Technical trends appear to be forming a base with growth stocks, which is surprising. On Friday, the 10 year yield appreciated to 1.93%, a high for the year and growth stocks still found a bid. This has not been the case for the better half of the last year where one could argue there’s been a purge like sell off. Don’t get me wrong, they have sold regardless of yield price action moving up/down on the 10 year but the larger leg downs have typically been correlated with a leg up in the yield.

This trend appears to be reversing and the case has become even stronger where growth stocks could be the at or near the bottom for the year given Macro conditions. Essentially, the narrative on Wall Street has been, “sell all risk assets” because of the market going through a tightening cycle. Now, many growth stocks are down 50% - 70% from their highs. In other words, I think the saying goes, “ don’t throw the baby out with the dirty bath water”.

That’s exactly what Wall Street and retail investors have done. They’ve clumped all growing businesses together and threw them out regardless of business model, valuation and fundamentals.

In this Podcast Newsletter, I’m going to cover what Growth Stock Investors should pay attention to this week as well as the opportunities and risks that are developing. The general structure will be:

Technical Trends Emerging

Macro Data to Pay Attention to and the Implications

This Weeks Growth Stock Earnings to Pay Attention to

If this is content you like, please consider becoming a free or a paid Subscriber. Free subscribers will have access to free content and paid subscribers have access to:

Exclusive Discord Community

1:1 access to communicate with me

All upcoming and archived exclusive content which usually includes my personal strategies, how-to guides, and my stock picks

Growth Stock Technical Trends

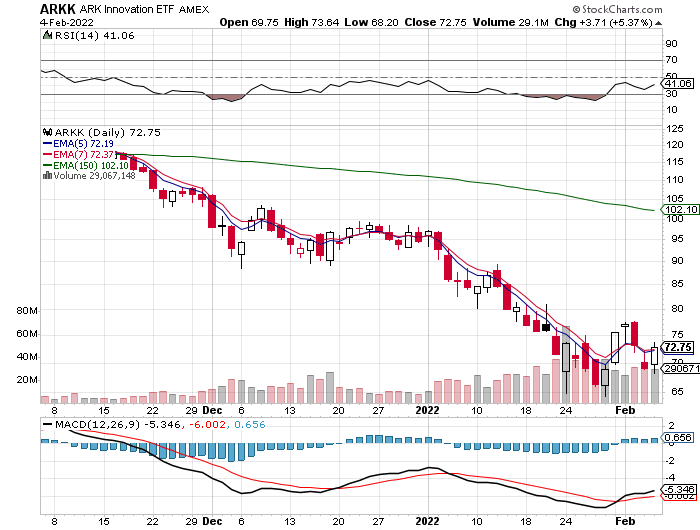

Typically, when I look at how the market is treating growth stocks, I look no further than ARKK. The reason why I do this; by definition ARKK is considered a “Mid-Cap Growth” from a categorical perspective. I do suggest growth stock investors use this, along with the NASDAQ, to get a better idea of where their portfolio’s may go in the short and intermediate run.

Needless to say, the last few months from November have been exciting (not really) as ARKK has sold off from $120 to $65. Trust me when I say all growth stock investors have felt this but what’s exciting is that, because ARKK and my portfolio moves so close together, I am able to hedge my beta by shorting ARKK on the way down. This helps growth stock investors reduce the draw down. I’ll post about the ARKK shorting strategy soon for members.

When looking at the chart above, it’s pretty interesting to see how ARKK has been trading at the 200 week SMA. It appears to be acting as support. The last time it found support here was the COVID-19 lock down panic. Now, we have our own mess of problems with inflation but, it’s easy to assume that the future will be ok and the long term up trend is in tact.

On a short term basis, this is where it gets exciting. It appears that if we are green on Monday we are likely to form a short term bottom. This is best represented by the MACD and the 5/7 ema. What we can see here is that the 5 (blue line) ema is beginning to cross above the 7 (red line) ema. It tried to do this in December but the difference here is the volume. ARKK reached an all time volume high on January 24th where it reached nearly 70m shares traded. Bottoms are usually represented by high periods of extremely high volume. In other words, the technical pattern looks healthy and we’re poised for a reversal in trend.

It is important to know that we’re not in an “official” up trend in growth stocks till ARKK trades above the 150 ema. The rule of thumb is that if the 5 & 7 ema are trading below the 150 ema, we’re in a medium term down trend and we should consider shorting ARKK to hedge risk during this period. Once above, we are in a confirmed medium term up trend. Regardless, this is encouraging because breadth seems very strong and it’s convincing. I’ll keep you guys updated by what I’m seeing.

