Portfolio Strategy and Review

My Strategy, Conviction and Positioning in Review

Conviction

This word is arguably the most important, but least talked about, word in the financial markets. There are different types of conviction. To generalize, there is smart and dumb conviction. Let me give you just one example of smart and dumb, then explain what I mean by “it’s the most important word”.

Dumb Conviction: “The stock is going up, I need to buy it.” Or, “the stock is going down, I need to sell it.” This type of conviction is emotional and usually in the moment.

Smart Conviction: “I am not going to buy till it’s cheap, or fair value.” Or, “the stock is trading at a very high valuation and I think future returns may be muted, I should sell some here.” This type of conviction is usually thought out and unemotional.

These are just two examples of conviction that I believe are the most common, but by no means is exclusive to, the financial markets. Participating in the financial markets is participation in capitalism, the dog eat dog world that only the strong (most confident) survive. Yes, you the reader, I believe, are apart of this elite group of individuals who has what it takes to succeed in this raw, and competitive, ecosystem because you’re doing the right thing in just “hearing out” someone else’s thoughts.

Today, my thoughts will speak on where I find conviction as I review my portfolio to share my thoughts and process… Where my conviction lies. Maybe you may take something away from it, maybe you’d like to share your process? Feel free to comment below:

In both trading and investing, the process in which that you (the portfolio manager) can have the most conviction will yield you the best results in the long run. There is not one single style that works for everyone. From just my knowledge, here are different trading strategies I have observed over the years:

Swing trading

Day trading

Value investing

Growth investing

Macro trading

Index investing

Position trading

CANSLIM trading

Commodities trading

Bond/fixed income investor

Momentum trader

There are more styles, but I am sure you get the point. There is no “one way” to do this. That’s the beautiful thing about the financial markets, there’s an unlimited way to be creative. There is no right or wrong, there’s just one thing. Alpha.

Alpha is the term market participants often use to describe a desired yield above the S&P 500’s “market returns”

Historically, investors have been approaching financial markets and just, “general investing”, with one goal in mind; a return on investment. The investor at the end of the day wishes to allocate capital toward a specific asset in the hopes it generates more money. The investor can do this with Real Estate, Stocks, Bonds, Commodities, etc. The goal always remains the same. The investor wants to give money to receive more money in the future.

But, like all things, there are benchmarks. These benchmarks can generally be associated with two assets:

The risk free yield (return) on a U.S. government treasury bill. Today, this is approximately 3.8% on the 10 year bond.

The expected (average) return of the S&P 500 of 7-9%. Some years this is less, some years this is more, but ideally this is the return that one receives on a nominal basis. It’s the benchmark for stock market investors and portfolio managers.

My strategy, stock picking, is focused on beating the ladder as I wish to receive higher compounded returns than the S&P 500 (7%-9%) on a multi-year basis. The goal is simple in nature but extremely difficult to execute. The goal is to find and buy companies that will out perform the index over a 3, 5 and even 10 year basis. This is where my conviction lies, it’s what makes the most sense.

More importantly I believe there is a MASSIVE chance the S&P 500 produces below 9% CAGR returns for the next 5 - 10 Years

This means that index investing, which has become incredibly popular over the past 10-15 years, has a strong chance of under performing in a meaningful way. The opportunity, in my opinion, is in individual stocks that are not typically tied to a benchmark.

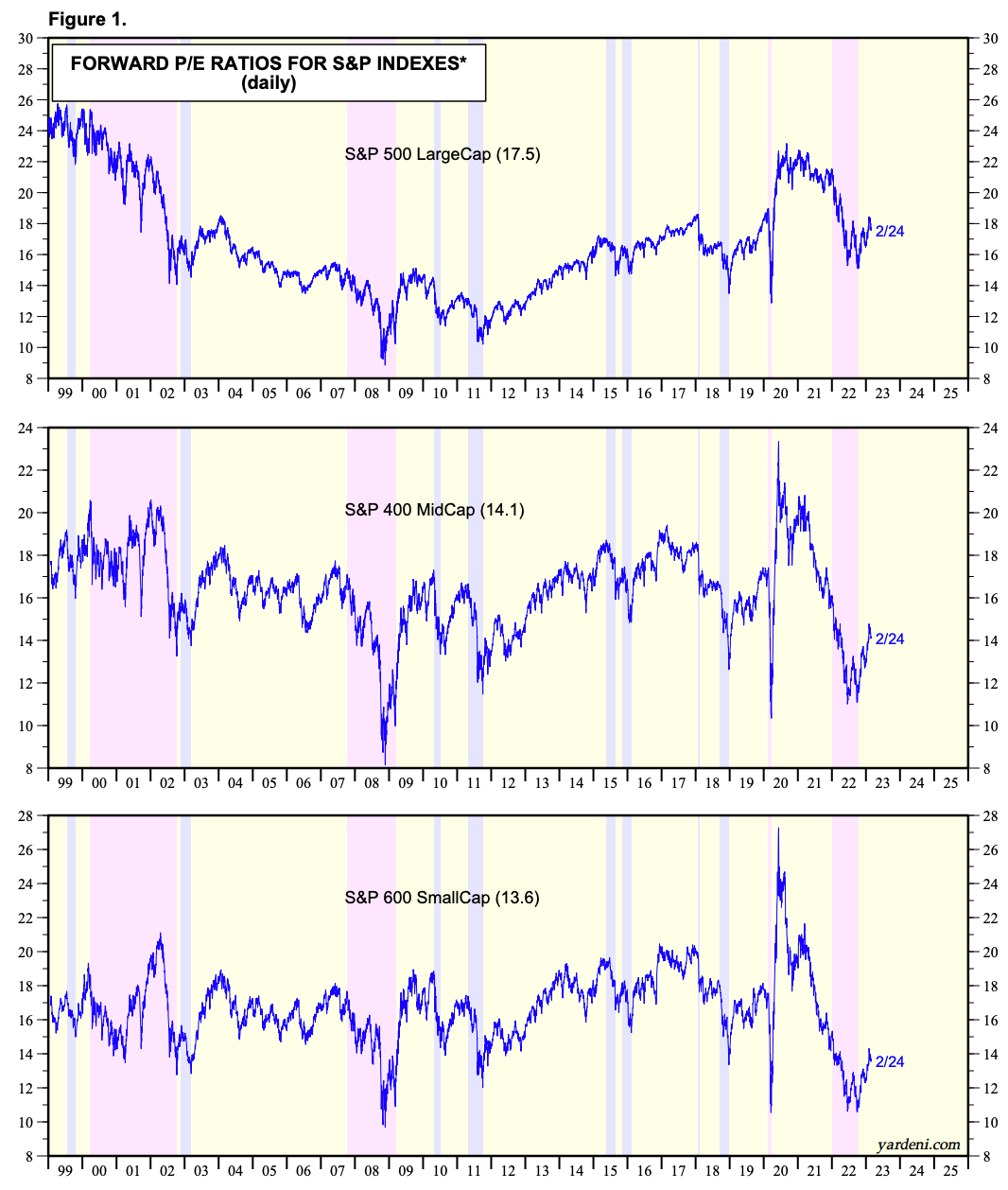

Above, we can see the valuation bifurcation between the S&P vs small cap and mid cap stocks that historically grow faster than Large Cap stocks

Where My Conviction Comes From

Under every stock, there is a business. It amazes me how much I hear people think of stocks as pieces of a broader liquidity puzzle in the financial markets. For example, there’s this common thought (that became widely popular after 2020/21) that stocks can only go up when there’s QE in the financial markets. Although this (QE) incentivizes investment and risk taking in the broader financial markets, completely ignoring the underlying fundamentals in any asset seems extraordinarily counter productive and limiting. This theory and narrative simply isn’t true.

So what does matter? The answer is more simple than you think:

Revenue Growth

Earnings Growth

Cash Flow Growth, &

Valuation

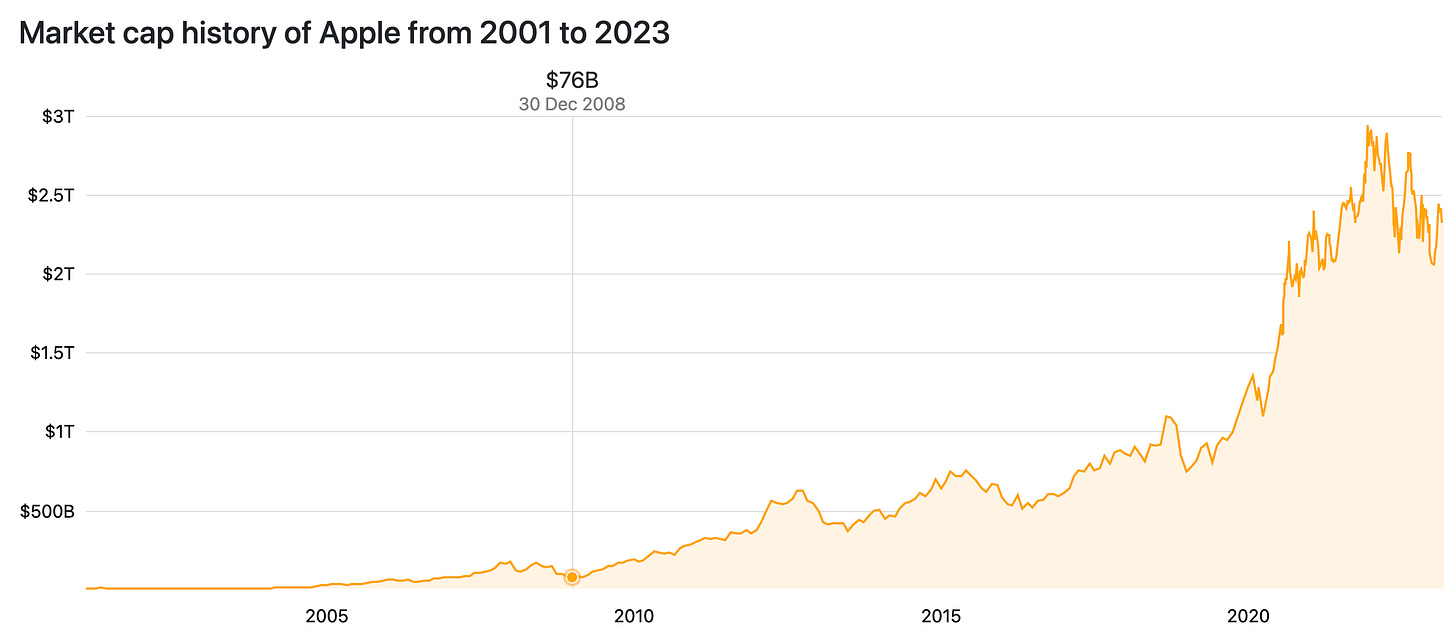

Stocks that out perform the broader financial markets often find a way to grow revenue, earnings and cash flow which creates an intrinsic (not macro) justification to a higher valuation. To receive a higher valuation, a business must accomplish all 3 pillars (revenue, earnings and cash flow growth). To put this into perspective, we can use Apple’s market cap growth over time.

To justify the market cap growth, we can look back at what Apple’s revenue and earnings were in October 2008.

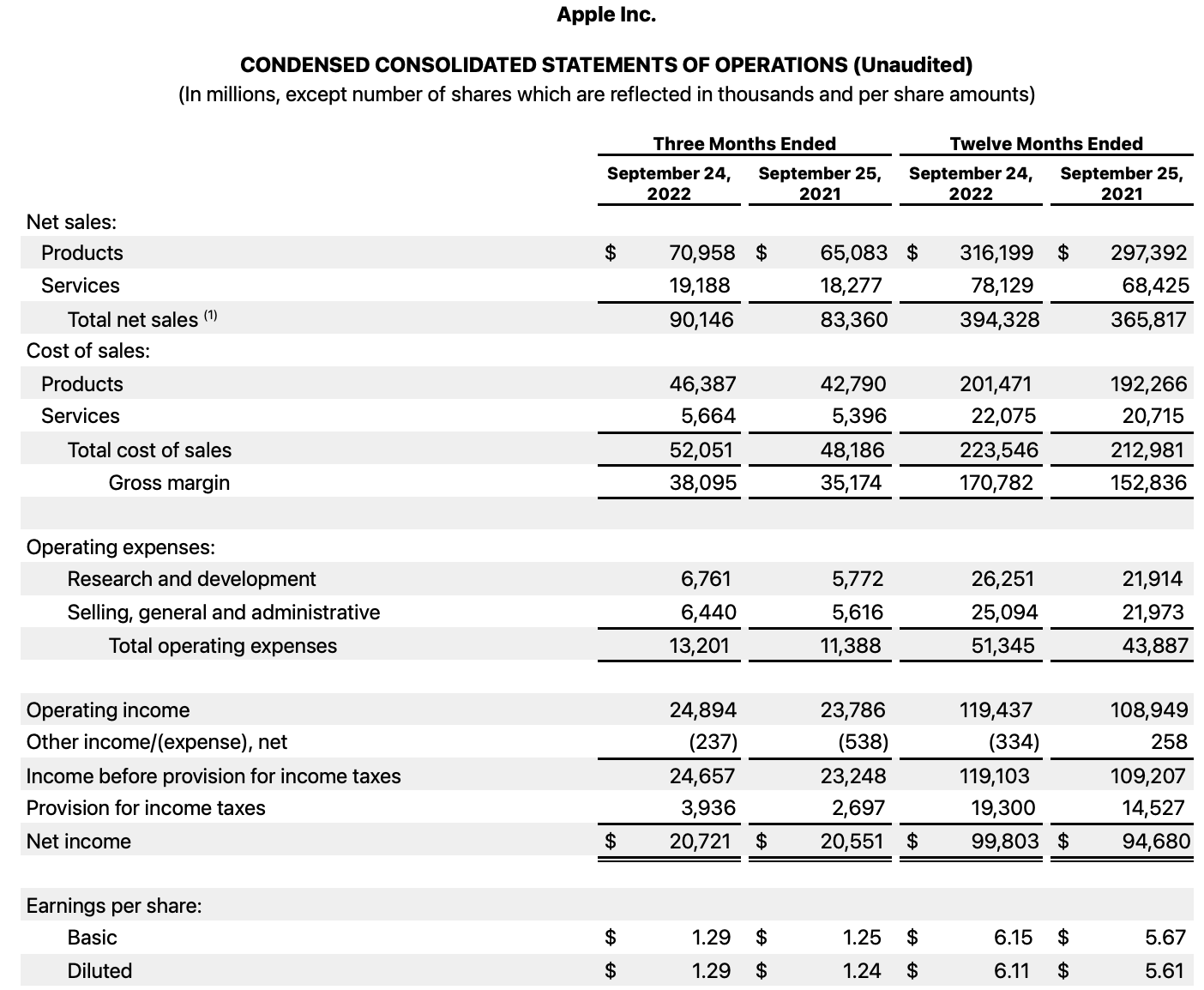

Back then, Apple was posting $7.9B in revenue for one quarter and $1.14B in profit. An amazing feat to grow revenue, earnings and cash flow during the collapse of capitalism as we knew it. Back then, we can see that the market cap was approximately $76B and today the market cap is $2.32T. For comparison, what was Apples latest quarterly results for Q4 2022?

Apple posted $90B in revenue (nearly 12x more) and $20.7B (20x more) in profit for their Q4, 2022, just 14 years later. The result is what you may expect, the stock price appreciated tremendously during this period of fundamental business growth. The stock price has 51x’d its value in December 2008. That means a $1,000 investment is now worth $51,000.

Intrinsically, Apple grew its earnings 20x from December 2008. In addition, They (the board of executives) did other things like buy back stock using the company’s existing earnings and cash flow to indirectly return value to share holders. In turn, this returns value to share holders due to existing share holders owning a larger piece of the company’s business after stock buybacks are executed. This creates higher stock price aside from any fundamental reasons.

By Focusing on Company’s that are Growing Revenue, Earnings and Cash Flow Faster than GDP (and Earnings) Growth, We Can Intrinsically Out Perform the Market.

The point I am making above from Apples example (which is one example of many) is that by focusing on company’s with growing/improving top and bottom line metrics we have the ability to substantially produce superior returns over the S&P 500, over time, and with the right mindset. Our focus doesn’t necessarily need to be catching every last move in these stock moves and there will be periods where a portfolio may return slightly less than the S&P due to macro-economic headwinds or one sector being more in favor over another for what ever reason. Our focus, my focus, should remain on:

Revenue

Earnings

Cash flow

The Business Thesis and Story

Competition

Cash and Cash Flow

Debt

Product/Service Developments

In essence, focusing on the business has the ability to produce meaningful results over a long period of time in the financial markets. You can/will produce Alpha over all other portfolio managers and investors who get scared out of stocks or attempt to time the markets. After-all, who honestly cares what the next 5% move is in the markets. We can make a solid bet that the next 100% move will be up. If a stock has strong financial metrics and is producing/growing:

Revenue

Earnings, &

Cash Flows

It is likely more of an opportunity than a risk when the stock goes down.

Reviewing my Portfolio

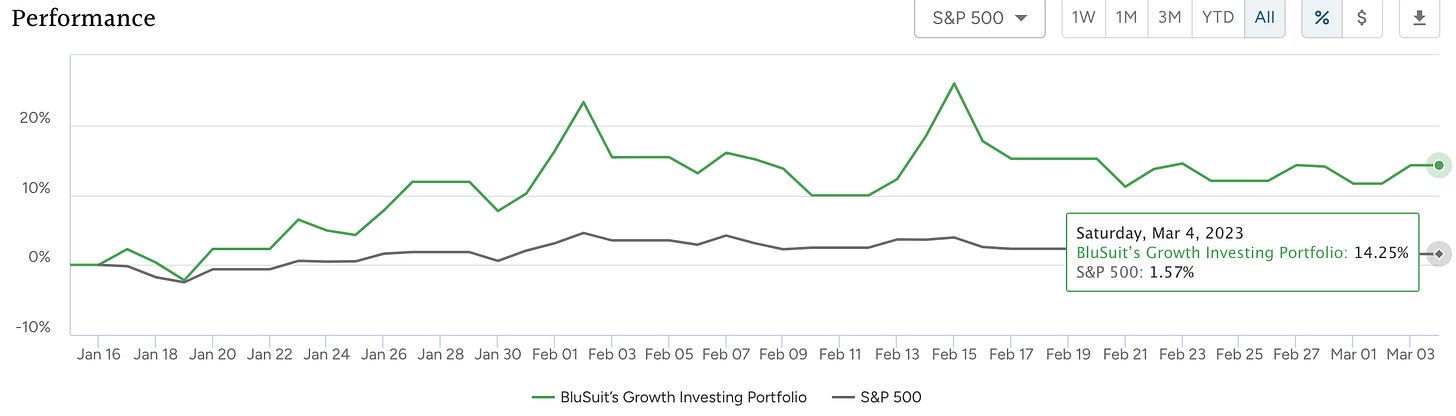

To see what I own as well as my performance over the index’s this year, you can see that here:

Savvy Trader Portfolio Was Recently Opened Up in January (a Transition Away From Weekly Substack’s and an Excel Document) as A Way for Investors to See What I am Doing REAL TIME and How My Strategy Performs Over Time. In Other Words 100% Transparency and Up-to-Date Information.

In this section, I am going to review every stock I own, explain why I own the business, show the research I have done on each business and explain what I see happening to the business over the next few years. I will also review the financial metrics, forward revenue/earnings estimates and current valuation of the business as well as where I think the appropriate valuation will be in one year from now. This should give everyone an idea of what sort of returns I am forecasting based on the current businesses I have.

Format so the reader can scroll to the positions that interest them the most:

MercadoLibre

The Trade Desk

Tesla

Snowflake

DataDog

SentinelOne

ZScaler

Global-E

Indie Semiconductor

Confluent

Monday

CloudFlare

DLocal

MercadoLibre

MercadoLibre operates Latin America’s leading e-commerce and payments platform. I like to think of them as a mix between PayPal, Shopify and Amazon (excluding AWS) for Latin America. MELI has three major business segments to pay attention to:

Payments Platform: +96% Growth on YoY Fx Neutral Basis

Credit Lending Platform

E-commerce and Fulfillment: +56% Growth on YoY Fx Neutral Basis

Their three business segments have me think of MercadoLibre more as a technology infrastructure business for consumers in LatinAmerica. Other smaller segments of their business include:

MercadoLibre Ads - Their AdTech arm

MercadoLibre Classifieds: Allows individuals to buy and sell real estate, vehicles and other items

MercadoShops: Enables merchants to set up and host their own digital store fronts

MercadoLibre, as I see it, offers investors a unique exposure to a leading digital innovator for LatinAmerican consumers. They are the market leader, with little competition, and operate within multiple different LatinAmerican markets, the biggest of which include: Argentina, Brazil and Mexico.

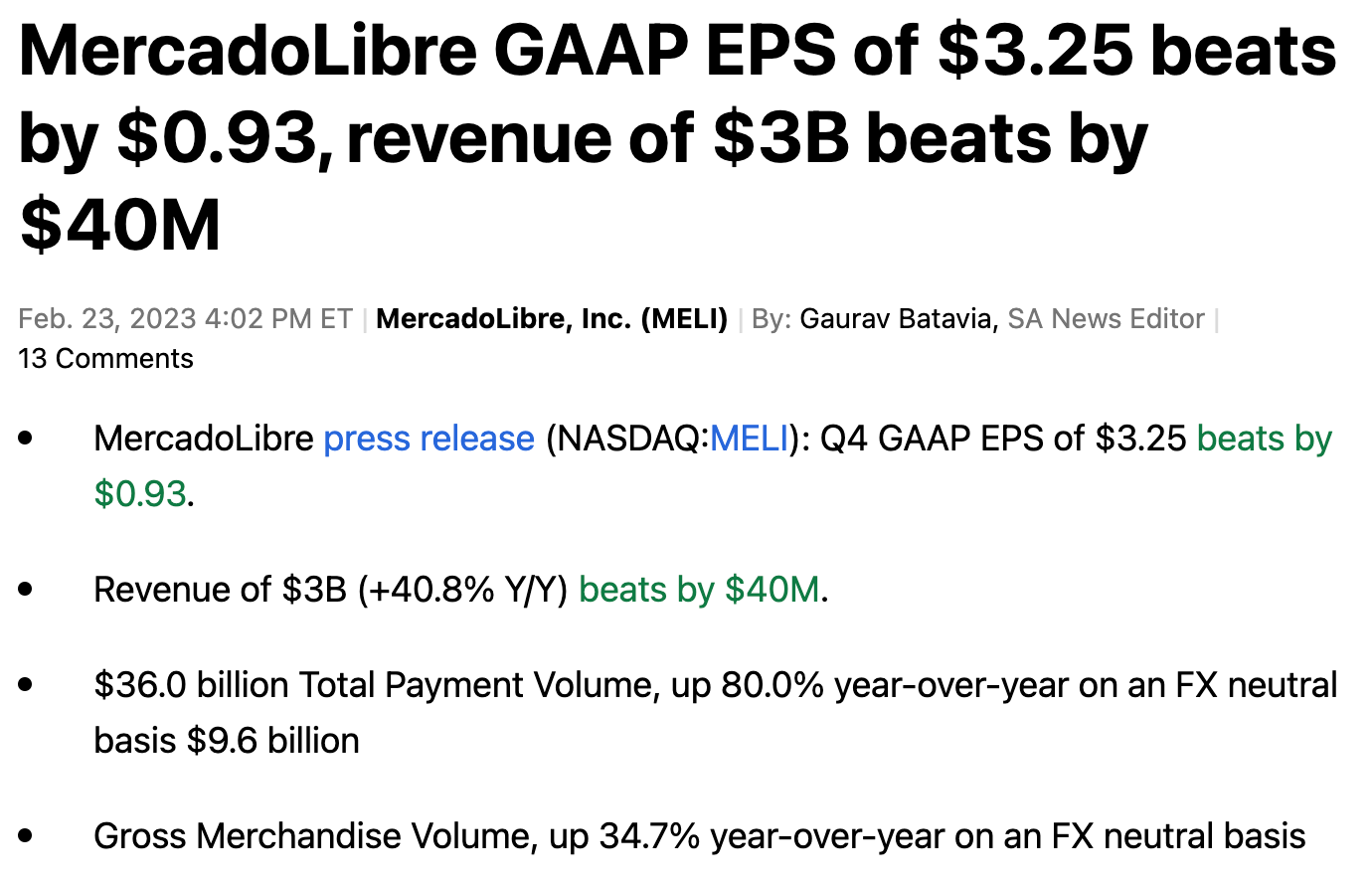

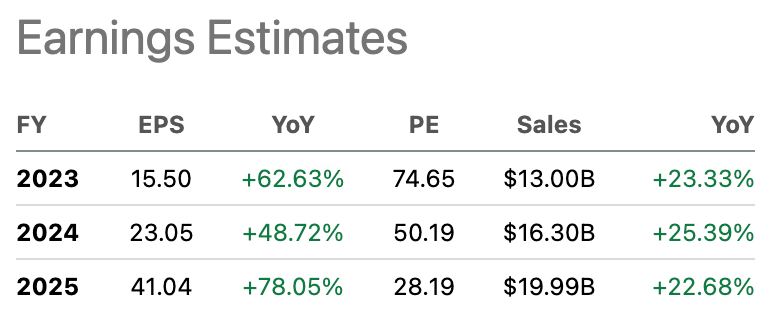

Their most recent results on an Fx adjusted basis were:

