Stock Ideas: Nuvei - International Payments Provider

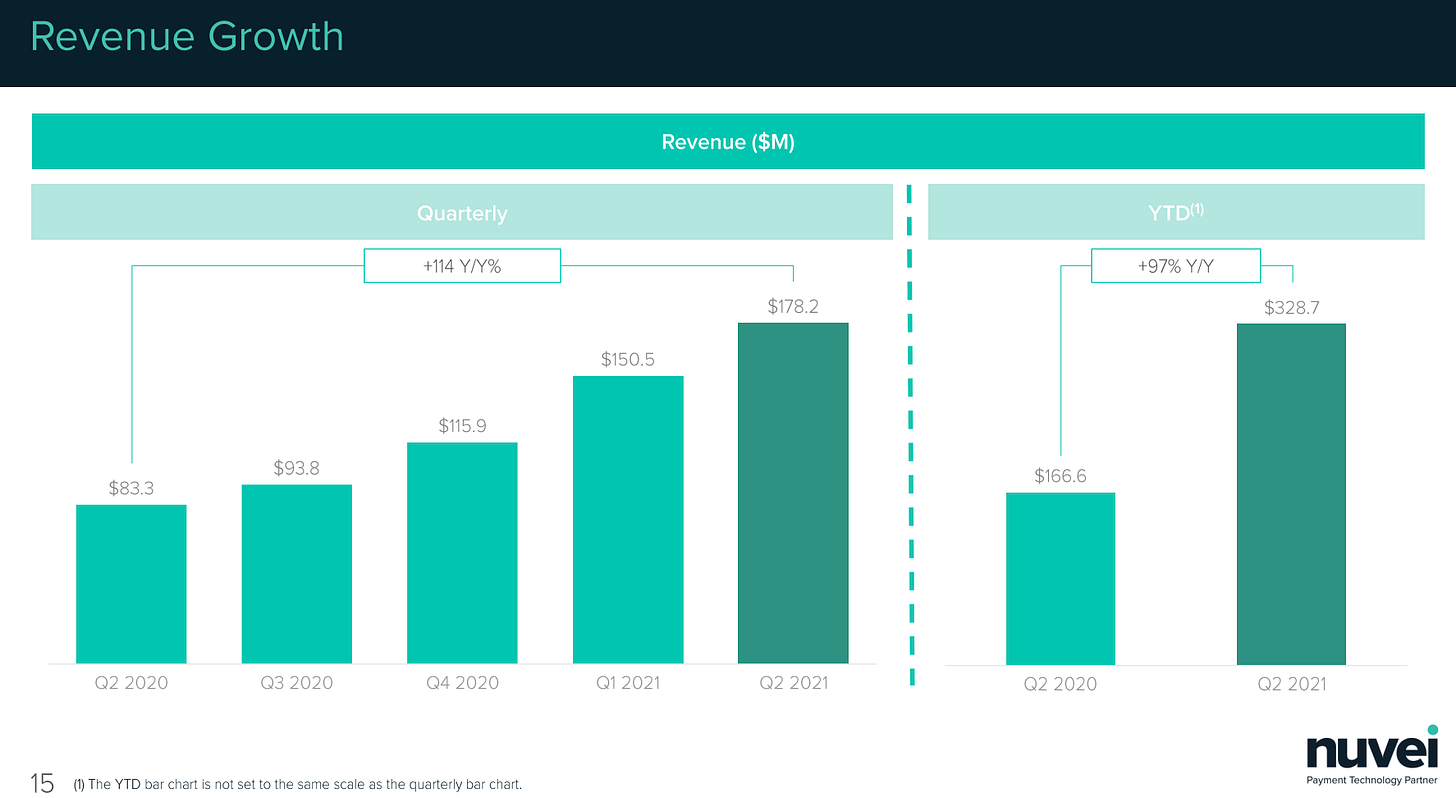

NVEI: Latest Quarterly Results: 114% YoY Q2 Revenue, Net Income 144% YoY

I’ve often received a lot of feedback that the service many subscribers and members appreciate the most is the opportunity to see and receive stock ideas before “the big run up”. This means a lot because I really try to bring new ideas to our community. Imagine finding the Shopify’s of tomorrow? I think we’re on to something with this one.

