The markets are positioned for an end of year rally. Confusing? Let’s see where we are today:

S&P 500 and Dow Jones undercut lows last week

Technical momentum to the down side

US Dollar continues to gain strength

Core inflation remains sticky

The Federal Reserve continues their tightening cycle

All of these reasons, coupled with recent developments, are why we are going to rally into the end of the year.

*Personally, I believe we are at a low that has a strong possibility of a major long term low.*

Format:

Inflation

Different types of liquidity (money) between consumer and banking

Global market response of the tightening cycle

“Fed Pivot” is becoming an over used term, this is what to look for

My Portfolio Positioning (member exclusive)

Last week was confusing, which is a large reason for the delayed portfolio update. I believe that quality content is better than just pushing content. I wanted to be accurate with my next assessment of the markets.

The amount of data that we have had to digest as traders and portfolio managers has been abundant and required meaningful thought. To say the least, we have had conflicting information and a Federal Reserve with an ego problem.

Here is the number one core fundamental understanding that reigns true through the entirety of today’s thesis. This is best depicted by the chart below.

The evolution of narrative has been emotional at best and I began picking it up last time the Fed spoke at Jackson Hole. The Federal Reserve last year looked at the American public, and market participants, telling us that inflation is transitory and that they shouldn’t take their foot off the gas too soon. This clearly ended up becoming a major policy error. Fast forward to the first half of this year, all I heard on every Twitter spaces was, “the Federal Reserve has no credibility. They don’t know what they are talking about.”

