The "Long Term" Investor, a Lost Art?

The psychology, understanding and process of investing

The “Long Term” Investor, a Lost Art?

I Have Recently Opened My Portfolio (positions) Using the Savvy Trader Platform.

I did this as I make a few changes (still building the new model) to BluSuit and what we offer. The reason why I did this was to enhance the ability for those who wish to follow what I do to experience a more transparent, real time, platform that allows me to send text/email notifications real time of portfolio moves I make. In addition, I can provide commentary (which should be pushed to email/texts as well) on company results after I listen to their earnings calls. I also like to provide commentary about the overall growth stock market and what I am expecting as far as short/medium term price action goes.

This is a notable upgrade from the Excel Spreadsheet I used before which was difficult for Subscribers to keep up with and follow. Now, there will be no questions or weekly updates. Just pull up the app and check what my performance is YTD vs the S&P & NASDAQ as well as what positions I am holding real time.

Instant Gratification vs Delayed Gratification

Words cannot describe how often this has been on my mind recently as I make different life choices that are consistent with my investing process and philosophy. There’s this law, in the universe, that seems to favor those who endure and persist against challenge. Success often favors those “pay the price” (as the saying goes) and that price is often short term pain to achieve long term results. I have found that the key is both in “understanding” (or practical knowledge) coupled with the correct mindset that leads to success in life’s greatest challenges.

The purpose of today’s memo will be that of both understanding and mindset. It’s the understanding of the fundamentals that influence investing and the mindset required to execute and accomplish long term goals. I have organized this as follows:

First, we’ll cover the mindset and philosophy of investing

Then, discuss how the federal reserve (“liquidity” & interest rates) and business fundamentals influence stock multiples/valuation

Finish with examples of the out performance possible by ‘stock picking’ the best, growing, businesses of years past

The Mindset & Philosophy of Investing

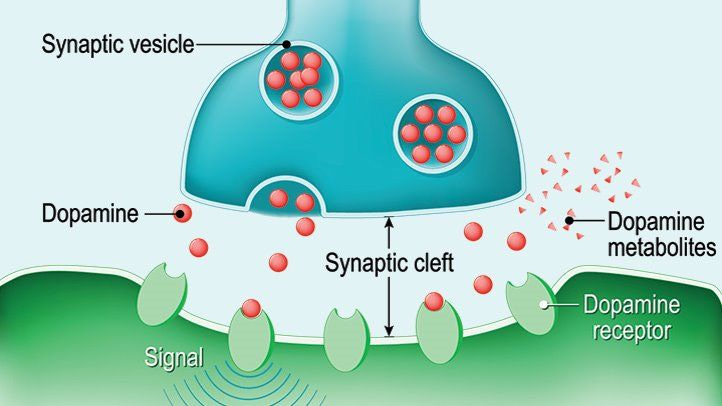

Dopamine is a chemical in your brain that makes you “feel good”. This is the chemical that people instinctively chase, oftentimes without even knowing it. How did you feel when you graduated high-school? Got married? Got that promotion? Got a new job? Yep, you guessed it. It’s dopamine that’s responsible for that on top of the world, invincible, feeling you often get when you accomplish that extremely hard task or achieve a major life event. It’s the re-enforcement chemical that rewards particular behavior.

On the contrary to accomplishing something difficult, dopamine levels can often be temporarily raised. Something that’s temporary is often instantaneous in nature. Alcohol, drugs, gambling, unhealthy food and even social media can temporarily inflate dopamine levels. But, this circles back to what I mentioned before about how the universe seems to favor those who pay the price in the short run for long term gains. There seems to be another law that goes something like ‘the cheaper the high, the lower the low’ that usually transpires following the dopamine rush. This leaves the instantaneous dopamine seekers wanting more as soon as it wears off.

Think of the drug addict seeking their next fix who eventually finds themselves at rock bottom. Or, the drunkard that finds comfort in a bottle, who could find themselves at a point where they lost their family, their job and their drivers license. The list can go on and on. In the context of the financial markets, it’s gambling, just like a casino, that many investors unknowingly fall into. Let me emphasize unknowingly because I don’t believe anybody who pursue’s wealth is seeking the same result as a someone sitting at a Black Jack table. However, the instant dopamine rush you feel when your stocks go up is a similar feeling that you may feel when you hit “Black Jack”.