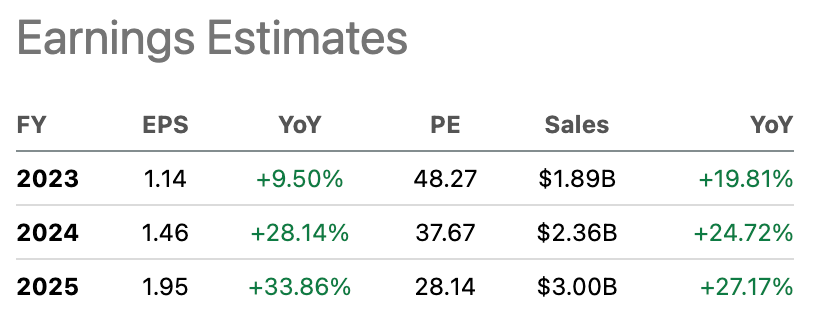

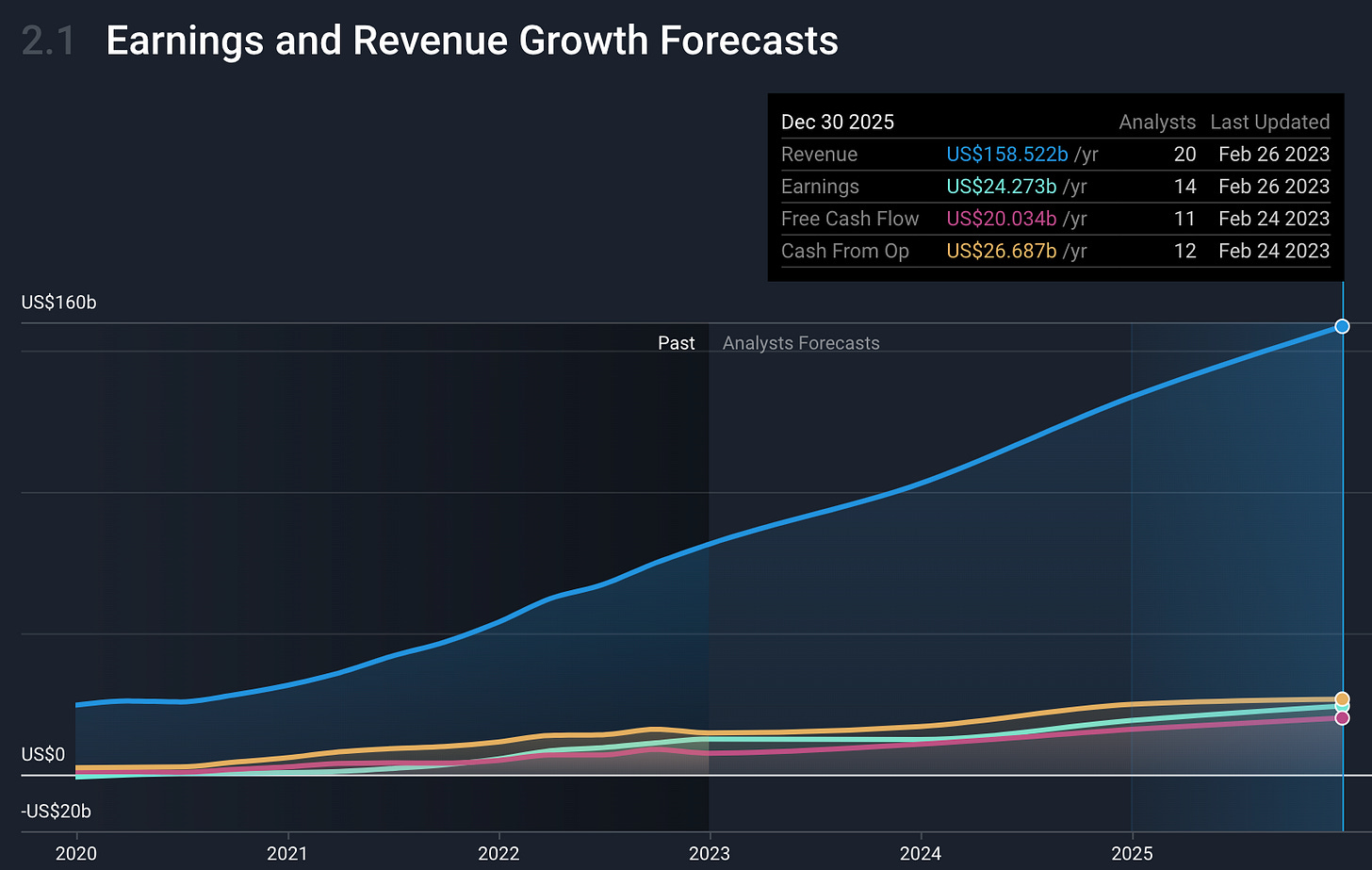

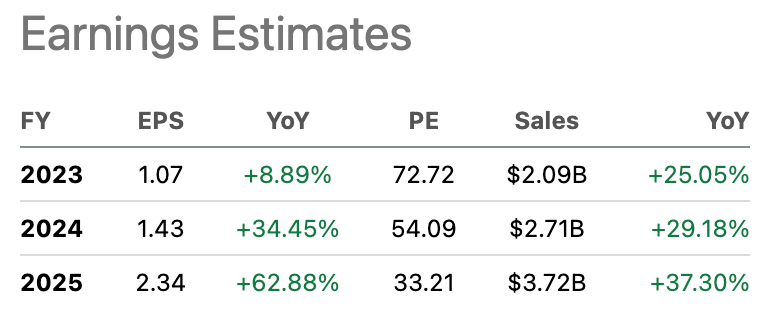

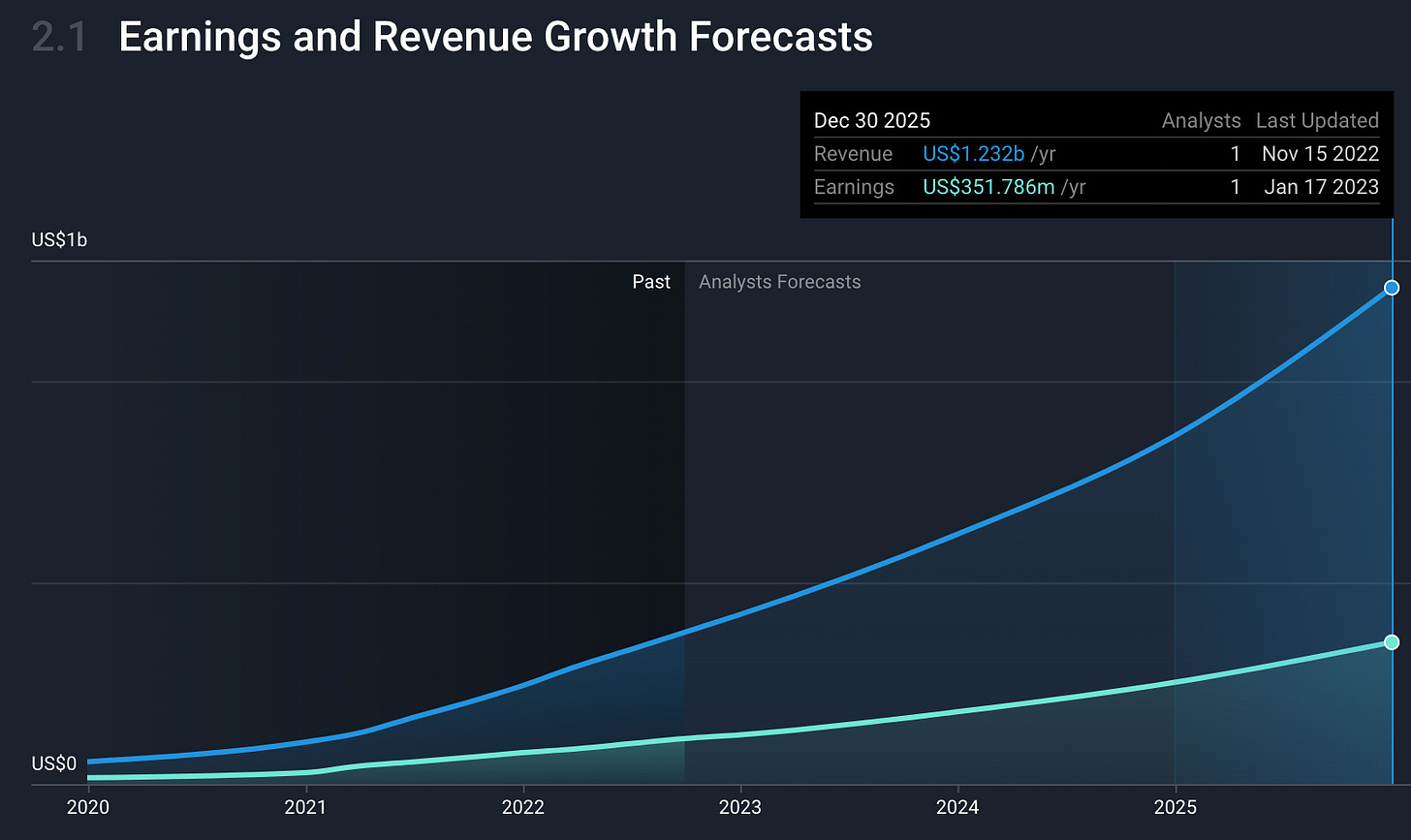

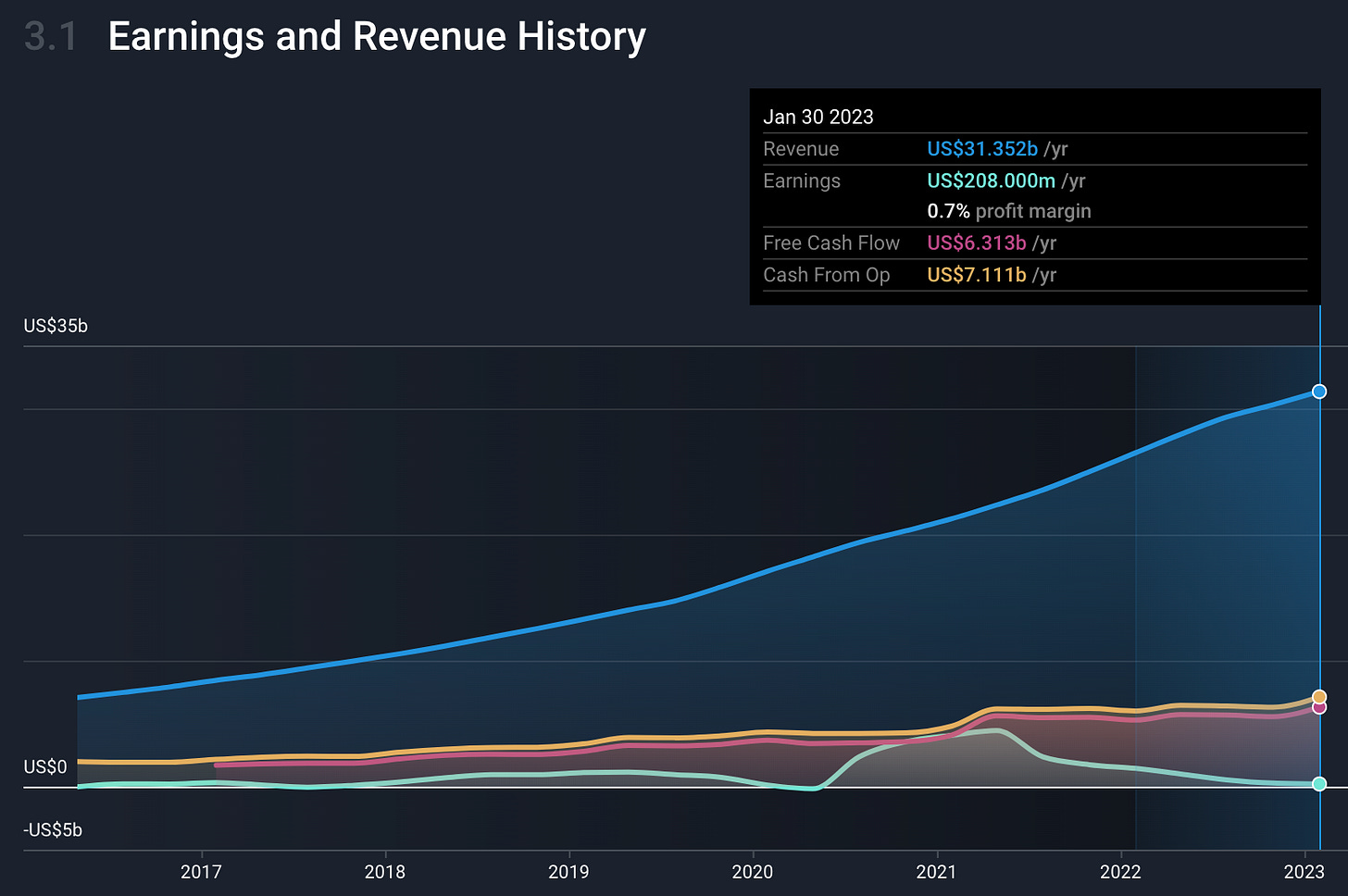

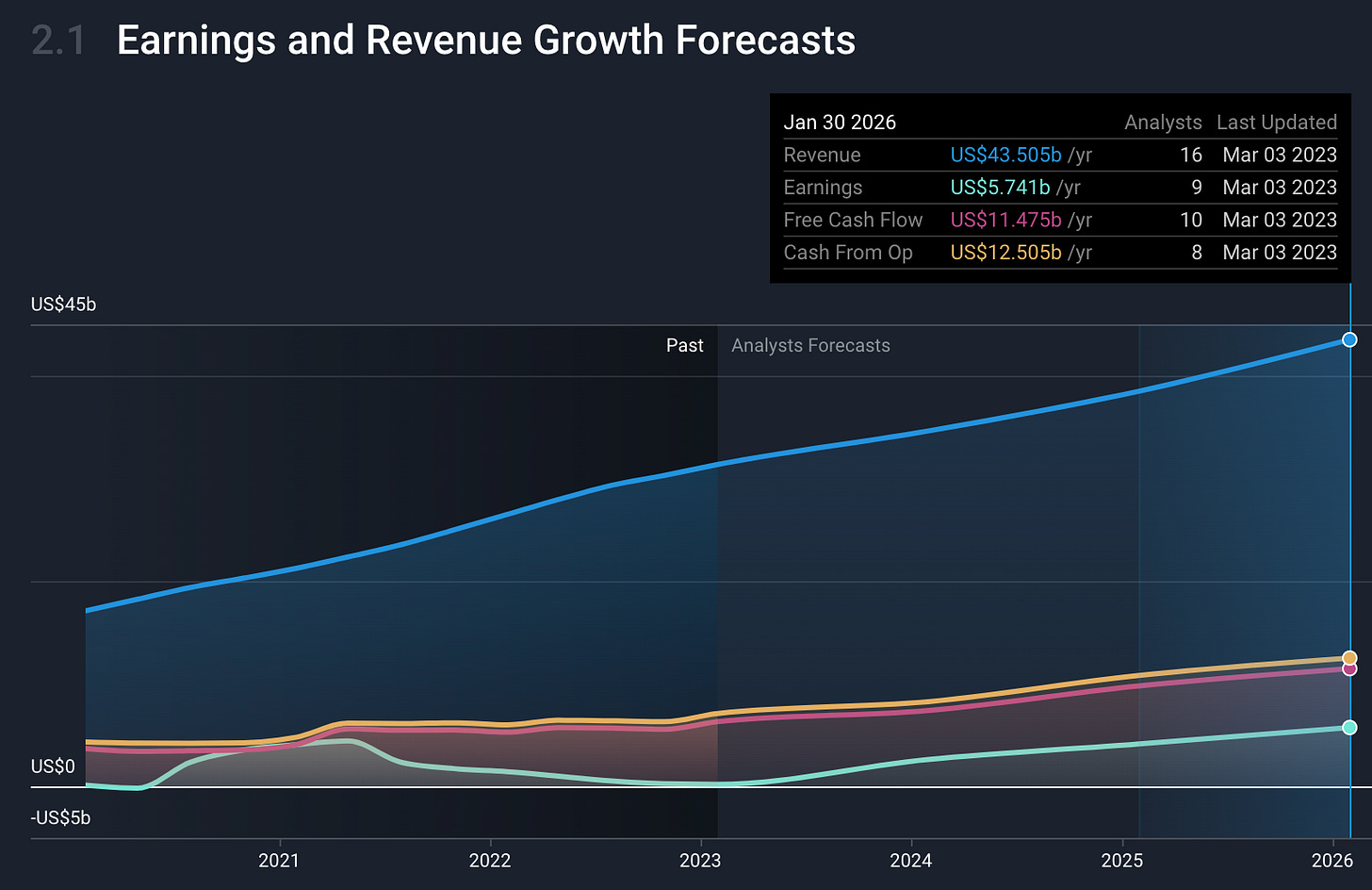

MercadoLibre forward valuation, future earnings and revenue expectations:

MercadoLibre is one of the biggest positions in my portfolio due to their extremely unique ability to produce revenue growth, earnings growth and cash flows with a clear leadership position in the respective markets they operate in. They appear to be at an inflection point within their business in their ability to expand GAAP bottomline metrics which means that they will continue to become more profitable over time as they continue to scale their business.

Personally, it’s difficult for me to provide accurate forecasts on MercadoLibre due to their many different business units. I do believe analyst estimates (which we will use) are very conservative and bottom line metrics should continue to expand with business scale. Assuming their forecasts are accurate, MercadoLibre should end the year approximately where they are currently trading at roughly $1,200/share. If they can continue to beat expectations or if there is a meaningful change in the macroeconomic environment where the USD weakens or the global economy resumes growth, MercadoLibre could finish the year approximately 33% higher at $1,600/share which would be consistent with its fundamental earnings growth.

The biggest risks I see with MercadoLibre are more geopolitical, political or regulatory in Latin America. However, due to MercadoLibre’s robust product offering and experience working with the unstable governments in LatAm, this proven winner should continue to do well in moving these countries forward into the digital age.

The Trade Desk

TTD is a demand side AdTech company. Historically, I have owned other AdTech’s as they usually run very profitable business models. The problem has usually been the market in which they operate in can be very cyclical due to the sensitivity of AdTech budgets. The Trade Desk, although not recession proof, has been growing 3x the rate of the overall AdTech market and continues to take market share from major peers like Google. For years they have truly innovated and led the market in a broad sense. Only recently their valuation has come in “fair” enough to buy.

The rationale for owning them and having them be such a large position is simple, they are a market leader growing both revenue and earnings due to the profitable nature of their business model. In addition, they have an excellent balance sheet (no debt) with an innovative vision that closes the gaps for Advertisers to have a higher ROI on their ad-budget. I do expect their revenue growth to accelerate as the economy recovers in the months/years ahead.

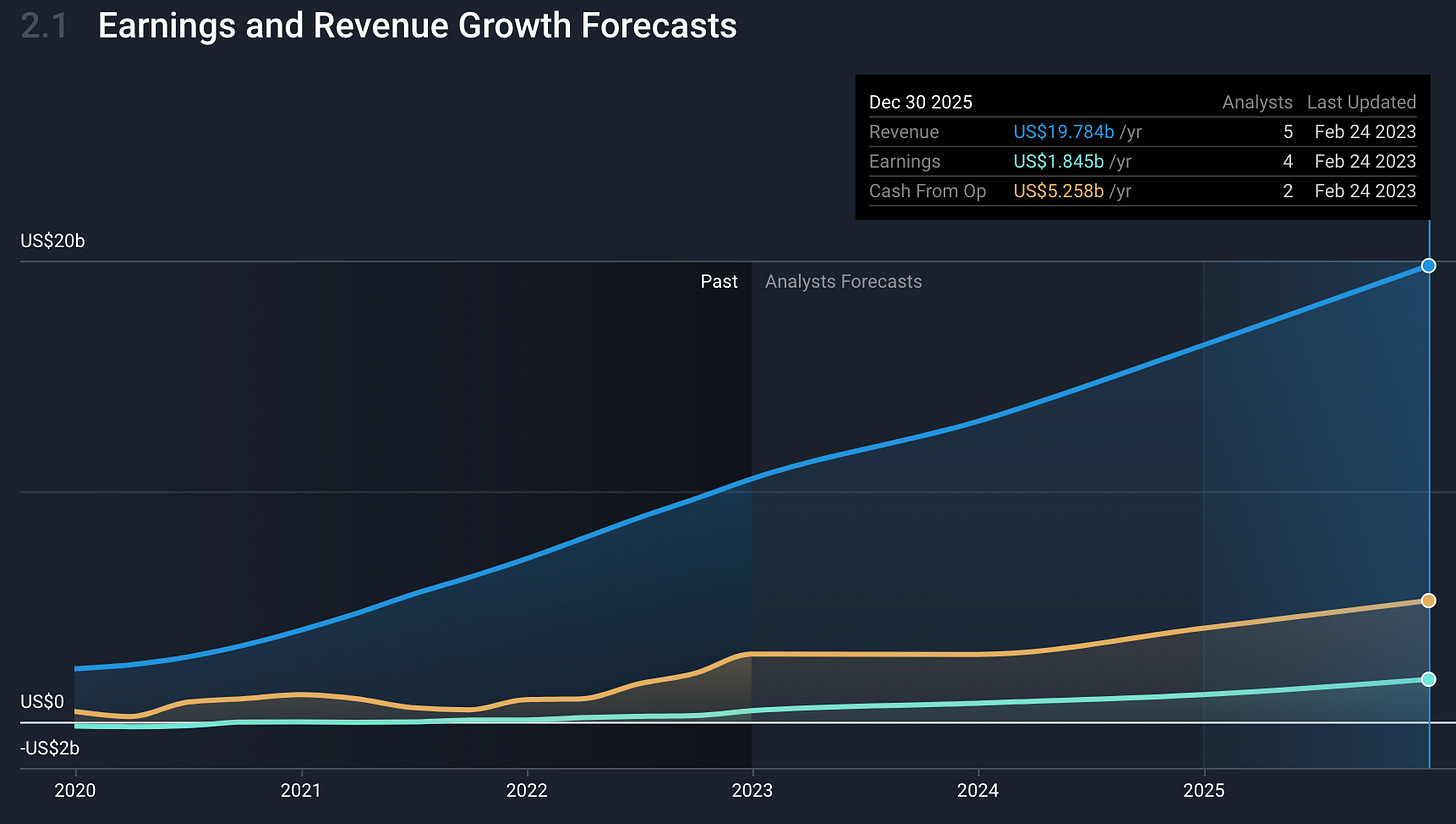

Recent quarterly results:

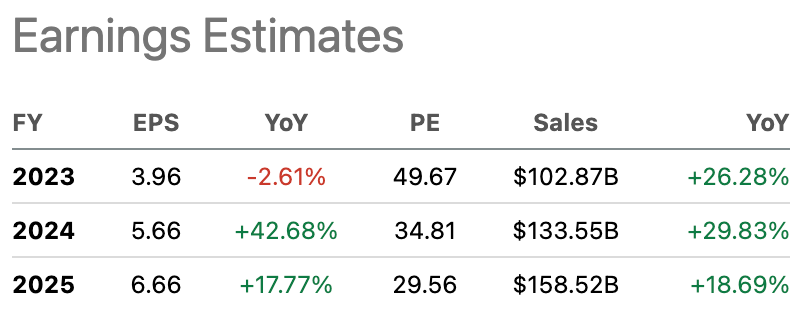

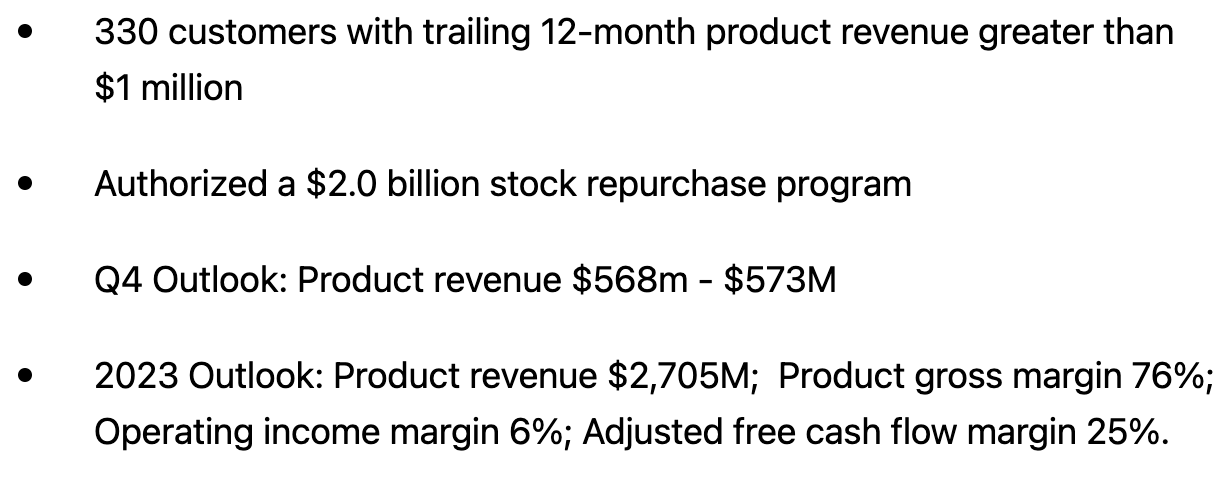

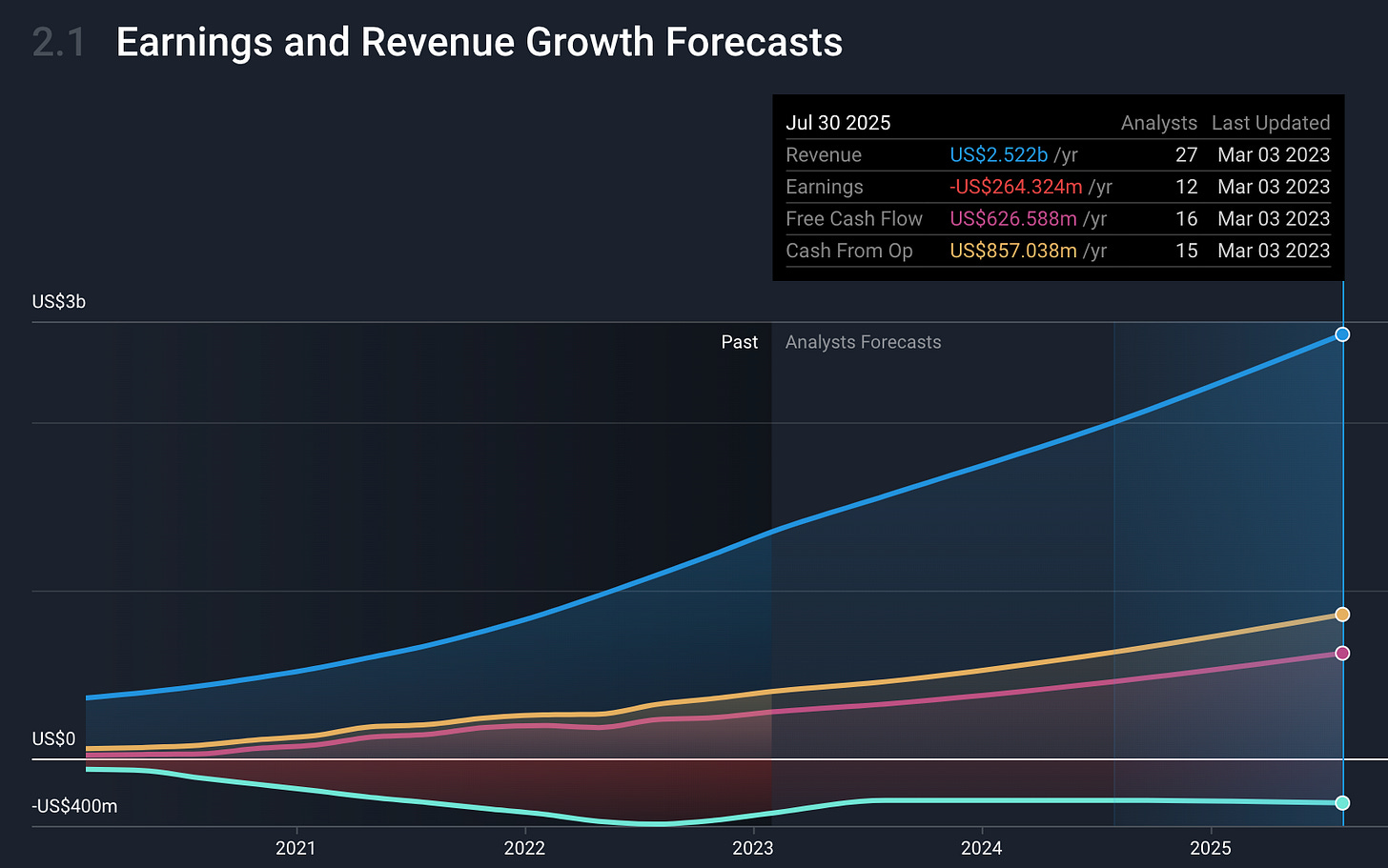

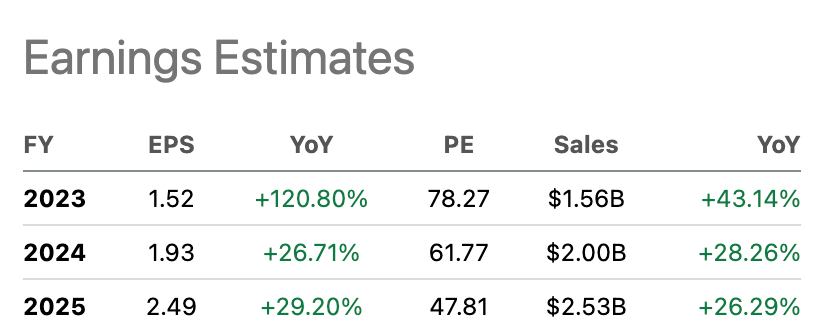

Forward Valuation and Earnings Expectations

When thinking about their future earning potential and their fundamental valuation model, I included both operating cashflow and free cash flow. Their forward PE ratio appears expensive but when you think about their EBITDA margin, it’s closer to 50% of revenue. If we did a EV/EBITDA valuation on TTD, it appears meaningfully more modest at roughly 25x forward EV/EBITDA.

