For the past 2 years, we’ve been in a liquidity fueled rally that created a different investing, or trading, environment. But today, the rules are different and things have changed. It’s volatile, hostile, and even worse, it’s shaking retail investors out.

Genuinely, I don’t want that. The retail investing community has grown over the past few years but it lost its way, especially in 2020 when the SPAC bubble began. In other words, we have to get smarter and evolve beyond YOLO trades and hoping for the best. I am fairly certain the better part of 2021 will be just as it is today.

In this publication, I am going to provide clarity on why prices are moving this way as there is a fundamental reason and explanation behind this. In addition, I’m going to provide perspective and a “2022 Playbook” for the investor seeking to build wealth. To be specific, we can classify three different types of retail participants, or “investors” to:

An Investor: Let’s drop the “long term” and just stick to investor. “Long term” typically indicates that they’re not actually long term because everyone is a “long term” investor till shit hits the fan. In this case, an investor is a retail participant seeking to understand the workings of the market and the businesses that participate in it. They select the best businesses they can to produce future wealth.

A Trader: Some of the best and most sustainable traders I know typically go off some variation of the “CANSLIM” methodology. These participants, once they get good, adopt trading as a profession and they’re good at it. These traders typically have a system they operate in and very rarely operate outside of it. To you guys out there, I got nothing but respect.

A Speculator: Often mistaken for an investor or a trader. This is typically where we all start in some way or another. ALL OF US, Traders and Investors. Typically this individual will either find a niche of trading or investing that best suits them and their life style. Or, they may lose a lot of money and never come back. There’s nothing wrong with being a speculator because in many ways, they become the expert traders or investors of tomorrow.

This publication is more geared to the investor because this play book is definitely going to be volatile in the short term, but rewarding in the long term. It’s rooted in the thought process of buying wonderful COMPANIES at amazing valuations for excellent long term rewards. But first, let me give you a format to expect:

The “why” behind the market sell off and “why” growth stocks have been left for dead

2022, the accumulation year and what comes next

Stock Picking 101

Macro, Micro, and the Great Inflation

The root of all this selling is directly related to inflation, which is a topic I’ve published a lot on. To summarize, inflation was driven higher by excessive government stimulus and spending in 2021.

The best way to think of it as a massive tidal wave of liquidity. However, with all this demand sparked by liquidity came another inflationary force. There was a drastic shortage of labor, which exacerbated worker shortages and supply chain disruptions. Make no mistake, it was related to the Fed but the core of inflation was through Government spending policy.

The reason why I bring in the spending policy is that it put money directly into the pockets of Americans which created a massive influx of demand. We can predominately see this in corporate earnings over the past year. It was the “re-opening trade” where the narrative was “pent up demand” and the consumer would go out and spend all their money. Surprisingly, this is exactly what it did. But we have a new problem surfacing.

It is recession fears, mostly driven by consumers not having the same type of buying power as last year and consumer sentiment extremely low. This is most apparent by Atlanta Fed’s GDPNow estimates coming in extremely low. More importantly, a lot of the company earnings we are seeing come in are guiding for Q1 results to be lower than expected. This is telling us that our economy IS slowing and with the yield curve flattening, there are a lot of recession signs flashing.

This is most apparent in the UofM consumer sentiment reading. You can see that when consumer sentiment falls this low, it’s typically during periods of a recession. The grey bars represent recession.

The Narrative Summed Up

Essentially, the COVID pandemic disrupted our entire economy and we are in one bad hang over. We drank too much fiscal stimulus and our economy and financial markets are trying to find a new equilibrium. There’s a lot of debate on Wall Street about what comes next especially when thinking about inflation or potential economic woes. A major concern, in many ways, is how this will be impactful long term. The biggest question of which; is inflation transitory? Inflation is really damaging the economy and exacerbating the wage gap.

