The Hidden Financial Crisis Today

An Epic Risk in the Markets Today

By Nature, I am bullish, or, a relatively optimistic person. With most things in life, I do believe it will get better and that when situations or circumstances become difficult, it just means that what’s on the other side is usually worth it. But here’s the thing… I am balanced in my analysis which requires me to assess and think through what can completely invalidate any prevailing market thesis that I may have. Think of it as the counter thesis to the thesis I have that appears most likely at any given point in time. What I believe is most likely (today) can be found in my 2023 market outlook.

But in the analysis above I mention that, “pending any Black Swan” my 2023 thesis will come true. This “Black Swan” is what I believe is looming, lurking, hiding beneath the surface of this developing bull market TODAY. It’s the biggest risk that can invalidate the progression of the entire market cycle and create the waterfall like sale that will haunt investors dreams.

Format:

The Roaring 20’s

Sowing the Seeds of a Financial Crisis

2008 Global Financial Crisis

The Biggest Risk Today

What to Watch for

The Hidden Black Swan

There have been four major bear markets over the past 100 years (1929, 1974, 2001, 2008) that have utterly shaken investors to the core. Stories of these time periods often tell of tales where investors put their entire life savings into the markets, only to watch it be reduced to pennies on the dollar. Overnight, it vanishes, and when there’s hope, it’s crushed again and again and again. What’s left at the bottom of the markets seems much like a barren waste land, as many investors have sworn off stocks. Those still daring enough to tread water, find that nothing but sunken returns await them for years of their life time, or, to watch it vanish with another leg down.

The black swan I am talking about would rival these events. It’s something to be aware of because even if it doesn’t happen today, it could happen tomorrow. If it doesn’t happen tomorrow, it could happen next week. But, at the end of this memo, there is one thing I know. You, the investor, will be better suited to identify this pending black swan and the leading indicators of it.

Let’s look back in history and talk about two bear markets in particular that nearly led to the collapse of capitalism as we know it.

The Roaring 20’s - Setting the Stage

The Federal Reserve was founded in 1913 after a series of banking crisis that happened in the 1800’s. What many people don’t know is that the Fed was never supposed to be a “central bank” as the prevailing economic theory in the early 1900’s was the “laissez faire free market (capitalist) system”. This economic idea was that investors seeking returns would allocate capital appropriately in exchange for some sort of future allocation of profit on the initial investment. This process would repeat till new innovations and the best ideas would prevail, leaving the not-so-great ideas behind. The initial role of the Fed was meant to be a “lender of last resort” to free market capitalism and the banking system.

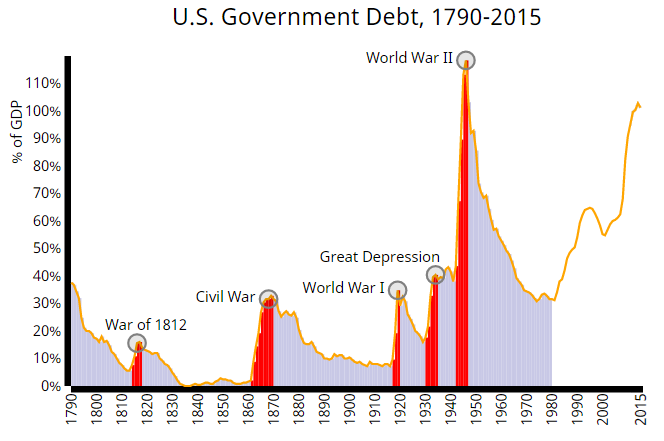

The Fed’s role would expand come World War I. Initially American’s didn’t want to involve themselves in the European based war but as it drug on, America began bank rolling the war effort for many of their European Allies. Eventually, America entered the war but the Central Powers (Germany and allies) would soon surrender. However, the war effort was still costly and the US Governments debt subsequently exploded higher, reaching levels not seen since the Civil War.