Let me pause for a moment talking about the instantaneous pursuit of dopamine and talk about the other side, the delayed gratification side. This side of the equation is usually not easy. It’s not cheap but helps an individual achieve a higher level of well being. From a broad perspective, it’s the pursuit of a difficult task that requires short term pain/discomfort. These events and accomplishments that require delayed gratification achieve some sort of higher low and higher high. The end result is real, intrinsic and can be enjoyed not just for hours but a life time.

A few examples I can think of in particular in my life:

Graduating college required 4 years of effort, energy and sacrifice. There were many nights in my early 20’s I wanted to party but chose to study instead to graduate on time. The result led me to have the opportunity to pursue my dreams.

Becoming a United States Marine. For four years, I had to endure the lowest of lows along with extreme physical/mental challenges. It wasn’t fun at the time but it lead to my Business Degree being paid for along with so much more.

Going to the gym. I think it’s almost a requirement to come up with, at minimum, 10 different excuses why I shouldn’t work out every day. The result is usually a healthier, more balanced, emotional and physical state.

These are just a few examples because there’s so much that we can apply here. Some that you, the reader, may be experiencing today:

Marriage

Being a Mom/Dad

Paying Your Bills on Time

Working on Your Dreams

College Graduation

Working Out or Meditation

Saving Money & Balancing a Budget

Taking Care of a Pet

Delayed gratification does not always need to be grandiose, it could be as simple as taking care of day to day responsibilities. These day to day responsibilities often create a higher standard of living. The difficulty, the challenging part, comes when larger goals, higher goals or seemingly unattainable goals come to the fore front of ones mind. The goal of becoming a multi-millionaire.

When it comes to investing, it is like gambling as I mentioned above. There are few greater feelings you get when you see your stocks go up and your net worth appreciate (on paper). Like I said, it’s a dopamine rush that’s comparable to getting a “Black Jack!” at the black jack table. You feel like you “won” something on a slot machine. Except in the financial markets the stakes are higher. The ups and the downs are both extreme but…. In this game, the house doesn’t always win if you play it right. If you focus on tilting the odds in your favor. If you play the game correctly, the rewards can be tremendous. The rewards can be in the thousands, tens of thousands, hundreds of thousands and even millions.

The Dogma that Exists with ALL Investors

Let’s take a step back here and reflect on what we see every day in the financial markets. Many of us, regardless of investor or trader, keep up with the day to day news. It’s almost a requisite for us to “be in the loop” of what’s going on (but not necessarily always have an opinion) with politics, economics, monetary policy or just general price action of individual markets and stocks. As you could imagine, this creates a lot of noise, a lot of dogma.

It is extremely difficult to filter through this noise. I recall (in my earlier years investing) listening to major YouTube influencers or FinTwit (financial Twitter) personalities trying to gauge what’s going on in the financial markets. Some days we were red, some days we were green. It never really made sense because little of the day to day commentary spoke about “why” something was going on but referred to a chart or some sort of technical signal. It was confusing as messaging flip flopped day to day.

Quickly I picked up that major influencers, the “investing” Guru’s, had narratives (a form of dogma) that existed with a particular days price action. Here-in was my first experience with the broader psychology of the market. It wasn’t just individuals, outside of Wall Street (retail), it was the Suits (smart money) on major financial media channels as well. Many would lie and tell you that they were investors but indeed, they were not. These individuals developed little thesis and held a particular stock for a very short period of time. Usually just… Idk, maybe days, weeks?

The bright green squiggly lines that go up, the blood red downtrending lines, the flashing numbers, ALL CAPS TWEETS AND YOUTUBE VIDEO TITLES, “this” opinion and “that” opinion, Bull, Bear, etc. All of it is designed to have you consume a specific narrative, a story, throw you off your process and tell you what to do with YOUR money. Even the apps that we have, like Robinhood, have creatively designed a platform that “gamify’s” investing to promote trading and short term decision making. When you first see your stock go up in value, let’s say 10%+, it is absolutely a high. Why not, you just made 10% of your money in days/weeks. There’s a purpose to all of this.