Macro Picture to Pay Attention to

Macro is important to pay attention to because it can help guide the “perception” of risk appetite. Essentially, it’s a lot like the weather. People are more likely to go outside and play if it’s sunny and bright but they’re going to stay inside when it’s cold and gloomy. In this case, the picture is still gloomy and cold but there are definitely things to pay attention to. First, let’s talk about lagging data then we’ll get to what we should pay attention to this week.

On Friday, we received jobs data. This is important because this helps paint the picture of the underlying health of the economy. In this case, the unemployment rate did increase to 4% from 3.9% but this is hardly a number to really pay attention to. What was encouraging was work force participation rising .3% to 62.2%. This is the real number to pay attention to because it’s indicative of solving the labor shortage issue in the U.S. which impacts inflation. You can see we have a ways to go to get to pre-pandemic levels but the trend is promising.

This is a sort of “double edge sword” for growth stocks. The reason why, it means that the Fed has become more likely to tighten and potentially shock the market with a higher rate hike than expected in March. But, on a positive note, this means that a “recession” has become less likely on a longer term trend. This means that we will probably have to deal with lower growth stock valuations but, the overall health of the markets and economy are still in-tact. Multiple compression from risk premium is different than market crash’s from poor economic outlook.

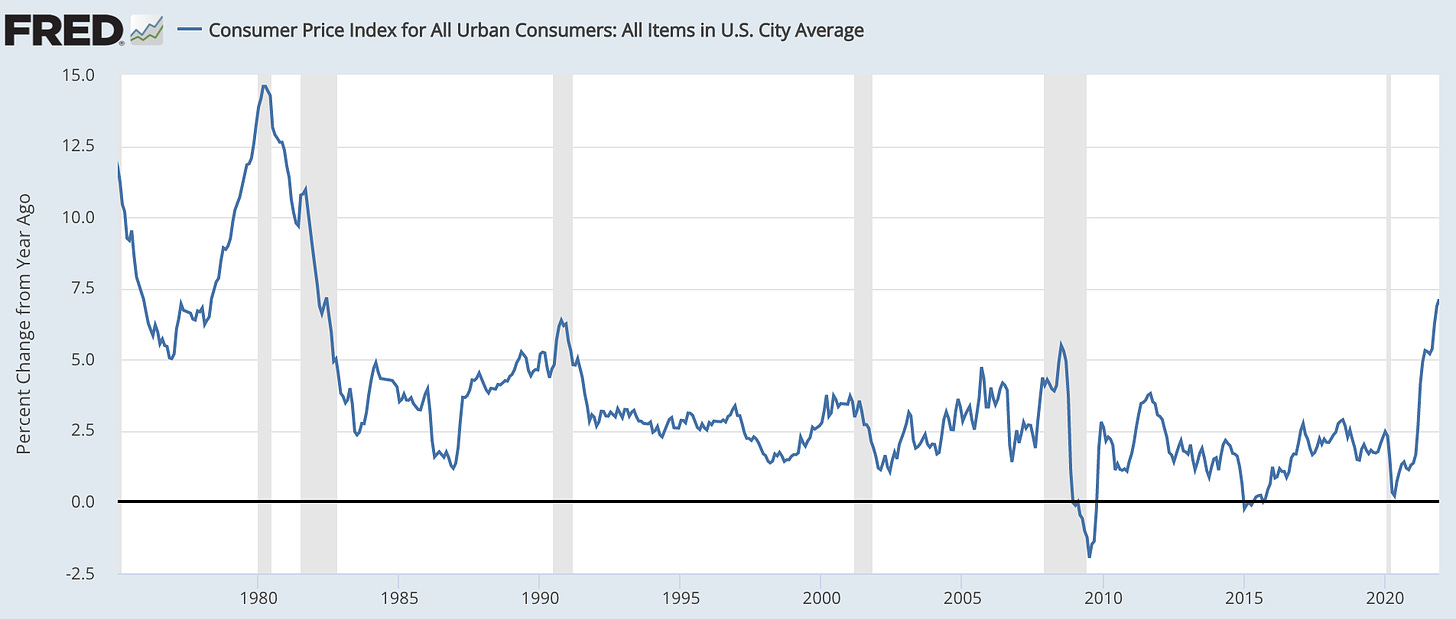

Inflation is also something to be aware of. I do think this goes without saying how bad it is right now. People who don’t even follow the financial markets know/feel/understand what’s going on. Essentially, this has predominately been the story for the better part of the past year.