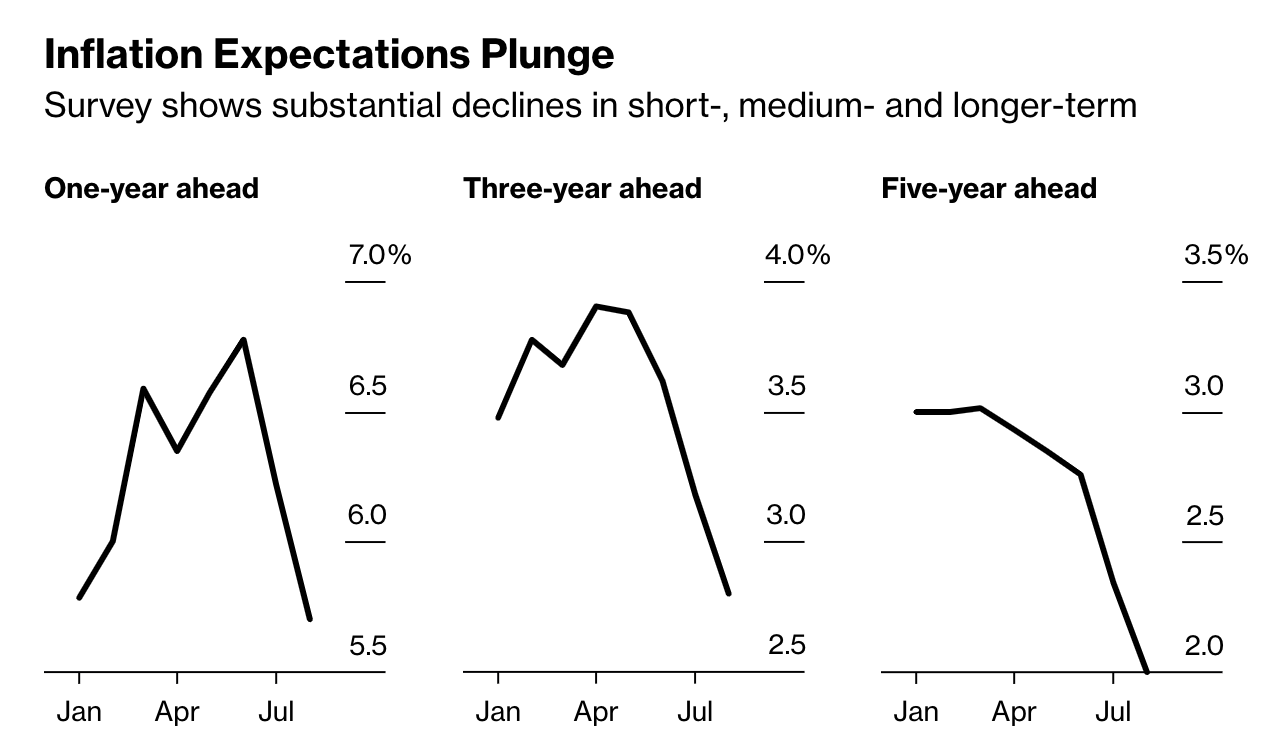

Now today, everyone wants to believe the Fed? This thought process confused me because listening to the Fed without reading between the lines has been, historically, poor analysis. I knew it was appropriate to take a contrarian stance. Not necessarily for the sake of being a contrarian but because the data is suggesting that inflation actually has peaked and has been coming down.

It is clear that the Federal Reserve knows that inflation is coming down. When thinking about the recent messaging, they (the Fed) are now either letting their ego stand in the way of making the right choice, or are attempting to jaw bone the market down to kill inflation expectations.

I trust that Jerome Powell is a reasonably smart guy. I also assume he has some idea of what he is doing. I don’t believe he is going to crush us because he has an ego problem. JPow has a mandate and a duty, he has to get inflation under control. His legacy is at stake.

Fed policy and history, as documented by Volker, mentions that it’s ‘managing’ inflation expectations that is the difficult part to breaking the back of inflation.

This leads me to be of the position that the Federal Reserve is doing a “nail in the coffin” approach to killing inflation expectations. They know CPI and Core CPI are showing signs of peaking and leading indicators from commodities, to house prices are showing this. They need us to believe they are serious or else their inflation fight wont work. FOMC members ‘need’ to act extremely hawkish.

On a side note, wondering if inflation actually has peaked? Look at:

Case Schiller index for housing

Commodities from oil, nat gas, metals (copper, gold, etc), food, lumber, etc

Shipping container rates

Trucking spot prices

Retail inventory levels (what are you doing Nike?)

Those are just a few examples.

Knowing what the Federal Reserve is doing and what is happening with inflation is crucial to understanding how this evolves in the coming months. More importantly, I can’t give financial advice, but you’ll see that I am putting my money where my mouth is on this thesis.

There are Two Types of Money in a Fiat Monetary System

Market participants usually say “liquidity” as if it was some sort of term when the Fed is implementing QE or QT. However, I have not necessarily seen many break down exactly what the two different types of money are:

Spendable money in circulation created by debt (hyper inflationary)

Banking liquidity implemented by QE (moderately inflationary)

This is a crucial for investors to understand to differentiate noise from reality.

"Alright, cool Dillon. How does this influence my portfolio and the equity/bond markets?”

Well, it’s leading me to believe a soft landing can actually be pulled off.

Let’s Start With the Inflationary Side to This, Spendable Money in the Economy and What Has Happened Since COVID

The consumer is strong, very strong. As an American, it doesn’t matter where I go. Restaurants are full, events are packed and I rarely hear about anyone not having money to go out. This could be a result of many different causes but individuals from all walks of life are able to go out and enjoy life.

Yes, this spending is inflationary, but there is more to this story that’s important to understanding what is happening about ‘what comes next’.