All of it is Designed to Promote the Rush of Dopamine

The very psychology of investing is completely contradictory to what happens every day in the market and what is said. It goes against our nature as humans. The psychology of investing is that of a delayed gratification mindset and a deep understanding of a particular asset, its fundamentals and a long term thesis. It is fighting the initial high you receive when you hit that first 10%, 20%, 30% or fighting that low that you see when your stock goes down 10%, 20% or even 30%.

I will explain more in the next section why stock values fluctuate so much.

There are people (the loud minority) who will tell you to sell, call you names, or belittle you for buying when they are too scared to buy and these same exact people will SCREAM at you to buy at the very, very top. DIAMOND HANDS, they will say. This doesn’t change, it has never changed and has existed for as long as financial markets have existed. It isn’t just the media and platforms we use that promote gambling, short term, behavior but it’s other market participants as well.

The Tulip Mania of the 1600’s “the time, it was different”

The first and most important step to investing is to understand and identify that market psychology is just as much apart of the markets as technicals, macro or asset fundamentals. It’s wise to take everything with a grain of salt and approach everyone with some sort of “tinfoil hat”. It’s wise to have a distrust with what you hear, read or see but ONLY use others analysis/research as some sort of tool to help you make YOUR OWN decisions. It’s wise to understand your own emotions and how they can lie to you as well. The only thing that matters is in-between your ears, it’s your mind. It’s controlling the dopamine highs and lows, staying true to YOUR process and thinking longer term.

Why Stock Prices Move Every Day

Recall me mentioning how it is important for all of us, by default, to pay attention to the financial markets. First, as I mentioned earlier, being aware of the noise that can occur with the price movement of a particular asset is important. However, deciphering the difference between noise and reality is crucial for an investor’s thesis and RISK MANAGEMENT. While trading, risk may mean volatility but the opposite is true while investing. Volatility is both an opportunity in the sense that you can buy a particular asset for cheap and considered a risk in the sense that you can over pay for an asset.

The challenge is understanding if a particular asset/equity is cheap. Is it because of the ‘market’ that an asset is cheap or is it cheap because it’s a low quality asset? Noise, narrative, the Fed and business fundamentals all play a role in determining the answer to that question.

Volatility can be defined as the rapid price fluctuation (up/down) of a stock, or asset, price.

The key to exploiting it (volatility) as an opportunity or identifying it as a risk is determined by what the cause may be of the rapid fluctuation in price. Over the years, I have found that there are 4 primary causes of short/long term volatility of any particular stock:

Technicals - Traders preferred strategy with lines of support, resistance, moving averages, etc

Sentiment - The long term perception of a particular stocks value and broader market risk sentiment

Liquidity - The Federal Reserve’s Monetary Policy

Fundamentals and Valuation - How the business performs, its financial statements and what the value of that may be

Coincidentally, I ranked all four of these in order from the shortest time frame to the longest. Technicals do strongly play a role in short term price action of any particular asset but are extremely un-reliable in predicting long term trajectory like the financial projections of fundamentals, or cash flows, may be of a business. From each of the four factors effecting stock movement, awareness of the nature of these can help investors identify risk or opportunity.

Let’s provide a brief example of each factor.

Technicals

Technical analysis (TA) is nothing short of the ability to see trends and what other people are doing. Traders lean into this type of analysis but investors can find significant use as well. TA allows the investor to identify areas of support (areas of demand) or resistance (areas of supply from trapped buyers) or the average moving price (also known as moving averages) in an upward or downward trend.

Think of it like this; most investors are extremely conscious of risk/return and a majority simply don’t like losing money. When an investor/trader loses money on an investment (if a stock immediately declines) they will be (behaviorally) inclined to sell once they break even, this is considered resistance. Or, vise versa, investors may find a particular asset attractive at a certain valuation, this can be considered as support.

