Lately the markets have been selling off in an aggressive fashion. The S&P reached 13%+ down and the NASDAQ entered bear market territory at 23% down. I think one of the biggest questions on everyones mind tonight…

Was that market bottom?

I wanted to provide a few interesting data points for you all to think about when positioning your portfolio for the upcoming market rally from the inevitable market bottom. Yes, I do believe this is a market crash within an ongoing secular bear market because it reminds me A LOT of late 2018 Bear Market.

In addition, I’ll provide you the growth stock lineup I’m holding. I’ve spent time listening to every earnings call and reviewing the financial results. Needless to say, all of these businesses have absolutely wonderful futures and, for the most part, are growing profitably. I’ve trimmed a lot of the excess around my portfolio and took advantage of the discounted prices. I think you’ll like what I got for you in today’s Newsletter.

Let’s Talk Markets, Was That Bottom?

By no means am I saying I’m right because at the end of the day, it’s all a guessing game based on what you know. But hear me out when I say, it’s becoming likely that we’re nearing the lows. There’s really two reasons for my rationale on a macro and technical perspective.

Macro Thesis Explained

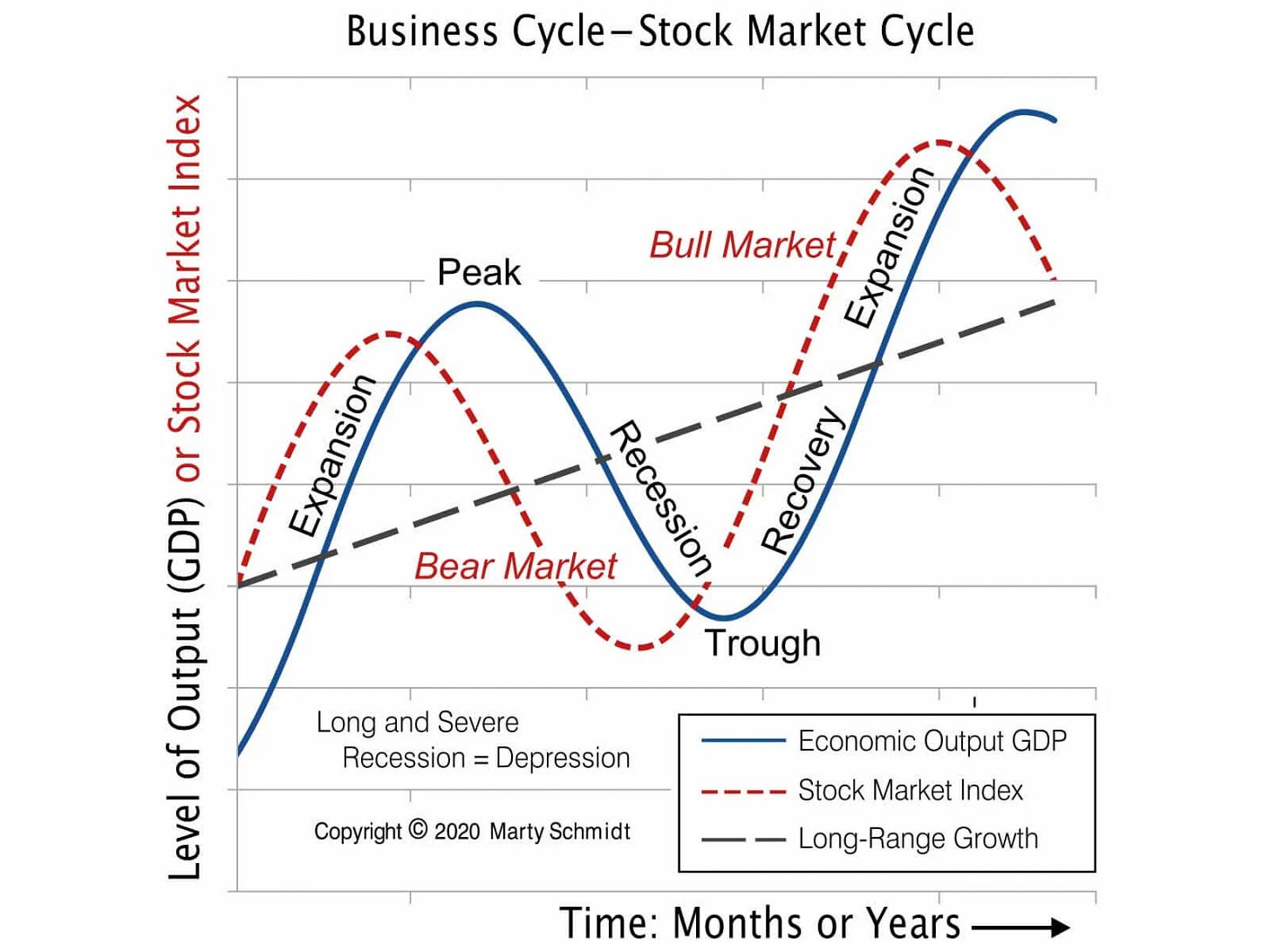

Since the 2008 market bottom, our market has been extremely prone to the liquidity cycles the Fed puts us through. Actually, this dates back for the past 100 years but it has changed. Previously, before 2008, it was interest rates that would be manipulated to adjust liquidity in an attempt to “control” the economic cycle.