Portfolio Strategy and Management

Let me touch up on a few terms quick:

Alpha: A return in comparison to a major index, such as the S&P

Beta: The measure of volatility

Since the bottom of the COVID pandemic, stock pickers enjoyed extreme alpha in high beta assets. The trade of 2020 was “stay at home” and 2021 was all about software and a “bar bell” approach to decrease beta. At the back half of 2022, we’re in hangover, risk off sentiment. Basically, the market is in “sell button” mode. It doesn’t matter what’s happening, just sell. Company fundamentals? Doesn’t matter, hit the sell button. Valuation? Nope, just smash that sell button.

If a stock or an asset has the slightest bit of risk, it’s automatic sell mode. This is directly due to fear and uncertainty gripping the markets. Some people think it’s due to tightened conditions with liquidity and although, yes, this is true there are two rebuttals here:

Bank Reserves: Are still extremely high, which is a measure of liquidity in the banking system. This says the banks are flush with cash.

Reverse Repo’s: This is another measure of excess liquidity and really became prevalent last year, in 2021. The Fed did this to control excess in the system and prevent banks from driving negative rates in short term bonds. It’s also historically, extremely high.

Essentially, one can quickly draw a conclusion that there’s more than enough liquidity out there. It’s the economic cycle that’s come into question with a lack of fiscal stimulus. This big question mark on the economic cycle is leading to a pause in the financial markets. Basically, if you take the punch bowl away the party stops which is exactly what’s happening today.

So, what comes next?

This will end, I can make a sure promise of this. The markets currently have 4 rate hikes and possibly quantitative tightening priced in. In other words, they’re pricing in a very aggressive, ugly, scenario from the Fed. Investors are concerned they’ll damage the economy and crash the financial markets. It’s all speculation, all of it. Nobody knows what’s going to happen.