Each price level is a level where investors will either step in to sell, or step in to buy. I have found that the more liquid the asset (the more volume that’s traded), the more technical analysis works. For example, I use TA on the broader indices (the S&P 500 or NASDAQ) regularly to gauge key levels to assess the short term trend and direction of the broader markets.

Amazon, back in 2015 - 2018 can provide a good example of trend following.

Both traders and investors have a tendency to pay attention to major moving averages. The one highlighted in the picture above is the 200 day moving average. You can see that the stock will actually move along this blue line as the business executes, expanding revenue and earnings. However, in late 2018 you can see that this “moving average” is broken and a market correction has taken place. The downward trend follows moving averages less and begins to bounce around areas of support and resistance. For example observe the black lines below:

These black lines are area’s of where Amazon’s stock had buyers or sellers step in based on previous levels. Specifically, the exact low of Amazon’s stock was an area that formed back in early 2018 (noted). After making the low in December 2018, the following high that occurred after the price recovered, sold off in July 2019 (as depicted by the higher black line) at the exact price as the top in September 2018. These zones and price levels are everywhere. Today, we can even see this in the NASDAQ.

The important thing here, for investors to know, is that a stock price will bounce upward at certain levels or sell down off certain price levels strictly based of the supply and demand at certain price points. As I mentioned, the theory is that it’s directly related to the trapped buyers (who become sellers) and dip buyers (who are looking to add to their investment) at specific valuation targets, or prices in the stock. Truthfully, it’s mostly the psychology of technicals that is respected by many market participants.

Sentiment

I often think of technical analysis as a foundational skill to be built on. First, you must know how to read a chart. Then, after you understand how trends work as well as how short term supply/demand zones can act as support and resistance, you can get a solid understanding of what drives technicals. The next three factors will explain this in more detail. In this particular section, sentiment is a very important role.

To define sentiment, we can think of it as an investing community’s long term perception (not reality) of where earnings may be over the next 3-4 quarters. The more optimistic perception, the higher the stock price (pulling forward returns from the future) and vise versa, the more pessimistic the lower the stock price falls.

Fortunately and unfortunately, we experienced this during COVID-19 pandemic particularly in Amazon’s stock and many other e-commerce stocks.

The idea, the “sentiment”, was that, during COVID-19 lock downs e-commerce would revolutionize the way business is done. Work from home, e-commerce and the meta-verse were all trends during this era as social distancing took forefront and people became fearful of leaving their home. The world went digital. The problem with sentiment is that it’s speculative in nature both on the way up and on the way down.

I recall listening to ZScalers (cyber security company) recent investor call with Needham and I think the CEO of ZScaler, Jay, said it best.

Sentiment is important for investors to understand because it is what has defined the market cycle over the past 3 years. Sentiment is the perception of future stock returns based on the current investing climate (tied into the 2 factors below) and can create massive swings in the stock price. It’s commonly tied to narrative, which is extremely dangerous for investors to fall in to. One must create their own picture of what is and determine where their conviction lies.

By buying when perception of a quality equity is dismal, you enhance the prospects of future return. By selling when the prospects of an equity is euphoric, you’re likely to preserve capital. Buy low, sell high, etc. Many investors do the exact opposite. They tend to buy high, attempt to sell higher, hold and lose all their money without ever understanding (truly) what a business is or what it does.

For some people this works. It is important to ‘define’ the business you are in. Nothing is worse than being a trader but becoming an investor or an investor and you become a trader. Respecting the other side and respecting the difference is important.

Liquidity & Fed Policy

Throughout market history, there has been no entity more important for every single boom and bust in financial markets. Major market bubbles can be directly tied to both US Government and Federal Reserve policy as well as the subsequent declines that follow the implosion of asset bubbles. This (topic) is where I have spent a majority of my research because it’s one that individual investors, and in some cases institutional investors, don’t fully know about. It is the “how” and the “why” behind everything we see, every trend, every bear market bottom and every bull market top.