Before I begin, I’ll share with you all a philosophy of mine. A lot of my research and stock picks are based on a few fundamental principles.

The stock must at least have a path to profitability. If the company is growing fast while earnings positive, this is even better.

Must have a competitive advantage and be a differentiator in their category. Competition is ok, but a clear moat is an absolute must.

Strong revenue growth, especially in organic revenue growth.

Participate in a market that’s large or growing rapidly.

At the very surface level, you can sum it up in these 4 points but there is more to go into it. I will be sure to write a publication on this process at a later date. Either way, the goal of BluSuit remains the same.

My goal is to provide our investing community with investing ideas, insights and strategies so we can ALL make money to achieve our financial goals. I always love your feedback and ideas too.

This does come with risks though, being a first mover. All stock ideas must not be considered absolute because there are variables and details that may not be relevant today that change with the rapidly growing/changing business climate. Picking stocks before the big run up is not easy and requires patience/conviction.

When I apply the four core principles of stock picking (above) with the business I am talking about today, it checks all the boxes. I believe Nuvei can generate long term share holder returns and should be considered for a further look. My research below that I hope you guys find valuable and entertaining. If you haven’t already, consider supporting/following BluSuit more or just follow along for the free content I do provide,

Digital Payment providers over the years have disrupted the banking industry. There are many solutions we’re familiar with as retail investors which include:

Buy now, pay later

Digital wallets

Cross boarder commerce

Point of sale

Crypto currency

Digital remittances

Nuvei finds itself at the intersection of cross boarder commerce, point of sale and crypto currency. The way they describe their business, taken off their website, is:

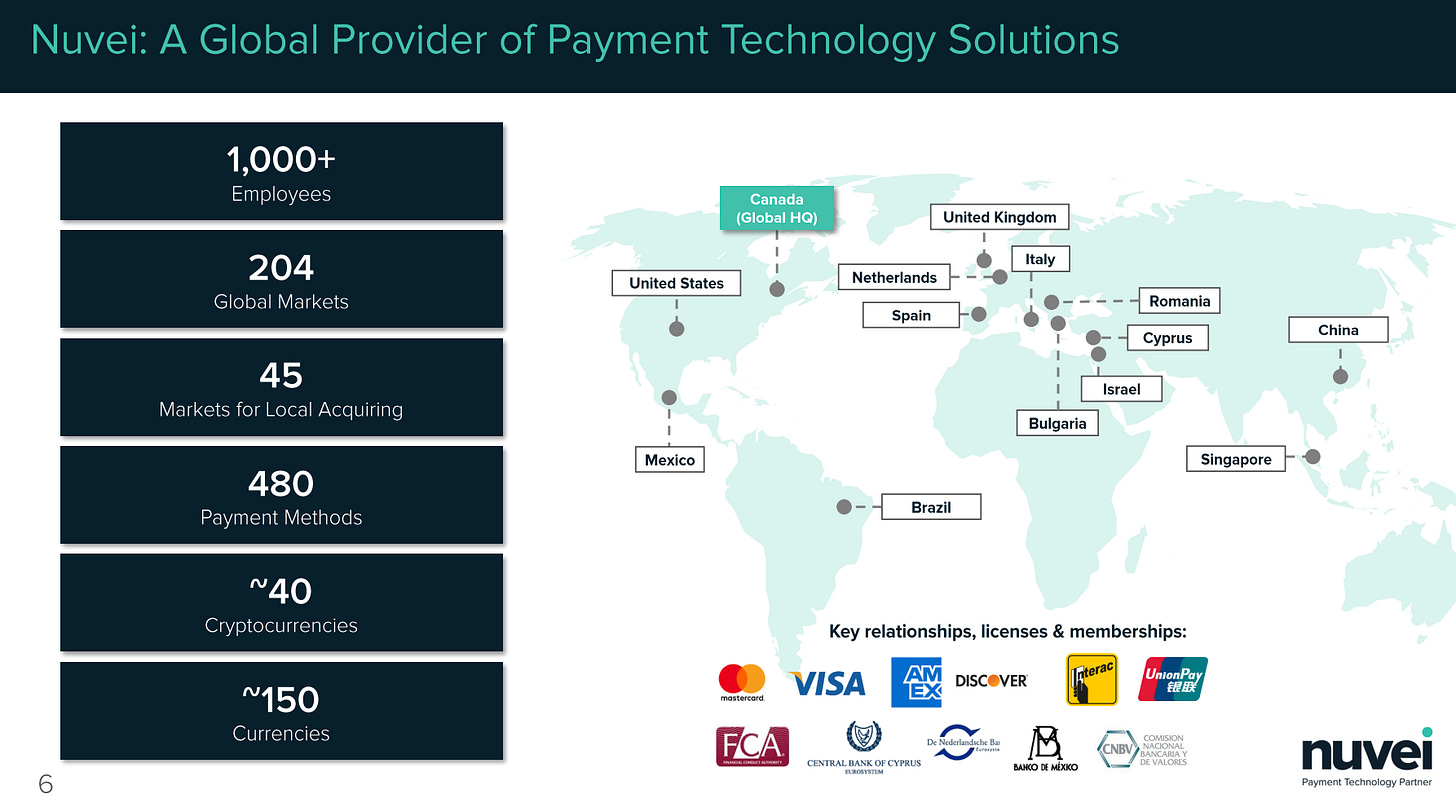

We provide the intelligence and technology businesses need to succeed locally and globally, through one integration – propelling them further, faster. Uniting payment technology and consulting, we help businesses remove payment barriers, optimize operating costs and increase acceptance rates. Our proprietary platform provides seamless pay-in and payout capabilities, connecting merchants with their customers in over 200 markets worldwide, with local acquiring in 45 markets. With support for over 500 local and alternative payment methods, nearly 150 currencies and 40 cryptocurrencies, merchants can capture every payment opportunity that comes their way. Our purpose is to make our world a local marketplace.

