I have been silent for some time, but it’s time to break my silence to warn of the dangers, and communicate the signals I am seeing from the financial markets. To provide credibility and serve as a friendly reminder, I correctly called the last market crash in November, 2021 which was a time of peak euphoria, chest pounding and bragging. I, myself, even found over confidence during this time period which was a humbling lesson that I will never forget over my next 30 years that I plan on participating in the financial markets.

After the last bear market, I learned crucial lessons like:

It’s never different this time

Every cycle must end

It matters WHAT YOU PAY

High valuations shouldn’t be ignored

Narratives follow price action

The Warning on November 10th, 2021

The Coming Market Crash

I am releasing this publication during the Q4 2021 earning season. There is a lot of noise and discussion about company results. However, one of the most important things to do as an investor is be proactive, not reactive, and be forward thinking. Markets as a whole are historically reactive, meaning emotions play a heavy role and tend to exacerbate moves. The goal is to have a plan and be aware of the three sides of each coin: the heads, the tails, and the in between (side). We are going to look forward at the impending, very large threat that looms ahead of us. Controlling your emotions will be crucial.

From macro, to elevated valuations and a deteriorating technical picture, I see similar warning signals now. However, what’s different is that we’re not transitioning from a bubble created by easier monetary policy but a bubble led by a “flight to safety”, or “quality” among all else. More importantly, this prevailing narrative that somehow chatbots (LLM’s & AI) will generate massive earnings growth for years to come, which it could, but a wake up call is warranted especially over speculative traders, investors and financial managers.

I See Danger Ahead

I don’t see risk equally in the market cycle ahead, much like the bear market in 2022, there are opportunities ( for example; Oil, Gas and Staples in 2022) that have the ability to, of course see volatility, but rebound aggressively once the Fed reacts to what’s to come. To me, this picture starts with both the technical picture and valuation picture within financial markets today. However, seeing risk is different than seeing the catalyst that will create the change in the market cycle, which I believe is the most important piece to this publication.

This thesis will be broken into 3 parts:

Valuations and Assessments of Risk

The Macro Catalyst to Shift the Market Cycle

The Sector(s) that Historically Benefit in the Next Phase of the Cycle

Before I go further, I must warn you that this will not be a popular opinion but it will be authentic, balanced, unique and thought provoking, at the very least.

Valuations, Technicals and the Assessment of Risk

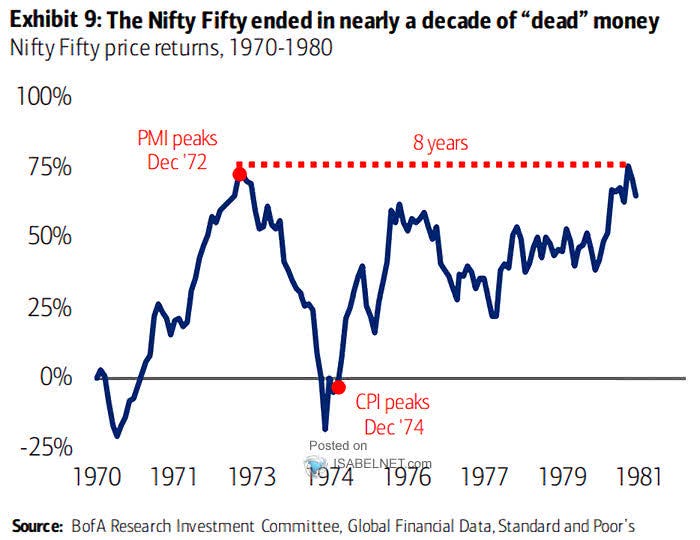

As mentioned, I don’t believe the balance of risk is equal in the event of a recession. I do believe this latest market cycle reminds me a lot of the mid/late 1960’s to early 1970’s. Just to be clear, I do think inflation will prove to not be secular, as it will be a cyclical phenomenon, but the late 1960’s offered a type of (investor) behavior that reminds me tremendously of the psychology we have today in the markets. It’s the psychology of, “buy quality”, “DCA into the index”, or “just buy the index and don’t worry”. It’s also the psychology of “buying companies that are immune to the economic cycle”. Those stocks, during the late 1960’s, were eventually coined as “The Nifty 50”, or the 50 best stocks that were not harmed by economic cycles, much like today’s Mag7.

This behavior originated after a series of bear markets began, after the longest secular bull market that began in 1950, that eventually ended in 1972. Below, you can see that, much like today, index’ing and (of course) buying the largest stocks proved to be extremely lucrative. Historically, this pattern has repeated itself multiple times. If you look at the bubble in the 1920’s, the largest companies drove the index up as everyone perceived these companies as “safe”. The same thing happened in 1995 to 1999, where the largest tech companies could “do no wrong”. There, historically, appears to be a phenomenon that the bull markets leaders tend to be pushed up to extreme valuations until the bear market begins and the cycle resets itself, then new leadership emerges.