On a month over month basis, we’ve seen inflation raise nearly 1% in some cases and over the past few months we have seen a gradual down trend. The reason why this is important to pay attention to from a growth stock investing perspective:

The impacts the underlying economic durability. Small caps and businesses with questionable durable motes may not be able to keep up with rising prices which impact the bottom line. This is likely why we’ve witnessed large cap stocks do so well for the past year and small caps essentially in a bear market.

This encourages the Fed to act more aggressively. The way the Federal Reserve fights inflation is essentially reducing the money supply and raising rates. This impacts “risk assets” (growth stocks are apparently risky) and long duration because investor appetite becomes shorter when liquidity is withdrawn from the financial system. When rates are raised, this effects the risk premium which is essentially the expected alpha over low risk assets like Government Bonds. Easy money = good for growth stocks. Expensive money = bad for growth stocks.

Inflation inherently creates a lot of uncertainty which decreases risk appetite for investors. At the end of the day, people need to want to buy an asset in order for it to go up in a market. If there are no buyers, regardless of underlying business fundamentals, the stock wont move. Markets are not perfect and there is no such thing as an efficient market.

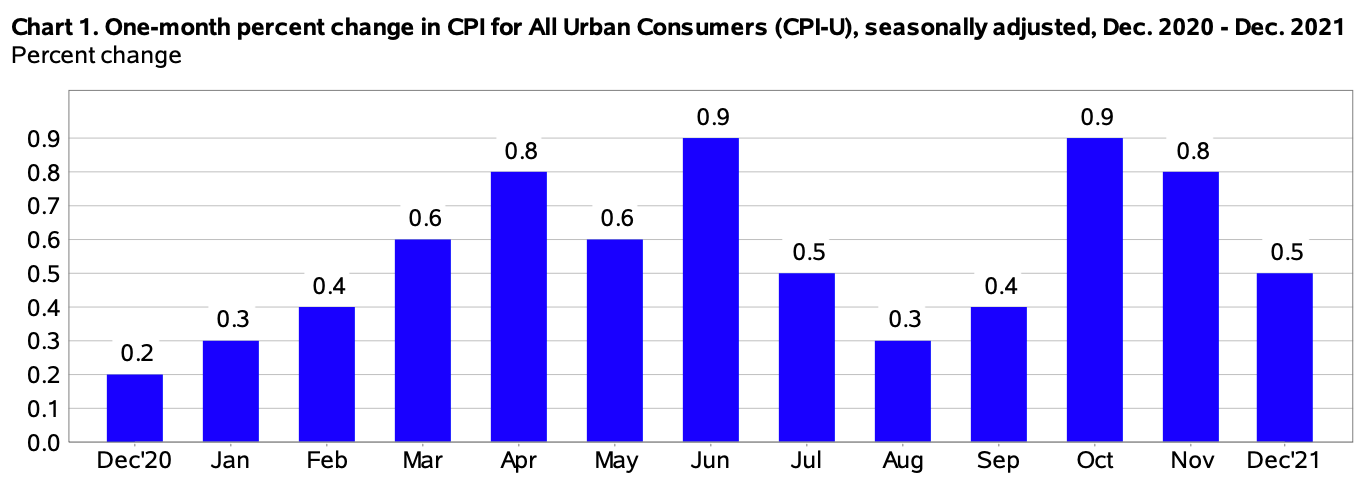

CPI Data this week is expected to update for the month of January. This is very important and a lot of factors hang on this release. Consensus currently has it coming in at 7.2% YoY from last January and .5% month over month, which is the same as December. Core CPI, a different measure, is also expected to come in high as well with 5.9% YoY and .5% MoM. Essentially, this is what is likely to happen when the data is released:

If it comes out hotter than expected, market volatility will resume and the NASDAQ is very vulnerable to a larger correction. ARKK is definitely questionable but will be put under pressure if it comes in too high. It’s pretty bombed out and it’s hard to imagine significantly more down side.

If it comes in lower than expected, markets will likely rally as this will adjust estimates and will impact the Fed’s tightening cycle. Our best scenario is it coming in cooler. Inflation needs to cool off and if the secular trends begin to take force, this will be good for the broader economy and financial markets.