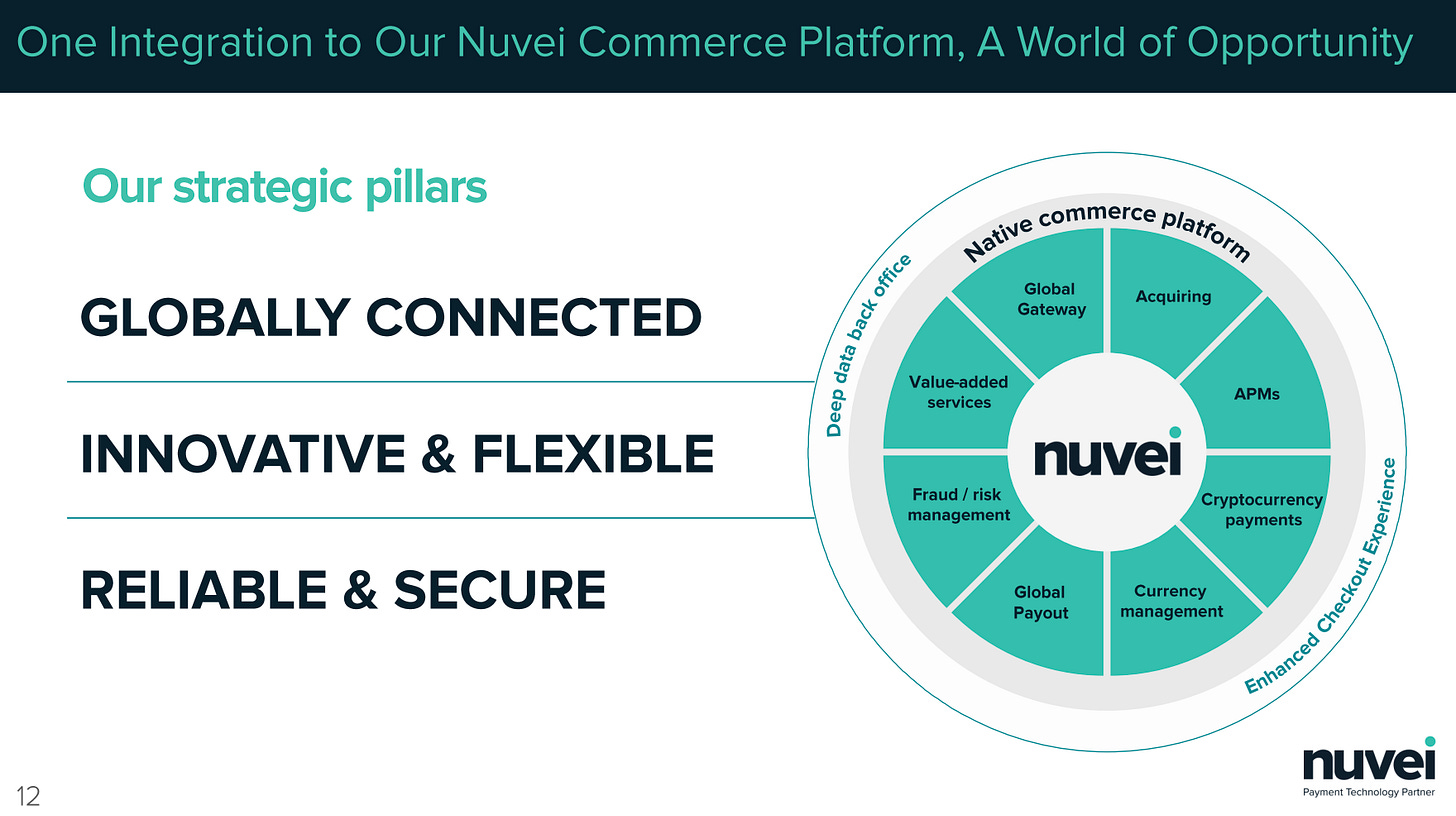

If I could simplify exactly what that means, I think the last sentence sums it up the best. They are closing the boarders of commerce with their payment solutions and vast offerings. In one of their investor calls, they described it as, “in relation to our competitors, we offer a more robust all in one solution. We can integrate with many of the larger players, like PayPal, and our clients and can still work with us. This really sets us apart because they will continue to use us, as their business grows, for more solutions.”

Let’s dig deeper into a few key details:

Nuvei business model

Total addressable market and competitors

Financials

Long term investment thesis

Nuvei - A One-Stop-Shop for Payment Solutions

A truly global company, I was originally surprised to see them finally up-list to the NASDAQ. With a current market-cap of $18B, this is not a small business and virtually unheard of in the FinTwit and YouTube community of retail investors. They IPO’d on the Toronto Stock Exchange in October 2020 too and have rallied 227%.

Nuvei provides digital payment solutions for its customers world wide, operating in countries all over the world. They currently have a global presence in North America, Europe, Africa & Middle East, Asia-Pacific, and Latin America. Because of their expansive global footprint, they’ve noticed increasing global payment volume which has created an acceleration in their revenue.