In a change of events, during WWI, the Federal Reserve (whose responsibility was the be the lender of last resort) created a strategic way to fund the governments debt and keep the cost of that debt, low. They began offering “incentives” for the public to buy government debt but artificially kept interest rates low by lending money to banks that promised to buy war bonds at low rates. Essentially, the Fed was indirectly funding the US Government’s war effort by buying government debt. The cause/effect of this policy was an initial surge of inflation and consumer prices as the money supply rapidly expanded.

After the War ended in November of 1918, the US Government quickly reduced the deficit spending and began paying its debt back. This turned out to be a mistake as our young country was still learning how government debt influenced economic contraction/growth and how it impacted the money supply. As a result, in 1920, the United States entered the “Forgotten Depression of 1920” where unemployment surged to 12%, commodity prices collapsed and the Dow Jones crashed 50%. This was one of the quickest, yet brutal, depressions in our economic history.

The lessons (government debt, economic depression, consumer prices, etc.) were new for the Federal Reserve but the discipline and philosophy of being the “Lender of Last resort” remained. With a renewed “American Spirit” after World War I, following 1920’s Depression, the seeds were set for the Roaring 20’s. With victory came new innovations, pride, Gold (from countries paying their war debt back) and relaxed lending standards (credit) to buy everything American’s could ever want. It was birth of the American Dream.

The Roaring 20’s was an American cultural revolution. New music, the prohibition, new (rebellious) culture, speak-easy’s, Ford vehicles, radio’s and more importantly money to buy everything (consumerism) created a boom in economic growth. The Dow Jones, as a result, would rise from $61 (at the bottom of the 1921’s bear market) to $384, a 530% rise in 8 years. This move and growth in wealth was further exacerbated stock “margin” and lax lending standards. American’s at the time could put up 10% - 25% on the initial purchase on select stocks and borrow the other 75%, using the stock as collateral. Everybody could get rich, quick.

Let me take a second here and explain exactly what it means when margin lending is expanded to be this easy, to this extent. Let’s think about the flow of capital:

Investor A wants to buy a stock, he puts up $25 to buy a $100 stock. The other $75 is borrowed. On paper, the investor’s net worth will go up and down with the stock price in this instance.

The stock, on the other hand, is directly related to a company. Let’s say company B wants to do a stock offering for $100 per share and all investors need to do is spend $25 of their own money to buy more shares. That $100 is still $100 per share to the company. Subsequently, the company increases the cash position of their balance sheet it raises from the financial markets. *Pay attention to the floating $75 that is only guaranteed by the value of the stock and the investors assets.*

This $100 is now being used for investing into the business, paying employee’s salaries, consuming commodities, buying other businesses goods/services and selling their own goods/services to other companies. This is now money circulating in the economy.

Shifting our focus primarily on the employee, who works for company B, his wage is directly being funded from the stock market (because company B just raised this capital from the financial markets). This employee, as a result, puts a portion of his paycheck into the stock market (on margin) because he is getting rich from his previous investment into company B.

This creates a cycle, a credit cycle, which temporarily can instill confidence and growth. The remaining $75 is “make believe” or “made up” by easing lending standards. So, now we have to stop and think, what happens when everyone is too leveraged up to buy any more stock and the company (who was raising capital from the financial markets) can no longer raise anymore capital? More importantly, what happens when if that company is unprofitable?

The Dow Jones after the Credit Cycle stopped and began to reverse 1929 - 1932

We have to think about the flow of capital in reverse now.

Investor A, who originally bought Company B, for $100 per share, and only put up $25 as an initial investment (borrowing $75) is also prone to a “Margin Call”. This means that Investor A needs to pay the bank back the $75 that was originally lent if the stock price drops below a certain amount.

Company B’s stock price fell from $100 to $75 on “Black Monday”, October 28th, 1929 (the initial crash). Investor A got a margin call and needed to pay the bank back the remaining $75 but Investor A’s money was all on paper! Investor A needs to sell stock to pay the bank back.

Investor A wasn’t the only investor that did this and there was a whole alphabet of investors who borrowed money to buy stocks! The result is mass selling and mass liquidation of the financial markets. The asset values of everything from stocks to real estate would decline as investors rush to pay their margin back.

The decline in asset prices is not necessarily the scary part here. It’s what happens if the investor does not have enough funds/assets to pay the bank the $75!