The explanations here can go in depth as the functionings/workings of the financial/banking system but what’s important for investors to know is how Federal Reserve policy influences the economic cycle. Subsequently, it is the economic cycle that determines Federal Reserve Policy. Where we are at in the respective economic cycle influences which stock market sectors perform (below best shows this) and which do not. Monetary (Fed) policy essentially controls credit growth and credit contraction. This credit contraction/growth influences the economy’s expansion and contraction cycles.

I know this a lot of jargon if you’re not familiar with monetary policy. Simply put, the Federal Reserve can put an economy into recession or pull us out of a depression by influencing the demand of the consumer by raising/lowering interest rates or the printing/destroying of money.

It’s not just the economy that the Federal Reserve can influence, it’s the banking system. In order to simply understand “banking system liquidity” it’s important to know there’s two different types of money in the world of fiat currency:

Real economy money - This is the spendable money that we usually see in circulation every day. M2 is a measure of this.

Banking system money - Usually this is the currency that major banks hold and transact with. It’s what impacts financial markets, it’s what QE and QT policy effects.

There are two ways the Federal Reserve looks at banking system liquidity:

Bank Reserves:

Reverse Repo’s:

I could write an entire memo around banking system liquidity and the details around it but I will keep it simple and focused on how it impacts stock valuations. At its very core, it impacts the risk premium allocated to assets. The more liquidity, the higher risk financial markets and institutions are willing to take. The less liquidity, the less willing large financial institutions are willing to take. This works on a spectrum best described by the pyramid below.

Think of the least risky assets on the top (cash and cash equivalents) and the most risky assets on bottom (sort of contradictory to the pyramid above but the methodology is all the same) in the image below. Once the least risky assets are filled up (the top buckets), and the return is low, then the water spills over to more of the riskier buckets in the financial markets. This would be the crappy companies with poor financial statements, crypto currencies, options, etc.

What’s important for investors to understand is that Federal Reserve policy does impact the valuations (and multiples) on many of your favorite businesses as well as the economic conditions they operate in. This means that when you do pick stocks, ensuring the businesses you’re investing in have large cash positions or are at least operating cash flow break even should ALWAYS be top of mind. A strong cash position is a strong business position. BUT, strong businesses can still sell off based on Federal Reserve policy (nothing to do with your stock pick) or poor economic conditions. This is simply multiple expansion and contraction based on the equity risk premium associated to all assets in the financial markets.

Fundamentals & Valuation

This is often where traders and speculators get confused. Most “investors” in the financial markets think “stock go down = bad company” but this couldn’t be further from the truth. Stocks can sell off for any reason listed above:

Technicals: Support/Resistance Zones

Sentiment: Perception about a companies future

Liquidity & the Fed: Booms/Busts and the equity risk premium

But the Only Reason Why Stocks Go Up and Stay UP is that the BUSINESS Grew Revenue, Earnings and Cash Flows Over Time

Full stop.

This is where investors need to live while simultaneously understanding the other factors of why stocks move. During periods where stocks sell off because of what ever reason the market feels like blaming in on that day (it’s always something), intelligent investors focus on the business, the fundamentals and the long term trajectory of this asset. There is no other reason in the world why a stock will go up and stay up other than the business grew revenue, earnings and cash flows over time while managing their debt position appropriately.

Let’s go back to Amazon, recall how I shared the price action from 2015 - 2018 as an example during the technical portion. If we zoom out and look at the long term chart, the picture looks different.

The return is astronomical +99,410.21%…. This is life changing money by just holding the stock through:

The tech and telecom bust where Amazon fell nearly 90% from the high to the low

The global financial crisis where capitalism ceased to exist (almost)

The COVID-19 pandemic

2022’s inflationary bear market

All of these events created wonderful opportunities to buy more of this business. These returns can create life changing money. For example, if you would have had $1,000 and put it into Amazon and just held, today you’d have nearly $100m dollars (check my math here but it sounds right). Your life, our lives would be completely different. But how is this possible?

Amazon Effectively Grew Revenue, Earnings, Cash Flow and Managed Cash/Debt Effectively

The investors who focused on the Amazon in the late 1990’s recouped all their losses from the TMT bust and became rich by owning just one. good. stock. This leads me to the ultimate point.