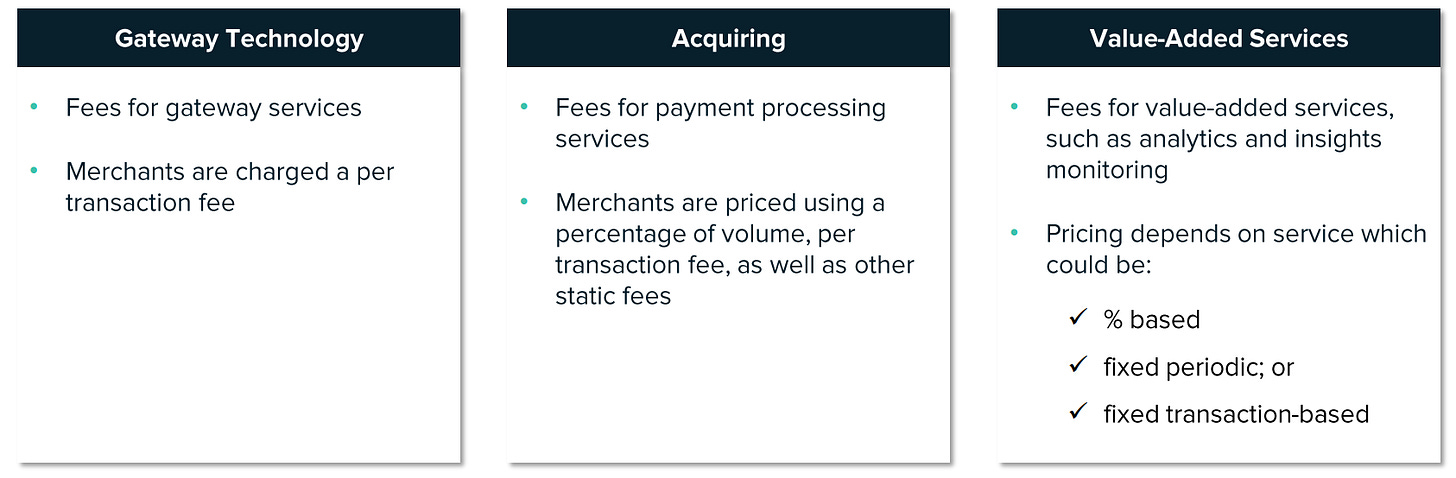

Nuvei makes money in three ways (above), which is typical for most payment processors. Much of the GPV (gross payment volume) is processed and a % is taken. In addition, fees are usually associated for using their platform. The unique characteristic of their model is that they provide a type of SaaS solution (Value Added Services) for much of their payment volume.

When thinking about their revenue model and the differentiation from other payment processors, it really is unique to see and understand their financial product depth and solution. Nuvei operates in an “all-la-carte” fashion as one platform for many different solutions; offering mobile/electronic, point of, and backend processing for digital payments. Their speciality services have enabled them to operate primarily within 12 verticals internationally:

Online gambling and sports wagering

Gaming, think of e-sports

Online retail, aka e-commerce

Marketplaces

Digital goods and services

Network marketing

Travel

PayFac’s & ISV’s, this stands for payment facilitator and independent software vendor. Think of their integration capability with other FinTech’s.

Shopping carts & platforms, much like what Shopify does

Developers

Banks

Recently, the announced that they will be the payment facilitator to BetMGM showing their interest and focus on gambling and wagering.

They also, recently, announced that they will integrate digital payouts with Visa internationally.

Nuvei’s vertical depth and expansive capabilities allow them to access and integrate within many different areas of the FinTech market. This allows them to have a unique competitive advantage over their competition. Essentially, they don’t need (but they obviously still do) to compete with their competitors because they can integrate and work with them to compliment any short coming.

The image above paints the full picture with exactly what they do. Nuvei basically runs pay-in and pay-out capabilities, but also enables other business transactions. This is helpful both domestically, but especially internationally. Nuvei’s global capabilities enable thousands of payment methods to work with one store, one solution. On the backend, Nuvei takes care of the security, global pay-in & pay-out, the currency exchange rates, fraud, and regulatory issues.

Nuvei has also integrated a crypto-currency component to their business model, which came from their recent Simplex acquisition. This will allow Nuvei the ability to convert fiat currency to crypto currency and visa versa. In addition, they will be capable of issuing Visa cards utilizing crypto payments, further enabling the buying and selling of crypto globally. This is a relatively new, bullish, business capability that can tell us as investors they are looking toward the future to continue further growth. We all know crypto is the future.

To summarize, I often like to do a “one liner” for a business description: Nuvei is a front end and back end digital payment solution that enables both the customer and business conduct commerce transactions, globally.

Market Opportunity and Competitors

Nuvei most reminds me of DLocal, another payment company I own. However, where they are different is that DLocal focuses more on emerging markets where a majority of Nuvei’s business is done in North America and Europe. DLocal’s solution is tailored to the emerging market as well, especially when it comes to pay-out’s for under developed countries. Two more notable competitors in this space are PayPal and Stripe. For those concerned about competitive risks, each business has their own unique niche and product offerings.