Secular Bull Market of the 1950’s and 1960’s

The reason why I chose to compare todays market cycle to be similar to the 1960’s “Nifty 50” is that, much like back then, they were really quality companies! Many of them still exit to this day. For example; Johnson and Johnson, McDonalds, IBM, Pfizer, etc. were apart of the Nifty 50 and still proved to be wonderful long term holds. Much like back then, it’s hard to imagine a world, today, or in the next 15 years, without Tesla, Amazon, Microsoft, Apple, Google, or Nvidia. However, as history often proves time and time again, there is a price to pay, regardless of quality, and that you often make money when you buy rather than when you sell.

McDonalds Stock in the 1970’s

This leads me to today and where I see the most risk, as well as the major difference between the bear market I believe is yet to come and the bear market (2022) that we recently had. I believe the bubble that exists in passive investing into large cap stocks where people believe, and continue to believe, that all you need to do is hold Mag7 stocks and you’ll out perform. Recency bias is real and to be aware of recency bias, you often become a contrarian in your future analysis. Let me show you my thinking in a few charts.

Major Index’s with Mag8 Separated

As you can see, Mag8 stocks have seen a massive run largely driven by multiple expansion since roughly 2016, where the bifurcation began.

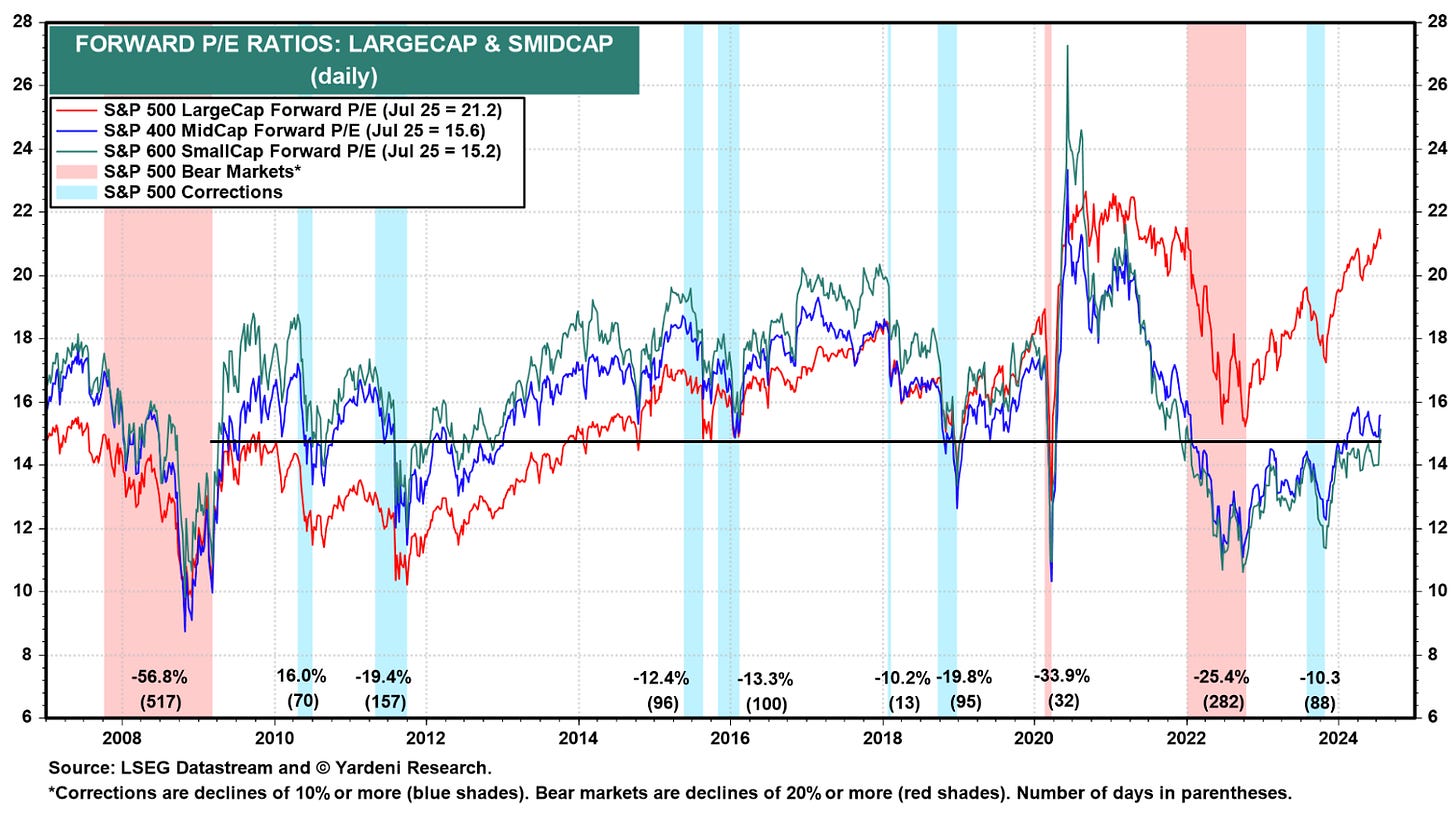

Large Cap, Mid Cap and Small Cap

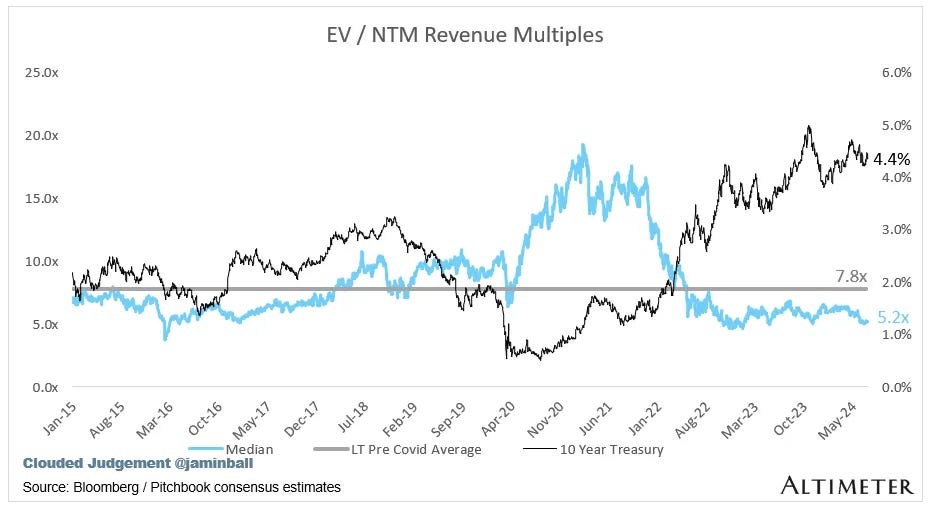

There has been a massive bifurcation in large caps compared to the rest of the market, in general. I believe this is psychological in nature due to many of the largest companies having “pricing power” (to combat inflation), durable business models (to weather economic down turns) and strong balance sheets (to be immune to high interest rates). Historically, small and mid caps are perceived as being more economically and interest rate sensitive sectors. This bifurcation is so pronounced that large caps are now as expensive as 2021’s bubble market and small/mid cap stocks are still depressed and comparable to 2012 levels. There are a few companies that come top of mind that have reached astronomical levels that no longer make sense.

Apple’s Forward P/E now Exceeds 2021’s Market Peak

Microsoft’s Gains have Largely Been Driven by Multiple Expansion Since 2016

Costco’s Forward P/E No Longer Makes Sense