Today, the Trade Desk trades at approximately a $27B market-cap. If we assume they come in at analyst expectations for the full year and begin thinking about where the stock should trade at by the end of the year and also assume they will still be trading at a 25x forward EV/EBITDA (a very modest valuation), the stock should be trading roughly 15% higher from here or $63/share in 10 months. In the years to come, we should continue to see TTD return roughly 20% - 30% CAGR as the digital advertising industry continues to transition away from legacy models. The 20% - 30% CAGR is reflective of both top and bottom line expansion in their underlying fundamentals. This excludes any stock buybacks (which they just announced $700b worth).

They’re a buy below $50/share today.

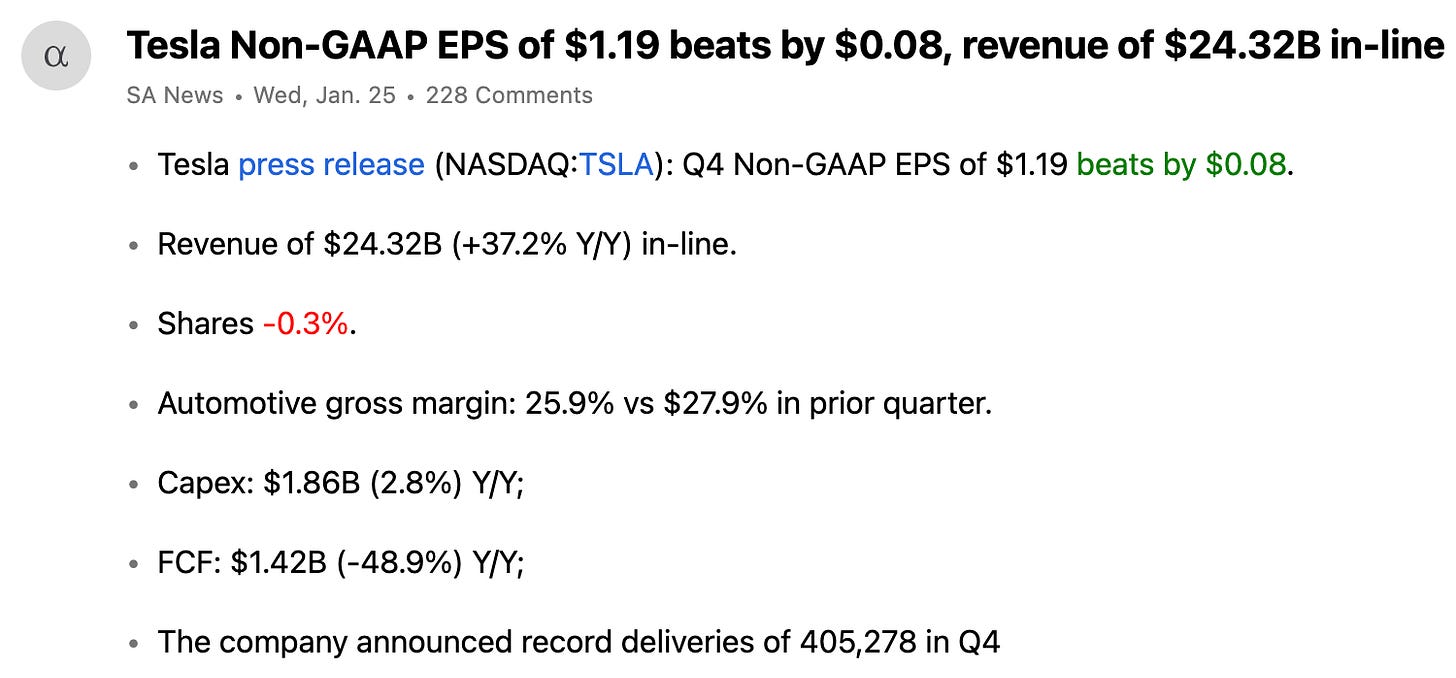

Tesla

A stock that needs no introduction but certainly needs explanation. Tesla is not just an auto-manufacturer (even though this is enough to justify its current valuation). If you follow closely to what they are working on and how their business is evolving, you find that they’re one of the leading players in artificial intelligence and renewable energy. In fact, I’d go so far as to say that’s actually the business they are in, they just sell cars today. For example, think Apple when they had the Mac computer. At first, they were just a computer company. After a few years, they became so much more. I think Tesla can do what Apple did and more in the next 10-15 years.

A few notable advancements to think about when calculating how we should value Tesla. They have a few other business units:

A renewable energy (solar) and battery storage business

They are about to produce and sell Cyber truck, the first of its kind

Autonomous driving is real, close to launch and comes with a subscription model that produces close to 100% gross margins

Long term, Optimus presents a very exciting opportunity

The best way to think about their business model is that… They currently sell cars, right? They are trying to make sure those cars drive themselves. In the process of making those cars drive themselves this requires an extraordinary amounts of data. More importantly, artificial intelligence to interpret and process this data. The vehicles they are producing are effectively becoming artificial intelligence robots capable of driving themselves and managing the entire trip from start to finish. This AI capability is just that, AI, which can translate into data that can be used to create Optimus, a robot that can navigate itself. Long term, this is a truly enormous opportunity. I could see robots on the battle field with us and in our homes in the years to come.

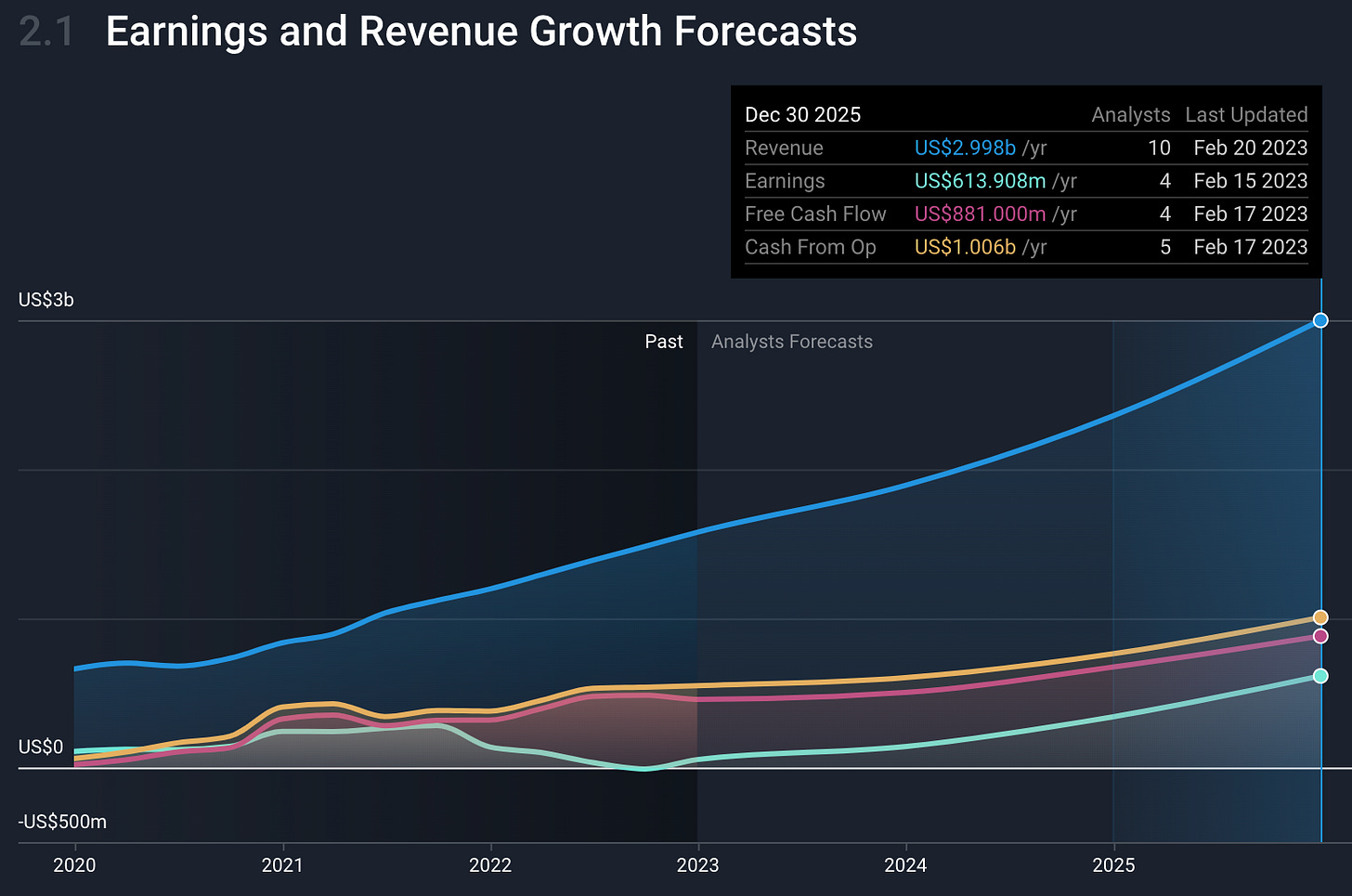

Not only are they working on all of these initiatives, they are very profitable too. It’s hard to imagine the below estimates are conservative but truly, I think they are. This year alone, I think they can reach 30% - 40% full year revenue growth.

By the end of this year, if they do grow 30% - 40%, assuming no multiple expansion and net-income margin at 15% their stock price should be roughly where it is today at $207/$210 range.

If you can get Tesla for under $200 per share or even in the $175 range this presents good short term opportunity. However, long term the value will be there as the company should grow into its valuation. Every year after this, a 20% CAGR for the next 10-15 years (while Elon is CEO) shouldn’t be ruled out as more than possible. I believe Tesla is just getting started and is a must own.

Snowflake

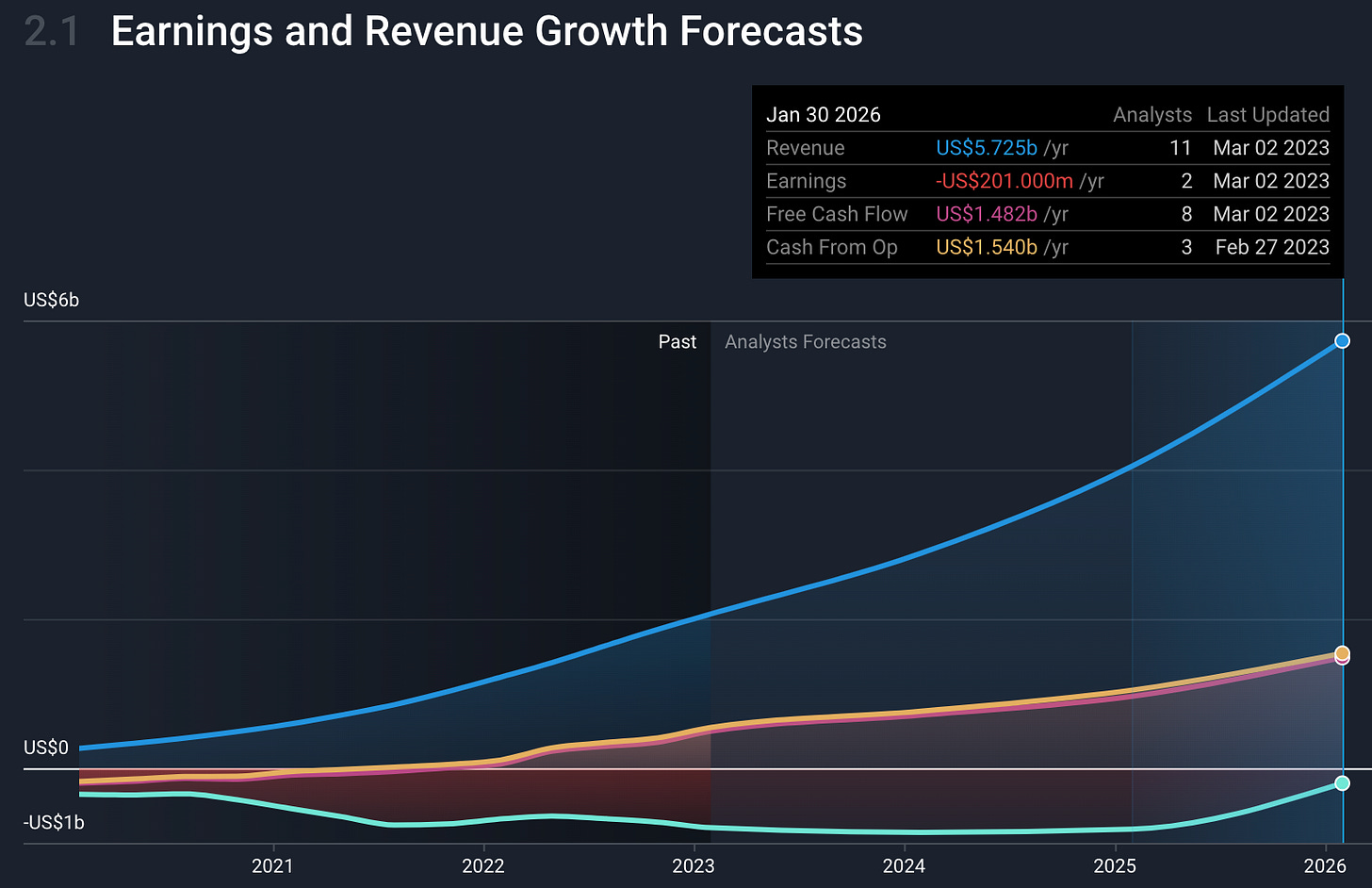

Historically, Snowflake has always been overvalued but they are finally growing into their valuation today. There’s a few important details to know about the business model because this can often be confusing for most investors. To simplify, they are in the big data and compute business. This means they are able to leverage their platform for companies to store and extract data to drive business results. It doesn’t just stop there though.

Just like a few of the other companies I have spoke about to this point, it’s less about where we are and more about where we are going. This is important to Snowflake’s story. Snow isn’t just a data lake and storage company but will be the core function to many businesses around the world. Above, they are saying they are transitioning to the app development phase where businesses can quite literally run on top of Snowflake’s platform. Because of their consumption model, this is massive.

Longer term Snowflake is positioned to take advantage of the AI opportunity more than most. Snowflake is really good at managing, storing and retrieving data. Artificial intelligence needs a platform and an application that can do this effectively. In the future, I can see Snowflake becoming a type of AWS infrastructure play in the future of business.

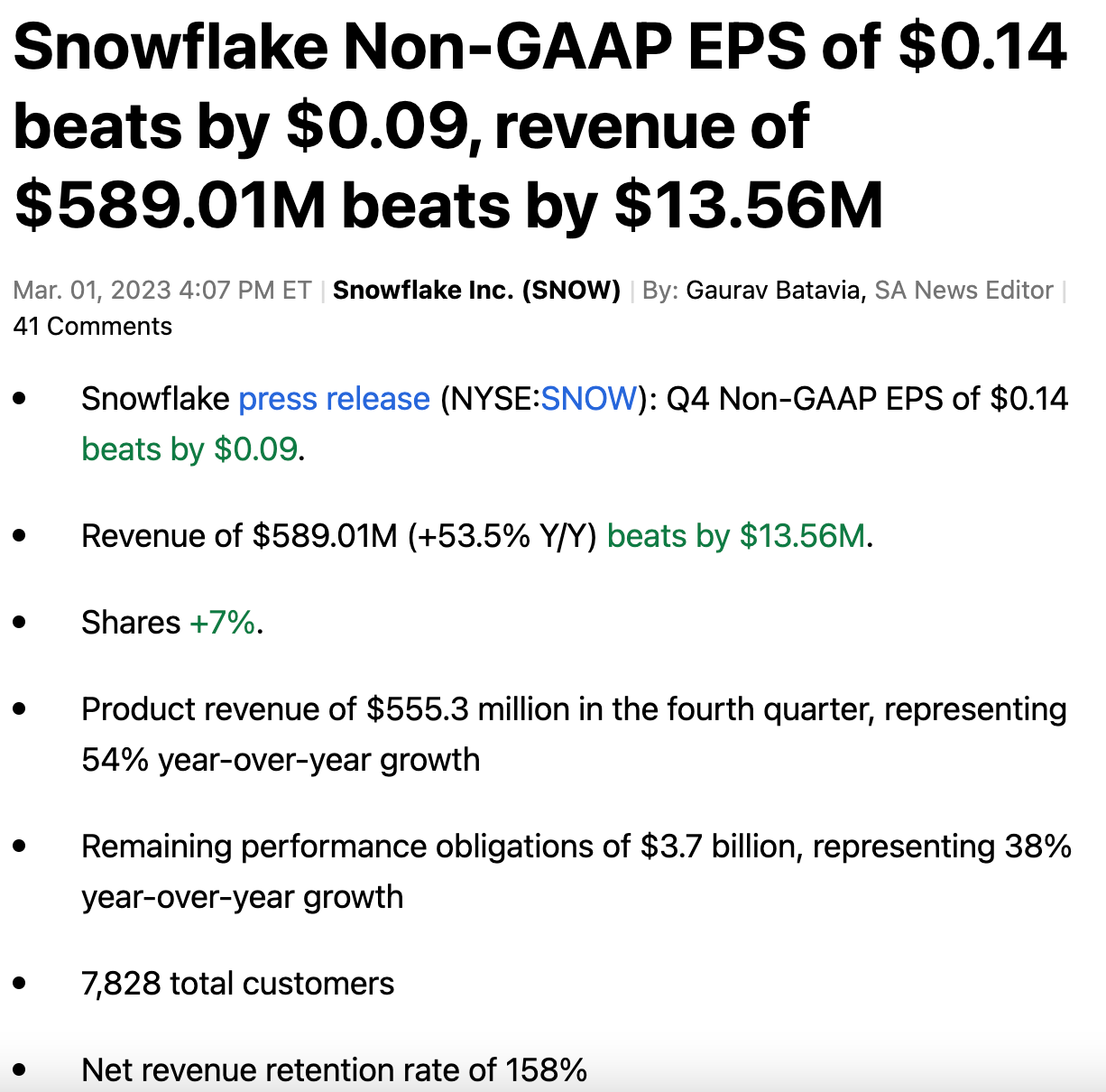

Recent Earnings Results for Snowflake

Snowflake guided revenue down on a full year basis and went from 45% guided revenue growth to 40%. This created volatility in the stock after earnings as they sold off relatively heavily the next day. By now, nearly all losses have been recouped and I did buy more Snowflake after reviewing their earnings. They are still expensive but I know that there is a distinct difference between earnings that suffer because of Macro or earnings (guidance) that suffer because of poor business execution. In fact, when I heard Snowflake’s leadership team they never once blamed their revenue guide down on macro, they blamed themselves. I really liked that they took that accountability as most CEO’s/CFO’s don’t do that. They will just say, “based on a tough macro” xyz.

Jamin Ball explained this volatility in consumption models during macro draw downs. I 10/10 recommend this read to understand more.

Currently Snowflake is still expensive (I don’t think they have ever been cheap) so upside appears limited in the short term unless they provide better than expected guidance for this year. If I were to recommend anything, a DCA approach may be best if you’re interested in the position. Long term, as the business scales and moves to GAAP profitability, this business has the ability to produce some incredible returns over the market’s expected returns.

At the end of the year, the stock does have some upside. Their market cap is currently $45b with an enterprise value of $40b which means they have roughly $5b in cash and zero debt while operating with 20%+ FCF margin. Assuming they maintain their premium valuation of roughly 15x forward EV/S, their enterprise value is set to appreciate roughly 42% from current levels. This puts their stock price at approximately $218-$225 by the end of the year.

Looking forward into the future, Snowflake has the ability to maintain 30% growth while scaling their business model toward GAAP profitability. If they are able to hit their projected $10b in revenue by 2028 (they say FY29 but it’s actually 2028) their stock price should be at near $300 if valued at a 30x forward FCF in late 2027 or nearly $513 if still valued at 15x forward P/S in late 2027.

Snowflake has unlimited potential but is risky due to competitive risks. Leadership will need to continue to execute at a very high level to meet their goals.

DataDog

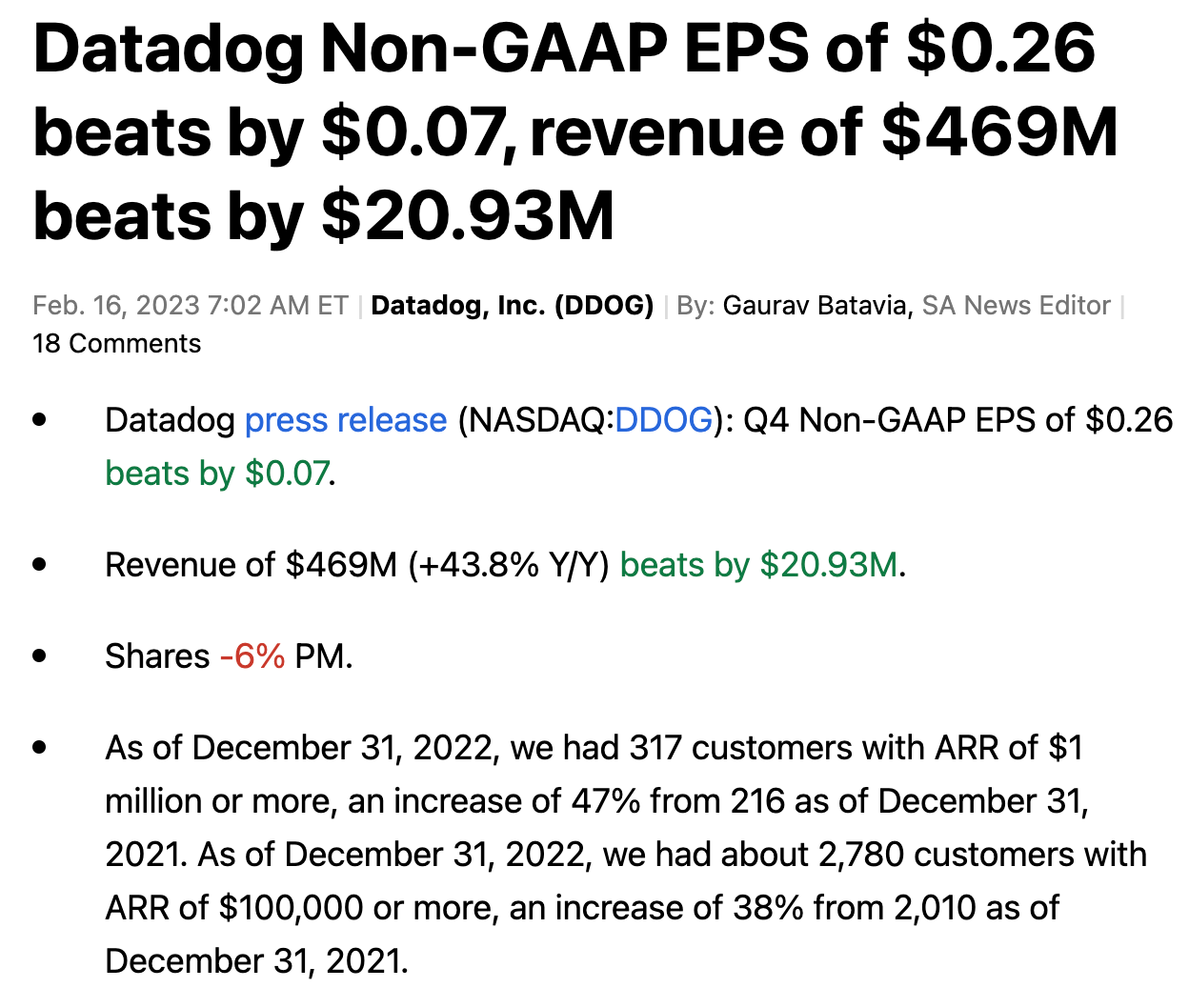

Recently DataDog’s earnings caused investors to sell out. This didn’t make much sense to me. It doesn’t make sense because they have a leading margin profile for SaaS company and are still expected to grow 25% to 30% in the years to come. Also, they have a long history of under promising and over delivering by a wide margin.