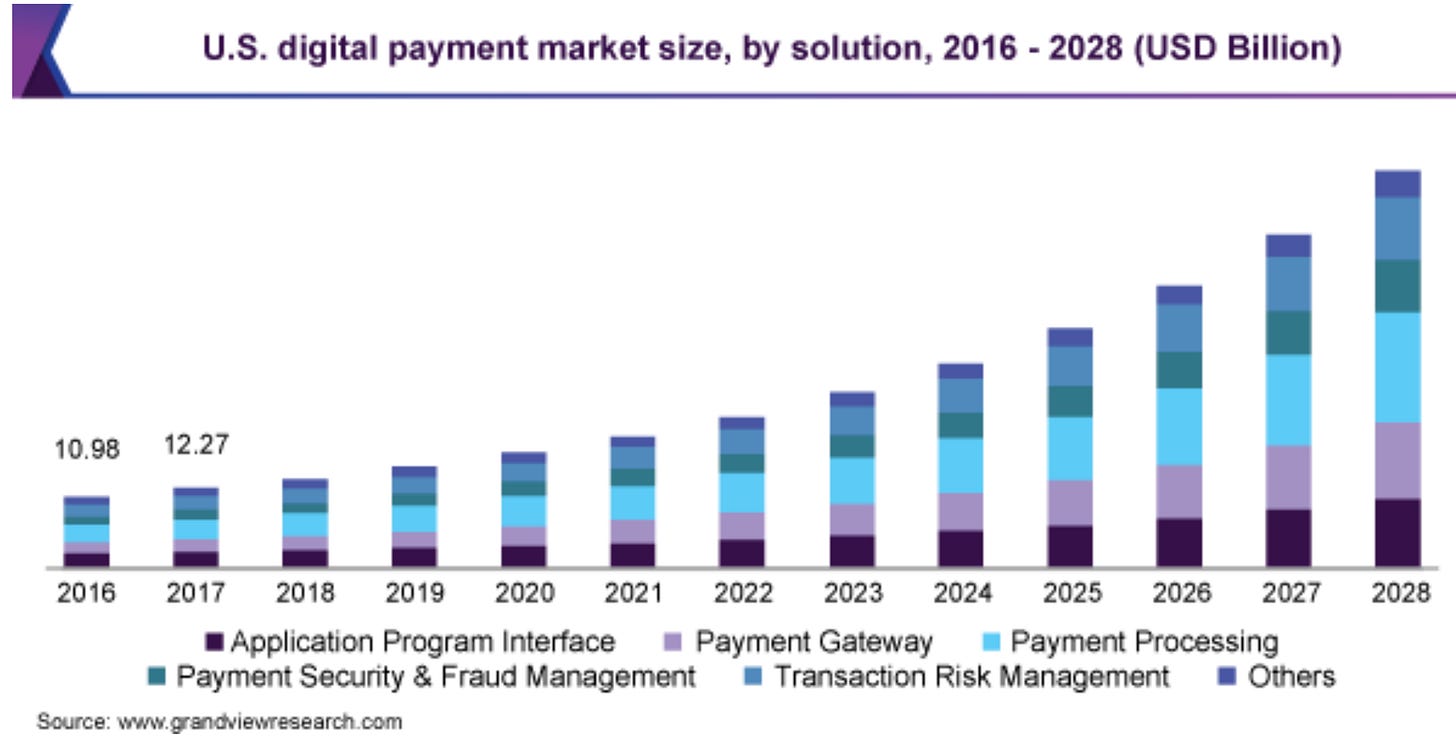

In 2020, the total addressable market was approximately $80b per markets and markets and has a CAGR of approximately 14% . Grandview research had it at a $58.3B market in 2020 with roughly a 19% CAGR until 2028.

With a market expected to grow so rapidly and while using a little speculation/assumptions, one can imagine the Global payment infrastructure is destined to expand for years to come. What’s more important is that Nuvei is capable of processing roughly 40+ crypto currencies, this is something the primary competitors cannot. Despite this, I still have no intention of selling DLocal. Think of it like this, if you could own Sea Limited, Amazon, and Mercado Libre, would you? When you have a secular trend like global digital payment enablers that participate in a seemingly limitless TAM, putting all your eggs in one basket seems almost irresponsible.

