Imagine a world where mundane tasks are all automated, especially all back-end office work. A world where routine tasks that make the individual feel like a robot is actually replaced and completed by a robot. Imagine a world where people spend more time creating and making decisions in the work place. More importantly, imagine a world where an entire enterprise is managed by robots and driven by artificial intelligence.

UiPath is bringing the automated enterprise to life and is on the leading edge of AI/ML. At first glance, it seems as though there’s seemingly unlimited potential and opportunity when you think about merging RPA (robotic process automation) and AI (artificial intelligence). This would explain why Cathie Woods, CIO/CEO of ARK Invest, has placed such a large bet and growing.

In preparation for this publication, I’ve spent hours listening to conference calls, reviewing earnings reports, and diligently reviewing other material on the web to carefully construct and consolidated all this information. The format is focused on the investor to address key, important to know, information when building a long term thesis in a particular stock pick. Contents are organized as follows:

The business model

Total addressable market and competition

Financial results

Leaderships strategy for growth

My closing thoughts

Business Model

Work as we know it has transformed over time especially, “desk work”. Many of these tasks have become very redundant and mundane. UiPath has created a solution to enhance efficiency, improve outcomes, and take the busy work out of the office by using “robots”. They like to consider themselves as the forefront of changing the way humans work, shifting employed work from these mundane tasks to management of the robots accomplishing these tasks. They claim this has a powerful, immediate and direct ROI that drives best-in-class retention metrics.

They have an expansive portfolio of solutions to help enterprises, it can be broken down like this:

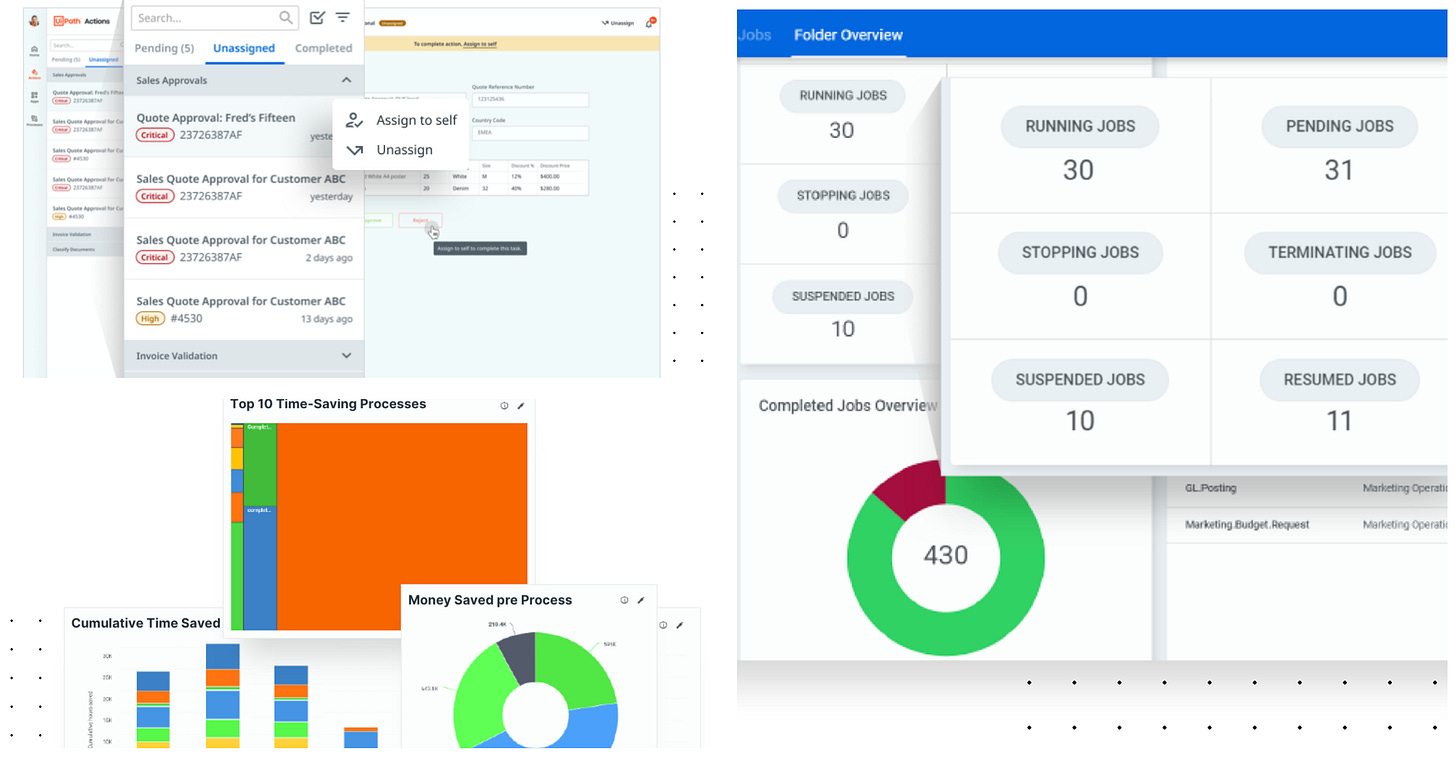

Discover new automation opportunities using automation hub, artificial intelligence, task capture, process mining and task mining. This can best be thought of as enabling current clients of UiPath to find new ways to enhance organizational performance through automation. This generates enormous opportunity for both the customer and UiPath.

Build automations from opportunities found in the discover phase. There’s a studio where developers can build new processes from scratch or there’s a market place for pre-built automation components. They also offer assistance/training for developers to assist with building solutions/automations.

Manage the robots and automations that have been built. Businesses can leverage an AI center where machine learning can be applied, test new robots/processes, manage the processes, and access analytics portal. This can be thought of as the user interface to manage all the functions.

Engage with robots using chatbots, or using the action center. Robots will check in to receive general direction from developers.

Basically, the one liner for this is that UiPath enables businesses to find new processes in the organization, construct new robots, manage them and even communicate directly with them. This is recorded and displayed, showing the results that businesses care about most such as time and money savings. UiPath directly impacts the bottom line to their clients.

Their revenue model is structured around selling access (licenses) to their software as well as charging for maintenance and service. License fees are derived from both access to their platform and the number of automations (robots) that are running on their platform. The maintenance and service fee portion of their revenue is derived mostly from training offered and customer support to develop, architect, and implement automations.

What struck me as most interesting while examining their business model, they’re essentially changing the way organizations think about work. As a leader in this space, UiPath’s pitch would sound like, “let me show you how to replace workers and automate your entire enterprise, in comparison to a well oiled machine that runs 24/7”. It’s important to know these robots can work longer, without breaks, PTO, or going on strike. This is a clear advantage for the adopters of this technology because it frees up time and focus away from mundane, robotic like, tasks.

Robotic Process Automation Market

RPA has been a major focus for some of the industry titans, like Microsoft. Competition has been increasing but when there’s an emerging market in the tech space the first resource I consult is Gartner, specifically the Magic Quadrant, and secondary, the Forrester Wave. This helps you access the overall landscape to gauge who is the most innovative (visionary), who runs a strong business (challenger) and who leads the market in both (Leader). This changes rapidly from year to year, so it’s always best to find the most publications.

UiPath is in direct competition with Automation Anywhere, according to Gartner, as these two businesses lead the RPA market today. However, UiPath’s lead looks more pronounced according to Forrester.

Falling out of favor as a Leader, especially in this market should be carefully monitored for all investors. The reason being the smaller size (today) in comparison to many of the other secular growth trends. According to Grandview research; 2020 had the total market at a $1.57B opportunity with a 32.8% CAGR till 2028.

UiPath sees a much larger opportunity long term, nearly $60b. They believe that what they are pursing is the fully automated enterprise and not necessarily just RPA. UiPath’s solutions, and I’m sure their competitors, have a strategic product road map set on this. There’s opportunity to leverage AI/ML to begin creating robots that make human-like decisions. Scary, I know. But it will most likely happen in the not so distant future.

Recent Quarterly Financial Results

UiPath measures their top-line business performance using ARR. Many subscription based business models do this because of ‘asc-606’ which is an accounting method that only lets a business record revenue after a service has been fulfilled. From the surface level, their revenue appears choppy but ARR has shown very clean, steady, growth. This metric is very helpful to identify exactly how much business they’ve closed and retained.

