“Opportunity always exists when the crowd believes it knows an unknowable future.”

In today’s Newsletter, there are three primary themes I want to talk about:

Possibility, reality, and stock market philosophy

3 month & 10 year yield inversion, recession and stock market history

FOMC and My Strategy

I am covering a lot of (what I believe to be) important information. Perhaps the most important here is the philosophical aspect. What many people don’t tell you is that this business is 80% mindset and 20% skill. All of the greatest traders, investors and portfolio managers universally have one characteristic in common (despite vastly different strategies). They have a positive and constructive mindset even in the face of loss/failure.

Before I Get into the Data Driven Portion of This Newsletter

The range of outcomes typically work in a scenario of principles. At the end of 2019, I recall hearing how optimistic 2020 was going to be. The stock market was roaring to all time highs and there would be no wrong. Little did anybody anticipate we would be hit with once in 100 year event in the COVID pandemic. That year we faced the fastest stock market crash in history.

Once the stock market crashed in 2020, NOBODY believed we would see all time highs for months/years and it was only in hindsight did the coming all times highs seem predictable. There is a strong argument to be made that 2020 was the year that individual investors/traders began taking the Fed seriously. Regardless of the outcome, the lesson was learned and it was only in history that the future would be predictable.

Now, my time managing money is limited compared to some professional money managers but the lessons learned over the past few years have remained consistent. When the crowd is looking in one direction (and is positioned accordingly), opportunity exists in the other direction. Not believing in this philosophy led me to make the biggest mistake I have made in 2022. Despite knowing, at the peak of 2021’s bubble, the song and dance was coming to an end. I chose to believe the narrative of “buy and hold”, or believing in “analysts estimates” for 2022. That’s when I posted The Coming Market Crash.

I have found that listening to narrative, or popular consensus, is a dangerous thing. In the past few years, I have seen many narratives come to fruition and the only thing I have quickly figured out is that narrative is constructed to suit an existing trend. Narrative only changes in the months after the trend has reversed. Then, a new narrative is constructed and the cycle repeats. The market reverses when a majority of investors believe, or give into, the narrative.

I am not saying that the narrative is always wrong because the contrary is true. Narrative is usually right, for a period of time, until it’s not. Waiting for narrative to change will certainly lead to missed opportunity on both the long and short end of the spectrum. When we apply this thinking to today, we can distance ourselves from the day to day noise and identify the narrative in itself.

“If the Fed is Raising Rates, and Inflation is High, then the Economy Must Spiral Toward its Death”

Not really, but this is often how it sounds today. Seriously though, think about it. How many people are now macro experts on Fx, Fed policy, QE, QT, Interest Rates, etc? This is by design. It’s brought on by today’s market cycle and what is currently happening rather than what will happen in the future.

This leads me to today’s analysis about where we are, what we are pricing in, and the next phase of the market cycle.

The Market Doesn’t Care About Inflation or Fed Rate Hikes Anymore - It’s the Coming Recession