Nobody can Argue that the S&P 500 is “Cheap”

I need to emphasize that I am not arguing that quality of these business models but that, simply, as a whole, these Large Cap companies have reached nose bleed, 20+ year high, valuations.

It’s Not Just the Fundamentals that Appear to be at Risky Levels, it’s Technicals too

If someone came up to me and said, “Dillon, when is the best time to buy stocks”, I would simply say, “at the 200 week moving average”. As you can see, below, healthy bull markets tend to have many cyclical bear markets which are important and crucial to the health of a secular bull market. If markets don’t reach the 200 week moving average for some time, much like in 2022, the draw downs tend to become more severe and prolonged. During those draw downs, years of index gains can be wiped out in a rapid and aggressive fashion. For example, in 2016, the S&P revisited 2013 levels and in late 2018 it revisited late 2016/early 2017 lows. In the event that a cyclical bear market hits, I would anticipate the S&P 500 to revisit early 2023 levels despite being nearly 30% higher.

This is a stark difference when compared to the small cap index, IWM 0.00%↑, that has been clearly bifurcated from the markets since 2021 and still has yet to make new highs. To me this is more of a quantification that small caps likely have limited down side in the event of a cyclical bear market than large cap stocks, that are currently trading at extreme levels.

This rally, in the S&P 500, has largely been driven by MegaCap Tech Stocks that, technically speaking, are trading at over extended levels. Only when the Fed was printing $120b/month or “QE but not QE” (in late 2019) has the QQQ traded this high above its 200 week moving average.

But don’t think all tech is frothy, the IGV (S&P 500 software index and similar to my investing style) is trading at reasonable levels and is forming what looks to be like a cup and handle, likely preparing for its next leg up assuming the “handle” doesn’t break down.

The reality is that the market, as a whole, is not necessarily in a bubble. The technicals reflect the same story that the valuations reflect. It appears to be MegaCap tech (the AI beneficiaries) that appear to have gotten an extreme bid that’s likely to correct. It would behoove of me to not overlook (the granddaddy) Nvidia, which, personally, looks terrifying and extremely similar to a lot of charts I saw at the end 2021’s market cycle.