DataDog is in the application observability and security business. What this means, in simple terms, is that they are help CIO’s and developers manage all the moving parts to their digital infrastructure. They stand to benefit directly from cloud computing growth or any sort of digital application in the enterprise.

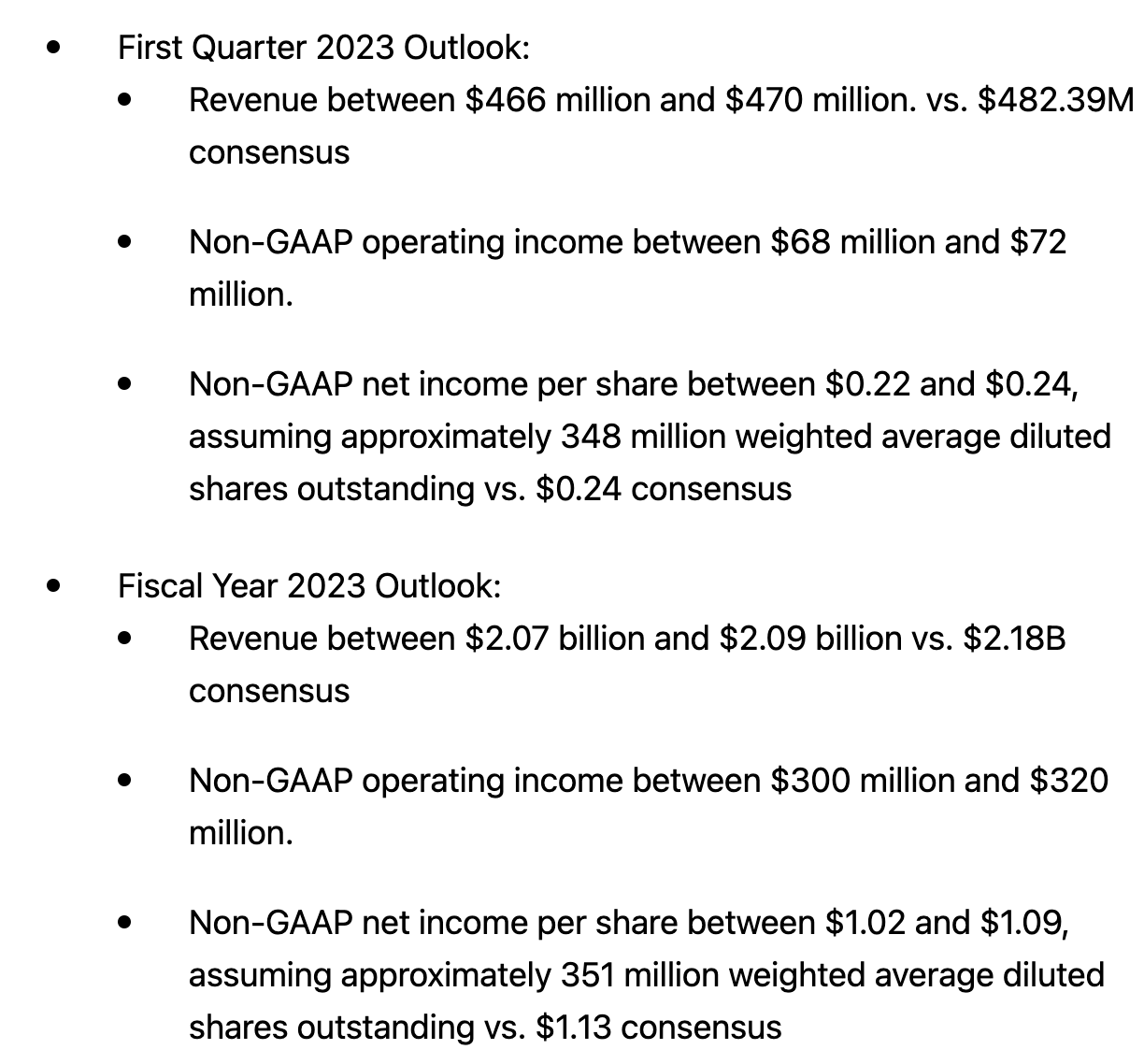

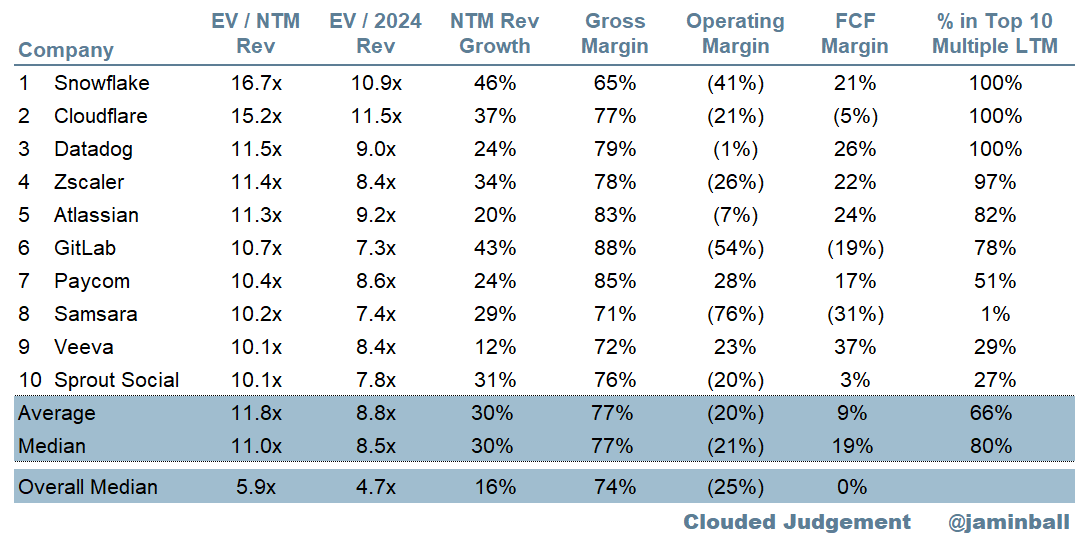

In DataDog’s recent quarterly results you can see that it’s not so much their latest quarter that investors had a problem with. It was the guidance they provide where they came grossly under estimates. Despite this, they still find themselves to be ranked in the “best of breed” SaaS class. Below you can see it’s up there with other fantastic companies like ZScaler, Snowflake, and CloudFlare. They are valued the way they are for a reason, because they have wonderful margin profiles and high growth.

Much of this growth slow down is priced in and I believe from here on out, we could see meaningful out performance of DataDog despite the slowing economy.

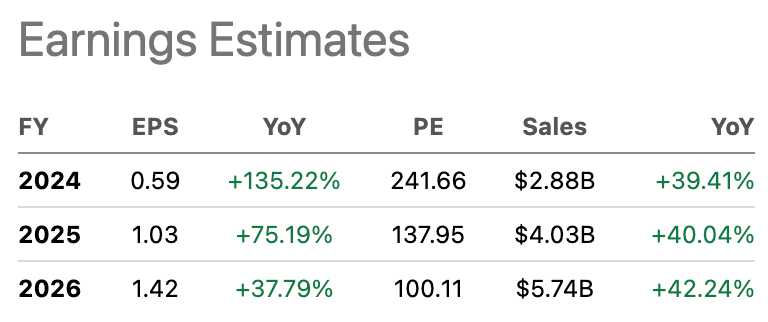

Above, you can see analysts only have them growing 25% this year, 30% the next and seeing a growth re-acceleration in 2025 due to inflation coming down. They are also expected to move toward GAAP profitable in 2025, which is extremely unique as most SaaS businesses never reach GAAP profitability. If they reach this transition toward GAAP profitability, investors today will be greatly rewarded.

When thinking about their current valuation and where they should be trading at the end of the year based on analyst estimates, we can value DataDog two different ways. The first, we can value at a forward EV/S of 10x. The second way, we can take the 26% FCF margin and value them based on future cash flows. For the full year 2024, we can assume that they should have around $3B in revenue (since I believe the guidance is very nerfed) which will put DataDog at a $30B enterprise value by the end of the year.

Today they have an enterprise value of $24B, which means there is approximately 25% upside from today’s valuation by the end of the year putting the stock price at roughly $100/share by the end of the year. This is assuming they barely beat their forward guidance and the economy doesn’t improve and neither do the secular tail winds of cloud computing and digital enterprise don’t accelerate with AI and big data. If we value them at 30x forward P/FCF then we find ourselves at this present valuation assuming they do $3B in 2024 and they have 26% FCF margin.

Needless to say, my bet is on DataDog out performing expectations which they usually do. To compensate for the tough macro, most of it has already been priced in. I believe $100/share by the end of the year is a fair assessment and will present market beating returns of 25% from today’s price.

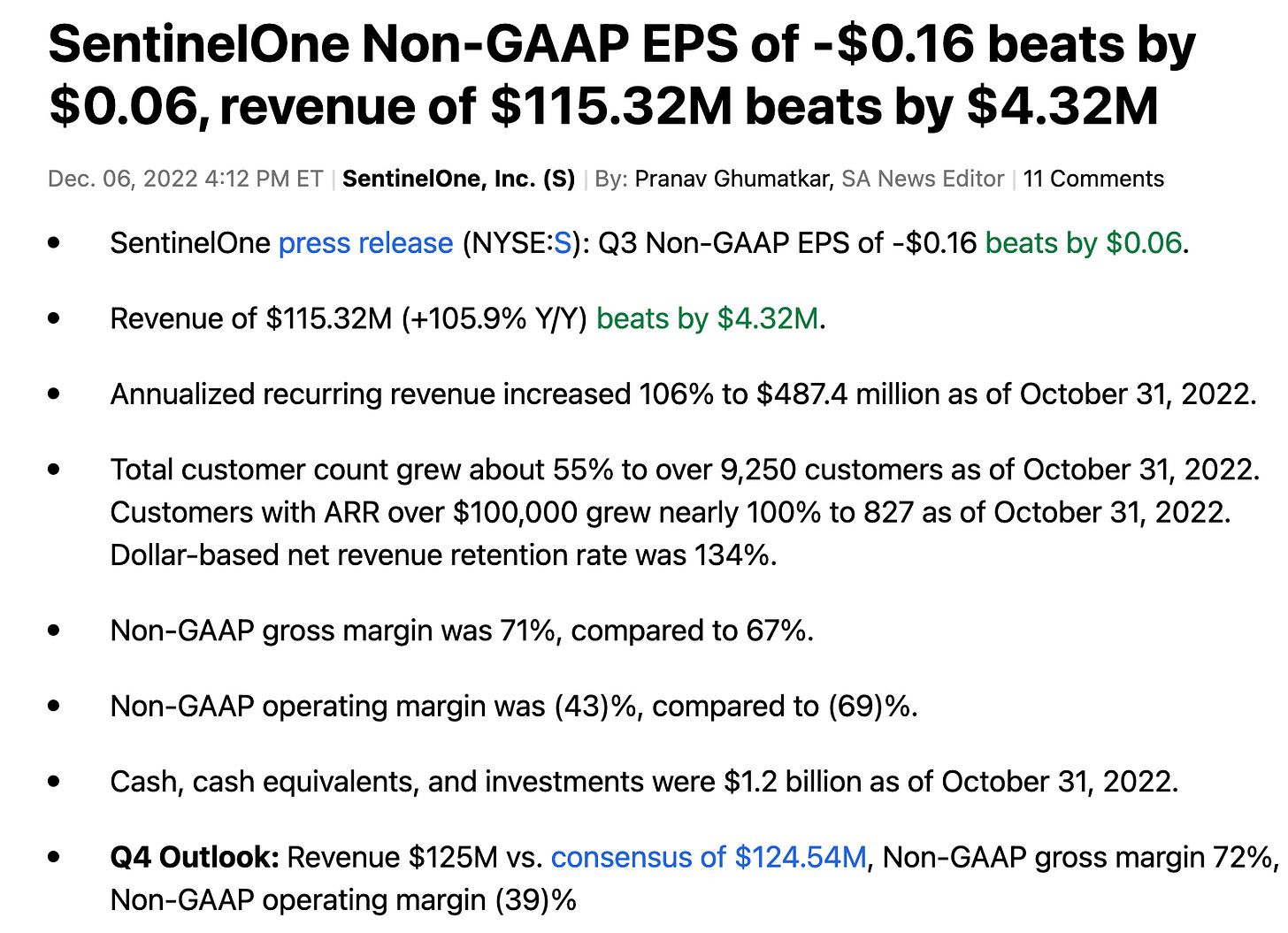

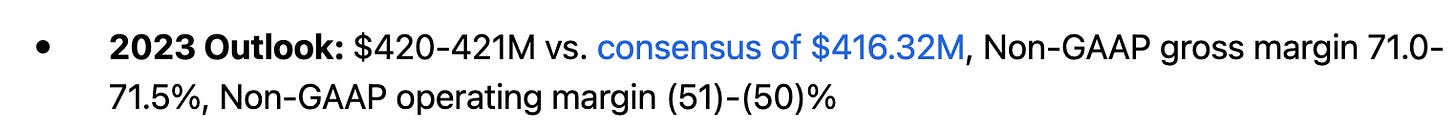

SentinelOne

SentinelOne is a business that I believe is the most undervalued and presents the highest upside compared to many of the companies I own. Currently, they are operating FCF negative but anticipate on reaching operating break even by the end of the year. If they reach this goal, usually there is a massive surge in stock price as future cash flows begin getting baked into the stock price.

SentinelOne S 0.00%↑ and CrowdStrike CRWD 0.00%↑ are often mentioned in the same breath when talking about SentinelOne on a stand-alone basis. However, I can simplify the difference and explain the business that they are both in.

SentinelOne is apart of end point protection which means that it’s a security layer at the edge of the network (the devices), CrowdStrike does similar. They both stand the benefit greatly from the digital economy and the rapid rise of cloud computing. The difference is how they approach end point protection. Both provide comparable products despite SentinelOne being significantly smaller but SentinelOne often edges out over CrowdStrike in the MITRE Report and SentinelOne provides an artificial intelligence first approach whereas Crowd does require more configuration and backend developer management.

Since IPO they have produced extremely strong results (top and bottom line) as they continue to invest into growth and scale their business effectively. They are growing meaningfully faster than competition and it can be assumed that they are taking market share from competitors. Their primary focus market is on SMB (small the midsize businesses) compared to CrowdStrike’s enterprise (large business) focus. An investor can assume that they will be directly competing with each other soon if they already don’t in deals.

From a forward projection, they are still priced for rapid growth but their current valuation of forward EV/S of 5x presents a very attractive risk reward. From these levels, we could see the stock price double (or more) if they do hit operating break even this year.

If they hit operating break even and grow at their expected rate this year, it would make sense to see them trade closer to forward EV/S multiple of 9-10x based on 2024’s earnings/revenue forecast. This would put their enterprise value at approximately $6.5B, or a $7.5B market cap. Today their market cap is $4.5B and their enterprise value is $3.5B. This puts their stock price at nearly $30/share by the end of the year.

Enterprise value = Market cap - cash + debt

60% - 80% stock price appreciation would assume that they can get operating break even, meet revenue expectations and still operate in a difficult macro environment but nothing too devastating.

ZScaler

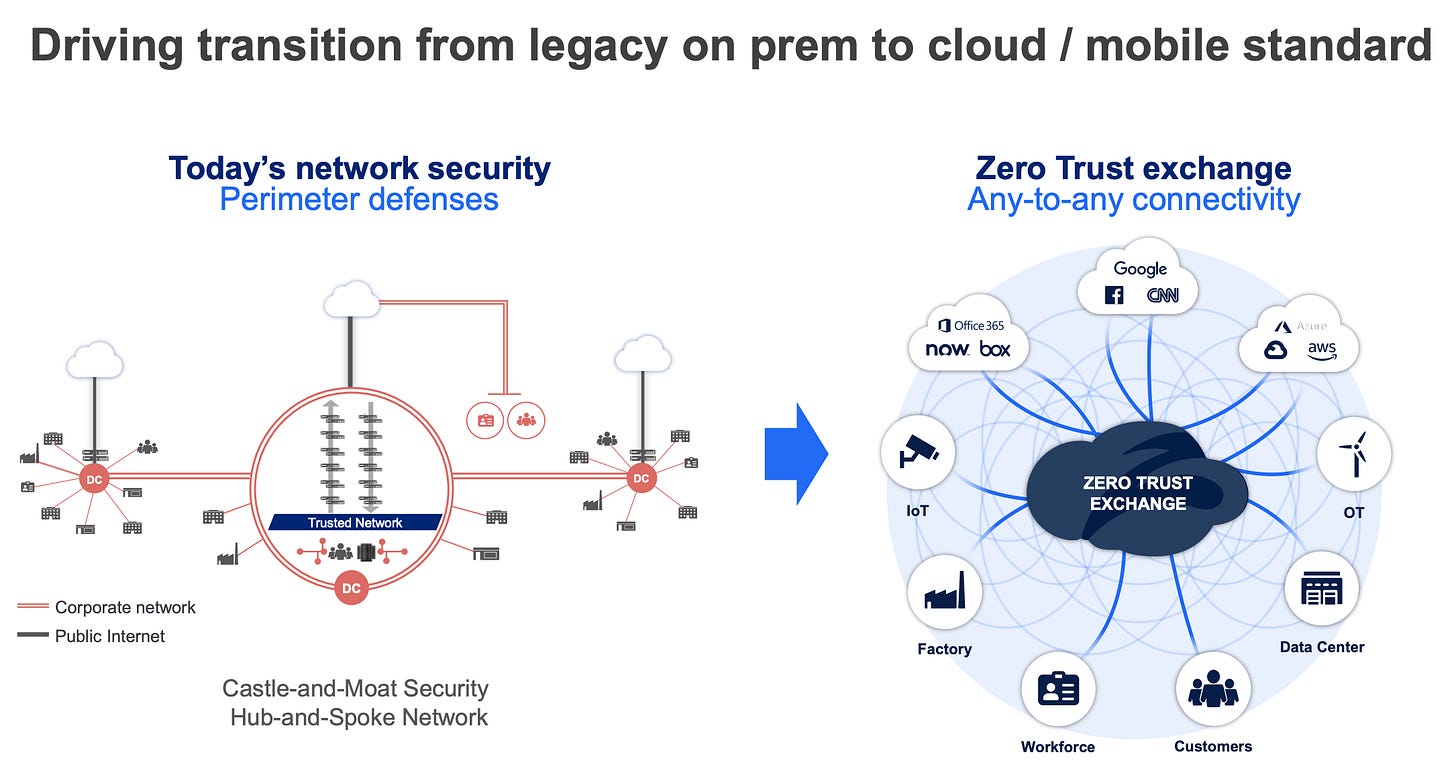

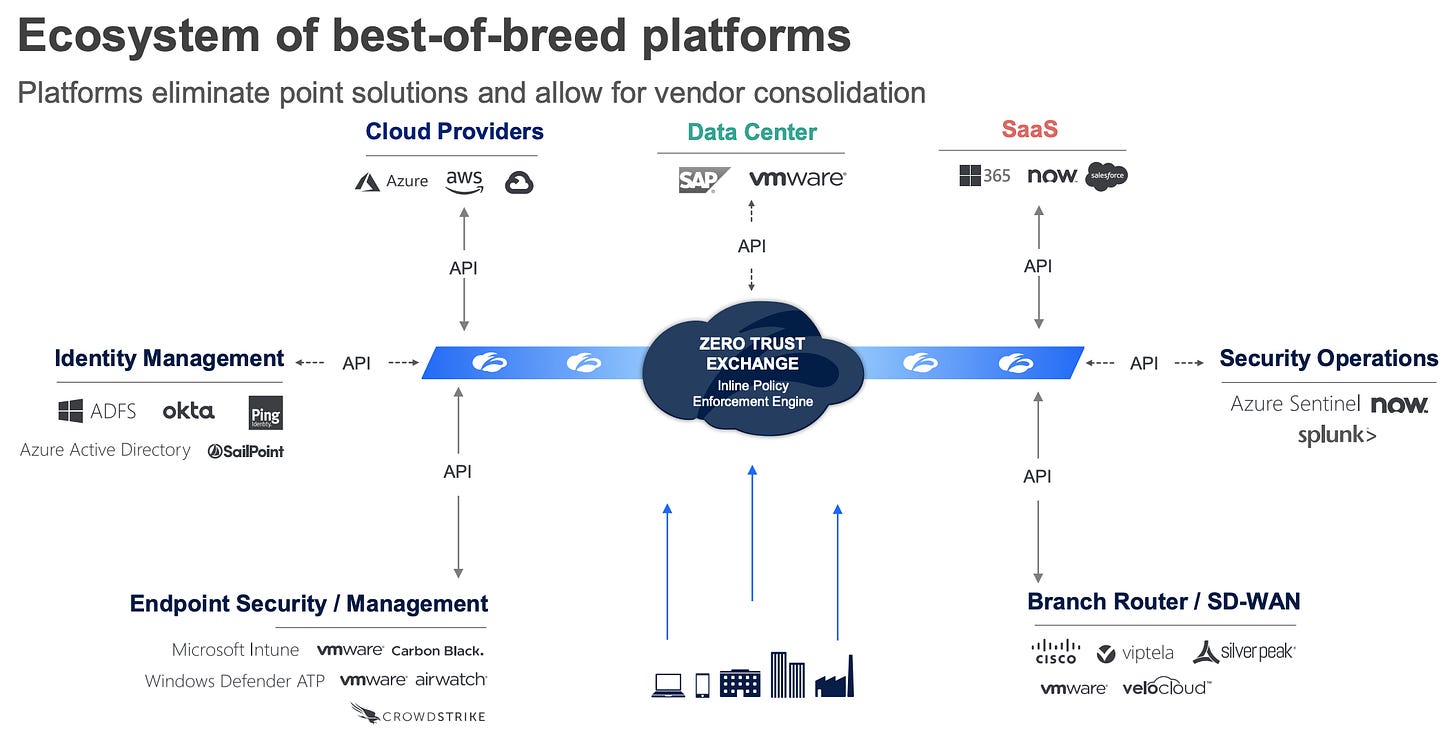

At first, I found it difficult to own both CloudFlare and ZScaler at the same time. I assumed they were similar businesses but this simply isn’t true. ZScaler focuses more on large enterprise customers and offers the most robust network solution and offers the best infrastructure, Zero Trust, security. In this space of Zero Trust architecture, they are unmatched.

ZScaler focuses primarily on cloud infrastructure and stands to benefit on cloud adoption by enterprises, much like DataDog. Their approach is on the architecture of the cloud where it has a “hand off” approach when many different devices and applications connect to a network. Below is how they show it.

Every application and every user connects directly to ZScalers Zero Trust architecture. It acts more as a brain that directs and coordinates all traffic to only go to its designated location rather than allowing a potential security threat infect their entire network like what is capable in yesterday/today’s network architecture. Essentially, they are the network architecture, the Cisco, of cloud computing.