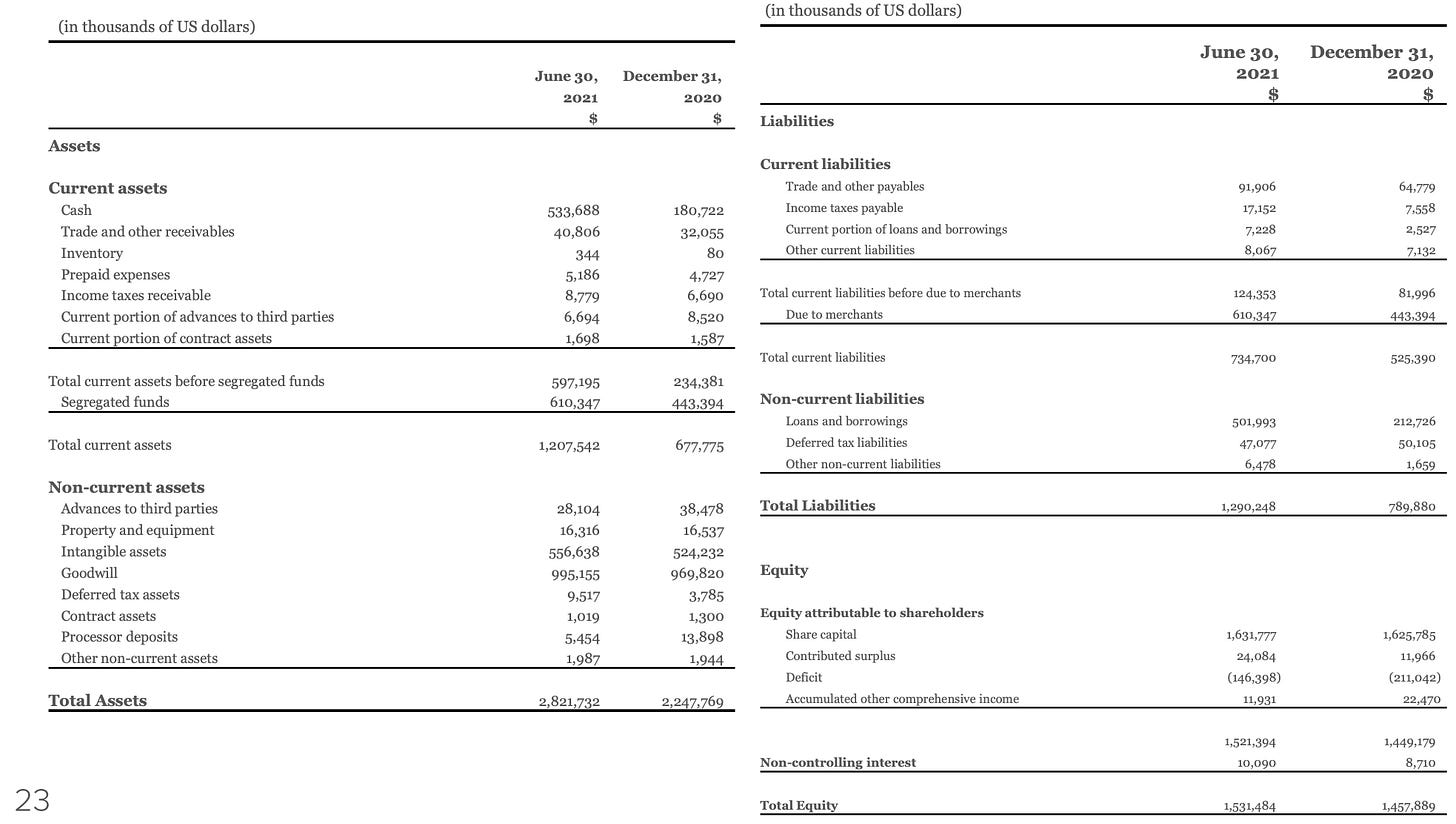

Financials

When first reviewing this business, the financials stuck out to me the most. It clearly became a no brainer to, at the very least, take a chance on this business and dig further. Let me show you a few highlights from their latest quarter:

Total payment volume increased 146% to $21.9B, up from $8.9B. 84% of this volume was commerce.