Although I could write a unique publication as to why I think “AI” is in a bubble, I can refer you to the Goldman Sach’s 30 page document (button below) showing what I began to suspect last earnings cycle. In simple, there has been a massive infrastructure build out with much promise that “AI will change the world”. However, after 18 months into this cycle the promises of AI have yet to prove anything other than a value add for developers or customer service (as noted by Google’s CEO).

To simplify, there needs to be AI models that can do better than glorified chat bots that hallucinate (incorrect information) or generate pictures of dogs and cats. There must be tangible business value, or a hard ROI, to justify trillions in increased spend. Otherwise, we will inevitably lead to an optimization cycle. Today, there appears to be a “Red Queen Effect” (coined by Jammin Ball) going on within Big Tech, which essentially has this prevailing narrative of, “it’s too costly to under invest rather than over invest'“. In other words, they are piling onto the exact same thing, same GPU, same infrastructure buildout with little to no results showing… Yet.

Don’t get me wrong, I’ve been actively investing into companies that I believe are going to be AI beneficiaries long before ChatGPT because I knew it was coming. However, today, there is clearly a FOMO effect happening within AI which is where my problem begins and ends with today’s market cycle. I do not believe Nvidia can maintain 70% gross margins, especially in the event we lead to an optimization cycle. Margin compression will re-rate the stock, substantially lower, and have many companies (that they currently do business with) question exactly how much compute they need before USABLE or VALUABLE models come to fruition and that can justify current, or future AI CapEx spend.

Regardless, I’m digressing, I think the real question is, “what is it that’s going to be the catalyst for this optimization cycle?” This leads me to my third observation on why I believe the markets are due for substantial downside…. It’s always a shift in the Macro.

Macro Data is Screaming Recession and Nobody is Looking

I must emphasize that, in addition to calling the top of the markets in 2021, I wrote a publication that called the bottom in late 2022, despite persistent calls for recession and the beginning of a secular bear market. Below, you can see the exact date, that was within a few weeks of market bottom. I must emphasize that I was belittled, harassed and silenced for publishing that thesis. It’s not that I bring that up for sympathy, but to bring attention to how wildly unpopular it was to even think about calling a market bottom. It was nothing short of contrarian, that was rooted and driven by data, not emotions.

Although not 100% accurate, the framework of thought was sound

All Time High's Are Coming

On Friday, I listened to David Lin on Twitter Spaces with Michael Gayed. It was perhaps the single most important data set I have heard recently. For those of you who are not familiar with David, he is a host of KitCo news (a popular YouTube financial News Network). He spent time discussing

The thesis was simple, during this market’s bottom, the rate of change in inflation during inflationary bear markets signals market bottoms. I must also add that the labor market was still structurally strong and imbalanced (tight labor market) during this time, which wouldn’t be conducive for a proper employment recession. However, there is one data point that we can look at, that’s a lot more simple to read and to gauge exactly when a recession is about to hit… It’s the bond market.

What’s Different about this Call Compared to the Last 13 Calls for Recession from 50 Different Market Commentators?