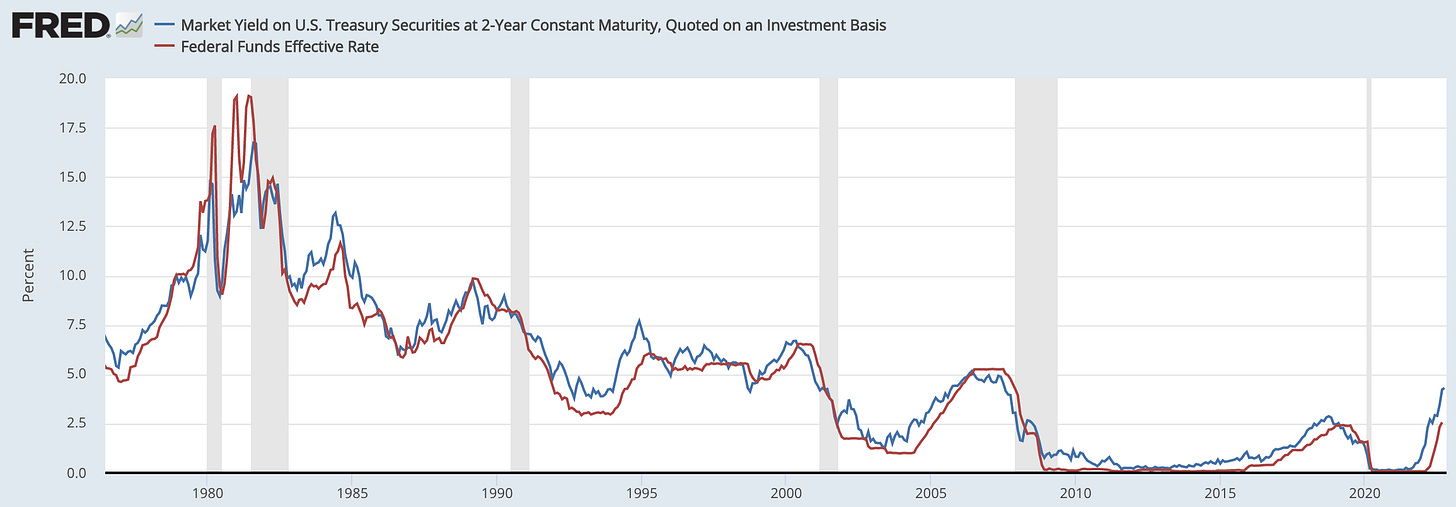

We are at the end of the rate hiking cycle and there’s a strong argument to be made that all the rate hikes are already priced in. Let me show you why we are at the end of the rate hiking cycle. First, let’s look at the 2 year yield and the effective federal funds rate. Then, we will compare the tops to the federal funds rate with the inversion (above) of the 10 year and 3 month treasury.

Today the 2 year yield is around 4.5% and the Federal Funds rate is 3% before Wednesday’s Fed meeting. It’s expected that it will go up to 3.75% by Thursday. The separation between the 2 year yield and the federal funds rate is what is “priced in” to the markets currently. The 2 year yield has historically led the Federal Funds rate and can give us an idea of where the Fed plans to go in the coming months. If we look back at history and find moments where the Federal Funds rate paused and the 2 year yield stopped going up, it historically has happened when the 3 month and 10 year yield initially inverted.

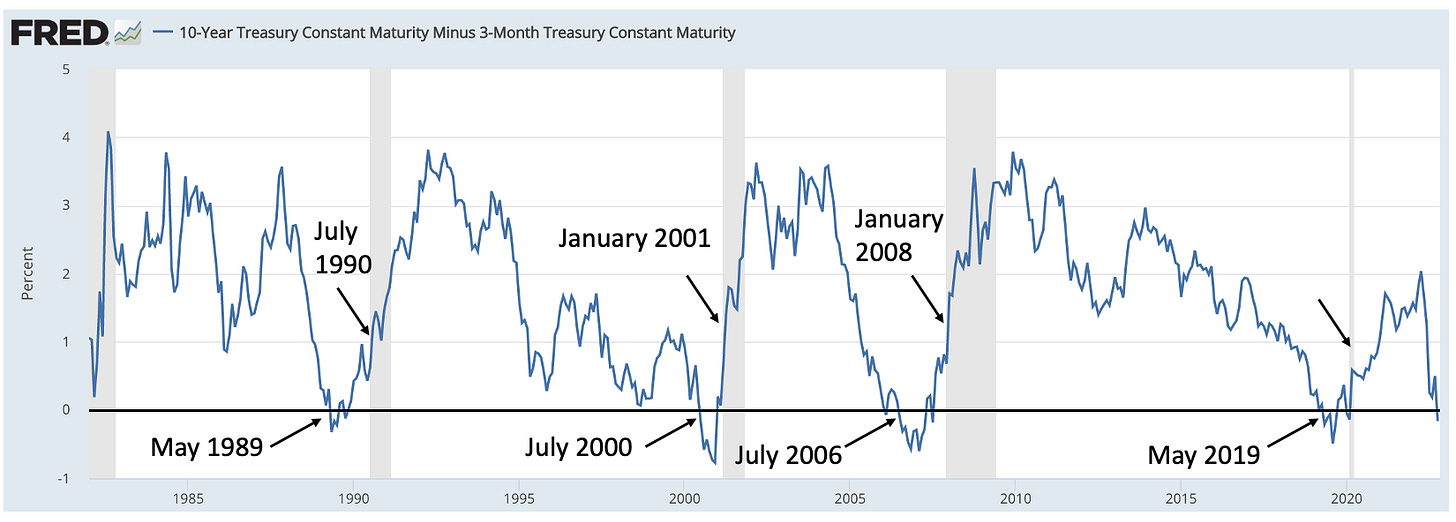

Dates Upon Initial Inversion and When Recession Began

Dates of the Pause in Rate Hikes

We Can Conclude that The End of the Rate Hiking Cycle is Either Here or the Fed is Ignoring the Warnings Signs it Used to Pay Attention to

