to be heavily sand bagging their 2022 growth which leads significant room for outperformance. Their forward P/E is 27.62x with EPS growth of 33% next year and revenue growth of 33% as well. As a long term share holder, I think they are sand bagging big time. Expected future growth, based on analyst expectations, for Digital Turbine:

With Digital Turbine not being spared from the recent growth stock sell off, I believe they were unjustifiably lumped into the other unprofitable growth stocks. However, this leads to a significant opportunity for outperformance in 2022 and will likely beat the S&P 500 on a return basis due to revenue and earnings growth. I see substantial room for multiple expansion as well especially if they integrate all four companies successfully.

1 year price target of $120/share due to multiple expansion, earnings beat, and accelerate earnings/revenue growth from synergies in the business. This will put its market-cap at near $10B which will represent an analyst projected forward P/E of 33x. This is entirely realistic to see from a fundamental basis.

The next section will be members only. Thank you for reading, please consider joining our community. Upon becoming a member, we offer an exclusive Discord community as well. If you are already a member, let me know via our Discord group. Link below:

Keep reading with a 7-day free trial

Subscribe to BluSuit to keep reading this post and get 7 days of free access to the full post archives.