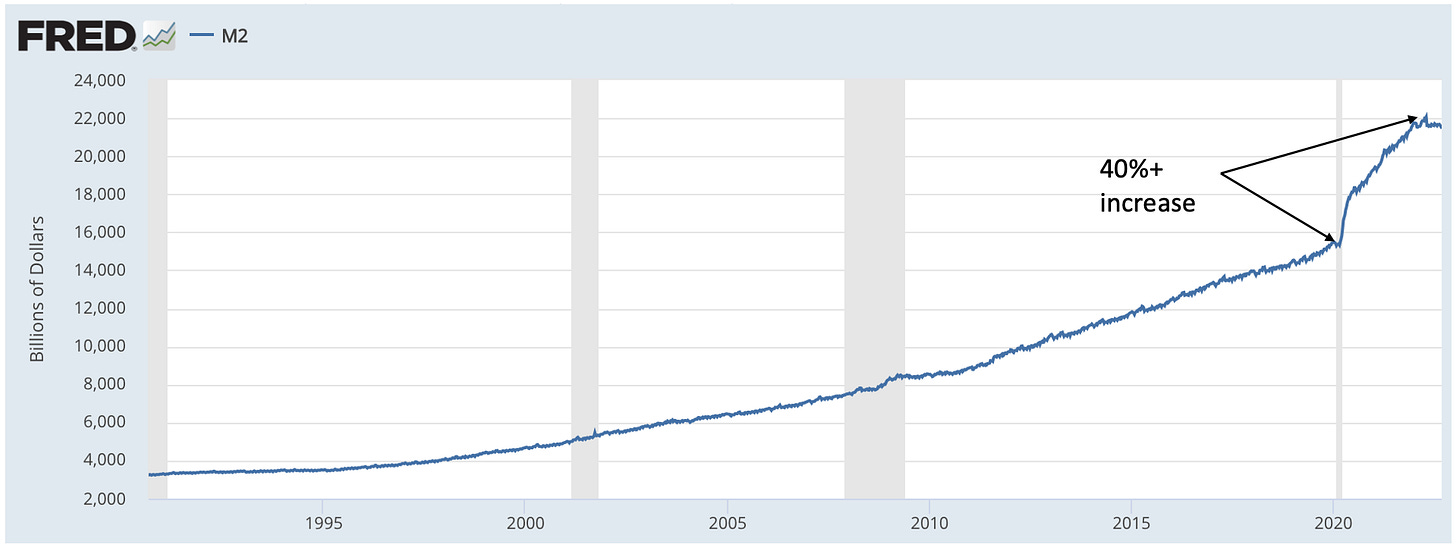

The Amount of Stimulus is Constantly Overlooked. M2 Money Supply is Considered the “Spendable Money” in Circulation. This fluctuation to the upside is historical and Unprecedented.

Based on recent history, the bearish narrative consistently says that we ‘must’ see unemployment go up and a large recession as a response to one of the fastest tightening cycles in history. This isn’t true! It’s not true because the factor they are always over looking the single most important detail to todays circumstances. The detail is just how unprecedented the monetary and fiscal stimulus was in 2020 - 2021.

COVID Stimulus Structurally Changed the Balance Sheet of American Consumers and Businesses

Trillions of dollars were printed out of thin air in 2020 and 2021. Quite literally, thousands of dollars of stimulus checks were given to Americans as well as hundreds millions of dollars in “business loans”. This obviously had consequences because this is “real” money printing but more importantly it structurally changed the balance sheet of every day Americans, the consumers. This data set is best depicted by the savings rate in 2020/2021.

Of course, we can look at this (above) and say, “oh, savings rate is down”. But we must ask ourselves a very important question, where is all that money that they saved before? It’s obvious, it’s on their balance sheet. Or, I should say, it was transferred to the U.S. Government’s balance sheet (more on this in a second).

The US Consumer was given free money to pay down debt, restructure loans (i.e. my home loan is now 2.5% and vehicle loan is 3.5%) and when combining both cheap debt and a higher cash position, it’s basic finance. Consumers can afford to spend more and take on more debt. Think of the income statement and balance sheet.

U.S. Federal Debt looks an awful like M2 growth

The Core Difference Between Now and Every Other Time, The U.S. Government Shifted Debt From the Consumer to The Public Balance Sheet

When the U.S. Government passed trillions in stimulus they fundamentally changed the structure of our economy. They gave out free money to individuals, businesses and unemployed citizens. The U.S. Government helped Americans pay down their debt and when combining 0% interest rate policy, it allowed consumers to now have low mortgages, vehicle payments and many other forms of cheap credit. This monetary and fiscal stimulus is still in the system.