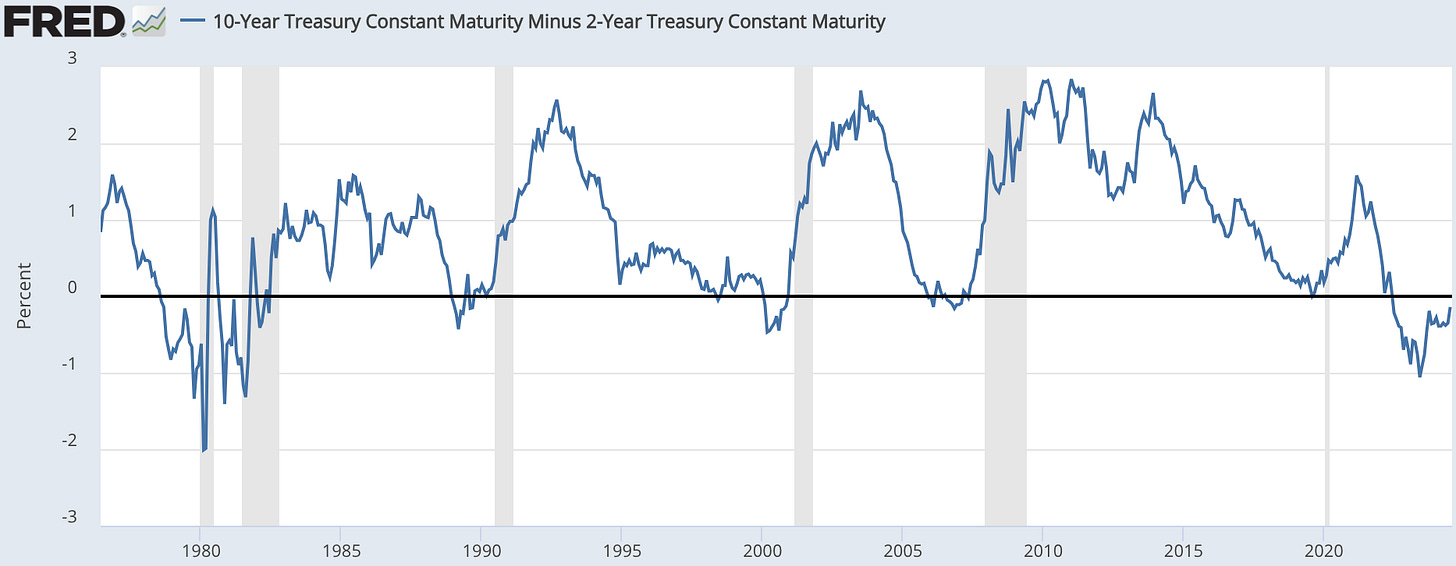

When commentators were calling for an unemployment recession, they never once thought about the most simple signal to read of all… It’s the yield curve. Historically, recession DOES NOT HIT till AFTER the yield curve un-inverts. In fact, it’s not for another 3 to 6 months that the economy enters recession. Below, you can see exactly what I mean.

Only during Volker’s on-purpose, Fed induced, recession, did we enter into recession while the yield curve was still inverted. Historically, it isn’t until the yield curve steepens significantly and the short end of the yield curve signals, “big rate cuts to come”, that are we at that critical juncture of economic recession and a possible market crash. Today, I believe we are very, very near this juncture especially with unemployment rising…

What’s Even More Terrifying is that, Despite These Signals the Federal Reserve WILL NOT Cut and WILL Continue to Wait Till it’s TOO LATE!