Revenue increased 114% to $79.4m, with 97%+ growth YTD

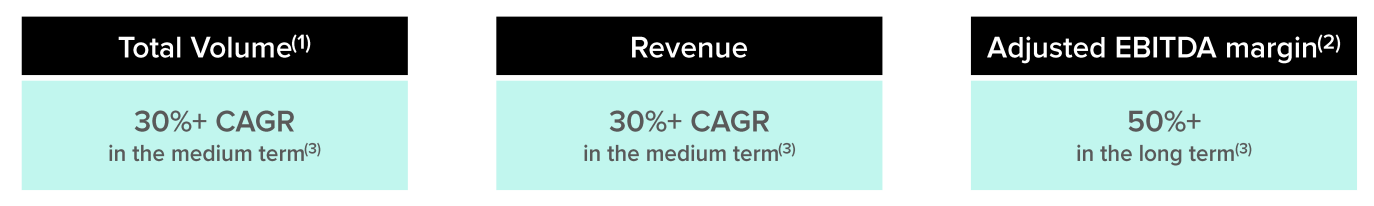

Adjusted EBITDA grew 112% YoY and 105% YTD from the last 6 months of 2020

Adjusted EBITDA margins of 45%, with a longer term goal of 50%+ EBITDA margins

Adjusted net income was $64.5m compared to $16.3m last year

EPS grew 144% YoY with 172% YTD. This is important because profitability is growing faster than revenue. Remember, earnings drive stock price appreciation.

Needless to say, there are few businesses that have margins like this. The Trade Desk, PubMatic, DLocal and a few unicorn companies fall in this category. It really is special to not just see this growth but also this profitability.

However, it’s not all it seems to be. A little over a year ago when they first IPO’d on the Toronto Stock Exchange, their growth was substantially less. Results below:

It’s not uncommon for businesses to accelerate growth shortly after they IPO because they have the liquidity to execute their growth strategies and I believe that’s the case we saw here. As I looked back on all their financial results, their revenue and net income continued to expand at an accelerated rate.

On their webcast presentation with BMO Harris, they mentioned that their accelerated growth can be attributed to their go to market strategy as well as the innovations they are focused on. Some of their latest quarters growth did come from M&A, but their organic growth was still very healthy. I think it would be reasonable for investors to temper expectations to be more in line with their medium and long term guidance.

A few things that are important to note, that I haven’t mentioned yet, is that they have consistently run 80%+ gross margins. They also have about a 1:1 ratio when it comes to debt and total cash on hand. Debt shouldn’t be an issue with low interest rates and a profitability margin.

Conclusion

I bought Nuvei and have began building a sizable position. Their margin profile and their opportunity for long term growth is very exciting. However, when thinking about the risks I am hyper focused on their growth and will be cautious to see/notice any sort of slow down. Back in 2018 - 2020, their growth was substantially slower than it is today. I am ok with owning a business that’s becoming larger, therefore their growth slows to 30% - 40% but noticing anything less than 30% in a hyper-growth, young company, is a massive red flag. I also will be paying attention to and will be continuing to study the competitors in this space. I believe as this market matures, there will most likely be some consolidation.

Regardless, the risks are lower than the potential reward for this profit and growth beast. I’m excited to add it to my portfolio of hyper growth, profit monster stocks.

Let me know what you guys think in the comments below, shoot me an email, tweet me, I enjoy our collaboration!

I always got more content with all of you. You know what that means!

Stay tuned, stay classy

Dillon

Great article, once again! You have an excellent ability to break down what's needed to start evaluating a new growth stock. The problem is my potential buy list keeps growing ;) I was almost going to ask how it compared to DLO (which I recently entered into on your recommendation), but you covered that! I'm really curious how the whole digital payment industry is going to play out. Might be worth a separate article at some point breaking down the industry players, competitive differentiators, growth projections, price entry points, etc. Thanks!