There has never been a time in history that the U.S. Government directly sent checks out to its citizens, implementing a form of UBI (universal basic income). This is a MASSIVE, CRUCIAL, VARIABLE THAT IS OVERLOOKED in the bear thesis. This is an important reason why I think the markets can still go up. The American economy is more durable than bears expect.

Of course, over time, higher rates will likely impact the consumer and will continue to slow money growth.

Looking back at the recent FOMC meeting, JPow mentioned “higher rates for longer”. This is needed/appropriate when assuming the 40%+ increase of money supply is still sloshing around the economy. If rates are too low, inflation will go back up. Think about it as an equilibrium that must be met.

We need higher rates for longer and it’s important/crucial to stability of the economy to slow money growth for the time being. However, the consumer will continue to be resilient for the foreseeable future and it’s something the data today is just suggesting is happening. Q3 GDP is even expected to come out positive according to Atlanta Fed’s GDP Now.

Further proof the consumer balance sheet is strong. Default rates are still at all time lows and even lower than pre-pandemic.

A Strong Consumer = Soft Landing

Assuming inflation does come down, we just need the Fed to slow down their tightening cycle, which leads me to my next topic. The Federal Reserve will need to slow the pace of rate hikes and tightening cycle. They don’t have a choice.

Banking Liquidity is Struggling

This is an extremely complex topic because it requires both myself and the reader to have a deep understanding of the banking process. In this case, understanding the different types of markets and banking definitions/meanings/systemic processes. What I will do here will be friendly to both readers.

To help navigate this topic, I am going to share the resources I am reading (for the more banking curious investors) and simplify what it is saying in a sentence or two (for investors who want to just of it) and why it’s important.

Last Week, The Bank of England Initiated a Form of QE (or Bond Buying) to Prevent a Market Collapse. Literally.

We were quite literally on the brink of a Lehman moment. Has anybody ever watched the movie Margin Call?

It’s definitely recommended.

Basically what Alf is explaining is that the credit markets volatility created systemic risk that would have forced pension funds (a massive $35-$40T industry) to force liquidate other riskier positions like stocks and other low grade bonds.

Yikes, guys, that was close. Forced selling in capital markets reminds us a lot of a few other times in history:

1929 - 1933

2008 - 2009

The worst bear markets in U.S. stock market history. Good job BoE, you saved the financial system for now.

Reverse Repo Markets are Creating Problems

This analysis (link below) does a good job about what’s going on in the banking industry, Quantitative Tightening and the stress it’s putting on the US financial system.

Alright, let’s break this down first then I’ll get to the nuts and bolts

Quantitative Easing = U.S Federal Reserve buys bonds, or U.S. Treasuries, to inject the banking system with liquidity

Quantitative Tightening = U.S. Federal Reserve decreasing the total quantity of their holdings by letting bonds mature and not replenishing the position or outright selling

Repo Market: a way for large financial institutions to post collateral (basically U.S. treasuries) for cash. This means that if they have U.S. treasuries on their balance sheet, they can go to the federal reserve or other banking institutions to receive cash in exchange for the U.S. government debt they hold.

Reverse Repo Market: A way for institutions to deposit cash in exchange for collateral to gain yield. Money Market funds (a risk free investment) usually participate here.

When the Federal Reserve initiated Quantitative Tightening (reverse QE), their Federal Reserve minutes mentioned that they wanted to decrease this chart. This is over night reverse repo’s, a place the Fed perceives as excess liquidity in the markets.

But they are actually decreasing this chart at a faster than expected rate. Bank Reserves can be thought of as banking liquidity.

The attached above is essentially saying that investors are seeking a more risk free return in money market funds, who can flood their wealth for a risk free rate comparable to the Federal Funds Rate (which is rising quickly). This is decreasing bank reserves (banking liquidity) at an accelerated rate while QT is simultaneously decreasing bank reserves by the Federal Reserve forcefully changing the composition of Federal Reserve balance sheets.

What this means is that, once again, it can lead to problems in the Repo market (similar to 2018/19) or constrain the banking system’s balance sheet that would further create turbulence in the credit markets.