Top-line growth metrics from their latest earnings call:

ARR to $726.5m, representing 60% growth YoY

Net based dollar retention of 144% (this is really good and tells me current clients are staying and spending more)

Global customers of 9,100+, showing a gradual increase form last quarters 8,500

Net New ARR grew 33% YoY to $73.9m, this is the newly closed business and an important driver for future growth

They are growing nicely but did see a moderate slow down from last Quarter. However, I wouldn’t be super worried about this because the overall market growth has a 32.8% for the next 8 years and UiPath is poised to capture a substantial share of this growth.

Their margin profile is best in class, representing an 82% gross margin. They are currently unprofitable but it’s pretty clear they are investing heavily into the business from both and R&D perspective as well as sales. The important thing to know is that they could be profitable if they wanted to be, but it’s too early and it would be irresponsible to turn profits now. Cash and profits will most likely be plentiful as the business scales and matures.

Looking at the balance sheet, it’s incredibly strong. They have no debt, limited liabilities and about $1.9B in cash on hand. They’re well capitalized to continue investing heavily into the business for years, especially with 83% gross margins.

My only concern has been and continues to be UiPath’s valuation, as it’s extremely rich. Projections have UiPath at:

January 2022 revenue @ $874m, gross profit @ $725m

January 2023 revenue @ $1.166B, gross profit @ $968m

January 2024 revenue @ $1.55B, gross profit @ $1.287B

They don’t have positive earnings or operating cashflow, so it will be best to use EV/S or EV/GP to roughly value the business. Their market cap is approximately $28B but they have nearly $2B in cash, no debt. This puts their enterprise value at $26B, which will put forward valuation metrics at:

2022 EV/S @ 30x, EV/GP @ 36x

2023 EV/S @ 22x, EV/GP @ 27x

2024 EV/S @ 17x, EV/GP @ 20x

The long term intrinsic ROI is reduced with more expensive stocks especially when a market shows any sort of slow down or when rates rise. I really like the idea of purchasing shares at an enterprise value of $20 - $25B

Leadership’s Strategy for Growth

This is extremely important to consider especially in a market that’s expected to grow exponentially. Maintaining a leadership position is crucial for UiPath to become a dominant force which will lead to exponential long term share holder returns. They identify both short and long term opportunities to be:

Growing global base with net new logo’s - They focus on enterprises but do have an SMB team as well to continue to drive growth. They assume that as their RPA product is adopted, other businesses will need to adopt RPA as well to compete in their respective markets. UiPath believes this will continue to fuel net new growth for years to come.

Expand current customer spend - There is significant opportunity with existing customers. This has a lot to do with their business model (covered above) as current customers will identify new opportunities to add more robots within their current ecosystem. UiPath also plans on expanding offerings to create more robots for other departments.

Driving preference of system integrators - Currently, UiPath has 4,700 partners but believes there’s opportunity to expand this. Partners help their current customers integrate robots and identify new solutions. When thinking about ‘partners’ we can define this as business consultants and/or other cloud/technology companies.

Sustaining innovation and automation leadership position - This is crucial, UiPath must maintain leadership position. They find opportunities to invest into new solutions, AI, and machine learnings capabilities. For example, they recently released “task mining” which leverages AI to identify opportunities for automation in an enterprise.

Continue investing in growth and scale - They’ve already invested heavily in sales and they for-see continued opportunity to expand business operations globally.

Conclusion

UiPath is extremely interesting and I believe this has extraordinary opportunity for growth long term. There are a few risks that I identified but nothing that would prevent me from beginning a position (I don’t currently own them). I believe they must continue to innovate at a rapid rate, especially with Microsoft and Automation Anywhere right behind them. Long term, I can envision that a market leader in this segment can be a leading innovator of robotics and artificial intelligence. The opportunity potential for owning cutting edge tech in robotics, machine learning and AI will lead to exponential growth long term. This, in turn, would generate handsome share holder returns for years to come.

Currently, I’m not a fan of the risk reward that their current valuation represents, especially with lockup expiration so close on October 18th. I believe that shortly after lockup expiration, this should present a generous buying opportunity for long term gains. I would love to see this drop to a low $20B market cap. At these prices, I would be excited to purchase shares.

If you guys like this work and in-depth research, I highly encourage opening up a membership to view exclusive members only articles. I got a lot of exciting content planned which includes new IPO’s and many high-growth, innovative, stocks.

Guys! As always, Stay tuned.. Stay classy,

Dillon