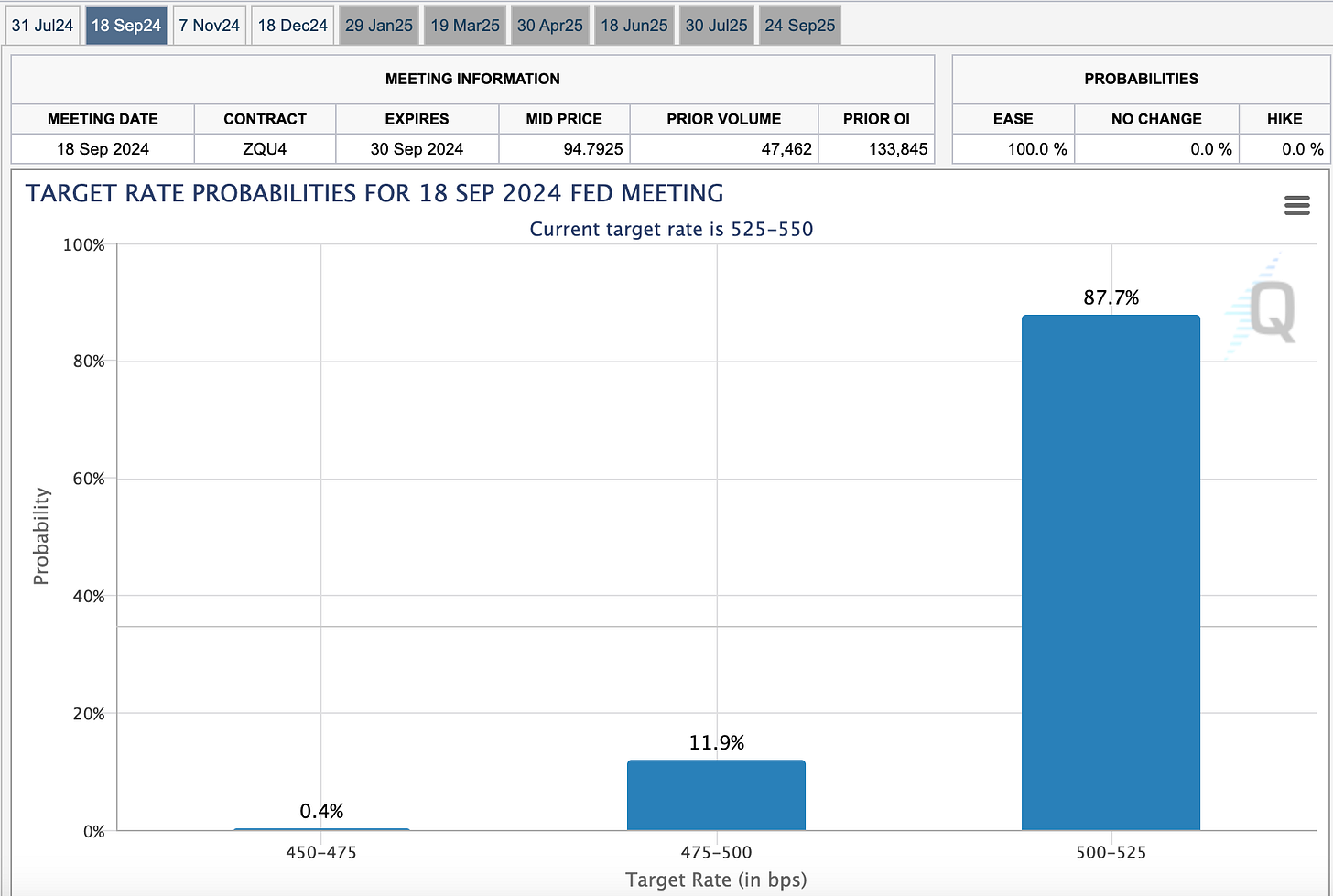

Despite how unemployment’s clearly rising, or how inflation’s clearly at/near their 2.0% PCE target (today, as of July 26th, PCE came in at 2.5%) the Fed is SO AFRAID of inflation that they will wait till it’s too late and recession is at our door steps. Today, we have a roughly a 5.35% Federal Funds Rate that is still in deep restrictive territory, inflation that is well maintained, rising unemployment, companies like: Nike, LuLu Lemon, Dollar General, Five Below, Dollar Tree, Disney, Sam Adams Beer, Celsius and many other consumer facing brands not able to find a bottom in their stock price because they’re all saying, “the consumer is facing pressure due to high interest rates and persistently high inflation”.

Honestly, the Federal Reserve should cut rates at the July meeting to avert an economic crisis, but they won’t. Odds are currently at a 95.3% chance for a “pause” and a 4.7% chance for a .25bps “cut”.

Instead, the Federal Reserve is likely to “punt” the rate cut for another 2 months until the September meeting. From my perspective, I think the economy (from the earnings calls I’ve been following) has been rapidly deteriorating on a month over month basis, especially since the start of Q2 and especially over the past 3 months.

There is no sense in debating amongst each other, or debate in general, about what the Fed is going to do or should do. I do believe what’s most important is:

1.) What is the Fed going to do, which we know. They’ll be late to the “dive” party (get it?)

2.) How we should respond to this likely scenario. The scenario in the presented case is an official unemployment recession

3.) When this, recession, should approximately happen and what can we do to benefit from a volatile market

If I were to make an educated guess, based on today’s trends, I expect us to enter into recession during Q4 of this year or Q1 of next year. This will allow for the election cycle to play out because the Federal Government won’t let the economy enter recession in an election year (or at least till November) especially with an incumbent… VP (I think?) running against a challenger.

The Sector I Believe Will Stand the Benefit the Most from the Coming Market Cycle

Before I continue, you have to know that I am obviously going to pump my book especially where I find the most conviction. Below are all my positions according to weighting within my portfolio. It’s important to note that the “cash” position is actually OneStream (a new IPO) and Savvy Trader has not updated the ticker yet to mark my buy.

The respective returns I have with each position, since Jan. 2022, excluding a couple new ones, is as follows:

To follow my portfolio, you can click this link:

It is behind a paywall, as is everyones on Savvy Trader, but I am running a 50% off coupon for an annual subscription all summer.

The coupon code is: 2024SummerDiscount

Tech Stocks, Small Caps, Mid Caps and Interest Rate Sensitives Will Catch a Bid Immediately After the Fed Reverses Policy and Interest Rates Drop

MidCap and SmallCap tech stocks, especially software stocks, have been predominately left out of the rally that has occurred for the better part of the year (since February, 2024) despite above average growth of 30%+ over the last 12 months. If you recall, this is roughly the time period where the markets went from pricing in 6 rate cuts this year to zero over the course of 2-3 months. Basically, monetary conditions went from easy, to tight, which drastically impacted the valuations for long duration stocks.

Technology growth stocks, software stocks, mid caps, small caps, regional banks, solar, real estate, automotive and biotech companies are historically interest rate sensitive. When rates go up, they (these sectors) often struggle at a business level due to how the economic and credit cycle impact the consumers behavior and risk appetite. When rates go down, these sectors tend to see strength in their earnings, revenue and stock prices, as consumers and businesses feel more optimistic about the future and are willing to take more risk or invest into their business. Basically, when rates go down, people buy stuff and when rates go up, people don’t buy stuff. Buying stuff is important for overall economic activity, which helps provide a tail wind to smaller companies.