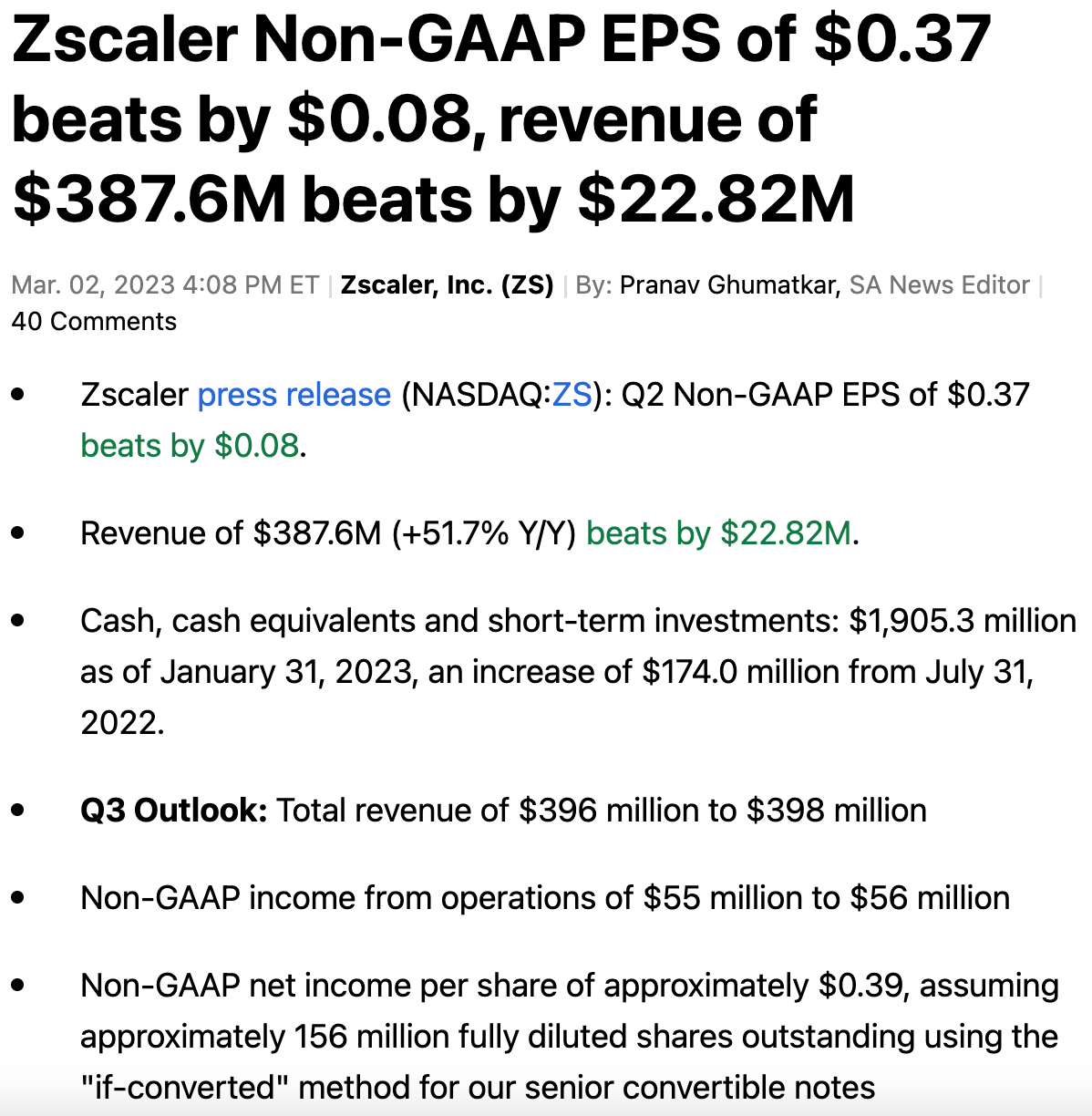

Recently ZScaler announced earnings:

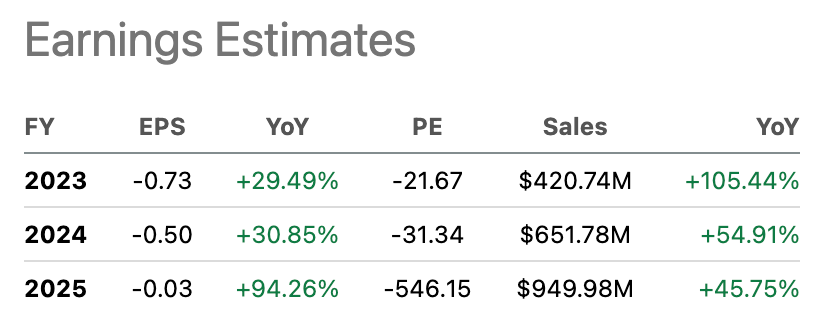

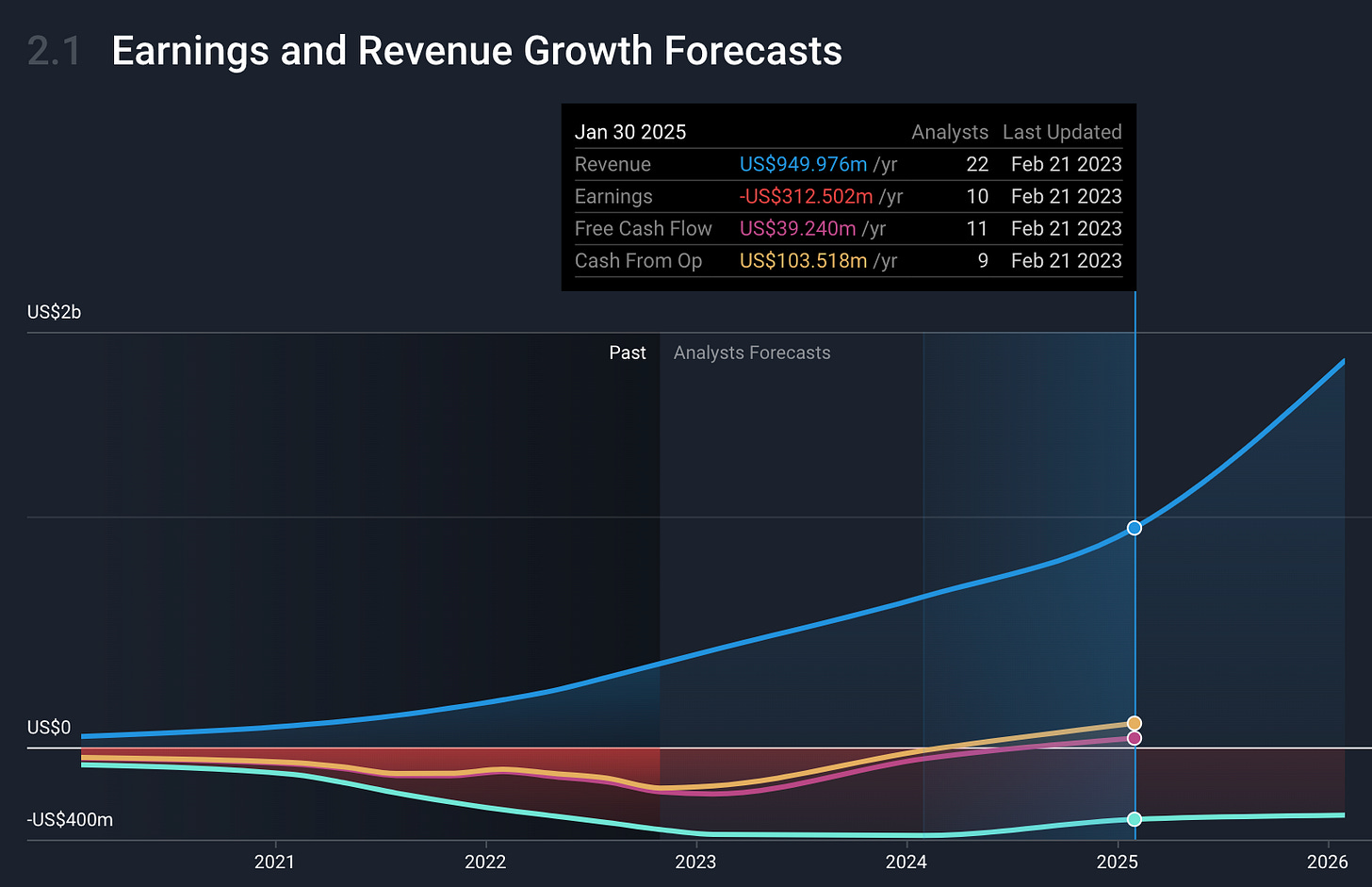

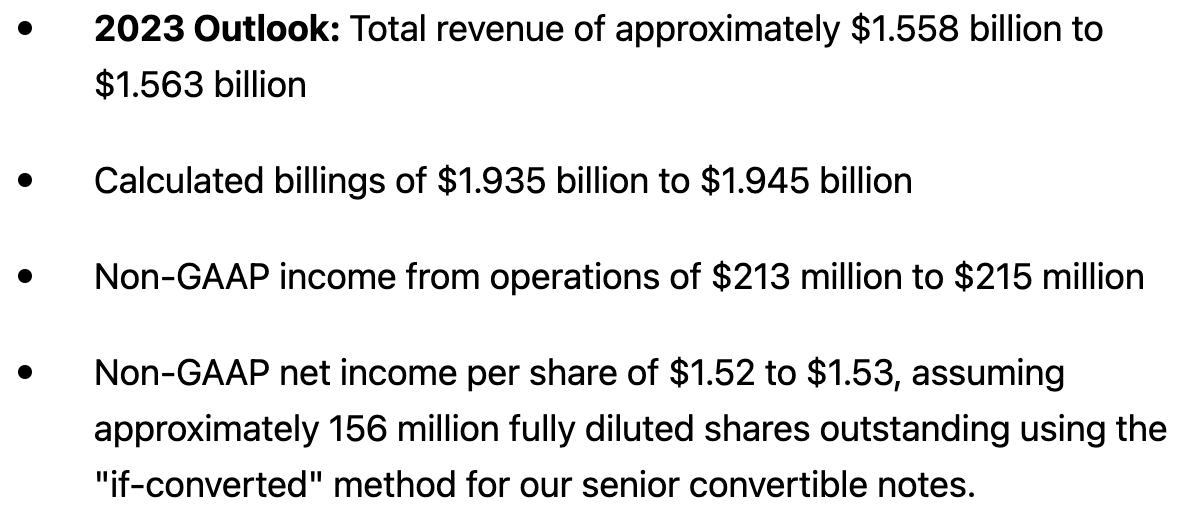

Future revenue and earnings estimates for ZScaler:

What I like about ZScaler is their ability to generate massive amounts of cash with a FCF margin similar to Snowflake and DataDog (approximately 22%). Overtime, I’d like to see them reach GAAP profitability before their growth slows down to sub 20% but as long as they are increasing their cash position and continuing to grow over 30%, this will fall into a category of “acceptability”. In addition, referencing above, their bottom line is expected to grow faster than their revenue in the years to come. This usually happens as a company begins to scale.

When we think about future returns and where they should be trading by the end of the year, we can stay consistent along with the other stocks. We will use analyst estimates and grant them a consistent valuation (10x forward EV/S) as what they have right now. Today, they have an $16.5B enterprise value and if they meet/exceed their earnings this year they should be trading at roughly a $20B enterprise value ($21B market-cap) by the end of this year. This implies an 22% upside assuming valuation stays consistent and all earnings reports are met in the future. If the macroeconomic climate gets better, we can assume there would be a lot of expansion in both the multiple and future revenue guidance.

Expected end of year stock price: $142

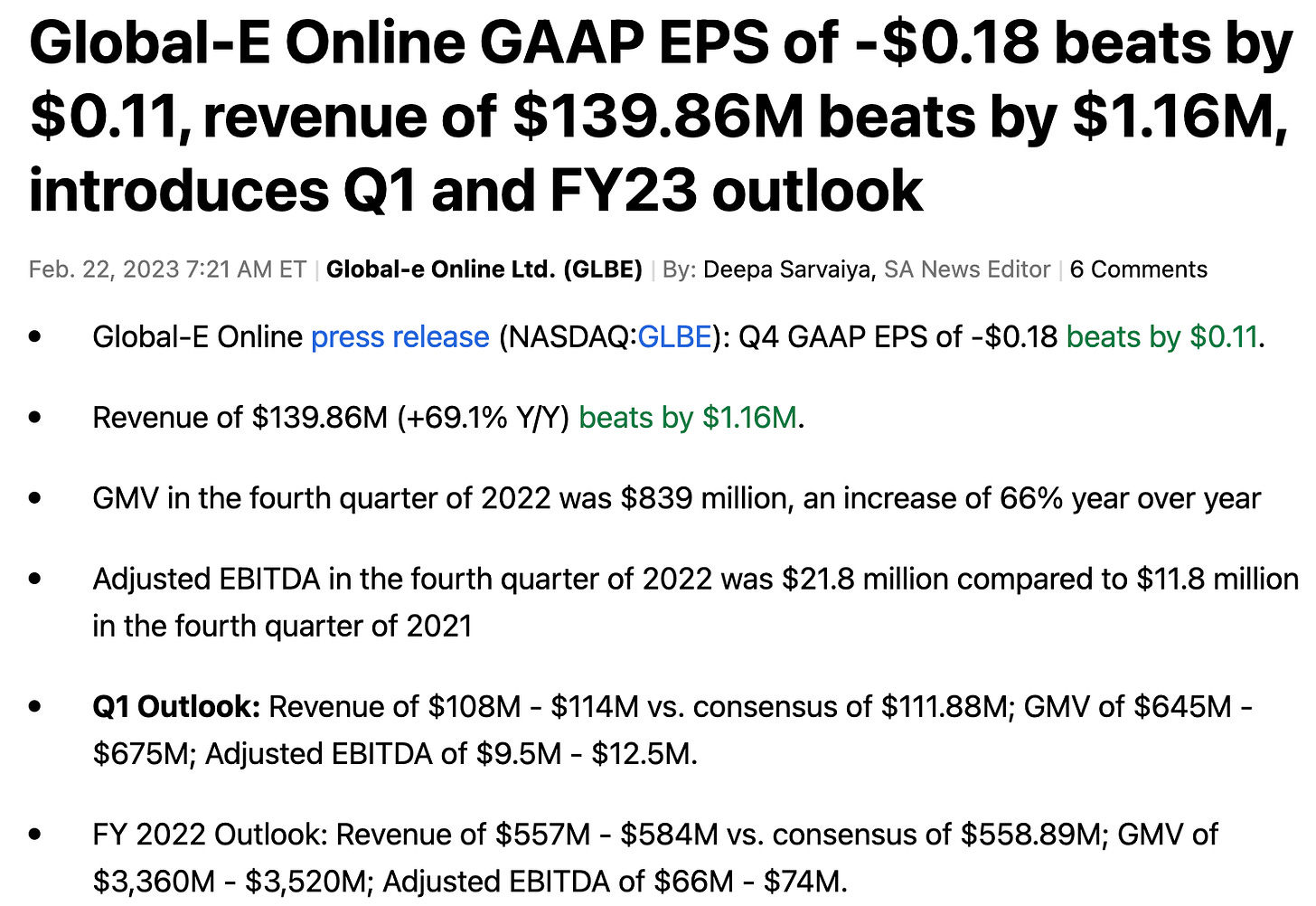

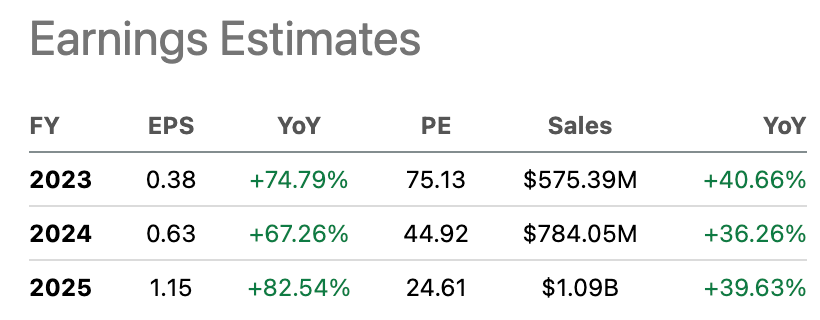

Global-E

A stock I have followed for awhile, since IPO. I fell in love with Global-E’s business model since I first read about it and knew Shopify was going to take a stake in ownership on IPO. The idea of closing boarders when it comes to global commerce while also enabling merchants to maintain the direct relationship with their consumer seemed like a “no-brainer”.

Global-E works on the back end on their merchants (customers like Adidas) behalf. They manage all the logistics, language barriers and payment methods for their merchants and substantially reduce the complexity of cross boarder commerce. In exchange they take a portion of the revenue they help facilitate from their merchants, called a “take rate”.

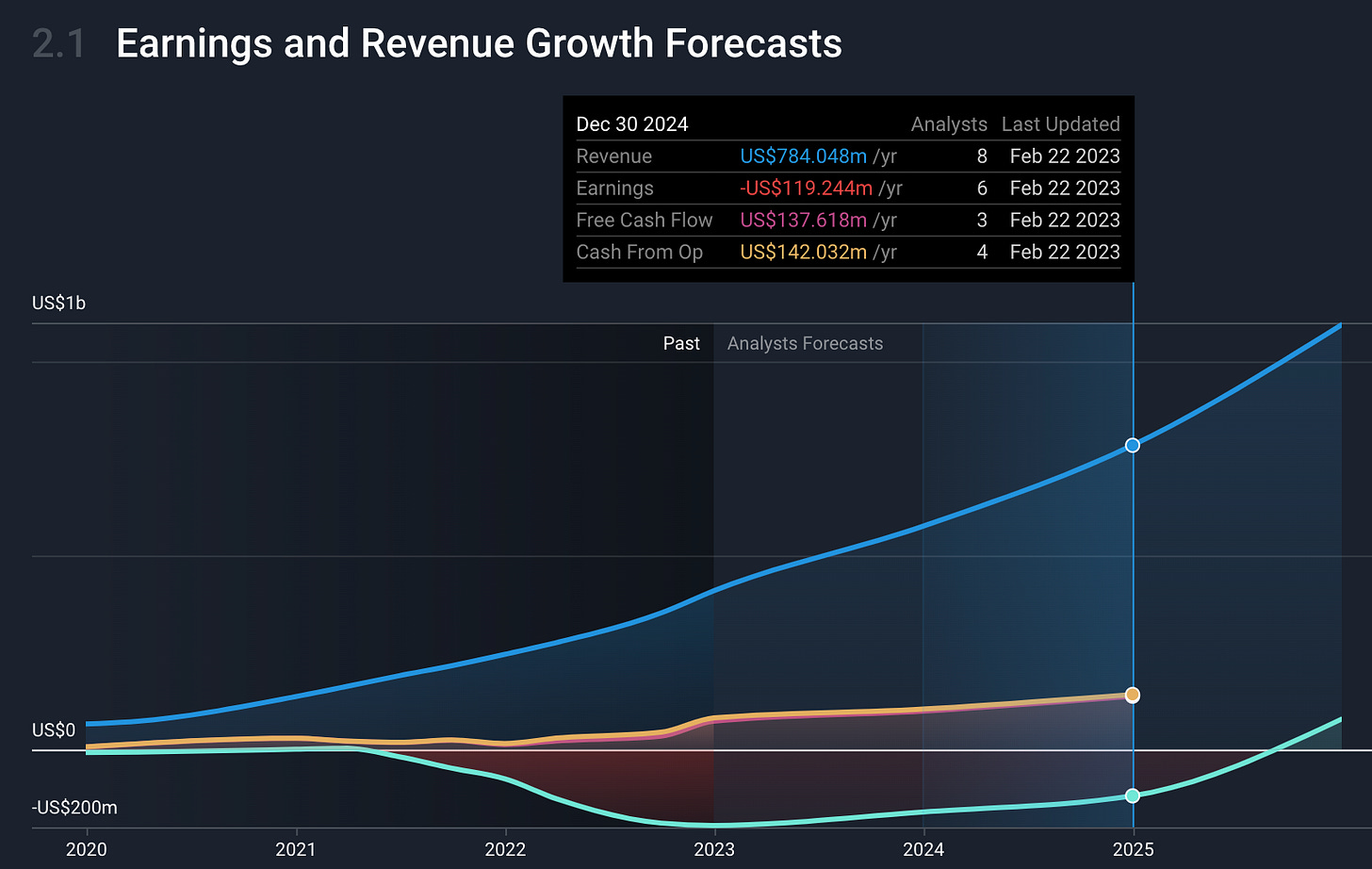

Global-E’s growth has been meaningfully higher than the broader e-commerce due to their onboarding of new merchants and offering new expansion opportunities for their merchants. Not only are they growing meaningfully higher than their respective market, they are EBITDA positive meaning they are operating with positive cash-flow which provides a level of security and durability to the business model. As they scale, I expect them to reach GAAP profitability and maintain growth above 30%+ for some time.

From a valuation perspective, I find their stock price still reasonable at a $4.4B market-cap. If we think about what their stock price should trade at by the end of the year, we can use a few different valuation metrics to get an idea of where they should be.

P/S (due to them having a subscription model) under 10 which could place it under a $8B market-cap, or nearly double from where it is today. The stock price would be approximately $50/share in this case.

P/EBITDA of forward 30x, which would keep their stock price at this valuation today by the end of the year. $25 - $30/share.

At only a $4.5B market-cap, I believe Global-E has the opportunity to yield incredible long term results especially as they scale to GAAP profitability. Their market opportunity is massive and their product is mission critical. As long as they manage their cash position well and continue to focus on “smart growth”, the thesis will remain strongly in-tact. Their partnership with Shopify provides a nice safety net.

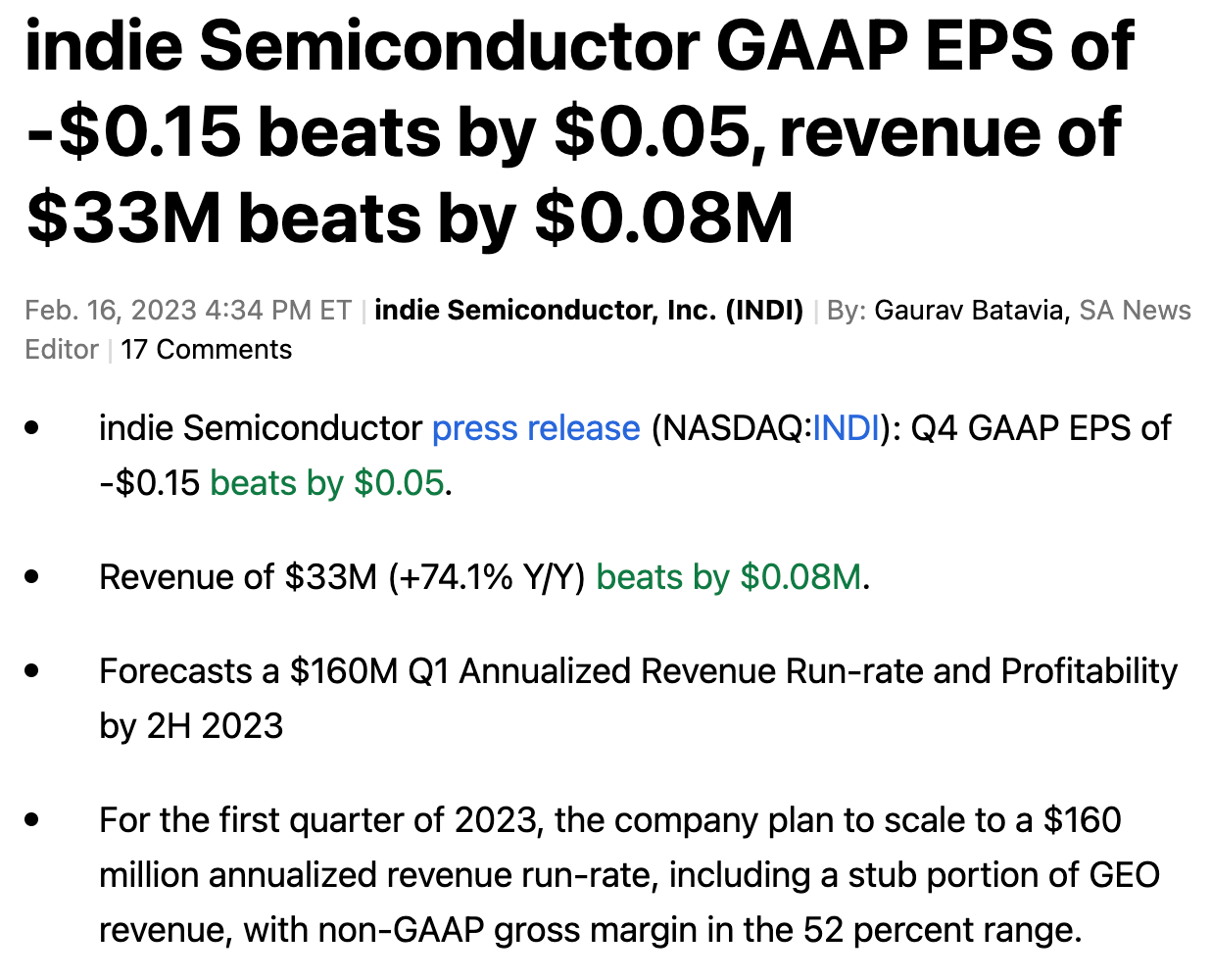

Indie Semi Conductor

Indie is one of the newest stocks that I added to my portfolio. Thanks to my friend Eric, from Fired Up Wealth, he produced a YouTube video that I watched and was instantly curious to see what this company was all about. I usually have these types of companies on my watch list (high growth) but don’t necessarily dive intently in to them till I see some sort of opportunity. Their latest financial results really caught my eye.

Indie SemiConductor Q4 Results:

A small cap semi-conductor company growing 74% YoY in a year that absolutely killed the bigger players like NVDA and AMD? Alright, that’s something I’m looking for. What do they do? Can they be profitable?

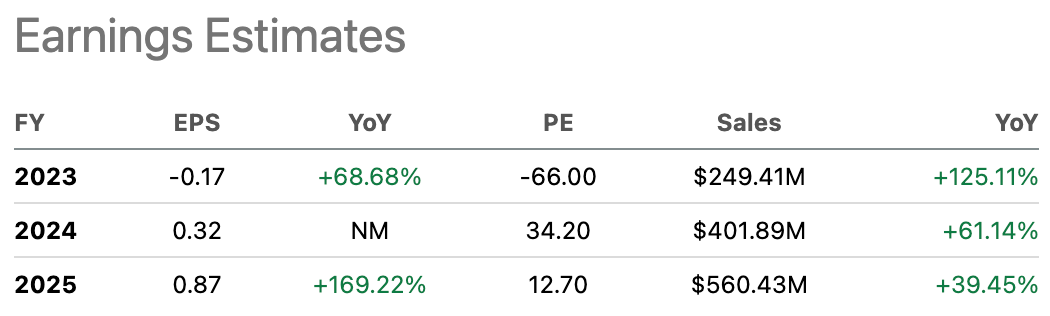

Analysts have them reaching GAAP profitability by 2024 and have them growing exponentially for the next few years before growth slows down. Yes, this is exactly what you want to see as a growth investor. You’re looking to find companies that have a strong chance/ability to reach GAAP profitability but that also means you need to identify the business model durability and cash position.

The YouTube video above from Eric was very helpful as it was the CEO that had the chance to describe exactly what they are doing and where they plan on going. Indie Semiconductor operates as an automotive semiconductor and software company that enables advanced driver assistance systems, connected car, user experience, and electrification applications. Basically, they produce the chips that go into cars that have autonomy and are EV’s.

The reason why this is important is that, as cars become more advances (every year), they are becoming more software enabled and EV’s are in high demand. This requires more semiconductors to put into these automobiles which is exactly why we have had a “chip shortage” for quite some time in the automotive market. Many other car manufacturer’s are trying to keep up with Tesla but need the chips and know-how to do it. This is where INDI comes into play. To put further clarification on this opportunity, these two slides really put things into context for me.

Today, about $700 worth of Semiconductors are placed into a car. In the future, this will be significantly higher, they think it will be about $7,000.

They are focused on three mega trends in automotive: Software, Autonomy, and Electrification

You usually need to take investor presentations with a grain of salt, as they are sales presentations but here’s what I know.

The market of which Indie operates in will grow as vehicles become more advanced and require more semiconductors.