During a Credit Super Cycle Investors Don’t Have Sufficient Capital/Assets to Pay the Bank Back.

The result is that the $75 literally vanishes. It is now destroyed money. It’s gone, nobody can access it. Company B can no longer raise the capital it needs to fund its operations which means that Company B needs to now lay employees off to stay in business. This, in turn, raises the unemployment rate but the company still ends up defaulting because it can never reach adequate profitability. The economy ends up contracting and the default cycle now beings.

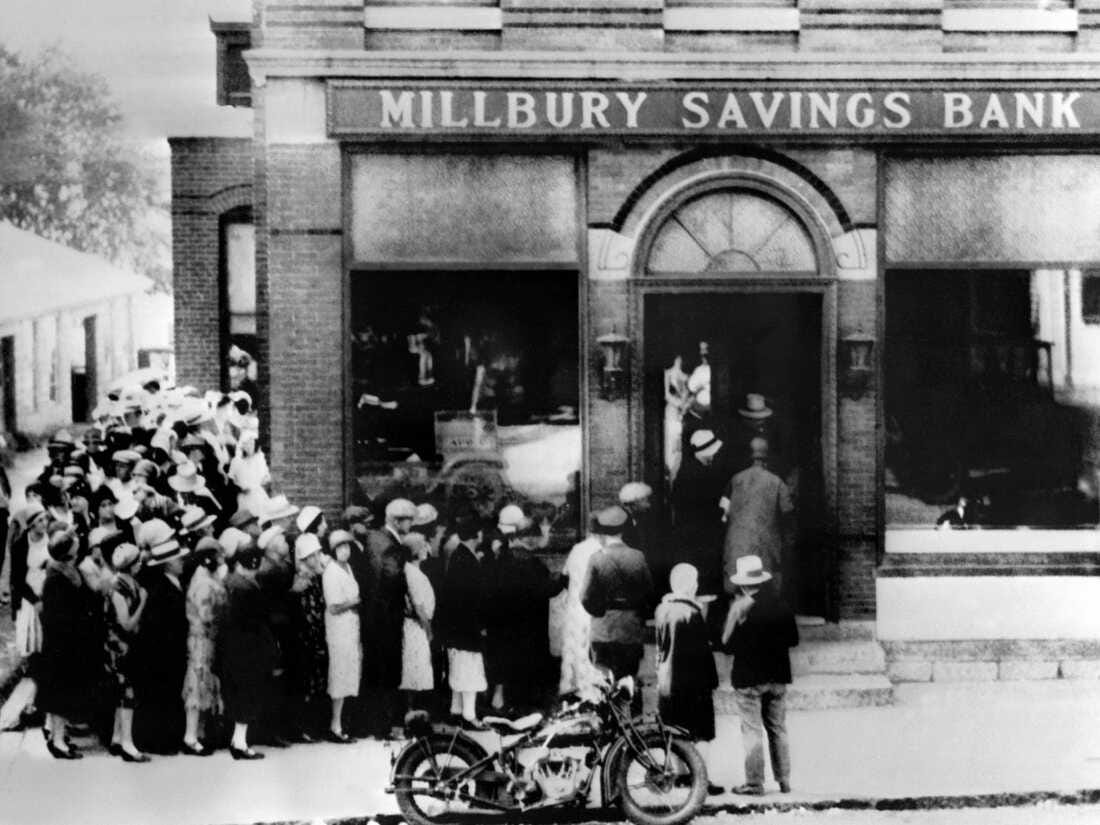

The real problem lies in the banking sector. What about the money that wasn’t invested in the markets and was just in people’s savings account? Remember that $75? It is now destroyed, vanished, gone and that means that the bank lost $75 in assets that it thought it had. If the bank loses these assets, this means that the bank eventually leads to default.

If Banks Begin to Default, People’s Money Further Vanishes

What I am talking about here is called a Credit Super Cycle. It’s the unwind of the credit system, where the money supply contracts, people’s life savings disappears and the value of assets decline due to the inability to pay borrowed money back. Usually, unemployment sky rockets, money becomes scarce and the result is a depression (or a decline) in economic activity for a prolonged period of time.