The reason why the Fed tries to adjust liquidity during the economic cycle is in the attempt to try to “smooth things out”. If an economy becomes too hot, you get inflation (like what’s happened) and a potential for a devastating credit bubble which can create a pretty wicked recession (in some cases depression, think 1929 or 2008). In this case, the Fed raises rates. On the inverse of this equation, when the market is slowing or going through a recession, the Fed will lower rates to speed up a recovery.

This is all working on the principle that credit is money. When you make borrowing more accessible, you get an economic expansion. When you make borrowing more expensive, you get an economic contraction. The goal of this is to create nice, steady, economic growth.

What’s most interesting is that the stock market is a leading indicator of the economy. Stocks are valued based on their FORWARD earnings, not trailing. Macro funds like Ray Dalio’s Bridgewater Associates are entirely focused on where the flow of money is going next.

How does this play a role into why, from a Macro reason, the markets are bottoming?

The markets look forward and one can argue that the markets have been discounting rate hikes for the past 4 months. Technology has been destroyed and many have sold off 50% - 80% from their all time highs. But you ask yourself, what has rallied?

Energy, financials, utilities and consumer staples.

The stock market is forward looking, right? If we assume that credit booms and busts create economic cycles and there has been no meaningful expansion of credit (government spending) since the end of 2021. Couple this with rising rates making credit less accessible.