Indie is expected to become GAAP profitable by 2024. It is important to note that leadership, the CEO, thinks they will become GAAP profitable later this year in 2023. This means the business is healthy from a margin profile perspective. They currently have $350m in cash and about $170m in debt ($150m of it is longer term debt) meaning they have enough cash to reach profitability.

Semiconductor shortages are real in automotive and have contributed to some of the automotive inflation. There is a demand for more players in this market.

For smaller companies there is always a need to hold these businesses under a microscope and monitor them very carefully. The larger companies, I have noticed, are covered and scrutinized more which gives us (the investor) more resources to monitor them. For Indie, we have to ensure they reach GAAP profitability this year and if they do, the returns for us will be tremendous.

They are currently trading at $11/share, or a $1.38B market cap. If they reach GAAP profitability this year, and meet/beat expectations this year, we can value them on a forward P/E basis. Today, based on analyst expectations, they are trading at 34x 2024’s PE. This is a fair valuation given their growth trajectory. I did notice that analysts do not have them reaching GAAP profitability this year and because of this, this presents some upside. If we think about a P/S basis, due to the nature of their fast growing business model, they are currently at 5x P/S for all of 2023 and 3x P/S for 2024.

Let’s assume they will reach GAAP profitability (the exact earnings are hard to estimate) this year and we assume a 5x forward P/S for 2024 later this year. This will put Indie’s expected valuation at approximately $2B or 45% upside from these levels. The stock price, by these metrics, should be trading between $15 - $20 by the end of the year. This is assuming good business execution.

Confluent

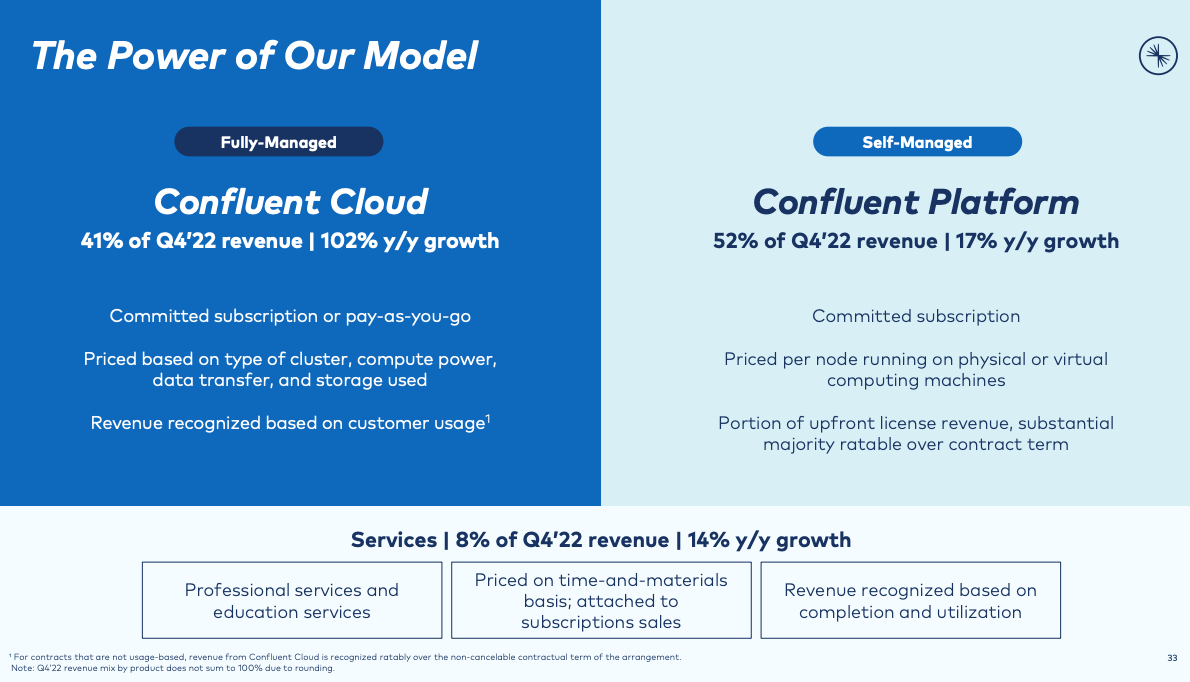

Confluent is a very misunderstood stock among growth investors. I believe that it’s likely because they are only “showing” 30% growth but that’s only on an overall basis (they have three sources of revenue).

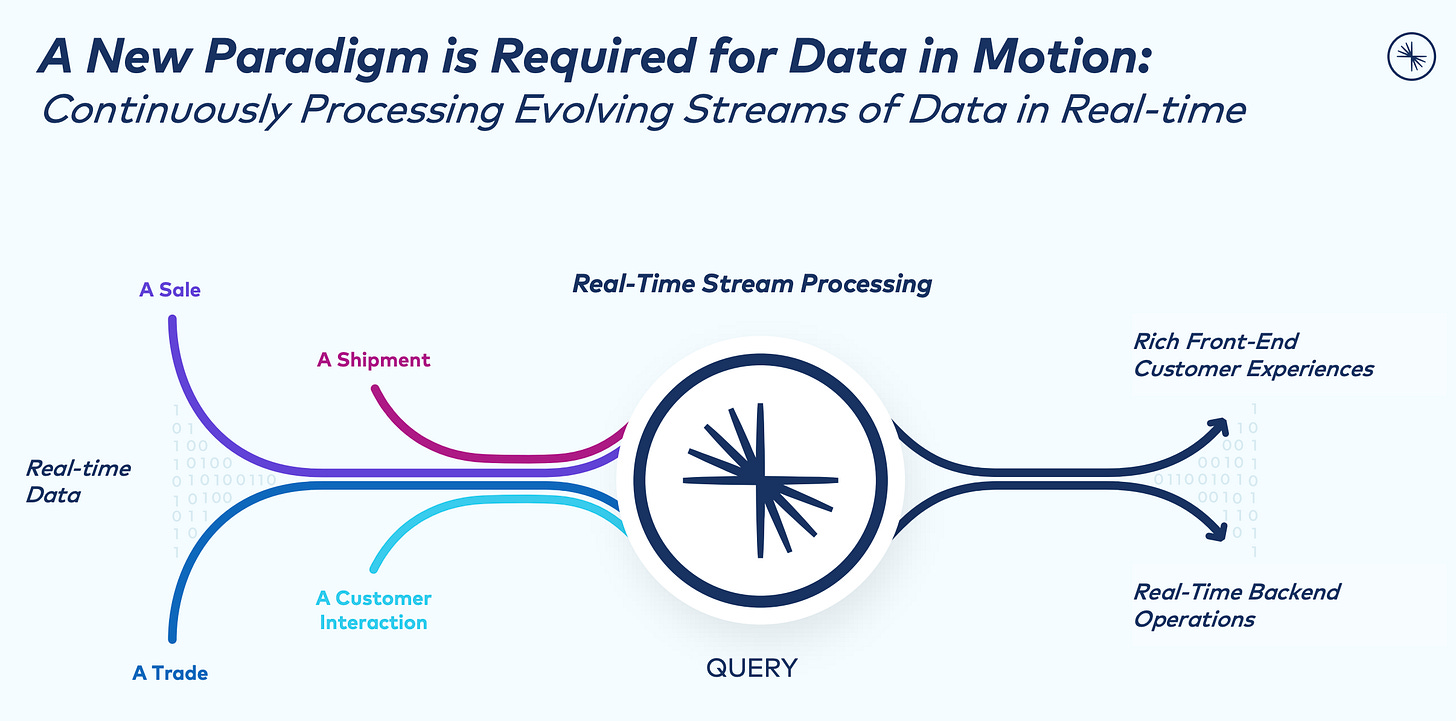

The story with Confluent, to me, starts with its founder Jay Kreps. Jay used to work on the LinkedIn team where they founded Apache Kafka (a type code that enables real time streaming of data). Over time, they broke off from LinkedIn to find Confluent. The core business capability of Confluent is data streaming management. Let’s simply explain what that means.

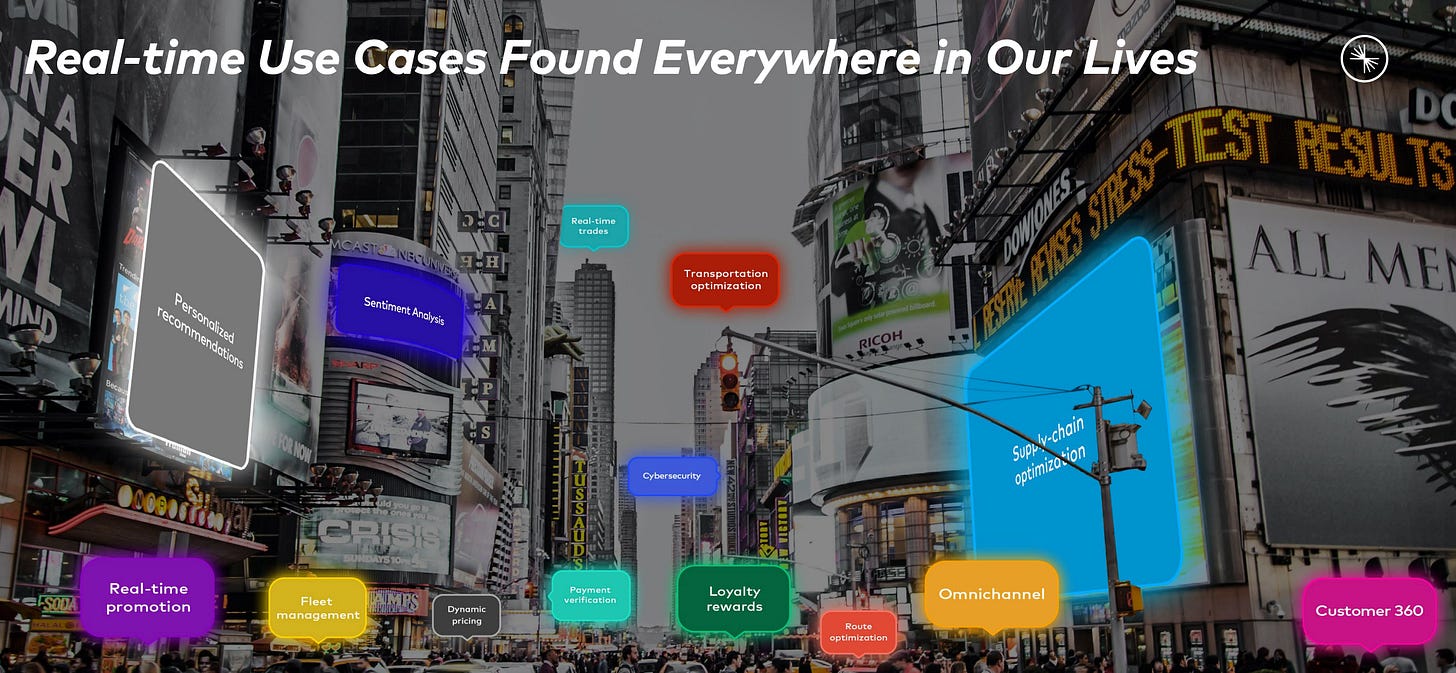

First, we need to understand exactly what “data in motion” is. From a non-engineering perspective we can think about it as the “push notifications” on our phone, or real time data processing. Another example could be us using our banking cards, it’s instantly transacted in our accounts and our account balance adjusts real time (you could get a push notification for this too). The concept is simple, it’s the streaming of data so that you don’t have to go to a specific location and run a query to receive a particular set of information.

This is where Confluent comes in. They provide a backend infrastructure component to this types of code that is implemented in an organization. The use cases for this component (data streaming) are not as sparse as many may think. Confluent has a use case in nearly every aspect of the organization as organizations become more digital over time.

To provide more examples of real world use cases, I found this slide in their investor presentation helpful:

Simply put, Confluent is a platform for businesses to manage these capabilities.

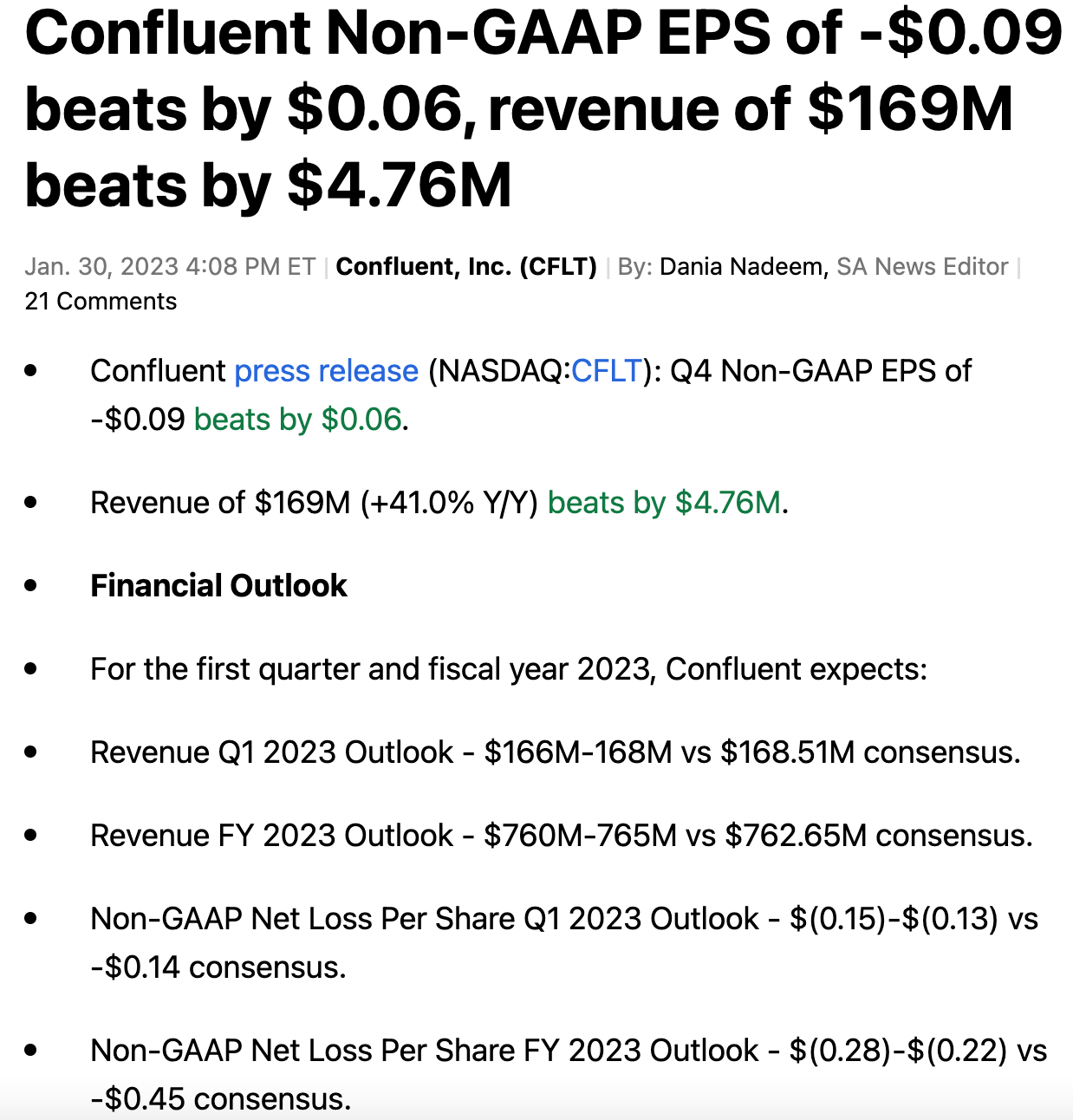

Confluent Q4 Results:

Notice Confluent Cloud growing 102% YoY, this will become a larger portion of revenue over time. Their “Platform” revenue is their on-prem (not cloud) solution.

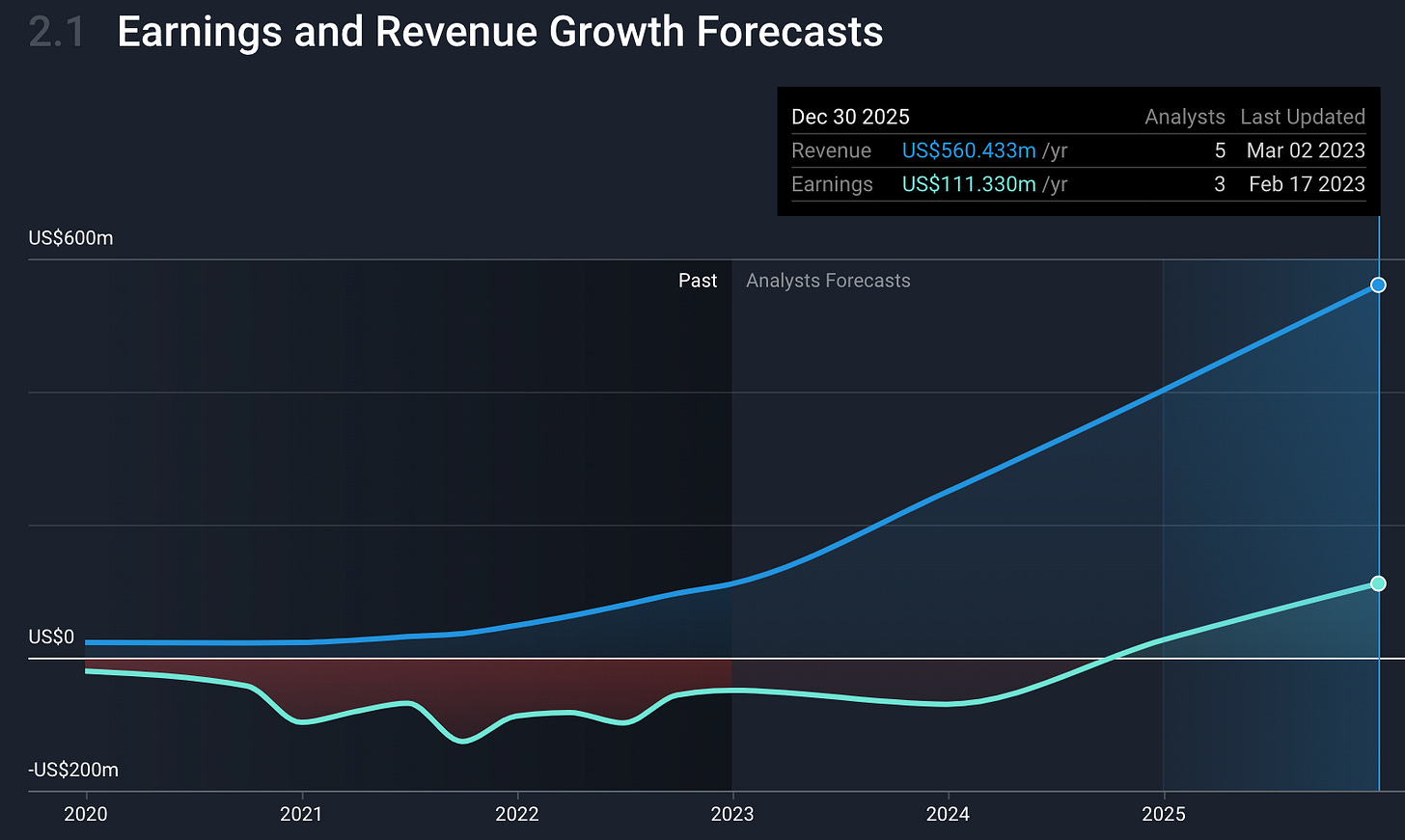

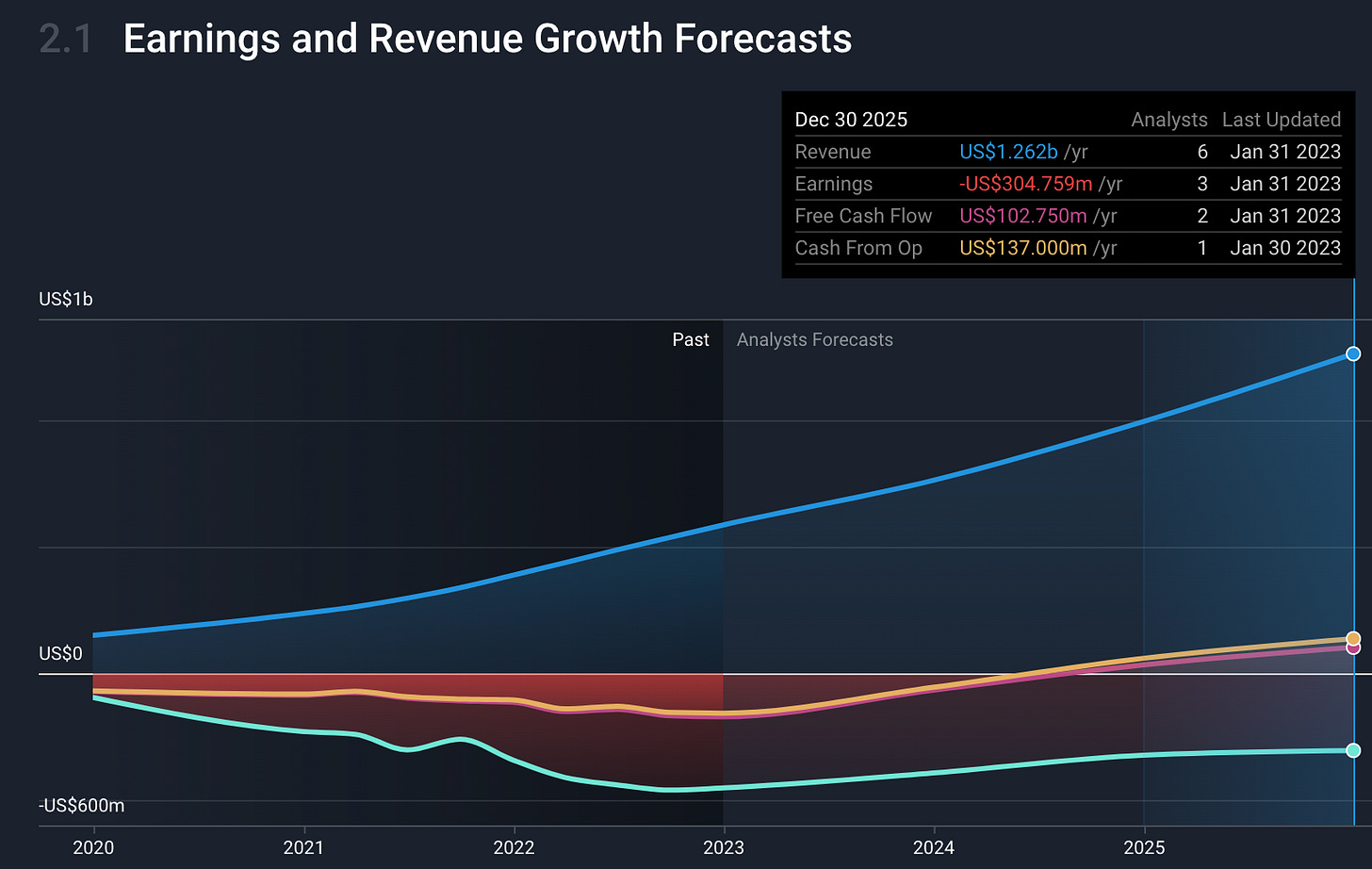

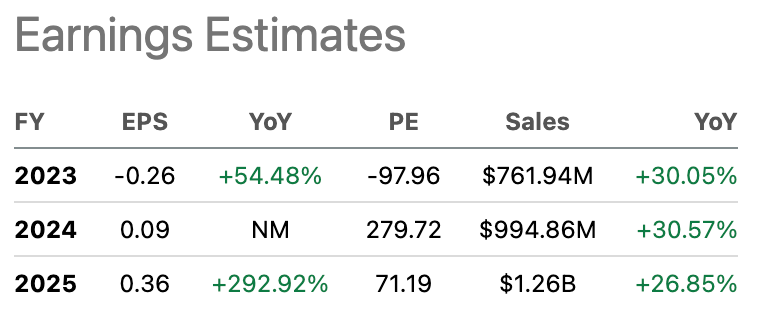

Confluent released great results, in my opinion, and provided in-line guidance during a period that has otherwise been difficult for many software companies. Analysts (below) have them operating at a break even cash flow in 2024 but in their latest earnings call they moved this date from 2024 to this year in 2023. I would expect that late Q3 or mid Q4 they begin to operate at cash flow break even, which is exactly why I own them.

I rarely own stocks that are unprofitable. If they are unprofitable (or at least operating at cash-flow break even), I don’t necessarily believe it would be a lucrative investment. In this particular example with Confluent, I am an early investor because I believe Jay (the CEO) can get Confluent there and they have the balance sheet to get there with cash around $2B and total debt at $1B (which are low interest convertible notes).

Today, they are trading at a $7.53B market-cap which puts their enterprise value at roughly $6.5B. Their FY 2024 sales should be approximately $1B, which means there is some upside here. SaaS companies that do reach cash-flow break even often trade at a higher valuation than their non-cash flow break even peers. Today, they trade at roughly 6.5x 2024’s EV/S, by the end of the year they should trade approximately 10x 2024’s EV/S which is inline to their peers that are operating at a cash flow positive valuation. This implies that Confluent should be trading at nearly a $10B enterprise value, or $11B market-cap.

I estimate that Confluent should be trading 46% higher by the end of the year assuming in-line business execution and slight multiple expansion due to reaching operating cash flow break even. This implies a $37 - $40/share price target by the end of this calendar year.

Monday

Monday has the worst name in SaaS (lol). If I were to provide a recommendation, they should at least choose Friday for a name. Purely kidding of course, in all seriousness they have a wonderful product and an excellent business model in relation to their peers.

To overly simplify Monday’s business model, they are low code/no code collaboration platform. In simple english, this means that they are a lot like Microsoft Office for collaboration and work flow management. They enable their users to simply build a platform that works for their existing business processes. In my opinion, they are an all-in-one application SaaS platform and pose a serious threat to CRM’s, Microsoft Teams, and Asana (one of their direct competitors). The easy customization ability really provides a unique value add to their product offering.