If it comes in-line, markets likely to move little. All expectations and projections are currently priced in.

In my opinion, it’s a total toss up and bulls/bears are equally able to be wrong with inflation projections/outlook. There have been factors that would suggest CPI cools off and that it’s still hot. In this case, there has been chatter that vehicle prices could have fallen in total for the month of January and will likely see continued weakness for the rest of the year. But, on the other side of the coin, Supply Chains are still a mess. Yes, they are showing signs of easing but shipping and transportation costs are still high which is being passed onto the consumer. My expectations are that it likely comes in line but the inner bull/optimist is hoping for a cold reading.

This Weeks Growth Stock Earnings

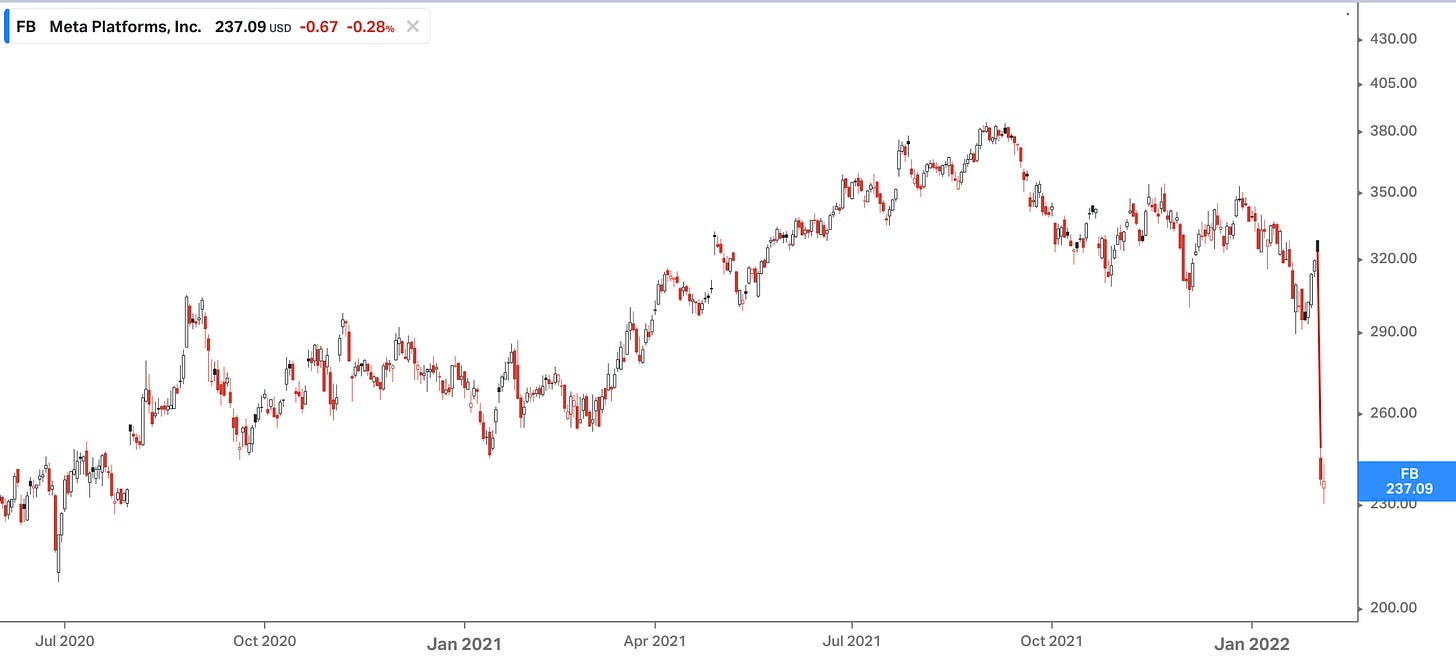

There are many growth stocks in the market but there are few that, in my opinion, have a very optimistic outlook. These are the ones that are very notable and we could see some big moves in any of these stocks. This expectation of volatility comes from no where else other than Facebook (Meta).

Or, SnapChat rising 50% after earnings, Amazon +13.5% and Pinterests rising +11%. The funny thing is that a lot of this earnings were not that stellar. But, I believe so many of these growth stocks have been priced for death that anything more than missing expectations will likely have a multiple re-adjustment on the upside.