The Real Question, then becomes, what is the Fed supposed to do about all this?

Fast Forward 100 Years to 2007

Over the past 100 years, we witnessed America exit the Great Depression (which was the collapse of a credit super cycle we just talked about), WWII, the Vietnam War, End the Bretton Woods Agreement (where dollars ceased to be backed by Gold) and experience a massive technology boom caused by the rise of the internet. All of these events had implications that helped shape the Federal Reserve’s role (evolving away from the “lender of last resort”) in the economy and also had market crashes with them:

The Secular Bear market of the 1970’s (1974 bear market being the worse) and hyper inflation

The 1987 crash, one of the fastest/deepest crashes in history

Tech and telecom bust of 2000 - 2002, a result of another stock market bubble

None of these events quite had the devastating impact that the Great Depression had on the every day individual. The worst economic situation was likely the hyper inflationary environment of the 1970’s and the inevitable, Federal Reserve induced, economic recession of the early 1980’s where unemployment reached levels not seen since the Great Depression. That was, at least, till 2007.

The Global Financial Crisis

The Credit Super Cycle showed how us devastating it could be in the 1930’s, when the worlds financial system “deleverages”. The result is usually unprecedented money destruction, poverty and unemployment. The question, to Fed officials and politicians then became, “what can we do if we ever experience something like that again?”

The Recipe for a Credit Super Cycle Rhymed, but Wasn’t Identical, in 2008 as it Was Focused in the Housing Market. If we recall, what were the things that happened in the 1920’s?

Lax lending standards

Over confidence

Inflated asset prices

Decline of those asset prices

A “margin call” on those assets that spurred further decline

Banks defaulting

The last part, banks defaulting, is the key to this equation. Banks defaulting on bad loans has historically been the missing piece, that 1929 had, that other market crashes did not have, that created the contagion necessary for a Credit Super Cycle to take place. That was, of course, till 2007. What we need to do is go back to when Lehman Brothers declared bankruptcy.

What led to this?

What happened?

What could have happened?

What did the Federal Reserve and the US Government do to prevent the next Great Depression?

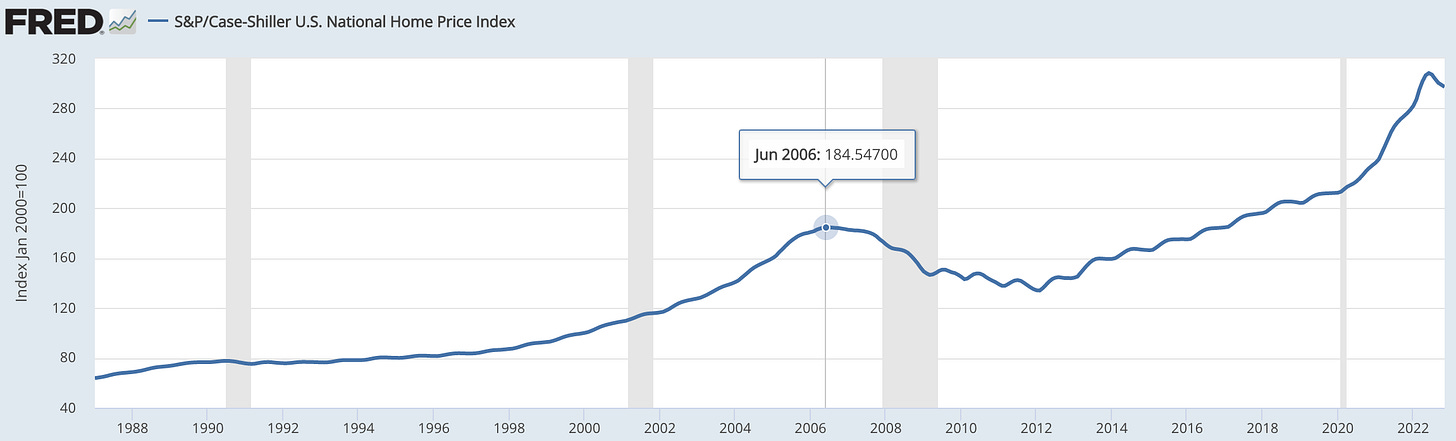

Lax Lending Standards, Over Confidence and an Inflated Asset Bubble

In the 1980’s, mortgage under writers began creating unique ways for home buyers to get access to the credit they are looking for to buy a home. One of these ways, or solutions, was called an ARM “Adjustable Rate Mortgage”. This was a way for lenders to introducer a “teaser rate” or a lower interest rate on a mortgage before resetting to a higher rate some time (usually 2-5 years) in the future. Originally, this wasn’t a problem.