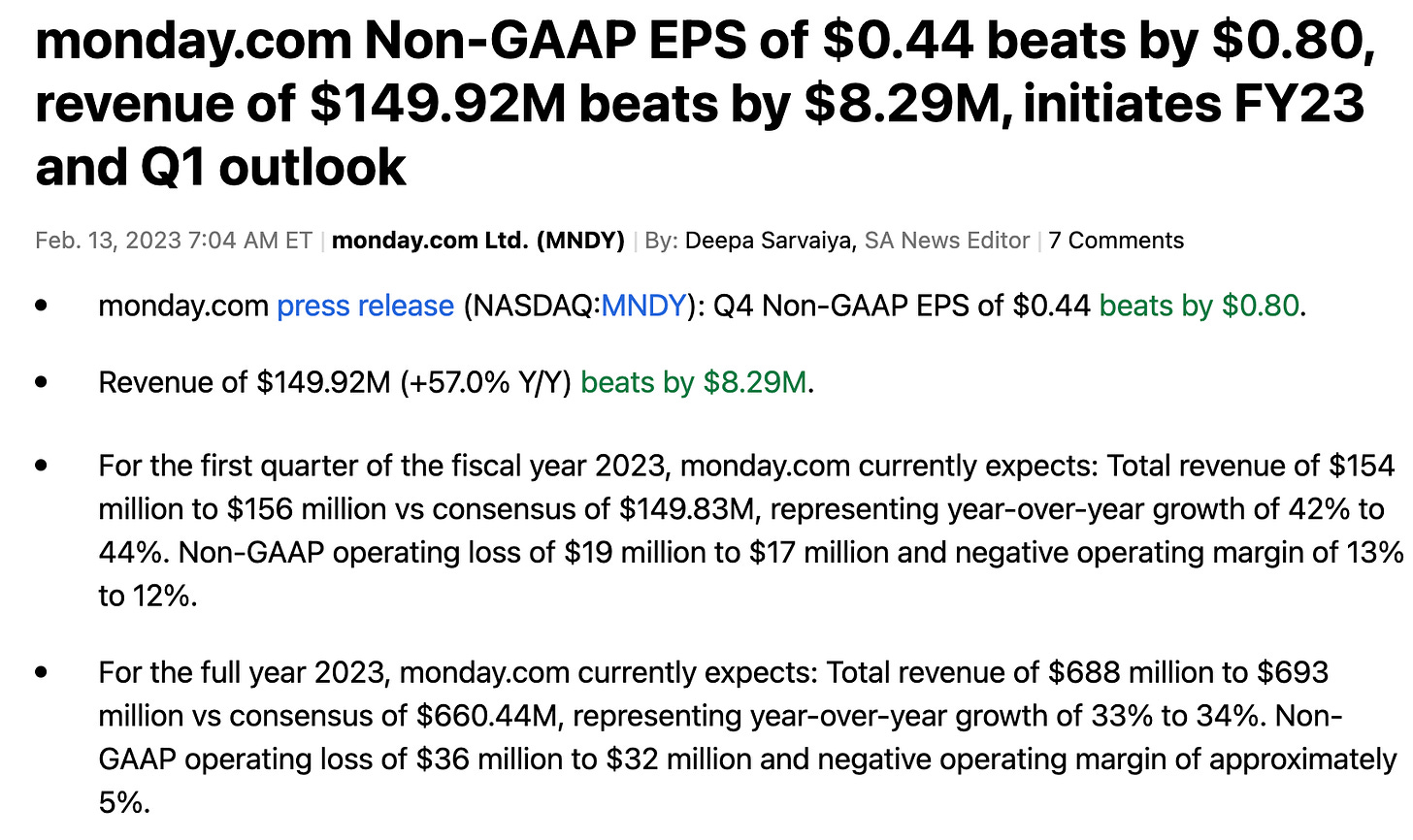

Monday’s Q4 Results:

After earnings they really got a nice bump up in the stock price, it even really surprised me to see their bottom line results produce positive operating cash flow. I didn’t own them prior to their earnings but, as I ran the valuation, it still made sense to start a position where I did. They have a history of sand-bagging guidance but, as usual, we will use analyst estimates to see exactly where they are going.

The long term market opportunity, as they have mentioned before, is tremendous as they do have the ability to become a Microsoft Office like SaaS application. They have a CRM solution, a collaboration tool, work flow automations and a market place for other people to use others built in application process.

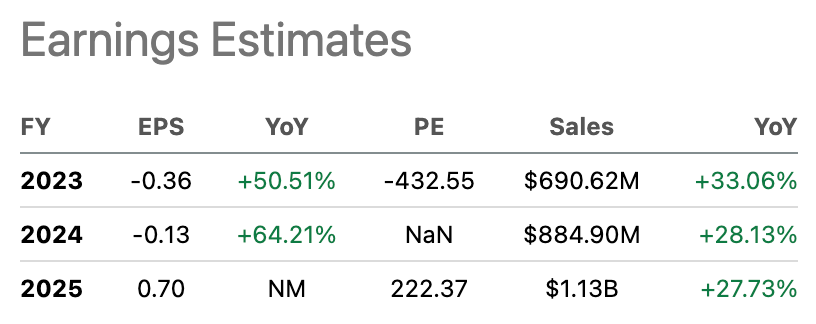

Monday, I believe, has upside from today’s valuation (like many of the others listed above). Their valuation is currently $6.8B with an enterprise value of $5.8B. Above, we can see that they are expected to have approximately $900m in 2024 while operating with FCF and operating cash flow. In the short term, I could see further multiple expansion from todays levels and organic business growth to give us Alpha over the rest of the year. Assuming they trade at 10x NTM EV/S like other FCF+ SaaS businesses, they should reach a $9B enterprise value, or a $10b market-cap, by the end of the year. This implies a 47% upside (mostly due to organic growth) by the end of the year.

Monday should be trading at roughly $230-$250/share by the end of the year.

CloudFlare

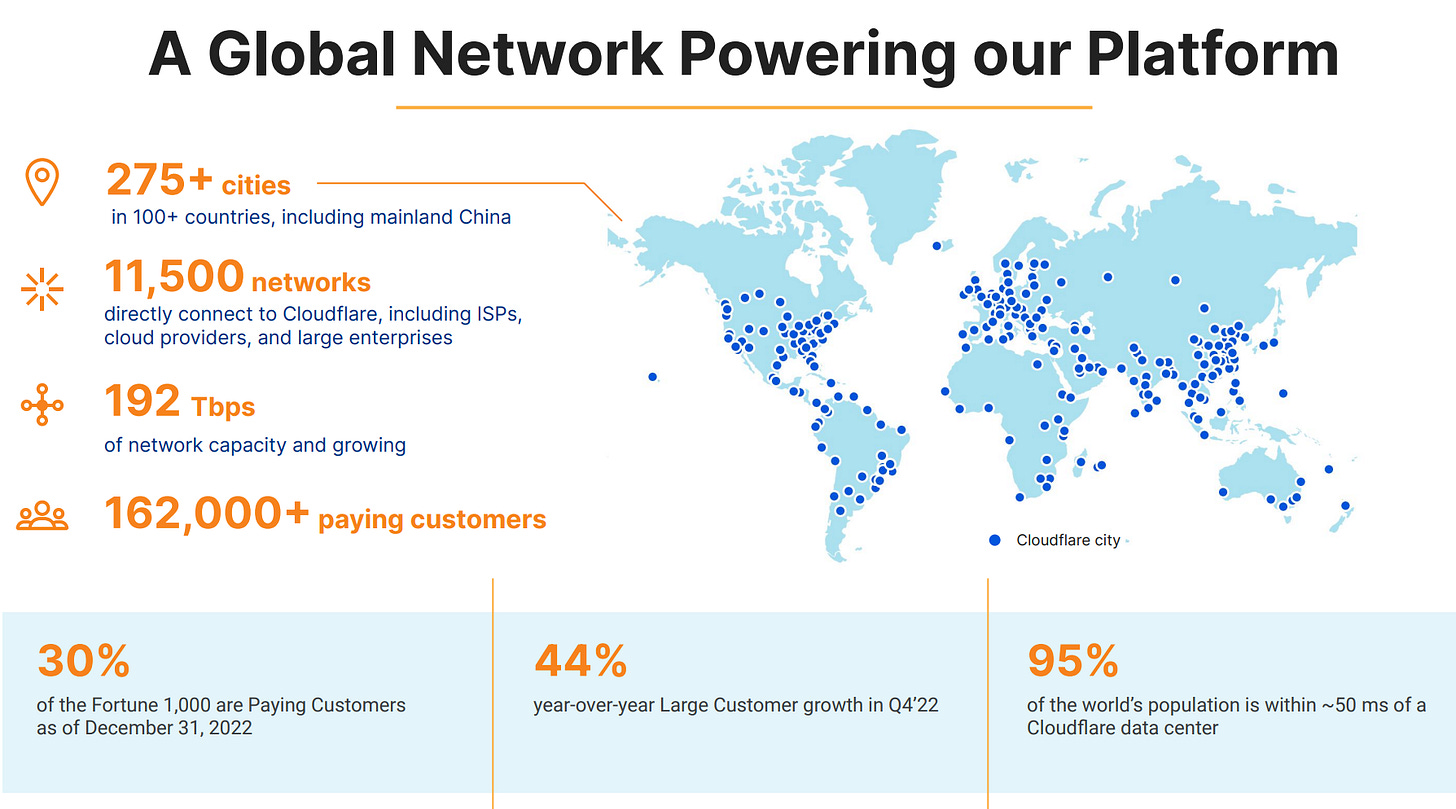

A company that needs little introduction. With 74% institutional ownership, Cloudflare represents a unique growth opportunity that demands a premium valuation. The opportunity is in the durability of their business moat where they offer a truly unique product.

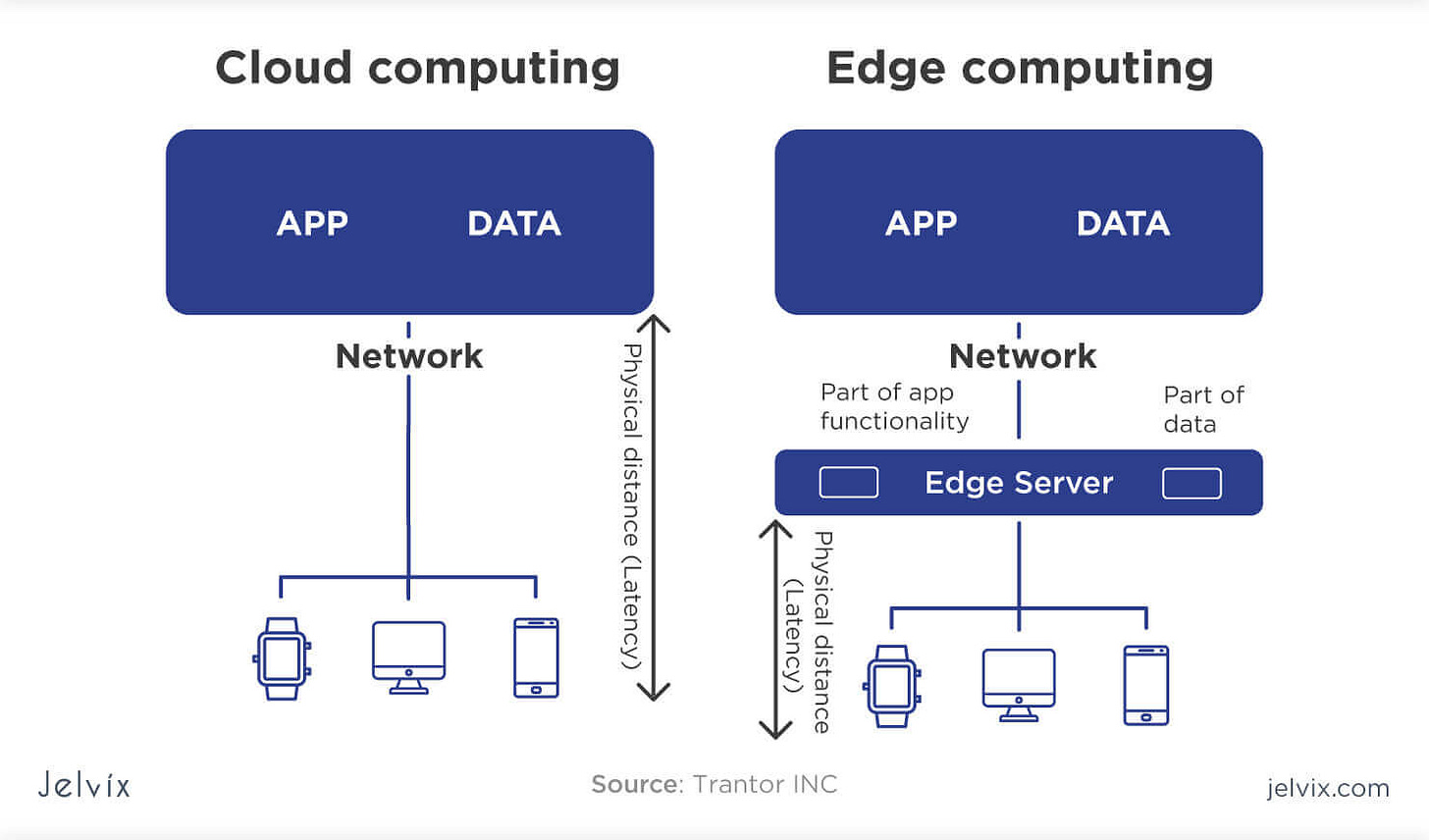

Cloudflare offers a cloud networking platform that serves to improve speed, security and network architecture. In simple form, they act as a backbone to business function by providing networking solutions “at the edge”. To make more sense of their business model, I included the image above that represents locations Cloudflare operates out of. We have to define exactly what edge computing is compared to traditional cloud computing.

When ever you or I log into a website, this sends a signal back to some sort of server around the world. The connection from our devices to the servers takes time, even though it’s at the speed of light. When you go further toward “the edge”, this means that the servers are closer to you which improves computational performance and reduces any lag. Above, it simplify’s in a visual context how this works. Cloudflare has edge servers all over the world and improves the reliability, safety and effectiveness on a global basis. This is becoming a mission critical need as data and information is becoming more demanding every year.

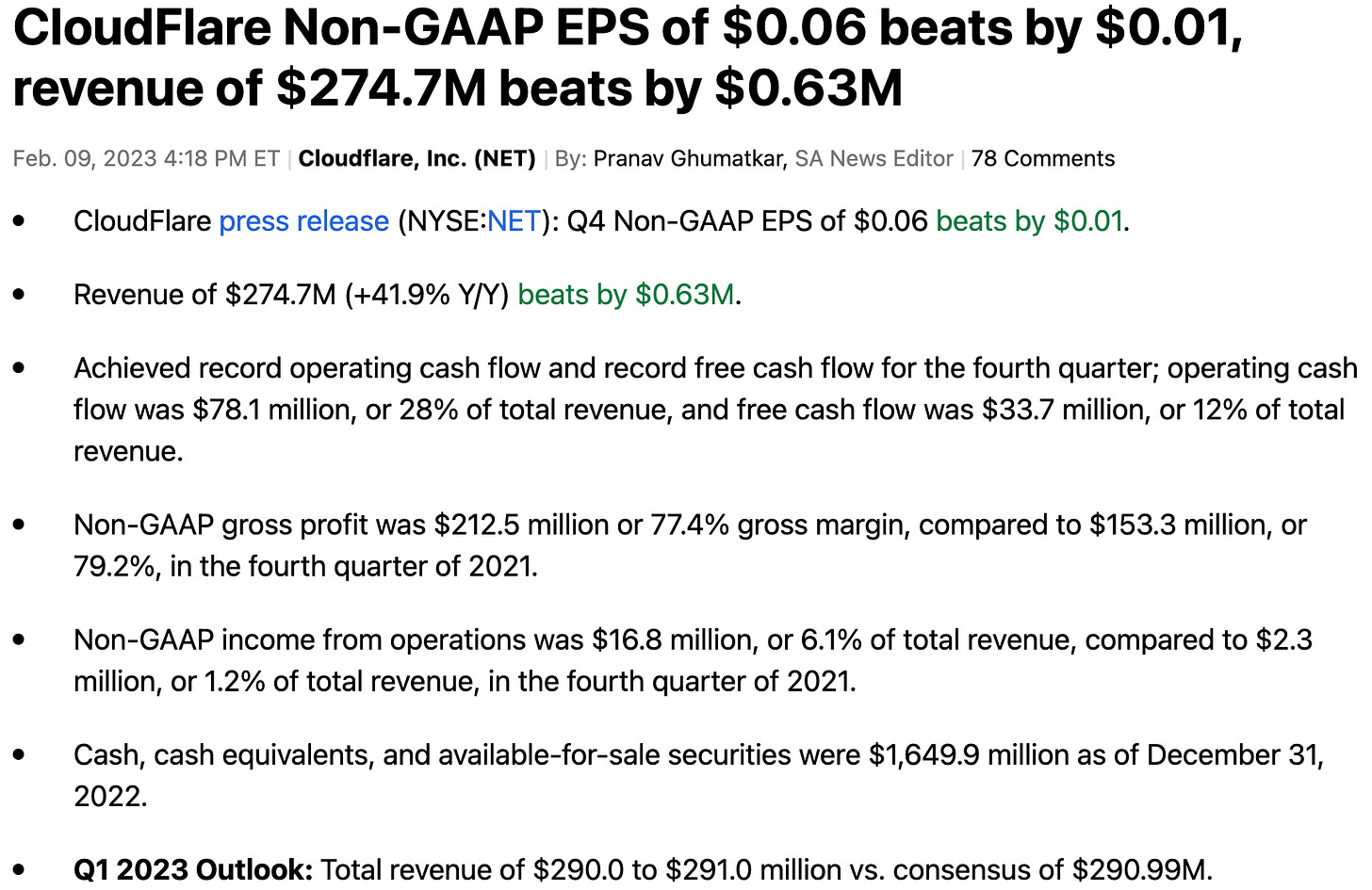

Their financial results have been impressive during a period where many other cloud computing company’s have lowered guidance, beating expectations and maintaining/raising guidance. The real story here, in my opinion, is that this year they finally reached the scale necessary to transition their business model toward cash-flow positive. This is important, having an ability to generate cash, because this enables them to continue to invest into new products (that seem unlimited if you own the network at the edge) and maintain business results.

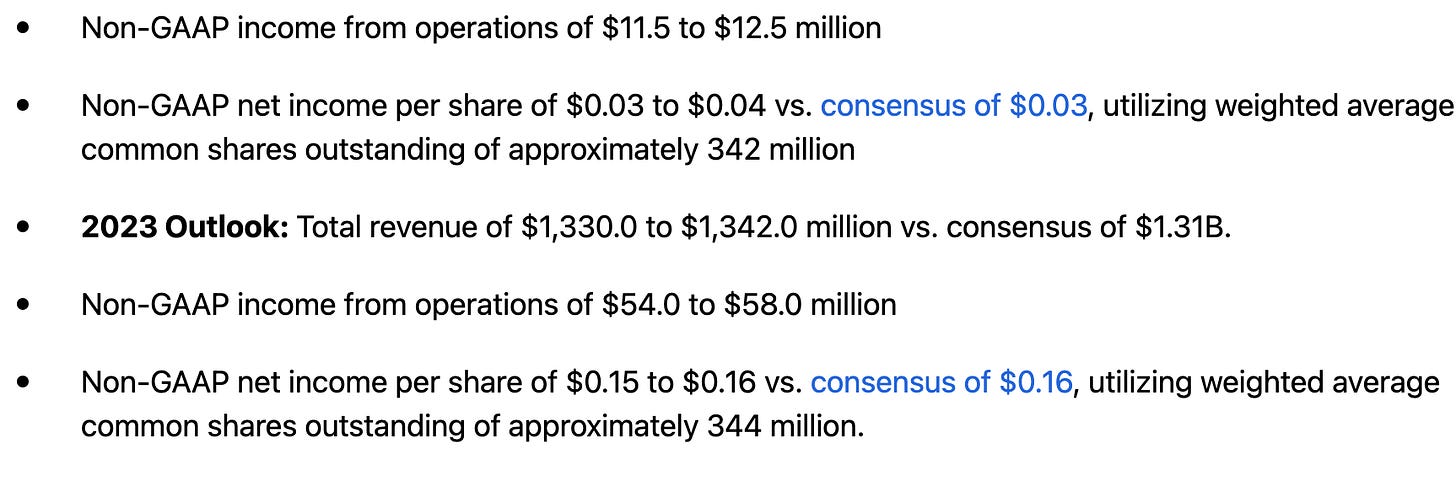

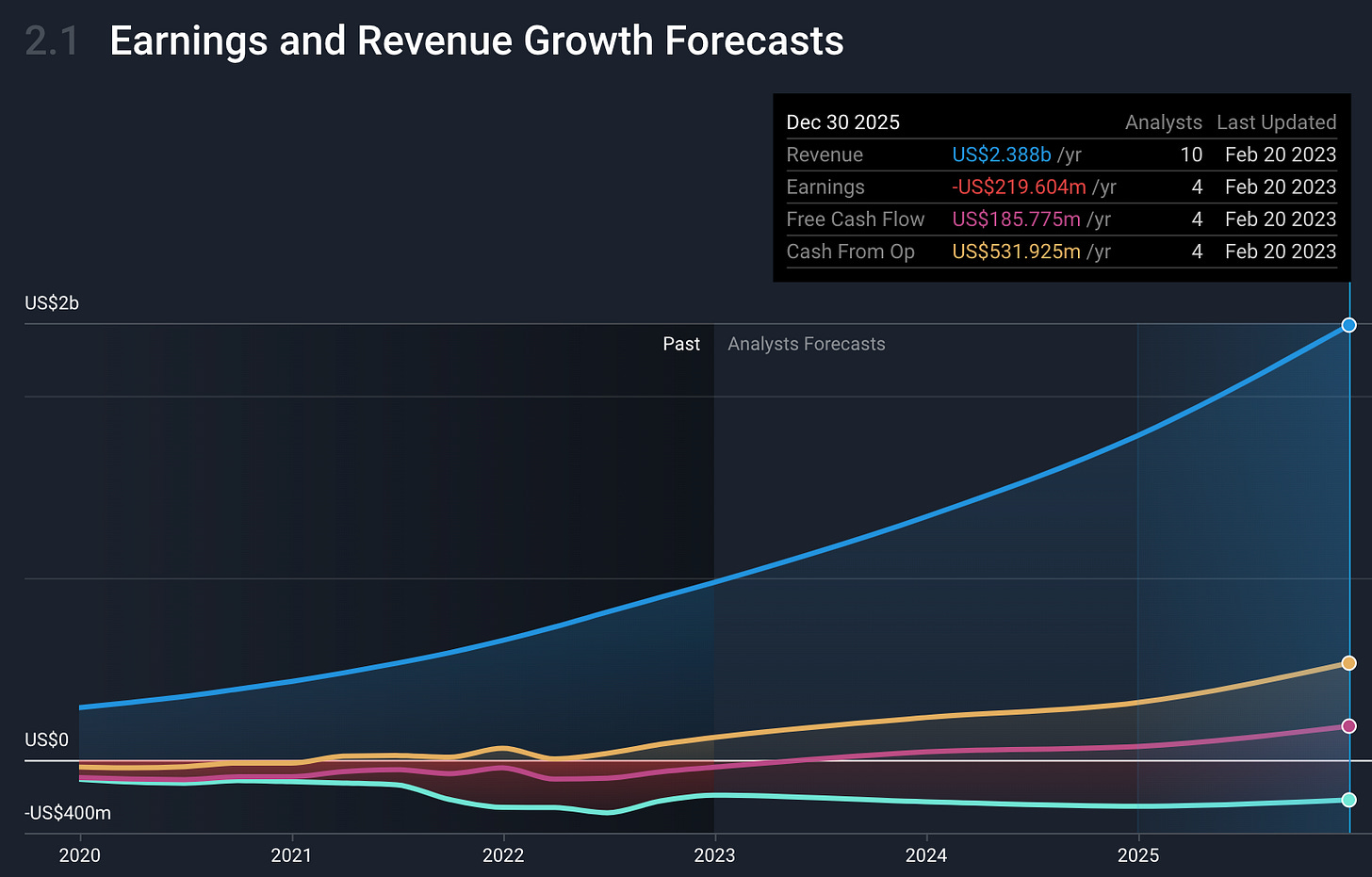

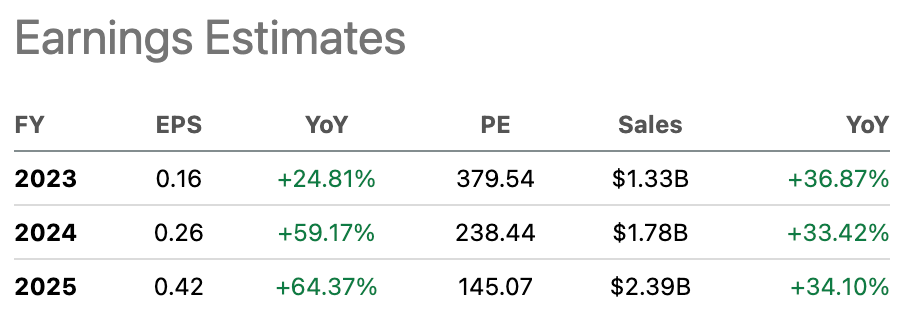

Their business should maintain 30%+ growth (being conservative) for some time as they find new ways to innovate on their platform and more businesses adopt the Cloudflare platform. Analysts have them growing 30%+ for at least the next three years, while expanding bottom line metrics at a faster rate than top-line metrics (notice EPS growth estimated near 60% YoY).