Important Growth Stock Earnings to Paying Attention to:

Tuesday, February 8th

Digital Turbine $APPS: I have a position, Digital Turbine specializes in its “single tap” technology for android devices and falls under the AdTech category. Their forward P/E is 20x with an expected 30%+ growth this year. Expectations for this earnings: Revenue $353m and Non-GAAP EPS of $.43.

EnPhase $ENPH: EnPhase specializing in solar, battery storage and renewable energy. I have had this one on my watch list for awhile and have been following along. Their forward P/E is 45x with an expected 40%+ growth this year. Expectations for this earnings: Revenue $399.62 and Non-GAAP EPS of $.59.

Doximity $DOCS: Doximity is a social media platform for Doctors and other physicians in the medical community. They monetize by selling ad-space to Pharma and Med-Device companies on their platform. Analysts have their forward P/E at 81x with 29%+ growth this year. Expectations for this earnings: Revenue $86.3m and Non-GAAP EPS of $.12.

Wednesday, February 9th:

Twilio $TWLO: Twilio operates a cloud communications platform that allows for customer engagement for its users. I follow Twilio and don’t have a position. Their forward P/S is roughly 10x and they’re expected to grow 32% this year. Expectations for earnings: Revenue $769.3m and Non-GAAP EPS of -$.22

Thursday, February 10th

DataDog $DDOG: DataDog specializes in cloud application management and security. I have a position in DataDog and believe they provide a unique combination of growth and profitability. Their forward P/E is 255x while expected to grow 40%+ this year. Expectations for earnings: Revenue $291.3m and Non-GAAP EPS of $.12.

InMode $INMD: InMode specializes in radio technology that is used for body contouring and other vanity methods. I have a position due to unit metrics, leadership execution and unique competition position. Their forward P/E is 23x and is expected to grow 20%+ this year. Expectations for earnings: Revenue $103.5m and Non-GAAP EPS of $.57.

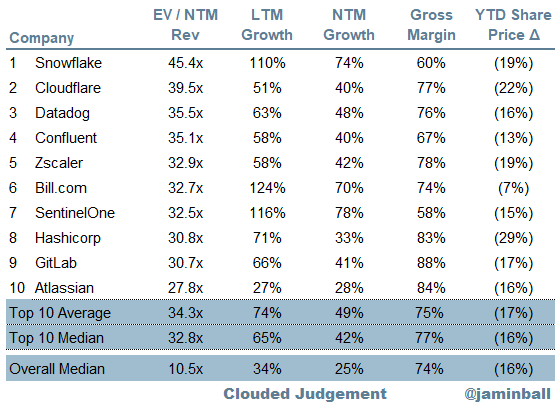

CloudFlare $NET: Cloudflare operates a cloud platform that provides various cloud business services, including security, world wide. I don’t have a position because I still have a difficult time valuing this company, as it still trades at a premium. I will dig deeper. Their forward P/S is 37x and is expected to grow 35%+ this year. Expectations for earnings: Revenue $185m and Non-GAAP EPS of $.00.

Confluent $CFLT: Confluent offers an enterprise solution for Apache Kafka. Its platform acts a lot like a “central nervous system” with Confluent acting as the brain to Kafka management. I have a position and will be watching for managed cloud growth to continue to expand 200%+. Their forward P/S is 31x with an expected growth of 37%. I think growth is sandbagged due to managed cloud growth and acceleration. Expectations for earnings: Revenue $109.8m and Non-GAAP EPS of -$.21.

With many growth stocks 50%+ off from their highs, a few of these companies do still trade at a premium, like $NET. But, there’s an argument to be made that CloudFlare will continue to grow for 10+ years due to their product offering and the outlook for cloud. Confluent and DataDog also trade at premium valuations but an argument can be made that DataDog’s profitability, future and growth is unrivaled and Confluent’s managed cloud being incredibly difficult to value. Regardless, all of the stocks listed above are worth paying attention to and should all beat expectations handsomely. If they do, I would anticipate seeing a small valuation expansion.

This is no better shown than by @jaminball and 10/10 recommend following him on Twitter and subscribing to his free SubStack.

Until Next Time

I’ll continue to keep you guys updated on quality growth stocks and the outlook from a technical and macro perspective. My passion is growth stock investing and I am optimistic about the future of innovation and technological evolution. If you’re not already, please subscribe to either free or paid.

Thank you for taking the time to read or listen.

Stay Tuned, Stay Classy

Dillon

Growth Stock Outlook - The Week Ahead