Year of Accumulation to Pay Off

Portfolio Update, Signals of a Major Low, Data to Watch and Important Levels

Sentiment is more transitory than inflation (lol) because it usually follows the existing trend. In this case, recency bias has everyone destined to believe that there just can be NO WAY this is a major low in the market. However, I have always been under the impression that if something can’t last forever, it wont and that everything works in cycles.

In this weeks portfolio update, I will talk about specific data points that support a major, tradable, low in the markets. In addition, I will provide the exact leading data points that will give us a warning sign that another leg down is imminent. To support this weeks update, it will be important to at least be familiar with what I spoke about in previous weeks:

Post 1.) Funny thing, I had enormous criticism for this post. Sentiment was very bad during the initial release.

End of Year Rally in View - Oct. 4th

Post 2.) Crucial to understand the fundamentals and valuation metrics of the S&P 500

S&P Hasn't Priced in a Recession

Identifying Where We Are in the Market Cycle

It’s important to know what we are watching for in any instance. The data points here today give us an idea of where we are currently in the Fed’s rate hiking cycle, the economic cycle, and exactly how the equity market responds to the emerging data. Here at BluSuit, we operate under the assumption that markets move based on 2 fundamental forces:

Equity risk premium in relation to bonds

Future earning expectations

Today, we are going to cover a few important factors that will directly impact the equity risk premium as well as future earnings expectations. At the end, I am going to show you (the reader) my portfolio and exactly how I have positioned my portfolio for the next multi-year rally. As a Subscriber of this Newsletter, I always provide full transparency (including losses) and a members only Discord Group that offers incredible value not just from my perspective but other investors who offer unique (valuable) perspectives.

BluSuit is evolving to be more than just me, it’s becoming a community of some of the best experienced independent investors. In the future, I would love to bring in additional analysis under the BluSuit name.

It’s a Fed Pause, Not a Pivot

The pause isn’t the important part of this. The past 14 years have conditioned investors to believe that the markets can’t possibly rally without some sort of accommodative policy, which simply isn’t true. My case study for this is 2016 - 2018, when the Fed hiked rates for two years. It’s unusual that people forget such important, recent, data.

What is important, when thinking about a possible bottom in equity markets, is:

How does this impact inflation

What comes next after a “pause” in rate hikes

How does this impact the economic market cycle moving forward

What does the next phase of the economic cycle mean for corporate earnings

Remember, the equity markets sold off for three main reasons:

Markets got overvalued from an excessively accommodative Fed. This needed to correct.

Inflation

Aggressive Fed tightening which increased the possibility for “tail risks”.

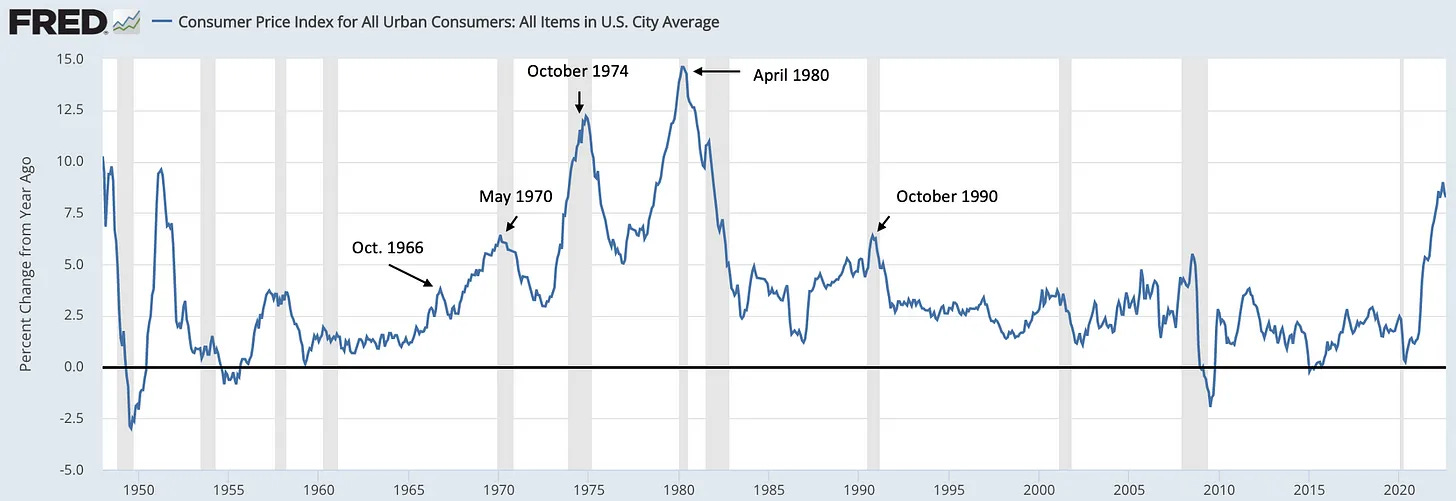

Perhaps enemy number 1 of all of this is inflation. When looking at the past we know that during periods of inflation, it’s actually the peak in CPI that creates a bottom in the market rather than a “Fed Pivot” toward accommodative policy. We know this when looking at the 1970’s and cross referencing peak headline in inflation.

It’s 5/5 times correct when CPI reaches above 5%.

Two Major Headwinds for Stocks are Going Away

This last week, we got two major data points that validated my end of year rally and possibly sets us up for a major (multi-year) low in the markets.

Keep reading with a 7-day free trial

Subscribe to BluSuit to keep reading this post and get 7 days of free access to the full post archives.