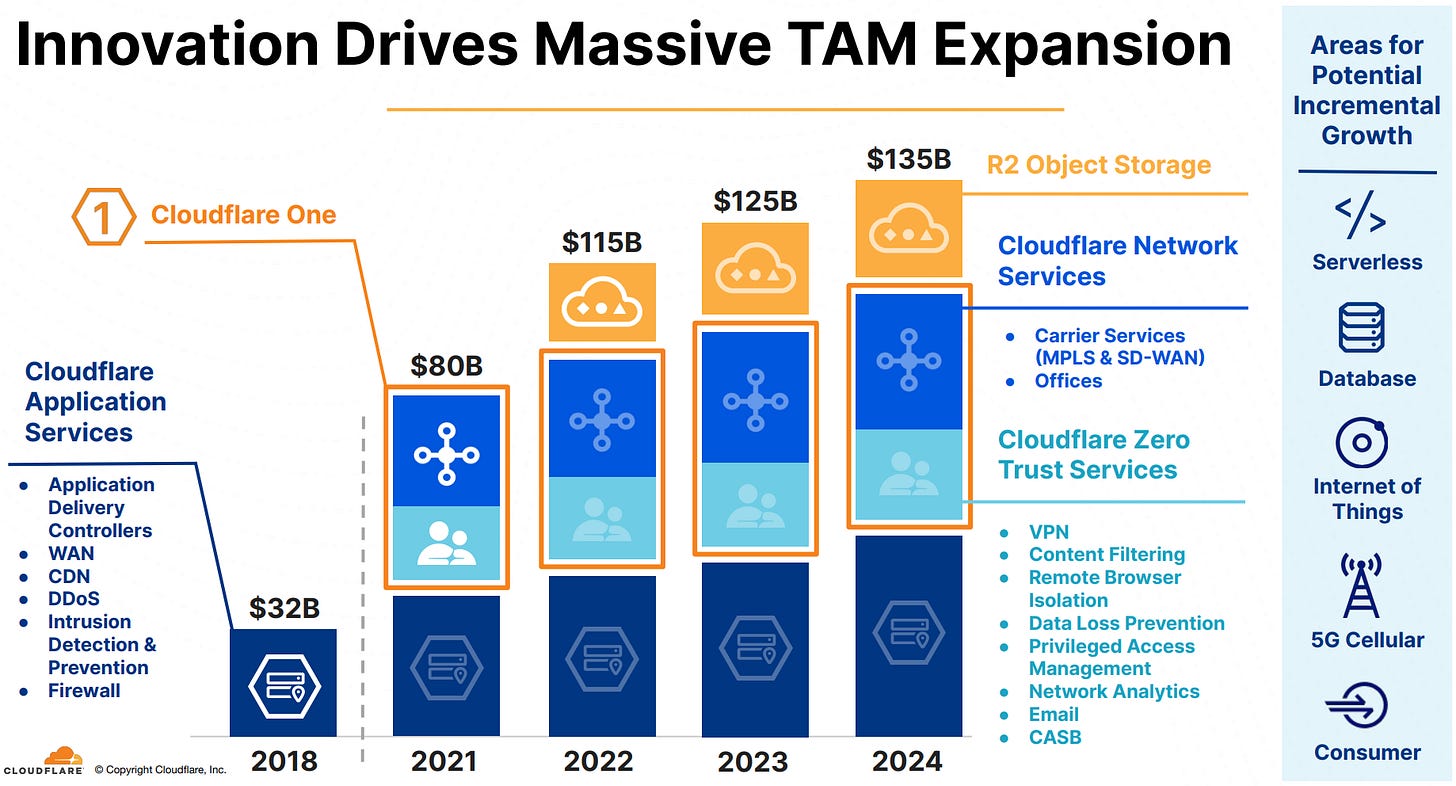

Perhaps the most important thing that will drive this (expected) growth is their ability to rapidly innovate. Today (below) they are focused security, network services, storage and application services.

On their last earnings call, they mentioned that these four categories is where they’ll maintain their focus “for now”. As data needs become more demanding and the need for better network infrastructure rises, Cloudflare has the ability to continue to innovate and create new capabilities on their platform. No other company has this ability quite like Cloudflare, even the Hyper-Scalers (AWS, Google, Microsoft). The up-front investment needed to deploy data centers all over the world while improving the product offerings creates a very high barrier to entry. The time factor alone is significant, not just the capital demand. Basically, they own the infrastructure to build new applications on top of to meet client demands. Long term, this will pay dividends.

I recently bought Cloudflare after earnings, at what could be an expensive price. However, they gave a lot of clues that they were sandbagging guidance, saying they were only going to get to $1.33B - $1.342B this year. I believe they’ll get closer to $1.4B in revenue this year which makes their valuation easier to swallow. For next year, in 2024, we can assume (based on analyst estimates and margin of safety) that they will be close to $1.8B - $2B in revenue.

Today’s market-cap for Cloudflare is $20B making today’s price accurate for a 10x forward EV/S by the end of the year. This suggests there is little upside from today’s stock price. If Cloudflare maintains their valuation at 15x forward EV/S, this would suggest that there should be approximately 50% upside by the end of the year.

Cloudflare’s stock should be trading at $65 - $90/share, or a $20b - $30b market-cap, by the end of 2023. If you’re able to get Cloudflare in the $50’s, this presents a solid R/R.

DLocal

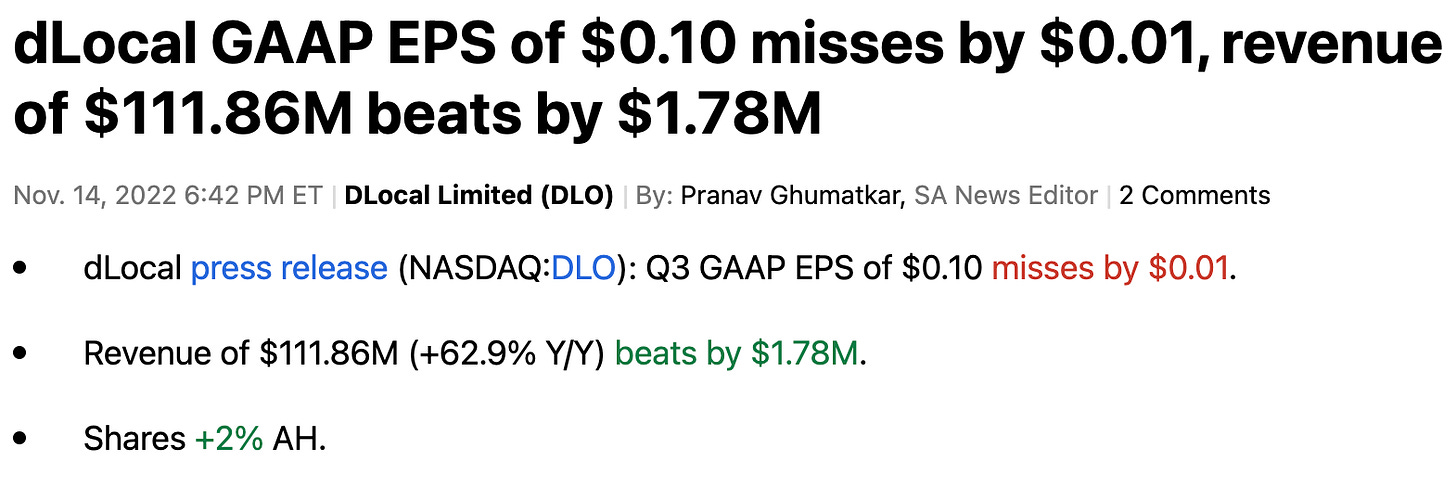

DLocal is the riskiest position that I own. Recently, they were a victim of a short report from Muddy Water who claimed that DLocal was a fraudulent company based on many accounting errors. I did have a chance to talk to their investor relations and they appeared to have a strong argument, mentioning that their top merchants (Microsoft, Google, Amazon) were notified of the short report and they had to provide justification to them. In my opinion, as it stands today, I have seen short reports go after companies that are vulnerable to make substantial claims about their business model. In this case, it’s an international payments company that specializes in emerging markets, the perfect target for a short report.

Today, I believe that (as long as DLocal isn’t a fraudulent company) the opportunity is tremendous for this GAAP profitable growth stock. Not just from a valuation stand point, due to being rejected by the market based on Muddy Waters short report, but on an intrinsic, fundamental, basis.

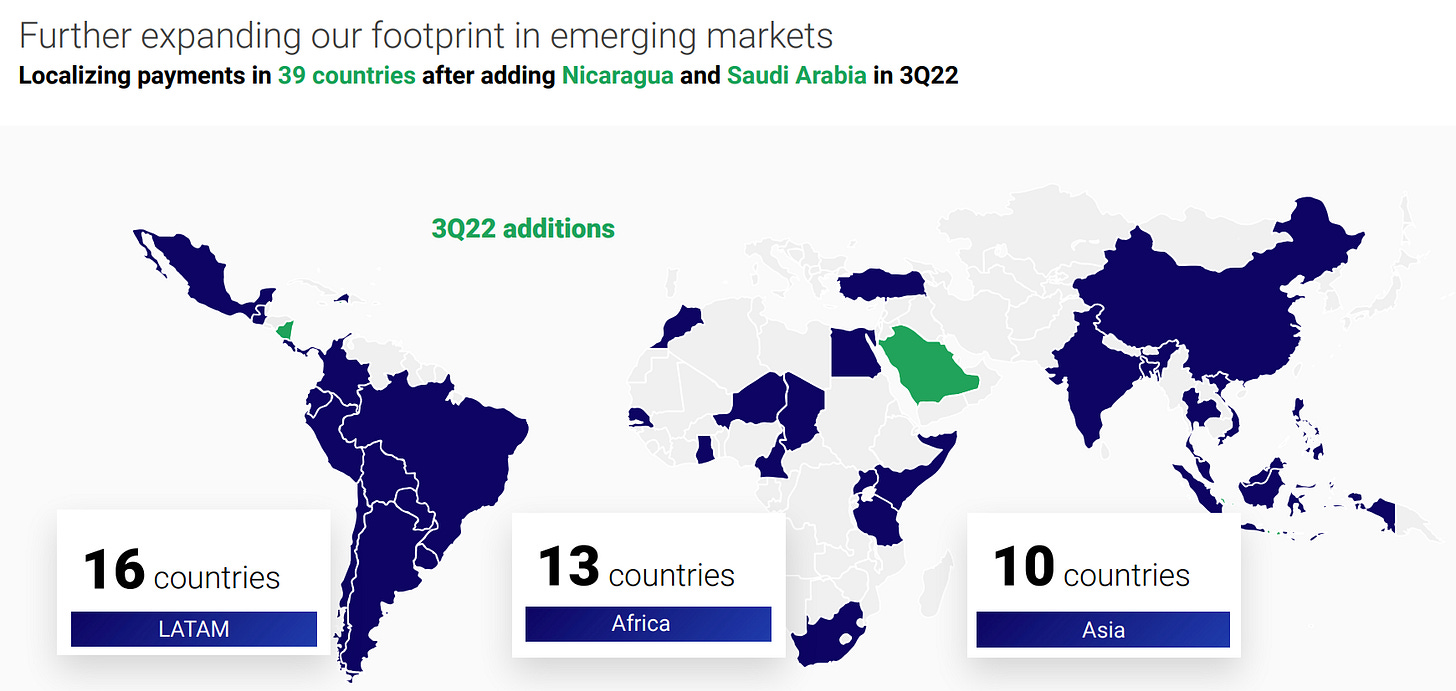

DLocal is an international payments company that specializes in emerging markets. A majority of their business comes from LatAm, since they’re based in Uruguay, but have rapidly growing segments in both Asia and Africa. The split in revenue is roughly 80% LatAm and 20% Africa/Asia.

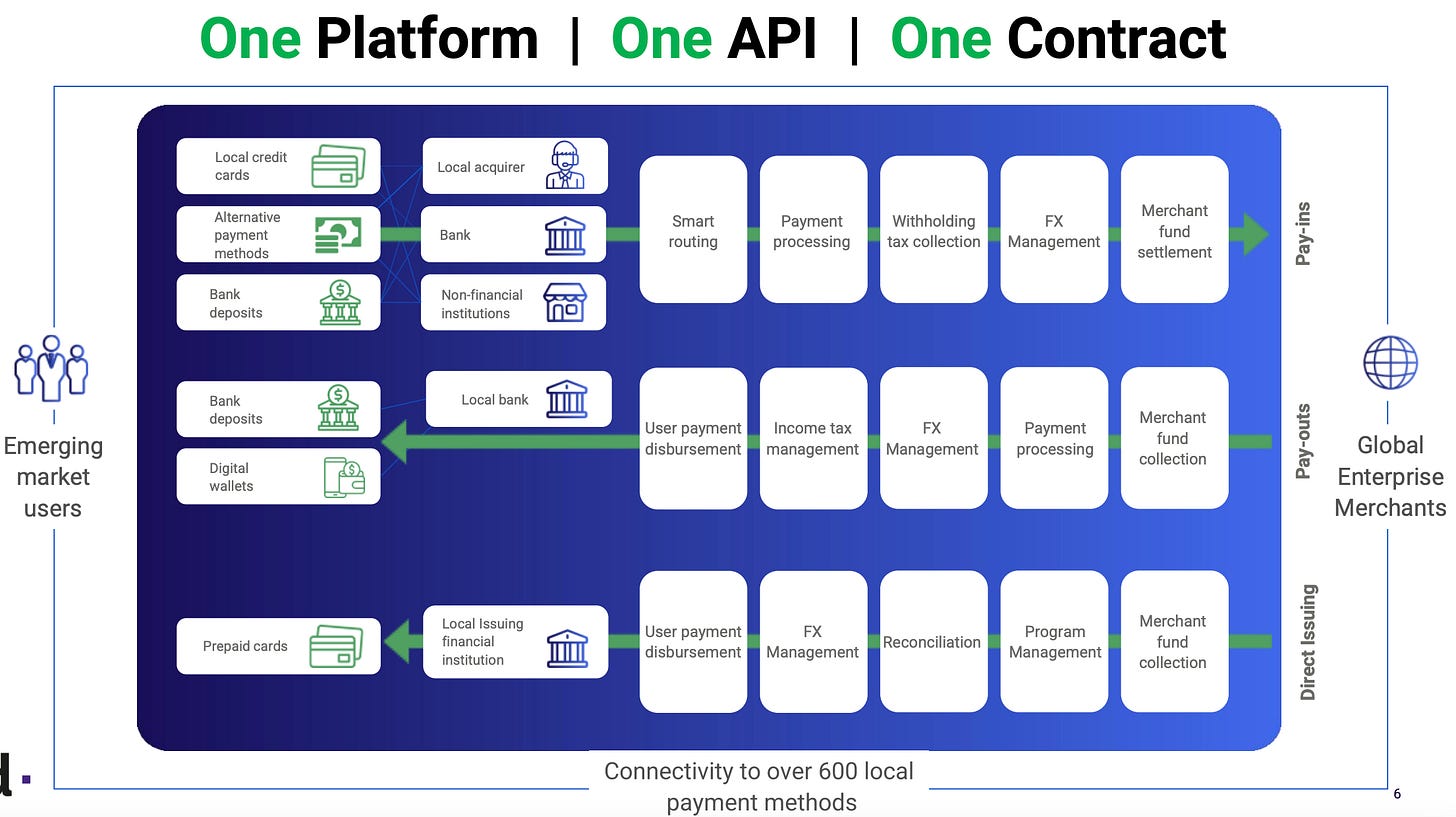

To explain their business model (above) with exactly what they do, DLocal provides pay-in and pay-out services to merchants across the world. Emerging markets have complex challenges like regulation hurdles, Fx hurdles, taxes and end-user adoption challenges to both receive payment from consumers or pay out their employees. DLocal reduces this complexity and specializes in these cross-boarder transactions through a single technology API.

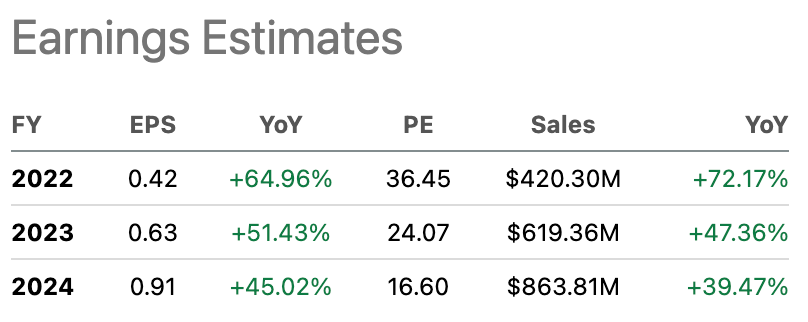

The real story, in my opinion, isn’t necessarily their opportunity but it is in the financial metrics they have. Very few companies grow as fast as DLocal does, let alone on a 35% - 40% EBITDA basis. On a forward valuation basis, DLocal is considered cheap by any metric due to an overall disinterest in the stock.

The way I see it, it’s one of the smallest positions that I have and for a reason. If DLocal is a legitimate company, their opportunity and financial profile represents a solid opportunity for significant multiple expansion in the near term. If the business thesis further deteriorates, it’ll be no harm, no foul. For 2024, the full years PE is only 16x, based on analyst estimates.

So where does this put us by the end of the year?

If we applied a forward P/E of just 30x based on 2024’s earnings (to get an idea of where DLocal should be trading later this year) we get a near double in stock price from today’s valuation. According to analyst estimates, they are expected to do about $863m in revenue for 2024 and have about $250m in GAAP earnings, which is about a 29% GAPP earnings margin. $250m x 30 = $7.5b market cap based on today’s market-cap of $4.5b which is a 77% upside over the next 9 months. Obviously, this is contingent on sentiment improving for DLocal and proving the short report wrong.

DLocal’s stock price should be about $27 - $30 by the end of the year assuming business execution and improving sentiment.

To Summarize

All businesses that I own are relatively similar in the sense that they have three things in common:

Growing market opportunity & leadership position in the respective market

Revenue growth signaling adequate demand for the product

Generating cash or almost FCF (free cash flow) positive

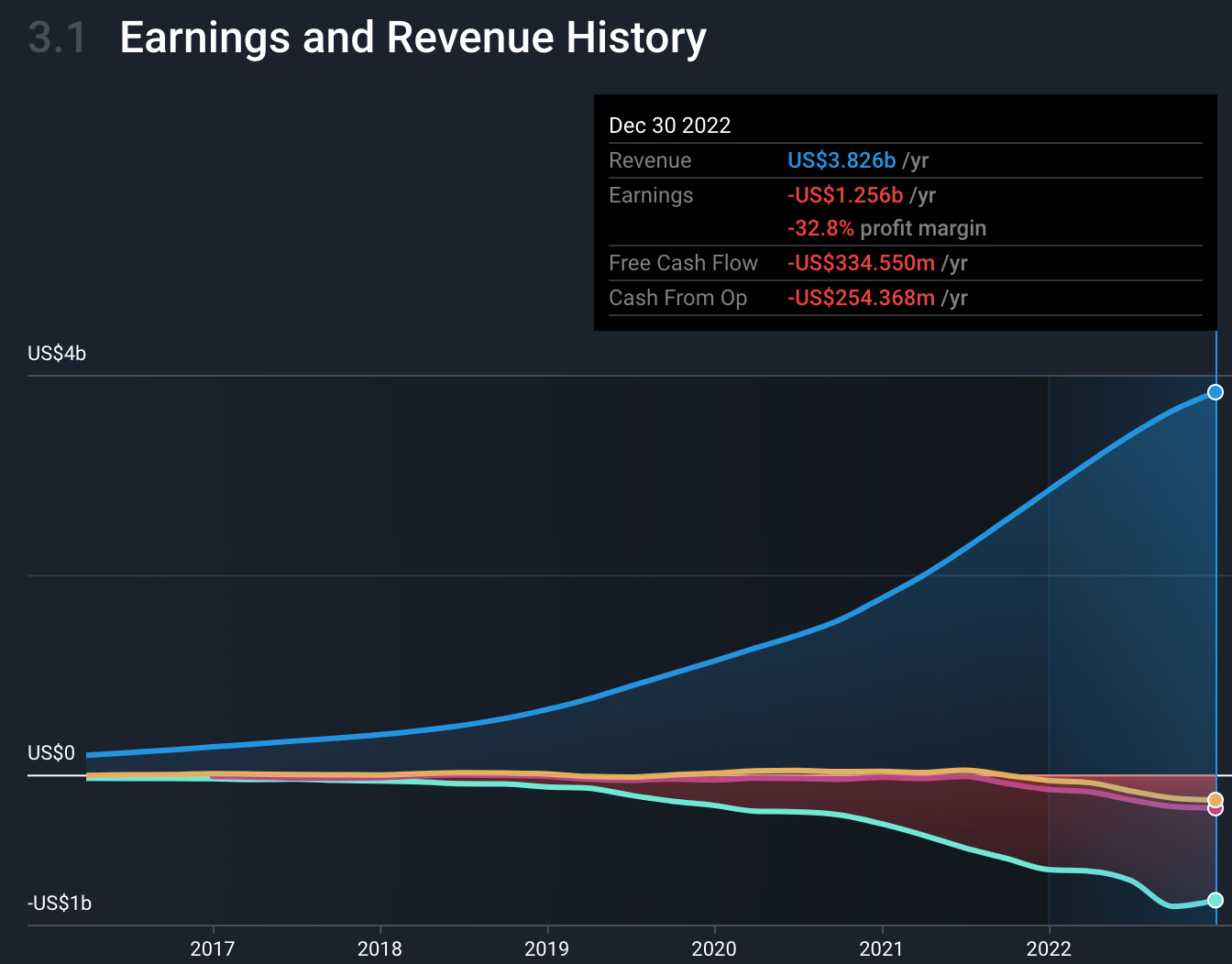

I adopted much of this strategy from what Peter Lynch used to do at his Magellan Fund. The idea is to treat the individual businesses like businesses, not stocks, with valuations and a future potential return. If a company is growing revenue but not earnings or cash flow, there is usually a strong tendency to under perform the market. A good example is TWLO whose revenue growth has been extremely healthy but has not produced to the same returns as some of their peers. This can be directly related to the poor bottom line financial performance.

TWLO Past Financial Performance

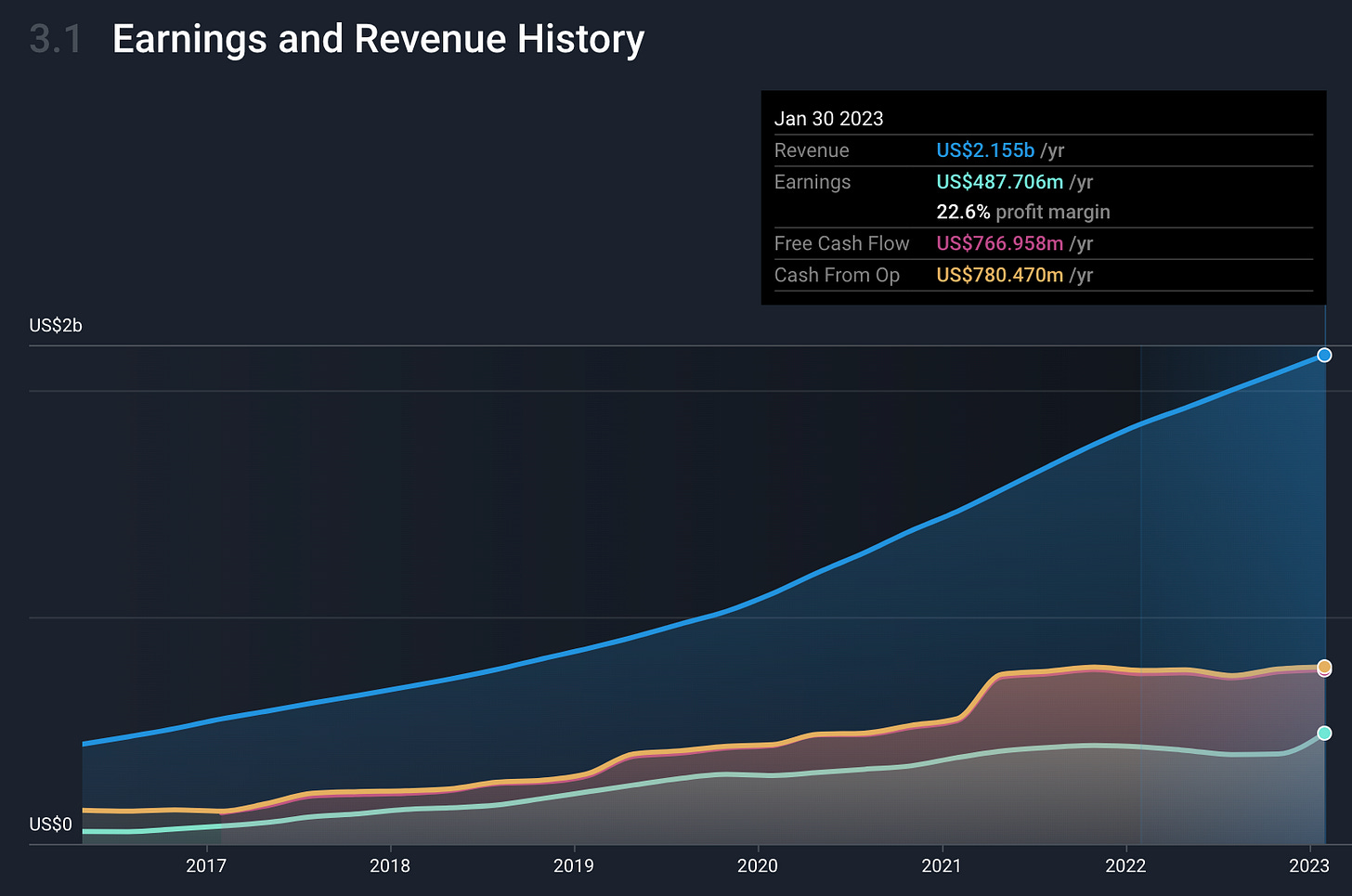

You can’t value a stock on a future P/S basis alone. They need some sort of cash return or GAAP earnings return. What’s really excellent to see is when some of these high growth, sticky software businesses, reach GAAP profitability while also generating meaningful cash flows. Two examples I can share are VEEV and CRM.

Veeva Systems

Salesforce

I would never categorize myself as a “tech investor” but simply an investor who is looking for growth in top and bottom line metrics. It doesn’t bother me what it may be in but they do have to have some sort of growing market opportunity. This just happens to be in technology, or software, these days. Over the next 5-10 years I think there will be a few themes that will really stick out:

Artificial intelligence

Data management, storage and processing

Business application development

Autonomy and process automation

Self driving cars and EV’s, etc.

These theme’s aren’t necessarily just themes, however, they are needed product developments necessary for us to move forward as a human civilization. We, us, investors are just trying to capture and be apart of the opportunity ahead of us. The future is brighter than most people think.

Stay Tuned, Stay Classy

Dillon

Thank you for this amazing article. Tt was a great demonstration of your skills.

Thank you for this amazing article. Tt was a great demonstration of your skills.