Long term investors focus on the business fundamentals (to tilt the odds in their favor of the house) but understand why/how prices fluctuate on a daily basis. They need to understand that, although the markets are designed for short term thinking, it’s smarter to think opposite from the crowd. It’s smarter to accumulate good businesses when it doesn’t feel good (delayed gratification) and unwise to focus purely on the short term (instant gratification).

Does Long Term Investing Work? The Coffee Can Approach.

This memo is getting long and I think this portion of the news letter can be simplified with relatively basic math. The purpose here is to put a visual mathematical equation, with a margin of safety, on what returns could look like while investing in the bear market of 2022. Let’s say you have $10,000 to invest and it’s the bottom of 2008/09 bear market. You decide to be a growth investor (like I am now) and go for 10 different stocks.

Of these stocks that you own, you put $1,000 into each position equally. Of those positions, you buy:

Apple

Amazon

Google

Salesforce

Adobe

and 5 other businesses that go bust, complete zeros. But, you have 5 positions that work out well and you decided to hold from, let’s say, December 1st 2008 (when the NBER finally declared a recession) to now. What would your returns be?

Apple went from $3.30 to $141.11: Position size is now $42,760

Amazon went from $2.30 to $97.52: Position size is now $42,400

Google went from $7.06 to $99.79: Position size is now $14,134

Salesforce went from $7.30 to $155.87: Position size is now $21,352

Adobe went from $21.41 to $364.98: Position size is now $17,047

This portfolio was $10,000 in 2008. Today, in 2023, despite the bear market, it’s $137,693 for a total of 19% CAGR over 15 years compared to the S&P’s 10% CAGR over the same respective period.

What would the $10,000 portfolio be worth if you just put it into the S&P? The same portfolio, if just put into an index, would be worth $45,747 compared to the stock pickers portfolio of $137,693. IF we break this down further, we can see that just by owning one good stock like Amazon or Apple, it would be enough to perform inline with the index over a 15 year period.

What would destroy the stock pickers results?

If the stock picker attempted to time the tops/bottoms, buy above the 200 day moving average, move money around or “try to sound smart”, they run significant risk of under performing the markets over the same period. Many investors (which I believe is happening today) END UP IN CASH AT THE BOTTOM OF A MARKET and END UP IN MARGIN AT THE TOP OF A MARKET. When the exact opposite (not advocating for margin) should be happening.

The Psychology of Investing

The very nature of the financial markets promote a type of gambling addiction for investors and traders. If you add in the noise one receives on a day to day basis along with the gamification of trading platforms, it goes against our most basic human emotions. We, as humans, are emotionally designed to fail in this environment. I see small investors do it, I have see large investors do it. I have seen fund managers blow up and investing strategies tank. This business humbles everyone.

However, there is one strategy that always seems to endure the test of time and it’s the most simple. Find great businesses, buy great businesses, sell bad/deteriorating businesses, focus on the business fundamentals and do your best not to over pay for an asset. It’s the very principle Buffet speaks on, Lynch speaks on and even famous traders like Stanley Druckenmiller incorporate within their strategies (he has owned Palantir for 14/15 years).

Long Term Investing is Not a Lost Art, it Will Never Die

New investors will come, many will fail and old investors will get rich with time. The old investors seem to be the ones who survive, respect risk but also understand what risk truly is. It’s those young investors who make good decision, over the long term, who survive, to eventually accomplish their goals of becoming multi-millionaires. The young become the old and the cycle eventually repeats but the process always stays the same.

The stock market has always been a mechanism to transfer wealth from the impatient, to the patient.

Stay Tuned, Stay Classy

Dillon

Outstanding!

Absolutely great read Dillon...as always. Hugely impressed by your ability to look at the market from so many different angles and perspectives. Keep it up and thanks for what you do. Many don’t tend to say thank you but I do know that many appreciate you and your contribution to making a difference to so many people. I for one have learnt and continue to learn a great deal from you. 💪