Credit Markets are Just “Beginning” to Show Signs of What’s to Come

We all know it, if the Federal Reserve keeps going down this path, these two headlines are just beginning of what’s yet to come. If Jerome Powell continues with his resolve to combat inflation with this current strategy, the global credit markets are in very big trouble.

I can’t help but theorize that it’s not necessarily the hiking in itself that’s creating problems. It’s likely more to do with the pace of tightening that’s destabilizing the global financial system. The Federal Reserve would be wise to pause rate hikes and let the financial system rebalance to catch up. Jerome Powell would be a fool to keep this pace.

Jerome Powell would not only be a fool for destabilizing the credit markets but he is destabilizing the global economy. The global community has taken note and has spoken up.

Emerging Markets are In Trouble Due to Rapidly Strengthening USD

The value of the Dollar goes up when the Federal Reserve tightens. More on this in a second.

The problem is that a strengthening US Dollar is not good for emerging markets and the global economy. Today (at the time of writing), the UN called on Central Banks to pause rate hikes due to destabilization of emerging market economies.

UN Calls on Central Banks to Halt Rate Hikes (link)

Global Markets, Outside the Banking System, are Struggling on an Fx (foreign exchange) Basis.

The world is not built to handle a strong US Dollar, which is the Reserve Currency. At it’s most simple terms, this is essentially what is happening:

The world today is now a global economy with various currencies working together

These global currencies all have an exchange rate which enables, incentivizes or disincentivizes trade between nations. Many nations use the worlds reserve currency as a peg or simply hold the reserve currency.

When the Federal Reserve raises rates, this creates demand for the U.S Dollar

Demand for the US Dollar is driven largely by foreign institutions/governments holding ‘U.S. Dollar Denominated Debt’. The cost of borrowing becomes more expensive which literally sucks more USD from the global economy.

This, in turn, sparks demand for USD with supply of USD declining due to Fed Tightening

This creates a parabolic squeeze of USD, making it more expensive for countries to buy US Goods or service their Dollar Denominated Debt

The disruption of trade creates problems for emerging market economies, acting as another “shock” to their financial system. It also makes it expensive for their currency to keep up. Essentially, they need to print more of their currency to keep up with the USD, which further devalues theirs. The cycle 🔁 goes on.

Fx is not necessarily my forte’ but the important thing to know here is that, as the Fed continues tightening, this is putting a massive strain on the global economy. If they continue down this path without pausing, it has a likelihood of creating further systemic risks. We could see countries default or experience devastating recessions/depressions.

This is A Lot to Take in. Let Me Summarize What all this Information Means

If we combine both the strength of the U.S. consumer, which is the back bone of the US economy, with the struggling global financial system we can only come to one conclusion that makes sense.

A “Fed Pivot” Toward an Accommodative Stance is NOT Likely. BUT, a Fed Pause is On the Table In the Next Meeting or Two.

A Fed pause will allow the global financial system to stabilize, which will prevent forced selling. In addition, this will stop the equity risk premium (stocks correlation to bond yields) from contracting further, stabilizing equity markets.

Combine less multiple contraction with the fact that the US consumer being as strong as I think, which will prevent a deep recession especially if unemployment continues to stay low. If a recessions is fairly shallow and earnings recession will be mild. We are more likely to see cyclical business respond to COVID business disruptions in the form of excess inventory from tight supply chains (think Nike, Walmart and Target), less shipping as consumers spend more of their money on services and less on goods (FedEx), and interest rate sensitive industries slow down (think car manufacturer’s and real estate stocks).

Basically what I am saying is that the equity markets can and likely will rally into the end of the year pending any further black swan news because the Federal Reserve doesn’t have a choice but to back off (or at least slow down). If credit (interest rates) remains historically low, but still moderately restrictive, the economy can still grow just at a very slow pace which is bring inflation down.

In other words, a soft landing. If and only if inflation expectations continue to decline/stay anchored.

This is How I am Positioned

I rarely use leverage, but this is an exception.

Keep reading with a 7-day free trial

Subscribe to BluSuit to keep reading this post and get 7 days of free access to the full post archives.