This is why I’ve coined 2022 as the year of opportunity and asset accumulation

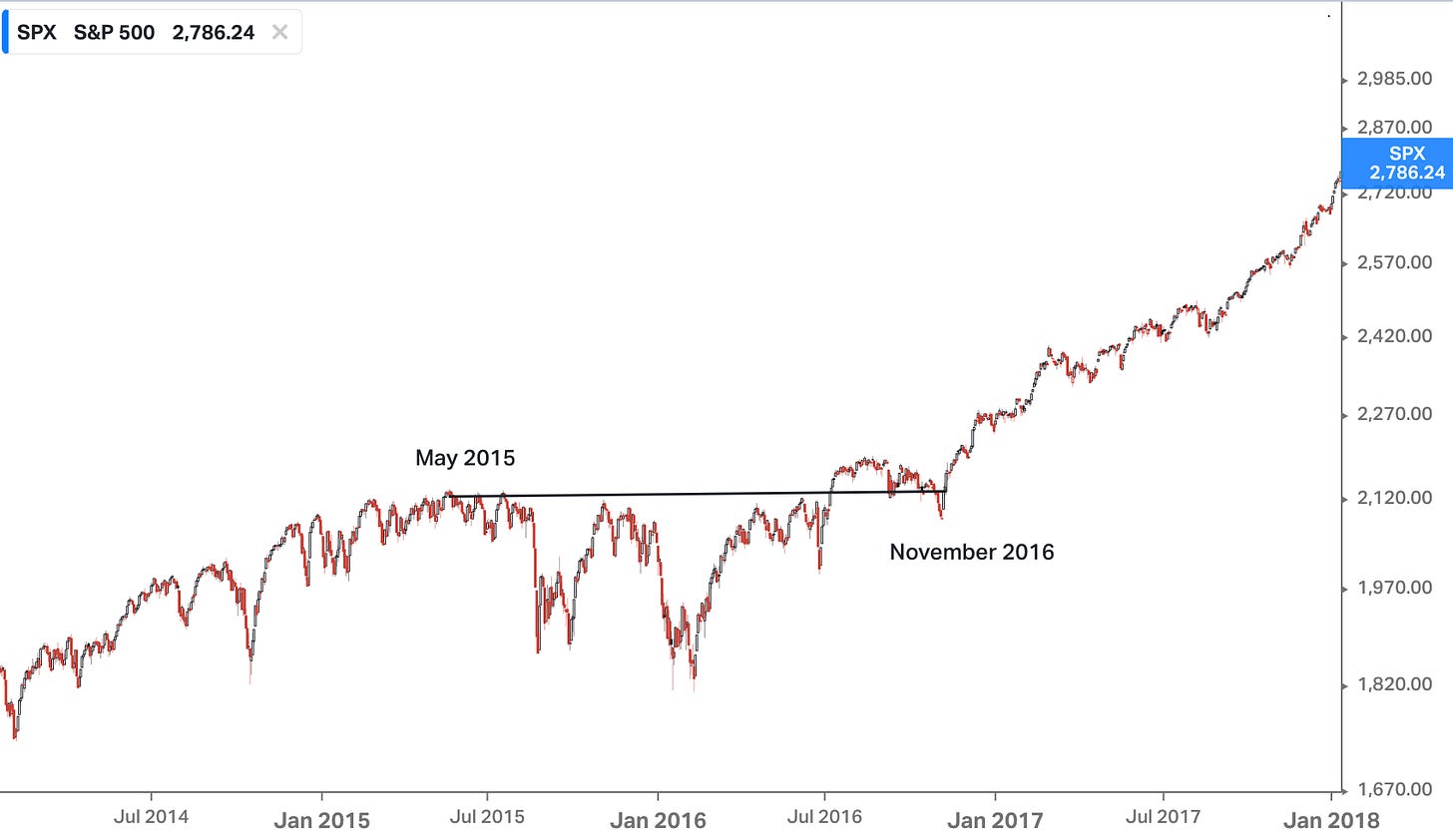

This most reminds me of 2015 and 2016 during the last time we began tightening of monetary conditions.

This was, once again, a time of extreme uncertainty with tightening fiscal conditions. One could assume that 2022 will be much like this, where it began in November of 2021. In other words, I fully expect 2022 to trade relatively flat to down ALL YEAR.

I would be highly doubtful if any stock runs too far away from your original cost basis upon entry. In additional, you can nearly throw technicals out the door. Stocks are going to go which ever way they want to. As of writing this, February 3rd 2022, it’s never been more apparent. Recently, Facebooks stock has declined 25%+ in ONE DAY, PayPal has suffered a similar fate. On the flip side, Snap, inc. was up at 50% at one point in the after hours market!

This is insane volatility. But, there’s enormous opportunity everywhere.

I have to direct you to what happened after November 2016, when the markets finally got the direction they were looking for. The rallied, hard, for TWO STRAIGHT YEARS.

I am not saying take a total punt on this year. Obviously, we all want gains. But, I am saying it is incredibly smart to think about and understand that periods of high volatility is almost always followed by long periods of low volatility. In this case, the investor doesn’t live and die by the returns they may accumulate every quarter or year but they take the time to leverage their existing methods of cash flow to expand and improve on stock selection for the longer run rally.

For example, MercadoLibre today is trading at $1,000 per share. But during May 2015 to November 2016, it gave a big ole nothing burger and was nearly down 50%. Imagine focusing on the business during this year of volatility and adjusting your cost basis to be sub $100. Your gains in the years to follow were incredible.

Essentially, what I’m trying to say is focus on the business and think about what is to come. Your returns will come back 10 fold if you can handle the volatility, allocate cash to your portfolio and PICK good businesses.

Stock Picking

I wrote an guide for BluSuit Members awhile back which can be found here:

The guide linked above is a great resource to help you understand what to look for when doing fundamental analysis. But, when it comes to stock picking, it’s just as much about mindset as it is about skill.

Patience, volatility, discipline and confidence

Those, above, are all the highest quality skills you can have. It’s the ability to shut out the noise around you with FinTwit’s insatiable appetite for short term thinking and price action. The obsessive prediction of short term trends regardless of the underlying business performance. Because at the end of the day, good businesses produce life changing returns.

One article that I think is a must read that I published:

This talks about the importance of the foundation you, as an investor, build as well as the mindset you must have to succeed in this business. The key to life changing returns are rooted in doing what 90% of the people in the markets are not willing to do. It is embracing volatility as a badge of honor, as a sort of “fee” to pay to produce market beating returns over time.

Stay Tuned, Stay Classy

Dillon

Share this post