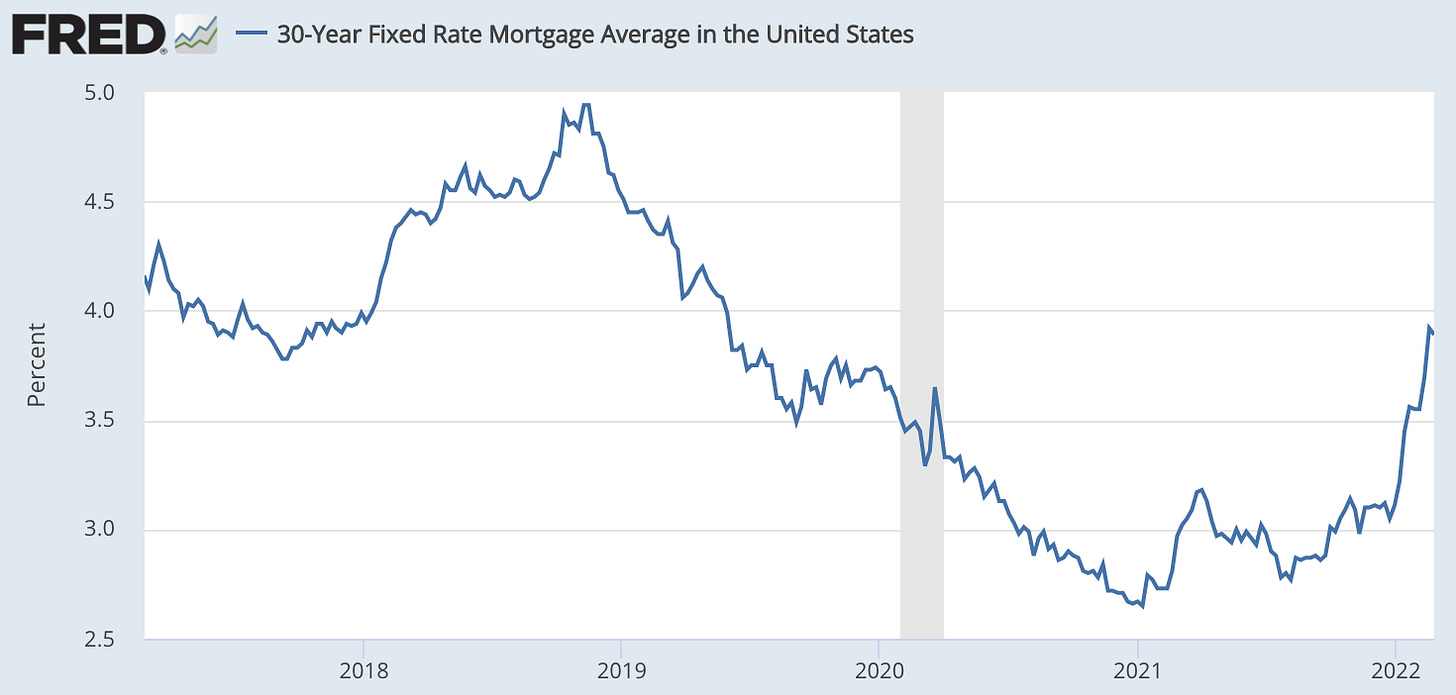

What people don’t know is that interest rates have already risen

What you get is an economy that’s going to slow, meaningfully. This means that corporate earnings need to come from somewhere, right?

Secular growth stocks grow from secular reasons, not cyclicals. This means their earnings will be constant and don’t need cyclical reasons to continue to grow. What’s more important, right now, today, is that they are cheap.

I believe the economy is slowing meaningfully because credit has already become more expensive and there has been no meaningful credit expansion to continue to fuel economic growth. No economic growth means slower consumer demand and, inevitably, a decline in inflation. A decline in inflation will lead to a more dovish fed. A more dovish fed leads to an economic expansion and a cyclical tech stock rally, specifically, the NASDAQ.

Technical Support is Very Strong Here

Previous market markets from past market corrections, historically, act as major lines of support. It’s incredible how consistent this trend is. If we take a look at the two previous NASDAQ bear markets, outside this one, we see a trend emerging.

If we assume, historically speaking, that we need to revisit the 200 week ema, as all major bear markets have, we can draw two conclusions:

This is likely a short term bottom, much like how 2015 & 2016 played out.

The markets are likely to trade sideways for quite some time, possibly another year.

I explained all of this rationale here:

Conclusion

This has a strong possibility of being a intermediate and possibly, a yearly bottom. The economic cycle and macro factors do play a role here but I cannot see the Federal reserve instituting any sort of aggressive QE for quite some time. I do know the Bond Market has QE re-established by 2024. This would appear to be an excellent buying opportunity with a strong likelihood of a correction in a few months to a year to revisit the 200 week ema.

Now, let’s talk about the fun part. Which stocks have absolutely crushed earnings this year so far?

My Highest Conviction Growth Stocks

Keep reading with a 7-day free trial

Subscribe to BluSuit to keep reading this post and get 7 days of free access to the full post archives.