The problems began when mortgage under writers began making “bets” on the future of the housing market, expecting it to go up. They introduced new, creative ARM”s, that were given to Subprime (think lower credit score) borrowers. The thought process was that these borrowers could just “re-finance” their home after the value went up into a new, creative, ARM and keep their monthly payment low. On paper, the value of the home would go up, the risk to the loan would go down (as the collateral appreciated in price) and interest rates would lower. In other words, American’s were getting rich, quick.

Once enough of these creative ARM loans were underwritten, a surge of defaults began happening as the monthly payments rose on these houses for subprime borrowers. Once enough of these homes came on the market (because of foreclosures), at the same time, the value of American homes began to quickly devalue and… well, 1929 began all over again.

Signs of the contagion began showing up and eventually led to one of the worlds biggest banks, Lehman Brothers, to collapse over night. Remember what I mentioned above, “If Banks Begin to Default, People’s Money Further Vanishes”. When Lehman Brothers collapsed, this led to other banks in the system show signs of default because assets on their balance sheet disappeared. The biggest of which, that people may recall, is American International Group (AIG) an investment bank that needed the US Government to bail them out.

The Federal Reserve and US Governments Response

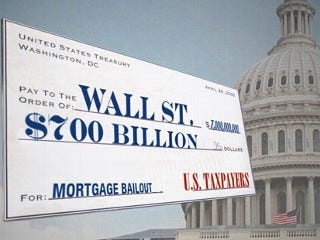

There was a strong probability that the Great Depression happened because the Federal Reserve (and US Government) did too little due to prevailing economic theory. The theory, as mentioned, being the laissez faire free market (capitalist) system and only being “the lender of last resort”. In 2008, the US Government and US Central Bank weren’t going to let another Great Depression happen. Their response…. Print money, a lot of it, and transfer the “bad debt” to the tax payer and the Federal Reserve. Something they didn’t do during the Great Depression.

The US Government passed a near trillion dollar spending package that would “bail out” Wall Street banks to stop the bleeding in the banking system. In addition, the Federal Reserve would announce its first ever expanded “Open Market Operations” (or QE as we know it today) to transfer debt away from the private sector and to the public sector.

The result, it worked.

The idea with QE was to transfer bad debt in the form of MBS (mortgage backed securities) and US Treasuries (to lower treasury bond yields) to the Federal Reserve (which cannot default) to encourage risk taking and investment in the US economy. This investment would, in turn, spark economic growth and bring confidence back into the US banking system. In addition, the QE would surge “Bank Reserves” higher. Bank Reserves are a form of banking liquidity that are used when people withdraw deposits from their account, they can have access to money which prevents bank runs and banking defaults.

Let me stop here at QE and explain how all of this apply’s to today.

The 2008 Financial Crisis Didn’t Become a Depression Because of Quantitative Easing, Government Spending and the Absorption of Bad Debt

Study of the Fed’s balance sheet is still relatively new and the Federal Reserve has even admitted that they are still “figuring out” how it impacts both the financial system and markets. Herein lies the risk that exists in the banking sector today. To understand the very nature of QE is to understand the biggest risk that exists today.

The Nature of QE

The very nature of QE was to “plug a hole” that existed in the banking system to prevent a credit collapse. It prevents a credit collapse by instilling trust into the banking system and by “holding debt” to take pressure off the economy. This, in turn, allows the economy to continue to expand its credit growth which fuels further economic growth.