In Event that The Federal Reserve Cuts Rates, Especially in the Event of a Recession, this Effectively Restarts the Business Cycle

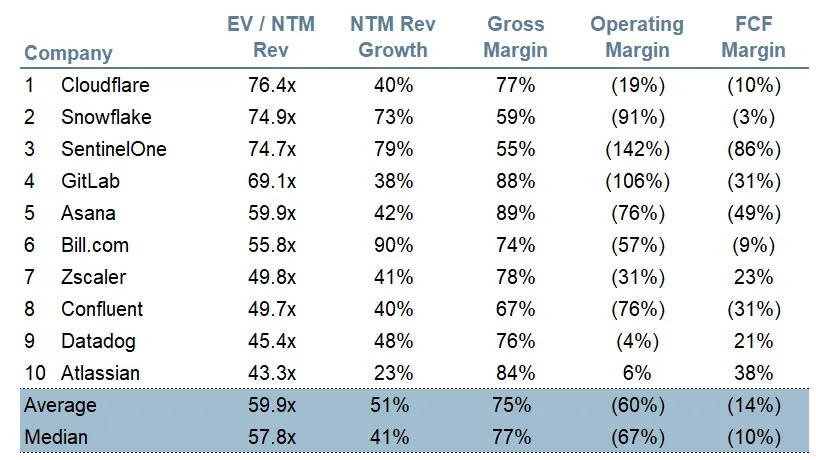

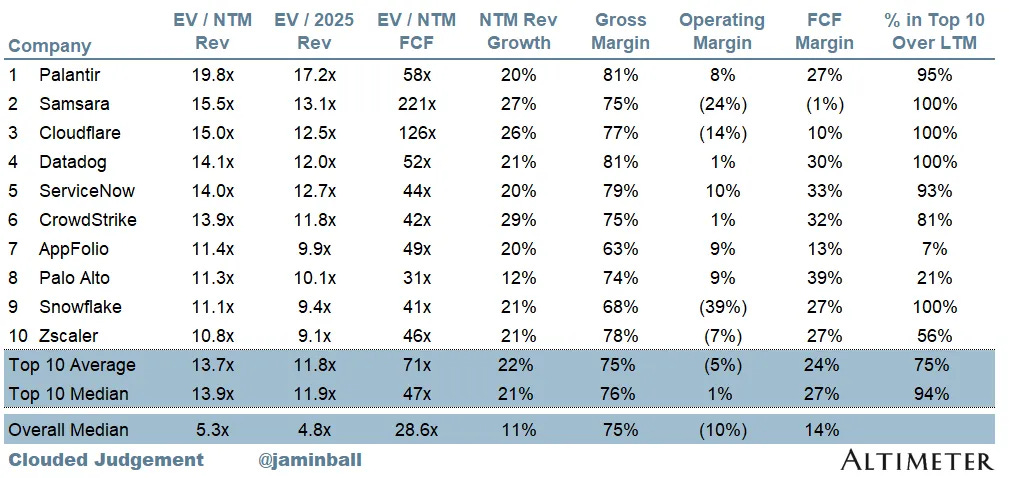

For context, to get an understanding how interest rates impact long duration stocks, it’s best to look at how the top 10 software stocks appeared at the peak of the market in 2021. It’s important to pay attention to their valuations and especially their NTM (next twelve months) expected growth rate. Notice how Snowflake, SentinelOne and Bill were expected to grow at an ASTONISHING 73%, 79% and 90% respectively! Keep in mind that these were ANALYST (who we are supposed to trust) consensus estimates!

Analysts rarely, if ever, factor in economic cycles, credit cycles or market cycles into their analysis. What they essentially do is take what’s currently known, today, and extrapolate today’s trends into the future and assume what the growth rates may be in the future. To show you even more about how extreme analyst estimates can grow to be, look at how (below) today’s top 10 software stocks look as of this Friday, July 26th 2024. The highest expected growth is CrowdStrike at 29%. Every other growth stock is apparently only growing 20%-ish over the next 12 months, which I don’t believe as we enter into a cutting cycle.

The reason why a lot of these stocks, like Snowflake, SentinelOne, DataDog and many others have traded sideways for the better part of 2 years, is that analysts have continued to drop their expected NTM growth and their multiple has compressed further and further downward. It’s crucial to know that, as an industry, this has been a trend and is not necessarily business specific. There have been many narratives to try to explain this, such as:

AI is taking all the tech spend: This, I believe is true but only half true. AI doesn’t disrupt companies like Snowflake, ZScaler or DataDog, it builds on top of them. However, application companies like UIPath have been disrupted mostly because of failed management agility. Longer term, AI will act as a tailwind to software infrastructure companies.

Software is Dead: The narrative is that software had it’s best days and now nobody needs software to grow their business…. Am I the only one that thinks this is silly? I don’t know any business that doesn’t need better tools to scale their corporation effectively.

Businesses are going on Prem: No they’re not, they’re continuing they cloud migration strategy as it offers businesses a unique ability to scale and manage cost effectively.