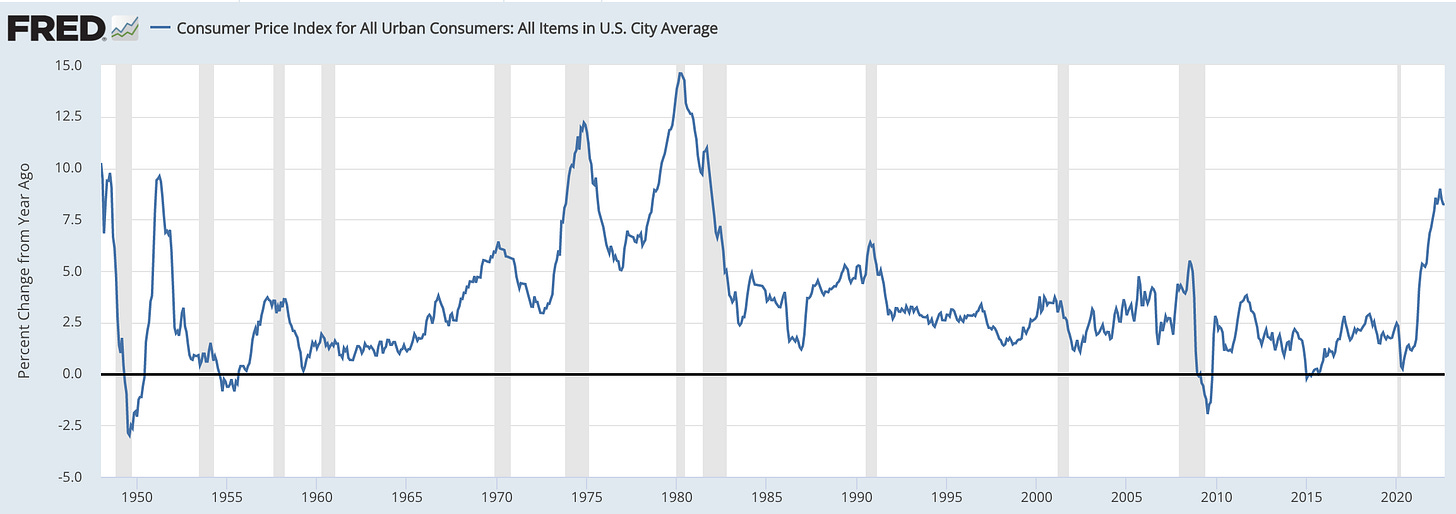

In addition to the ending of the Fed rate hiking cycle, it is note worthy that 11/11 times since the 1950’s CPI has come down during every recession. The shaded area’s are recessions and below is the YoY change in headline inflation data. You can see that the YoY change peaks during the shaded areas.

This only leads me to believe that since the market knows a recession is coming, it knows inflation will come down. If inflation comes down and recession is knocking at the door, the Fed will back off rate hikes. The next phase of the market cycle is now determined by earnings and earnings recession.