By understanding the credit collapse of the 1930’s, banking defaults and what happened in the economy, you can understand how/why the Federal Reserve launched QE in the first place in 2008. By understanding why QE was launched in 2008, you can understand the ramifications of reducing the debt holdings of the Federal Reserve. Today, the Federal Reserve is reducing their debt holdings of both US Government Debt and Mortgage Backed Securities.

The Risk of Quantitative Tightening

There is nothing that keeps me up at night more than the Fed quantitative tightening. Inflation is the least of my concerns with a looming credit crisis that grows bigger every day. Do you really think inflation can persist with a massive deflationary pressure over head like a credit bubble? With each passing day, the Fed is effectively destroying both banking system money and real economy money. It’s nearly impossible to have inflation if the Fed persists.

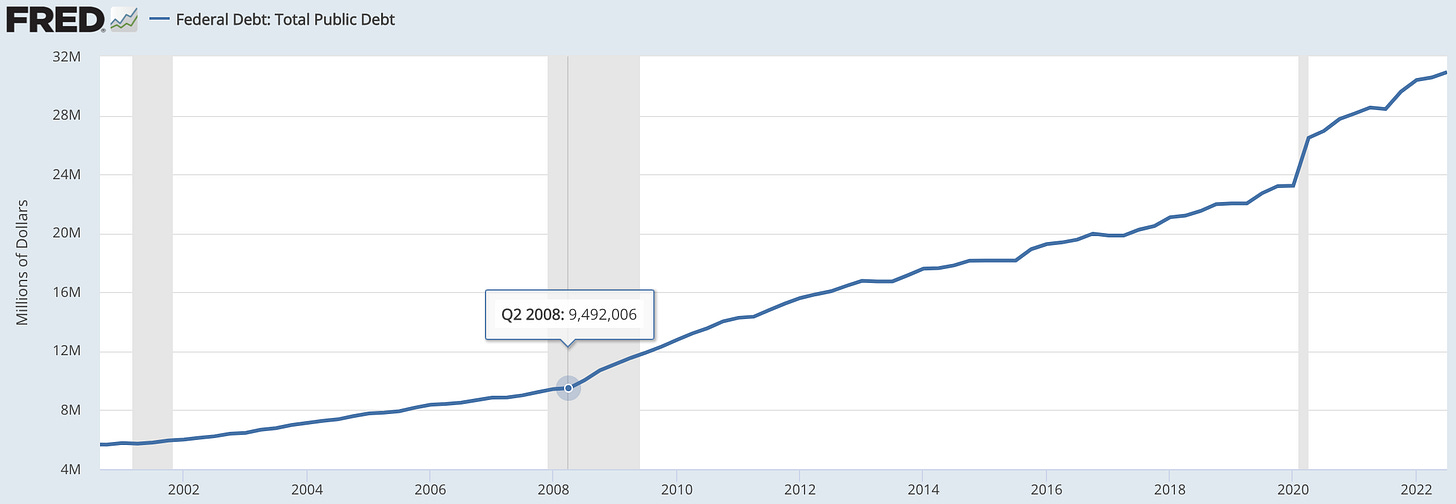

Meanwhile the debt burden in the United States continues to rise every day, week and month.

M2, the best measure of real economy money, is shrinking. This hasn’t happened since the Great Depression.

If the Federal Reserve Continues to Reduce its Balance Sheet, it is Only a Question of “When” Not “if”, a Credit Crisis Manifests Itself

There are few scenarios that are more cataclysmic than a credit super cycle beginning today and I think JPow knows this. In his most recent FOMC meeting, you could hear him begin to walk back saying “we have seen sufficient tightening” and “the deflationary process has begun”. Why would he say that when inflation is still over 6% (soon to be 5%)? Because he knows what he is doing and the risk he is putting the economy in by continuing to destroy money.

My theory is that, if inflation continues to come down rapidly, the economic system should find equilibrium but, at the same time, the Fed should be quick to respond to any credit crisis that occurs in the process we can (possibly) achieve the “soft landing”. I think they (the Fed) knows they can’t do this (tighten) for too long and I believe they are actively discussing the slowing of QT as well as a pause (reduction) in rates as well. But this begs the question, how do we as investors know something is very wrong?