The truth is that the business environment slowed because of higher interest rates. More businesses, especially small and mid cap companies, have effectively seen slow/no growth over the past few years. If the broader business climate has slowed/stopped, this means that businesses will stop investing for growth, which impacts B2B SaaS the most, as it’s indexed to economic growth with a secular component attached to it. This narrative, of a slowing business environment, will flip mid recession as interest rates drop, monetary conditions ease and the credit cycle restarts, which will stimulate business and investment activity, leading to a re-acceleration in growth for many growth stocks.

My Plan to Prepare for, What I Believe to be, a Pending Recession

With the stocks that I own, including many other stocks similar to mine that fall in the small and mid cap growth category, are what I believe to already be priced for recession. As I showed above, the next twelve month growth rate does appear very muted and has limited downside. Valuations on a historical basis are also extremely low and, as a sector, similar to the bottom of the 2022 bear market and lower than the COVID-19 crash.

I already shared this (below), but it’s important to emphasize and bring in the completeness to my thesis. Small and mid cap companies, on a broad basis, are not priced for perfection and expectations are already low. Below, you can see that there small caps are still trading at depressed valuations in relation to historical norms. I cannot help but believe that, even in the event of recession, there may be a 20% contraction (being generous) in the Sm/Mid Cap multiple compared to LargeCaps, where we would could see a 30%+ contraction in the multiple just to get to historical FAIR VALUE, not even “recessionary cheap” value.

The Last Time the Valuation Gap was this Extreme was During 2000 to 2002

Already shared above, notice the valuation gap between small and midcaps vs largecap stocks today and in 2000 to 2002

For comparison for what this looked like in 2000 to 2002 on “the sticks”. We can use $MDY, or the S&P 400 midcap index, and compare it to the S&P $SPX from 1997 to 2012

Notice how extreme the bifurcation has gotten today and, from visuals alone, appear to be even more extreme than 1997 to 2000

To Summarize my Thesis

All bull markets eventually end, and as investors, or even traders, we should always be ready for that. A market crash, or volatility, is not necessarily something to be afraid of and run away from. In fact, more money is actually made during bear markets because the economic and market cycles reset, valuations become low and future prospective returns are high.

I Do Believe that it’s Unwise to Assume it’s the Smart Thing to Just Buy the Index at 20+ Year High Valuations

It matters the price you pay (as the image shows above) and one MUST BE AWARE that the S&P 500 can trade back down to a forward P/E of 10x again, which is the valuation low in 2002 and 2008 which were the last two “real” recessions that the U.S. had. For better context, this puts the S&P at roughly 2,600…. This is working with the assumption that the S&P’s future earnings don’t contract and stay at roughly 260-ish eps for 2025. This is why it’s SO important to pay attention to the price of any asset you purchase. The multiple expansion has been so great, that the crash we’d experience would more than likely be historic, reaching 50%+ downside, revisiting 2017 levels.

More importantly, why is it irrational to think that the S&P can trade down to a forward P/E of 10x again (which is historically consistent) in the event that the yield curve is actually signaling a recession? You know how the saying goes:

“Valuations don’t matter, till they do and the world seems less certain.”

I have minimal exposure to some of the largest company’s (except for Tesla) or even the S&P 500 today. For a few months, this has led to underperformance in my portfolio, especially on a year to date basis. However, I am strong in my conviction that multiples and valuations matter especially during periods the economy doesn’t seem certain and forward EPS estimates actually come down due to economic conditions.

I am also strong in my conviction that when interest rates fall and monetary conditions ease (likely in the event that we’re in an unemployment recession), small and midcap stocks (especially innovative growth stocks) will lead the market out of a recession, leading to meaningful outperformance for years into the future. However, despite this conviction, I do understand patience will be of the essence because it may not happen next week. It may not even happen next year. We could even enter into a historic large cap bubble that will generate euphoric like returns for index investors everywhere.

But, I do know that when the tide runs out, you find who was standing naked. Or, in this case, when the cycle changes, you will find who has gotten complacent and stopped paying attention to the fundamentals of this business. This complacency is all I am cautioning against because the probabilities for a historic market crash are rising every day the S&P 500 goes higher.

Until next time my friends,

Stay Tuned, Stay Classy

Dillon

Great piece, thesis makes a lot of sense…do you think the top is in? How long until the bottom assuming we revisit 2017 levels? Minor quibble; I just can’t square your call for a recession with continuing to hold cyclical growth stocks like Tesla. IMHO, stocks like that are still expensive in light of downward earnings revisions and stand to get cut in half (at a minimum) along with the AI names.

Absolutely fascinating read Dillon. It always blows my mind the level of detail you go into with your writing. Extremely impressive and very very informative. I’ve read your work now for several years and have you to thank for the forewarning of the last market capitulation but also instilling confidence in me to double down on those disruptive best of breed companies that will undoubtedly help shape the future. Whatever uncertainty lies ahead, I’m no longer fearful as I now see opportunity as I’m here for a long long time. Thank you my friend. Appreciate you.