The Coming Recession and How Markets Respond From Initial Inversion to Beginning of Recession

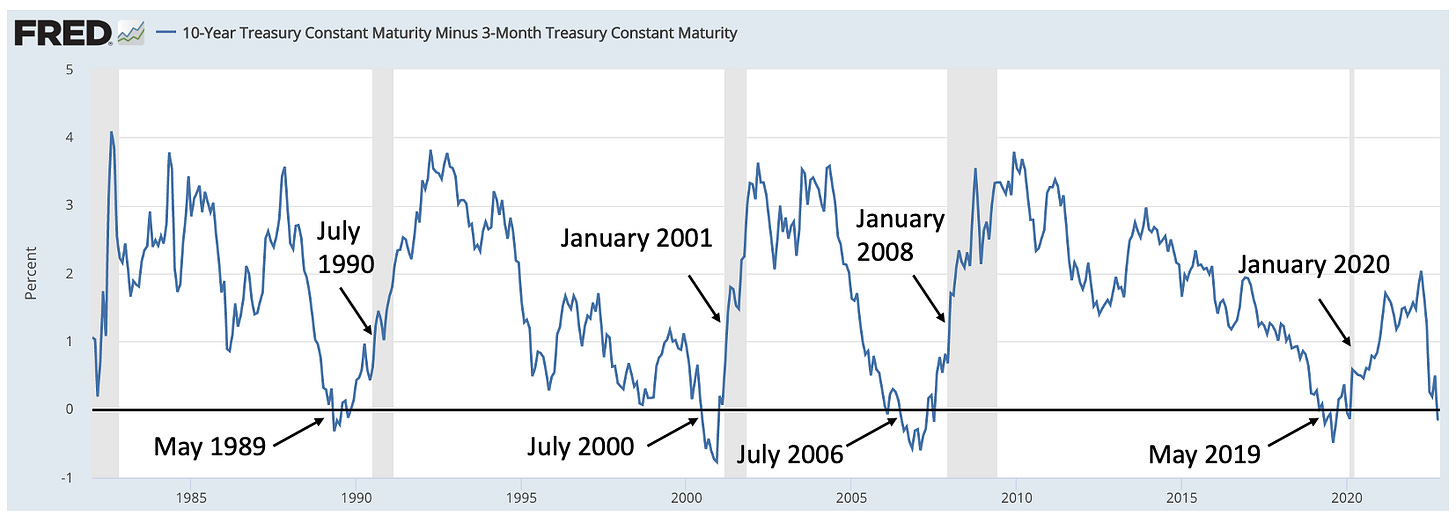

Going back to this chart (below), let’s map out on the S&P from initial inversion to beginning recession to see how the markets responded of a 3/10 spread.

S&P 500 Late 1980’s, Early 1990’s - The Market Rallied to All Time Highs

S&P Early 2000’s - Initial Inversion at the Peak of the Bubble, Followed by a 50% Decline

2008 Global Financial Crisis - Market Rallied to All Time Highs Before Recession Began

Did the Markets See 2020 Coming? - Markets Rallied to All Time Highs Before Recession Began

What Can We Conclude if History Rhymes?

Just looking at technicals alone on the S&P 500, it looks like we are about to begin a new longer term up-trend at least for a few months/weeks. The positive divergences along with the bounce off 200 week moving average tells me that we are likely see a meaningful rally.

Bringing all the Data Full Circle and Interpreting What Can Happen Next

A recession does seem to be coming and in my mind, it’s in the books. If we look at the past 40+ years, we can see that the 3 month, 10 year yield spread is accurate 100% of the time predicting recessions. The markets price action does not seem reflect recessionary earnings contraction until the recessions actually begins or, at least a few months before.

Wednesday’s FOMC Meeting Can Spark a Massive Rally

Saying this before the FOMC meeting is obviously risky but if history rhymes, the Fed will signal more dovish commentary and at least hint toward pausing interest rate hikes. This alone will be enough to spark a rally in the markets because the hawkish fed is letting go of the beach ball that’s being held under the water. During this rally, it wont be likely to end until the recession begins which could be a few months away. A solid guess would be roughly 6 months away from today before a meaningful recessionary bear market begins.

If We Rally From This Bear Market and Begin a New Recessionary Bear Market, in a Few Months, the November Market Top Will Likely Hold for the Next Few Years. These are Conditions for a Secular Bear Market.

During this next phase of the market cycle, I have an idea of what’s coming. It appears that we will rally in the short/medium term but we are likely to experience another tanking in the markets. Knowing this, I can prepare to manager risk (better this time around) than I have in the past when I blatantly ignored what the markets could/would do in November 2021.

My Portfolio and Strategy

Keep reading with a 7-day free trial

Subscribe to BluSuit to keep reading this post and get 7 days of free access to the full post archives.