If systemic risk in the banking system is our biggest threat toward today’s bull market, we should watch the bank stocks and the longer dated bond yields. Smart money (and the bond market) would signal that there is something very wrong in the economy before headlines even begin to find/notice that there is something wrong. Above, you can see an image of XLF (the financials ETF) that peaked in May 2007 long before the S&P (below) did in 2007.

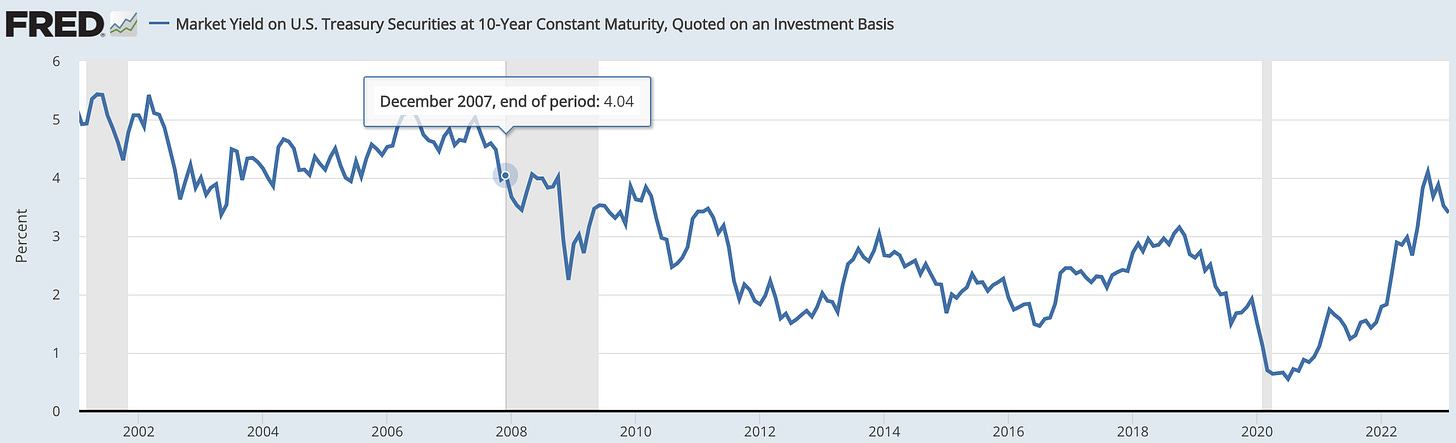

The 10 year yield in US Treasuries also signaled that there were structural issues within the economy.

Moving money to bonds in the event of a broader risk-off event, like a systemic, near banking system collapse, can save an investors portfolio. We can keep an eye on the financial sector (XLF) as well as the yields to get an idea if something is wrong in the banking system. If we see material weakness in XLF while the S&P 500 holds up relatively well, this can be our alarm to rotate money out of stocks an into bonds.

In Summary

Both 1929 and 2007 shaped our economy as we knew it. The lessons learned during the Great Depression were significantly more brutal (and important) than the lessons learned at any other point in our economic history. We faced nearly the same situation in 2008 as we faced in the 1930’s when the global monetary system nearly melted down.

However, our policy makers and central bank “kicked the can down the road”, printed money and moved debt from the private sector to the public (government) sector to off load a lot of that debt load to encourage investment into America’s economy. Today, our biggest risk is that the Federal Reserve continues to decrease its overall debt holding with both MBS’s and US Treasuries through “Quantitative Tightening”. If they keep doing this, they will strain the financial system more till eventually something “breaks” in the credit markets.

Although this isn’t a guarantee, we must stay vigilant. The best way for us to watch this risk develop is through inter-market analysis via the 10 year treasury yield and the financial sector stocks. If we begin to see “risk off” price action coupled with weakness in XLF vs the S&P we could be receiving our first warnings that something is breaking or has broken within our credit markets.

Till any warning signs of a pending credit system collapse, I am to assume that the current expectations of the market cycle will continue as projected. As always, I will ensure the keep all of you updated. Till then…

Stay Tuned, Stay Classy

Dillon

Excellent piece, thanks for taking the time to compile and share.